For the option buyer (has the right to):

- Close with a reverse trade in the order book (the same period and strike)

- Expiry Option (when, if it is profitable to perform it)

Example:

Long Call 65 000 and Si (on futures on the US dollar rate – Russian ruble) (1 200 rub.); BA cost = 65 000 rub.

Let's admit, across 2 weeks, BA increased up to 80 000 rub., наш Long Call 65 000 rose in price to 15 200 rub.

Expiration - we get futures at the price 65 000 rub. And 15 000 rub. arrived (80 000 – 65 000)

Grand total - 13 800 rubles (15 000 – 1 200)

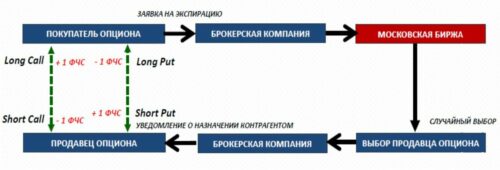

Expiration procedure

Remember:

For the option seller (has obligations):

- Close with a reverse trade in the order book (same term and strike) - thereby, his obligations will be nullified.