Risks of buying options (Long Call и Long Put)

In one of the past lessons, we briefly touched on, so-called, three-dimensionality option trading. Three factors affect the option position: BA price dynamics, time to expiration and volatility.

Respectively, at buying a Call option we have three main risks for this position:

1. Decline in futures- with a decrease in BA, our purchased Call will become cheaper, because. the likelihood of its execution decreases (don't forget, that our position earns on the growth of the market). This is the first and most understandable position risk..

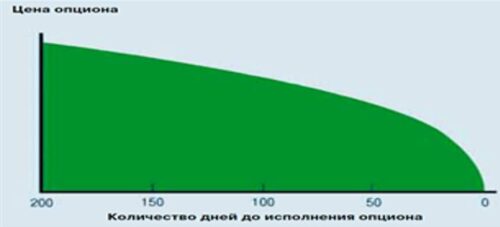

2. Expiry date approaching - every day is ours option loses part of his bonus. The fewer days before the option expiration, the cheaper its cost while maintaining the same values of the BA price and volatility.

For example, our Call option with strike 67 000 a dollar for 112 days before expiration costs 2 192 ruble.

For 60 days (at the same futures price) it will cost 1 597 rubles

For 30 days - 1 122

For 5 days - 443 ruble.

Moreover, this is the depreciation of the option value (even while maintaining the same BA price) will be nonlinear, namely (if you remember the concept of time value) maximize when the expiration date is approaching.

3. Reduced market volatility. Volatility in a simple explanation – this is the amplitude (scope) price fluctuations in the market.

With increasing volatility in the market, the likelihood of getting out into the money on purchased options increases and, respectively, options go up (with constant other parameters), what suits us, because. we buy options.

With a decrease in volatility, the picture is reversed, and option premiums in the market are getting cheaper. In this way, lower volatility is unprofitable for option buyers.

Even if after buying a Call the BA price does not decrease and there will be the same number of days before expiration, then the price of our purchased Call will still be lower, and we will receive a loss on this position.

At the time of buying put option risks will be as follows:

1. ROST BA – we (as we remember from the schedule) position, aimed at reducing the market

2. Expiry date approaching (the effect is the same, as with the purchase of Call)

3. Reduced market volatility (similarly).

In this way, summarizing all previously voiced, when buying options it is not profitable for us to move the BA against our position, reduced market volatility and time always works against our position.

Basic rules for buying options

Considering all these risks, you can formulate the basic rules for buying options in relation to entering a position, its creation and the time spent in it.