Crypt and crypto: Coinbase goes public

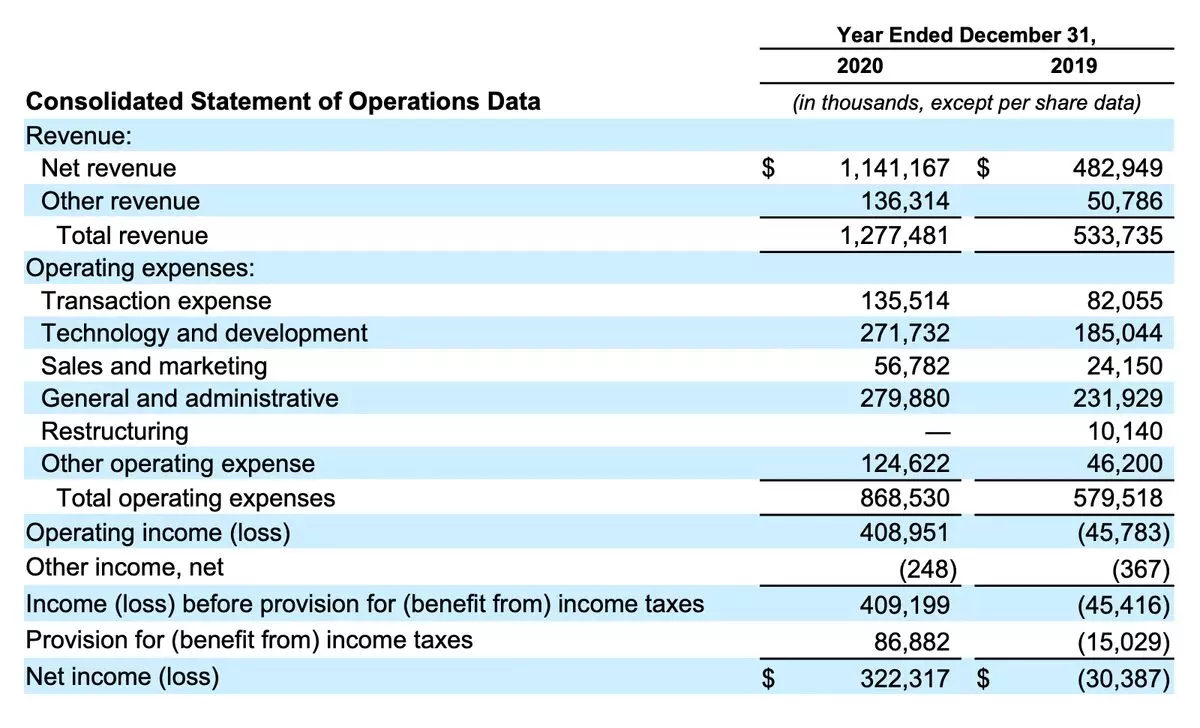

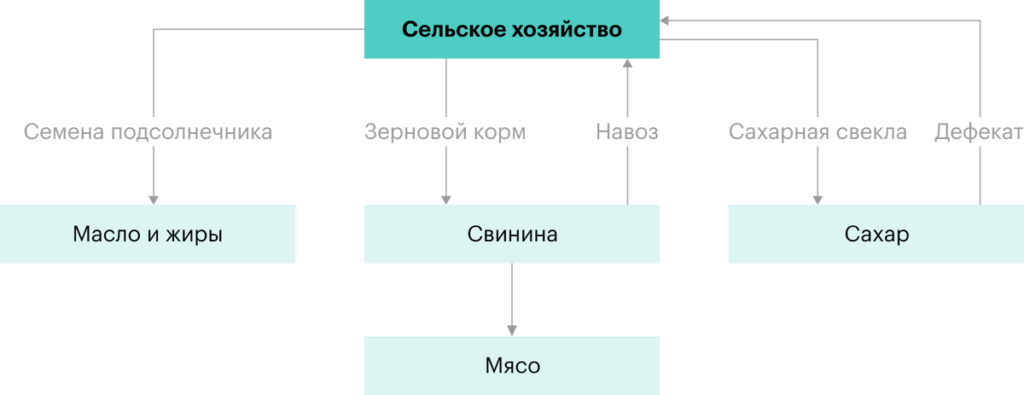

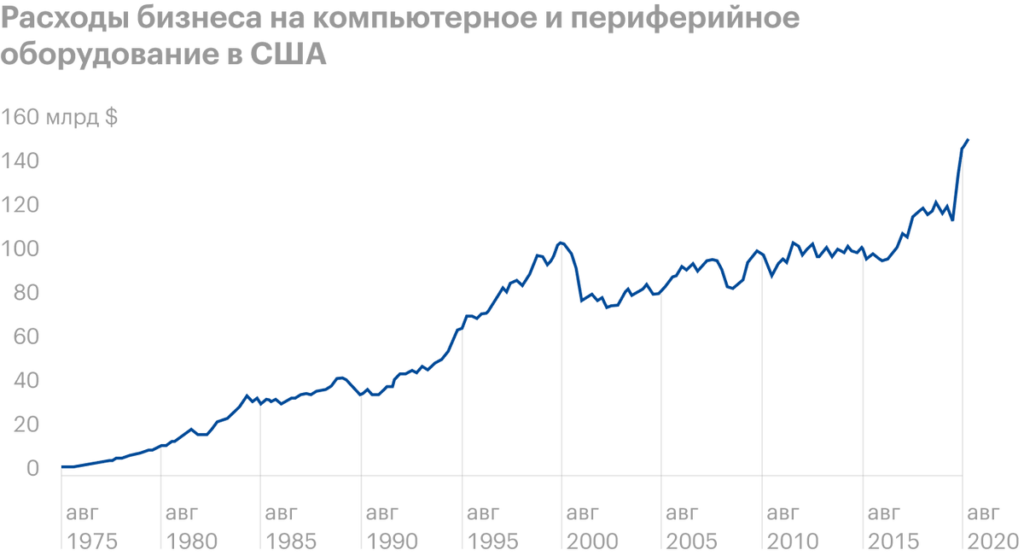

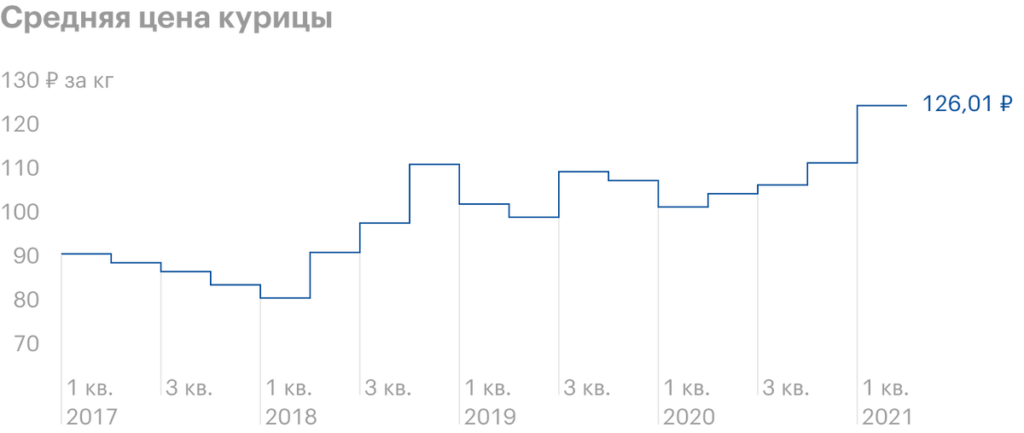

Expected, what 14 On April, Coinbase cryptocurrency exchange platform will begin trading on the Nasdaq exchange under the ticker COIN. Although the date may change, we decided to look into the fact, how does this business work, and also to reflect on its prospects.