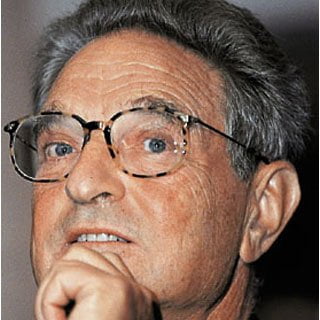

Thomas R.. Demark / Thomas R. DeMark

Trader and Consultant Tom DeMark (Tom DeMark) recently invented dozens of original technical indicators and relies solely on technical timing principles in his research and trading. He even signed up for the CFA program once. (certified financial analyst - certified financial analyst), but decided not to go through it to the end. “Markets in the long term are characterized by basic. But my indicators measure psychology - that's what, what does technical analysis do ", - Demark explains. DeMarke's first immersion in the world of finance occurred after graduating from graduate school in two specialties - business and legal, after which, in the early 70s, he was hired as a fundamental analyst at the National Investment Service, located in Milwaukee (PCS. Wisconsin). The firm managed pension assets and assets with a joint profit of about 300 million. Doll., investing mainly in securities and fixed income shares. The strength of the National Investment Service was in timing. Demark, however, this is how he remembers his first job: “I was a professional errand boy. I was the lowest in the company, but rose quickly, because he knew how to choose the time for operations ".