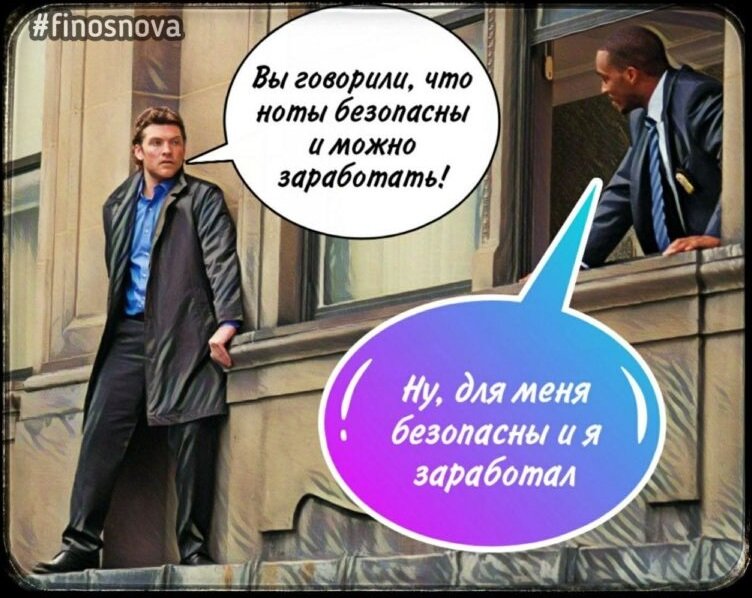

Want ten percent in dollars every quarter? - Structural merchants whisper and coax, that "practically a deposit".

It can definitely be safe and profitable for the client.? Yes, if a:

- Extremely eager to experience and one hundred percent capital protection

- Read mountains of documents and researched reporting

- A client or an advisor has a mathematical mindset

!The most common rule is no awareness of the instrument., no attachments!

I have already touched on the topic here and advised for you a music channel bcsexcess

Now visiting Stanislav Skripnichenko with his analysis of notes:

Not so long ago, several clients turned to me with a request to give comments on the structural notes acquired in our investment companies and state banks.. The client currently has losses on these notes - from thirty percent to seventy percent of the capital, the level of awareness of this tool is close to zero, and the desire to invest in the securities market now is also about zero.

Therefore, I would like to share some thoughts on structured notes..

For those, who has not yet set foot on this territory and wants to learn everything from the experience of other people: structural notes are a difficult investment product, which has become popular in the past few years.

WE WILL CONSIDER AUTOCALL NOTES FOR A SHARE BASKET WITH PARTIAL PROTECTION

I'll take a lightweight example of a note from the financier's knapsack:

The underlying asset is 4 stock:

- Biogen

- Western Digital

- Micron Technology

- Discovery Inc

Coupon: ten percent

Protective barrier: fall protection up to thirty-five percent

The term of the note: three years

Autocall conditions: in any quarter, if the cost of all 4 securities will be higher than the placement price

Minimum investment: 100 000 Dollars

Issuing bank: Societe Generale (France)

By the way, if you do not understand anything from the name and description of the conditions, then it means, that the sellers of the sheet music have an informational advantage over you and will present the note like this, how is it profitable for them.

HOW THE NOTE WORKS:

1) At the end of each quarter, you will receive a coupon (based on the calculation 10% per annum, i.e 2,5% from the money invested), but only if, if EACH of 4 above the indicated securities are traded in the range from 65% and higher from the price, which was indicated at the time of posting. In other words, if each of the securities did not fall more, than on 35% from the placement price. Conditionally, Cost 100 dollars on the date of purchase of the note, now stands 65 dollars or more. Difficult? This is the simplest so far.

2) If, nevertheless, AT LEAST ONE of 4 more papers fell, than on 35%, you DO NOT GET A COUPON, but the coupon is REMEMBERED. It means, what if at the end of the next quarter "bad" stock recovered, you get the expected coupon, and that coupon, which has not been paid before (effect of "memory" - remembered and paid). If at least one of the securities fell below the protective barrier in 35%, never recovered, you don’t get coupons in the end.

3) If all four stocks are higher than the price at the date of purchase of the note, then the note is canceled ahead of schedule ("Autocall"), and thus you stop receiving income, ie. you get back nested 100 000$ and earned 10% — 10 000$.

4) If the stock, included in the notes, somehow grew during the term, Fell, In general, changed in price, but there was no autocall situation, note survives to maturity. And further are possible 2 Script: or you get back the invested amount, along with the last coupon, or (Attention!) worst stock, which sank more than others, if she sagged more than 35%. That is, they invested 1000 Dollars, some stock like Western Digital fell in 2 times for these 3 of the year, and you are happy instead 1000 dollars par get this share, Really, by price, which was at the time of launching the note. This is a loss in 50% Dollars. If you still managed to receive a certain number of coupons, for example, First 2 year, the note worked well - it means, You received 2*10% = 20% coupons minus 50% loss = minus 30%. And you are now a proud shareholder of the American company Western Digital, which you do not personally understand..

