When selling a Put option, our maximum profit is limited by the amount of the premium option, and our the risk is not limited in the event of a decrease in the price of the underlying asset</b>.

We remember, that the buyer of the Put option is making money on the market decline, respectively, selling option Put, we, in fact, we bet, that the decline in the underlying asset (futures) will not.

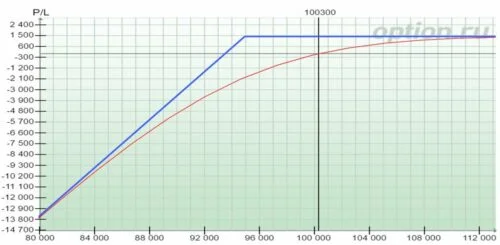

The same BA - futures on the RTS index. We sell a Put option with a strike 95 000 by price 1 450 points.

It will not be difficult to build a position profile.

If expiration BA does not fall below the strike (95 000 points), we will make a profit in the amount of the premium 1 450 points. It will be unprofitable for the Put buyer to exercise his right and sell the asset cheaper, what will it cost on the market.

When BA falls below the break-even point (strike - premium), ie. level in 93 550 points we will get a loss, the expiration value of which will linearly depend on the degree of futures decline.