Online trade, хе-хе…

Remains of long savings futures were fixed in the area 8620 – let the bulls wait for the continuation of the holiday.…

Remains of long savings futures were fixed in the area 8620 – let the bulls wait for the continuation of the holiday.…

I have a theory, what over time, if nothing changes, the cyclical nature of financial crises will accelerate. Maybe, this will lead to the disappearance of long-term investors as a class. What's the point in buying stocks and pumping money into the market for years, when assets can halve in two weeks. And this repeats itself more than once every thirty years, and with a regularity of two to three years. It looks like we're on the cusp of a new era. Will the golden billion learn to live within its means and start production again?, not consumption? Will we come to universal socialism in this decade?, as Wasserman suggests? I see, that the previous course is failing and needs to be changed.

Quite possible, that we won't see the market like this for a long time, what are you used to. Instead of directional movements – viscous flat swamp. Traders and managers (who else survived) will have to reconsider their approach, it will be difficult with clients. But it's all nonsense, costs of the profession, if only the exchange is not closed :)

Just noticed…

The story is not devoid of irony. :)

A long streak of success is highly relaxing, and perfect mistakes and punctures – our best teachers, albeit harsh – the main thing is not to get stuck in them and quickly jump out back…

MF Global raised GO for silver from $14,513 to $25,397. This is not the CME itself yet, but it is assumed, as the exchange will follow in the same direction. But, the question arises. Does it play a big role, if large speculators are not limited in capital! Well there will be a short-term downward reaction, and in the future, with the purposeful actions of Bernanke, to kill the dollar,it shouldn't play a role.

So.. impressions of the People's Option:It was super of course… I will write everything that happened around me personally.)——–…

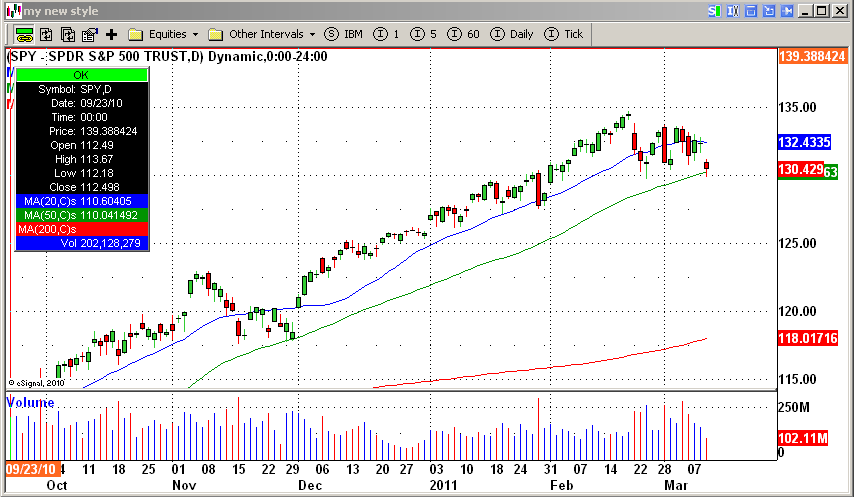

The market pushed down hard, but the key level is not broken.

Until we gain a foothold 1290 on S&P 500 – the sausage will continue.

It's better not to keep overs at a time like this. – the main thing is at least to take money from the table during the day.

I prefer not to trade at all on such days, or hold only a couple of the strongest poses..

As a result, AOL threw off part of the position at the close – let's see, what will happen today

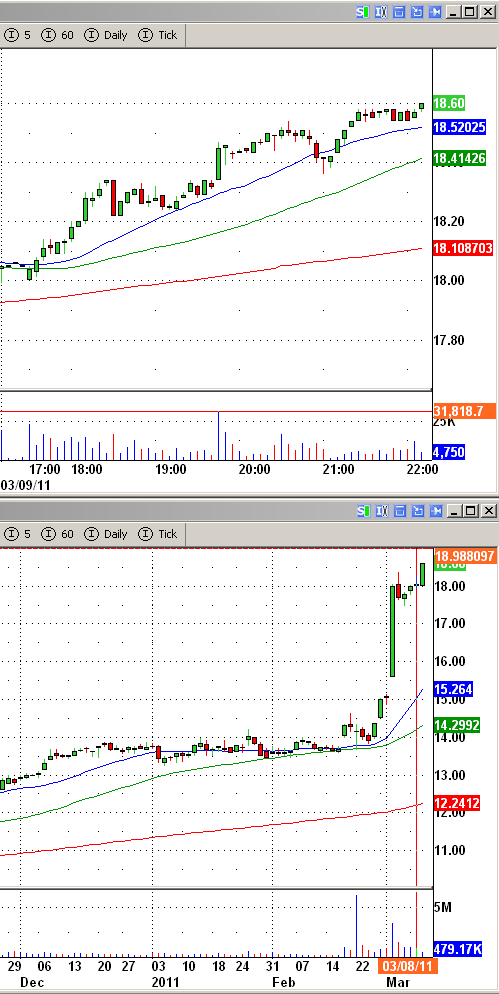

In the comments to the previous post, I was asked the question `` do movings work or not ''.

My answer – Yes, Work.

They are worked out very often and it is better to have them on the schedule..

I want to note right away, that this is NOT the MAIN signal.

But only an auxiliary.

When you see, that the stock went up, then it rolls back and sucks, the presence of movings as support for the base significantly increase the chances of the continuation of the upward movement.

If a stock falls and sucks under movings – good signal to short.

If the stock fell and fell on movings as support – I would wait until she breaks them.

The same is in the situation, if the stock is up, rested and defends under movings.

I hate going against moving averages.

I do not urge anyone to do as I do.

This is my personal opinion.

If you liked it – in no case immediately rush to do the same.

Calmly test, see how it works, and only then add to your vehicle.

Py.Sy. I use 20-50-200 simple moving averages. They work best on daily and watches.

They also work well at 15 minutes or less., but still work, at 5 minutes.

I also want to notice, that each stock has its own character.

There are stacks, which perform well moving averages, there are also, who don't do it the first time, but then the implementation goes anyway.

But there are also those, who do not care about movings at all.

Be sure to pay attention to this.

It will also increase your chances of success..

Banzai!

AOL continues to delight little by little.

So far nothing has been covered, let's see what close will be.

Also took BGS on the breakdown of yesterday's hay.