Let's try to disassemble their pros and cons..

Pros of structured notes

To save time, I'll tell you right away: FROM THE POSITION OF THE INVESTOR, THERE ARE NO.

But there are many advantages from the position of banks selling these products:

High margin for business (to 18% sellers of 3-year notes in Russian investment companies and banks earn from the money deposited)

Retention of client assets (client invests in 2-3-5 years and at this time cannot sell the note, withdraw money, or maybe with losses, which imposes restrictions on the investor's capital)

Tool, which is easy to sell to uninformed investors with the help of little knowledgeable sellers. "It's almost like a deposit" - pretty girls in the VIP-branches of large Russian banks say without blinking, "Guaranteed coupon in 12% per annum in dollars - who else will offer you so much?»These are not my fantasies, this is my correspondence with the manager of the state bank. And, seems to be, the girl believes in it and does not realize that simple fact, that any return is higher than the rate FED (0.25% in dollars now) by definition carries a risk, not to mention 12% per annum in dollars.

Cons of structured notes

- ROULETTE PLAY

For that, to invest in shares of specific companies, you need to understand them in a very deep, professional level. Otherwise, it is better to invest in stock indices and not try to select individual names.. I wrote about this in detail in the article "I want to buy shares of Gazprom and Rosatom". Furthermore, when you use a note to bet on the stock market, your investment horizon is limited, usually, 2-3-4 over the years. What will happen to the market, economy and world politics for these 2-3-4 of the year, nobody knows at all: nor Warren Buffett, nor Donald Trump, us Nassim Taleb.

Your personal bank manager, his investment director doesn't know either, what will happen to the market and what are the prospects of some American company. If the investment director knew even a little, he would work for a hedge fund and make millions of dollars, rather than structuring notes in this bank for 300 thousand rubles per month.

Putting on a note, you make a statement, that none of 4 shares will not fall over the next 3 years more than 35%. This is a bold statement. As known, the stock market has 2 type of investors: brave and experienced. Usually, these are mutually exclusive qualities. You bet on roulette, consciously or not, and the seller of the notes turns out to be the croupier, who will gladly accept your money. - WORST OF BONDS AND STOCK WORLD

In investments over the past couple of thousand years, very little has been invented that is new - the underlying asset is almost everywhere either a share in a business (stock), or a loan to a business (bonds). Stocks have an advantage - potentially unlimited income growth (225 thousand percent growth in Microsoft shares since going public in 1986 year) and dividend growth, lack of shares - non-guaranteed growth in value and growth of dividends. Bonds have an advantage - a guaranteed by the borrower a stream of interest payments and a guarantee of repayment after a certain number of years of the principal debt, lack of bonds - initially limited loan yield, and the higher the bond yield, the more elusive the guarantee of return. Why is that? Because those issuing companies pay high yields on bonds, who could not attract at a low interest rate. These are companies with a higher level of risk, and their money-back guarantees can only be taken with great skepticism.

Now let's see., what are typical structure notes. On the one side, you get a fairly low income if successful, comparable to high yield speculative bonds: 8-12% per annum in dollars, usually, unless it is a note with unreliable shares of small companies. With unreliable stocks, yields can be even higher. Furthermore, even this income will be taken away from you, if all stocks in the note go up and the note closes ( "Car seat"). - THE BANK EARNS FOR YOU AND FOR YOUR EXPENSE SO MUCH, WHAT CASINO OWNERS HOOK IN SILENT ADMISSION.

Average hidden commission of the note seller - from 2% to 6% for each year notes. That is, for a 3-year note, the bank's income from 6% to 18% of the amount you deposited. You have just managed to deposit money for the purchase of the sheet music, and the bank has already put the profit in its pocket. This is done by packing these commissions into a note using option strategies., where you take risks, and the bank generously takes over the income. Wherein, what is the most amazing, the bank incurs relatively small costs - if all the shares in the note start to rise up, then the bank has the option of automatic early redemption of the note ("Autocolla"), when he quickly returns the body of the note to you and stops paying coupons. That is, the coupon will not pay you full for everything. 3 of the year (30%), but only for one last quarter - 2.5%. Great business, casino marginality is much less: in roulette with 2 zero sectors on average expected casino income of about 5.2% from each bet. - YOU COULD LOSE 100% CAPITAL.

