Video conferencing software developer Zoom (NASDAQ: ZM) published financial report for the first quarter of fiscal year 2022. Here are the main results:

- revenue increased by 191%, up to 956 million dollars;

- operating profit increased by 9,7 Times, from 23.4 to 226.3 million;

- net profit increased by 8,4 Times, with 27 to 227.4 million;

- operating cash flow increased by 106%, to 533.3 million, and free cash flow 80%, to 454.2 million;

- the number of clients with more than ten employees grew by 87%, up to 497 thousand, and the number of clients, which brought the company more than 100 thousand dollars in revenue for 12 Months, grew by 160%, to 1999;

- Expected, that in fiscal 2022 the company will increase revenue by 50%, up to 3.975-3.99 billion.

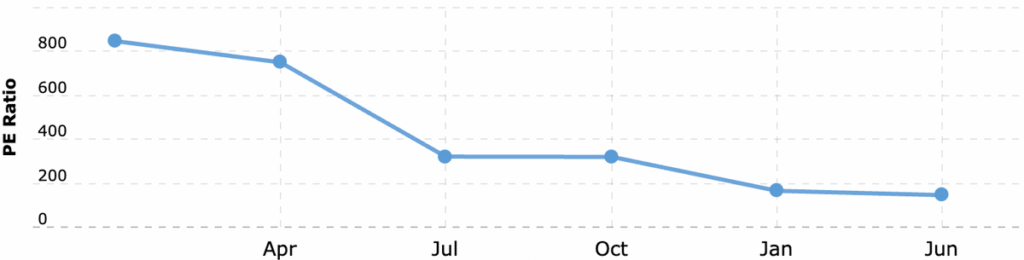

Zoom not only impresses with its growth rate, but also with his assessment. Now the company is worth almost $100 billion - like Electronic Arts (40 billion), eBay (40 billion) и American Airlines (16 billion), taken together. Due to high growth rates, P / E companies fell five times in a year, from 750 to 150, but Zoom still looks expensive. If at some point the company's growth rate does not live up to expectations, then stocks can drop sharply.

High competition in the technology sector is one of the main risks for Zoom. In some industries, such as mobile operating systems, leadership is undeniable: there are only two seats on this boat, and any third will be superfluous - ask Microsoft about it. But the video communication program does not look like something fundamental and unique..

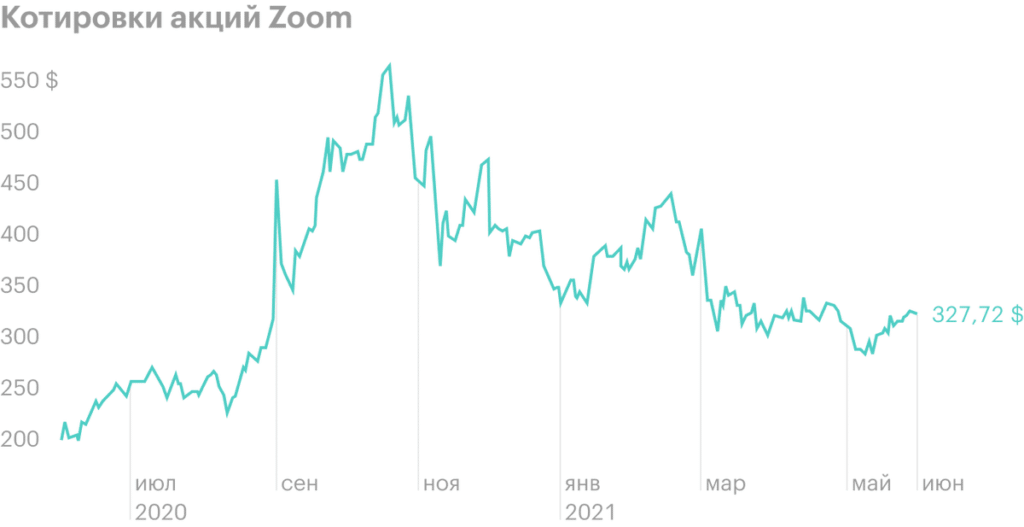

Now Zoom shares are worth 328 $ - it's on 44% below the maximum in 589 $. During the year, the company's securities added 58%, and analysts expect growth to 440 $ in the following 12 Months.