Hello, friends!

Today I want to touch on one topic, which is related to finance and financial markets. With loans and crediting. With politics and a monstrous chasm in the financial situation of the countries of our planet.

In general, the topic of social inequality in one way or another often pops up in conversations. Traders — people too and some of them do not mind taking a position, advocating the need to restructure the global financial system.

Utopia? Not really..

For example, many socialists wrote about, that the cause of all financial turmoil and crises is the interest rate.

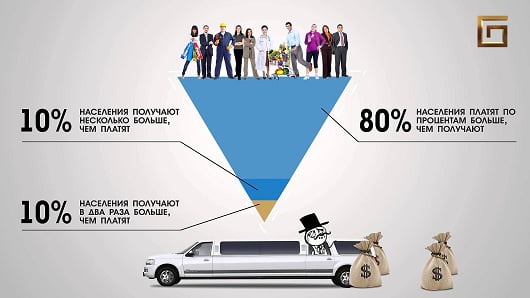

That is, the mechanism «the rich get richer, and poor — poorer» explained as follows: investors or wealthy families (here are conspiracy theories with their suspicion that, that the world is ruled by the financial elite with the help of their capital) have surplus money, which give a percentage of topics, who needs this money.

What happens next? Rentiers get interest and get rich, not producing anything at all. That is, the very fact of having free money when using lending interest contributes to the fact, what money (and their limited number) gradually flow there, where there is already a surplus of them.

That is, this scheme inevitably drives the poor into debt and bondage., and gives the rich the opportunity to build up capital and lend more and more.

Since this process stretches over many years, with time «fork» between rich and poor increases, it is noticeable at the level of states too, By the way. And at some point bam! a revolution happens, coup, change of power and redistribution of material wealth. Or the capture of financially weakened and sick countries.

One of the theorists of a different approach to monetary policy was Silvio Gezzell. He suggested using such principles in the settlement system., which would exclude the desire to make savings and lend them at interest. The emphasis is on the rapid turnover of money between the parties. Moreover, those, who has a surplus of money supply must pay a small percentage in favor of the community.

His theoretical calculations were put into practice.

During the Great Depression, to boost the economy, the followers of Silvio Gesell's theory conducted a series of experiments on the introduction and circulation of interest-free money.. The burgomaster of the city of Wörgl Michael Unterguggenberger convinced the merchants and management staff that, that no one will lose anything, vice versa, will gain a lot through experimenting with money in that form, as described in the book "Natural Economic Order" by Silvio Gesell.

31 July 1932 the magistrate issued 5000 "Free shillings" (that is, interest-free shillings), which were covered by the same amount of ordinary Austrian schillings in the bank.

All former city employees 50 % wages received "free shillings", and they paid all their earnings to newly hired.

This money was used to pay salaries and materials., merchants and entrepreneurs accepted them as payment. The payment for using this money was monthly 1 %, i.e 12 % in year. It should have been brought in by, who had the banknote at the end of the month. The fee was paid in the form of a stamp with a face value 1 % of the value of a banknote, stuck on the back of the banknote. Without such a mark, the banknote was invalid. Such a small fee has led to, that any person, receiving free shillings as payment, tried to spend them as quickly as possible, before proceeding to pay with your regular money. The inhabitants of Wörgl even their own taxes paid in advance, to avoid paying a fee for using the money. During a year 5000 free shillings were in circulation 463 Times, goods and services were produced in the amount of about 2 300 000 shillings (5000 X 463). The ordinary shilling during this time was in circulation of all 213 once. Fee received by the magistrate, which ensured a quick transfer of money from one hand to another, totaled only 12 % from 5000 free shillings = 600 free shillings. They were spent for public needs, that is, for the benefit of the community, and not for the enrichment of its individual members.

As a result of the experiment, a bridge was built in the city, pool, ski jump, row of buildings, improved road conditions, increased investment in public services, not only current taxes have been paid, but also eliminated most of the old debt. It was at this time, when many European countries were forced to deal with rising unemployment, the unemployment rate in Wörgl declined by 25 %.

When more 300 communities in Austria are interested in this model, The National Bank of Austria saw this as a threat to the stability of the monetary system. Despite the great interest in this experiment and its support by French Prime Minister Daladier and renowned economist Irving Fischer, the central bank of Austria intervened in the affairs of the magistrate and banned the printing of local money. Despite, that the dispute lasted a very long time and was considered even in the highest courts of Austria, nor Werglu, no other European community has succeeded in repeating this experiment.