Few of the clients, who bought sheet music, Understand, that they could lose ALL capital. If tomorrow is one of 4 venerable companies (in our example : Biogen, Western Digital, Micron Technology, Discovery Inc.) will declare bankruptcy and write off shares to zero, you will not get the average profitability of the basket from 4 Issuers, and the worst share, which will contact 0. Worst of delivery condition 4 shares is that, what do you agree with when buying a typical note. If the worst stock has not cleared (as is now accepted), for example, fell on 50%, you get not invested 100 one thousand dollars, and 50%*100 thousand dollars = 50 one thousand dollars. Losses may be more than "almost guaranteed income". - ERROR TO THINK, WHAT YOU CAN BUY BANK LOYALTY, HAVE AGREED TO THE NOTES.

Some clients think: okay, I'll take a couple of boxes of these incomprehensible notes, there seems to be a potentially good profitability, and the bank for this will less carefully check my sources of origin of funds. At least, this is what some enterprising bank managers promise to clients. As a result, the bank manager, if he receives a requirement from compliance to provide documents confirming income for the client, can do almost nothing, and the customer's profitability does not play any role here. The bank has already earned on it. - BUYING A NOTE, YOU ARE PAIRING AGAINST THE INVESTMENT BANK. The bank as a whole is much smarter and more efficient, than a private investor, so you have no chance to beat him.

Investor income on structured note is the expense of the investment bank. Therefore, initially the bank produces such a note, so that, in general, the expected return on the note for the bank is high due to commissions and investor losses. Certainly, many banks partially cover the risks for those notes, which they sell to customers, but only partially. There is still a conflict of interest: the bank also needs to sell a good product to the client, to make the client happy, and the client's income is the bank's loss. Because of this fact, the conditions of most notes just imply a quick closure of too successful for the investor (and unsuccessful for the bank) Music. - FROM THE POINT OF VIEW OF THE THEORY OF PROBABILITY, YOU ARE IN A LOSING POSITION IN ADVANCE.

If the probability for each security, what will she fall for 3 years more than 35%, is at least 20% (which is very optimistic), then it means, that the probability of NOT FALLING is 80%. Probability, what all 4 the papers did NOT fall by more than 35%, is 80%80%*80% = 40,96%

And that means, that the probability of getting a loss on a note is 100-40.96 = 59,04%. - NOTES ARE NOT LIQUID

Adds a pinch of pepper to the dish another cool property of the notes - the lack of the ability to sell on the public market. Liquidity of notes differs from none (can not be sold) to weak (many western banks quote their notes, but with a spread of 2%-5%). Unlike a portfolio of individual stocks, a weak issuer cannot be thrown out of the note, if his business fundamentals deteriorate. Will you marry that, whom you know very poorly and the prospects of such a marriage cannot be assessed. A common myth is that a good company means good stock returns. In practice, Microsoft shares with 2000 on 2016 year grew by only ... zero percent! At the same time, Microsoft's business itself grew by tens of percent every year.. The reason - the stock price was too high in the early 2000s (it was the dot-com bubble). - ISSUER'S RISK

If the bank, note issuer, goes bankrupt inadvertently, you, naturally, queue up with the rest of the victims. Therefore, in fact, you bear the risk not only 4 Shares, but also the bank, who issued the note. Want to test your ability to understand the risks of individual banks?

SO FOR WHOM ARE THESE FINANCIAL INSTRUMENTS?

IN 2005 Michael Barry, a small hedge fund manager, made a bet with Goldman Sachs and other major US investment banks. He put the entire capital of the fund on, that the market for substandard mortgage bonds will collapse, and asked these banks to help structure the credit default swap transaction (CDS) on these papers. He earned in 2008 year on the stock market crisis about 800 mln USD. for yourself and your clients, along the way, together with the same smart guys, several banks went bankrupt.

Any financial instrument had a reason for its appearance and for its existence. There is a separate category of professionals, who can assess all the risks and take a smarter position, than an investment bank. But most likely, these guys are not your investment bank manager.

This is a game of champions versus champions, and to us, mere mortals, all that remains is to read about it in books.

CONCLUSIONS:

1) Music sellers are modern Ostapy Bendery, knowingly or unknowingly putting clients at a disadvantage. I understand the guys perfectly: getting 2-3% from the invested money in the form of bonuses immediately, it is very difficult to give up such practice. Especially, that it often works (when the market is in a phase of active growth).

2) If you want high profitability - invest in your business, in loans with collateral, in venture stories, to individual companies, if you are professional enough, to assess their prospects on the horizon in 10 years and more, and be prepared to lose significant capital at the same time. Don't be fooled by the promise of high guaranteed returns.

3) Balanced index strategies work great in the stock market, who are able to give low (at current interest rates 4-5% in dollars) low risk or medium return (5-10% in dollars) with moderate risk.

Everything, which is higher in terms of profitability, can be a site of significant losses.

#investments # structured notes # investment portfolio # income