Designing Nvidia Graphics Microprocessors (Nasdaq: NVDA) reported for the 2nd quarter of fiscal year 2022:

- revenue increased by sixty-eight percent, up to 6.5 billion dollars;

- net profit increased by 282%, up to 2.4 billion;

- adjusted net income increased by eighty-two percent, up to 2.6 billion;

- operating foreign exchange flow increased by seventy-one percent, up to 2.7 billion;

- free currency flow increased by fifty-nine percent, up to 2.5 billion.

“Nvidia's work in computing continues to drive development charts, Scientific Computing and Artificial Intelligence", - said the founder and head of the firm Jen-Hsun Huang.

Revenue. Company topped $6.5 billion in Q2 revenue driven by growth in sales across all sectors.

In the gaming sector, sales increased by eighty-five percent, up to 3.1 billion. Video cards of the GeForce series and chips for game consoles enjoyed the highest demand.

Due to the popularity of GeForce products in the number of miners, a lack of graphics adapters appeared on the market. To somehow change the state of affairs, Nvidia has limited the ability of graphics microprocessors as part of the mining of cryptographic currencies.

Also Nvidia has increased the creation of CMP (cryptocurrency mining processor) — special devices for miners. Sales of such microprocessors amounted to $ 266 million, however, the company expected to receive 400 million.

Implementations of chips for data centers increased by thirty-five percent, up to 2.4 billion. Implementation of graphics cards for professional visualization added 156% and amounted to 0.5 billion. In the auto segment, sales increased by 37%, up to 152 million, due to the recovery of demand in the industry.

Forecast. According to the company, in the third quarter, revenue will amount to $ 6.8 billion - by 45% more compared to last year.

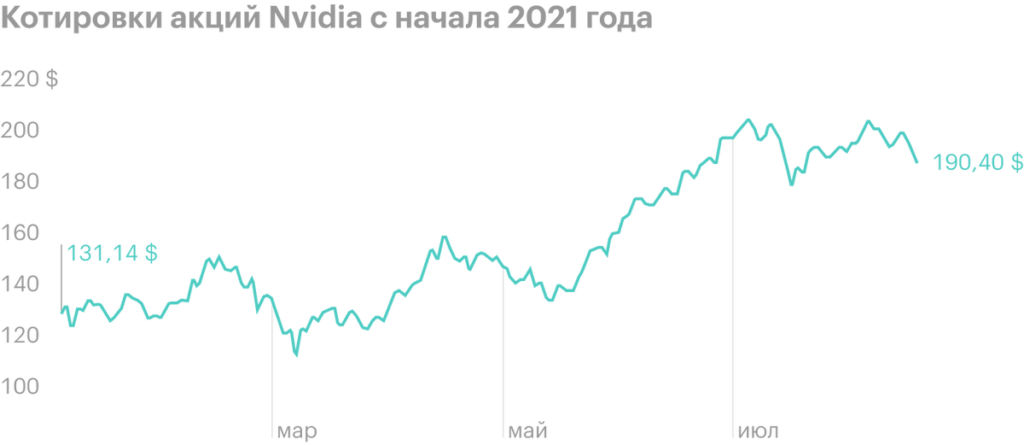

Promotions. After the main session, Nvidia shares rose by 2,3%, to 195 $. Shares have gained since the beginning of the year 45%. Nvidia spent the summer split 4:1. Number of shares quadrupled, and the price went down proportionally.