How do you? The idea itself is clear and does not require justification.. Really, loan interest — this is a very tricky thing. I quite agree with that, that this is the root of many problems of the world order.

When food is thrown away in one country, and in another, children are dying of hunger — this is in many ways a manifestation of the capital flow process, interest-related.

Quote from work «MANIFESTO TO BREAKING THE KABAL PERCENTAGE» Gottfried Federer

Large loan capital grows like an avalanche to infinity

Third, and the most dangerous moment, is huge, the growth of large loan capital exceeding all the limits of reasonable concepts with the help of interest and compound interest. I have to add something here and, by a small excursion into higher mathematics, explain the problem. First, a few examples.

The charming history of the emergence of the game of chess is known. The rich Indian king Yeherham, as a thank you for the invention of the royal game, promised to fulfill one request of the inventor. The sage's request was as follows: let the king put one grain of wheat on the first square of the chessboard, on the second - two, on the third - four and further: for each subsequent field twice more than the previous one. The king chuckled at the sage's supposed modest request and gave instructions to bring a sack of wheat, to distribute the grains to all fields. Known, that even the richest man on Earth could not fulfill this request. All the harvests of the world in a thousand years would not be enough, to fill 64 checkerboard fields.

Second example: Some, probably since school days, remember the pain of calculating compound interest: what will pfennig become, on which compound interest is calculated from the time of the birth of Christ, such, that every 15 years the amount doubles. Through 15 years it will grow to 2 pfennigs, across 30 years - before 4 pfennigs, on 45 year after the birth of Christ - before 8 pfennigs. Few will remember, what would this amount be today. Our whole Earth, be it pure gold, our sun, which in 11297000 times the size of the globe, all our planets, be they pure gold, - all this would not be enough, to express the value of this originally pfennig, on which compound interest is charged.

Third example: Rothschild clan fortune, the oldest representatives of the international plutocracy, today is estimated at approximately 40 billion. Known, that old rascal Meyer Rothschild, being in Frankfurt, somewhere in 1800 year laid the foundation for the enormous fortune of his Clan with the help of re-lending from those millions, which was entrusted to him for preservation by the land count Wilhelm I of Hesse.

If Rothschild had monetary growth with interest and compound interest at the same modest pace, as in the case of pfennig, then the growth curve would not be so steep. But, allowable, the increase in the entire state of Rothschild continues only at the pace of pfennig. Then in 1935 year it would be 80 billion, in 1950 — 160 billion, in 1965 — 320 billion and, thus, far exceeded all German national wealth.

From these three examples, one mathematical law can be deduced. Curve, expressing the rise of the Rothschild state, and curve, which is derived from the number of wheat grains on a chessboard, and also the curve, showing growth of pfennig according to the scheme of compound interest, are simple mathematical curves. They all have the same character. After initially modest and slow growth, the curve gets steeper and steeper., very soon almost tangentially approaching infinity.

By the way, very often you can find in books on self-development a recommendation to do charity. Give part of the income free of charge to the needy.

From my experience I confirm the fact, that by participating in charity, we increase cash flow, passing through us. And when you stop doing it — reduce it.

I don't know., is it connected with the Higher powers, By god, Universal Reason and Evolution, but if it happens — means society is really sick and needs change. After all, life itself thus indicates the need to share with others. Gives us the opportunity to volunteer for Divine Will, exercising their right to choose — live only for yourself, or for everyone.

We forgot, that we have a common house, common planet. That we all once had one mother. And all these divisions into black and white, Russians and Ukrainians, smart and stupid, worthy and unworthy does not contribute to a better life. We lived in fear, and die in fear. We are forced to invent weapons, spy on each other in an atmosphere of general distrust and suspicion.

Jesus came, but he was not heard. But he did not fight. He came to say, that everyone is one, all sons of god. What to share? It's clear., that everyone will feel better and easier, if we ourselves stop separating ourselves from our brothers on one basis or another.

Do not know… Maybe you need someone, who would conquer the whole world (and who will give it up so easily?) and got one idea into everyone's head — now you are citizens of the same country. No borders, no strangers. Now you are just neighbors =)

God bless you, at least until the next blog update

ps. I didn’t sell the blog and, in general, during the last month I understood, that he still needs me and we have everything ahead. And new spaces and new themes. So I will stay with you for a long time =)