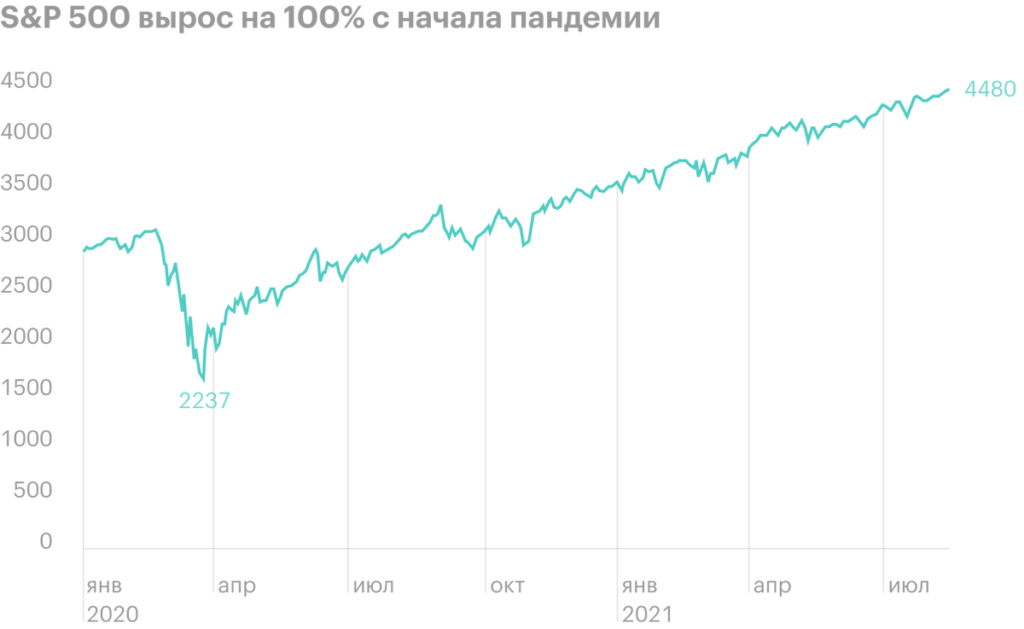

23 March 2020, when did the epidemic start, broad market index S&P 500 has fallen to a low mark of 2237 points. Yesterday, 16 august, the index reached 4480 points - this is one hundred percent higher, than last March. To walk such a distance, the stock market took 354 trading days - the highest total since the 2nd World War. On the average, to double, the market needs more than 1000 trading days.

“Usually it takes several years to double., so this is another reason to call this bull market indescribable ", - said Ryan Detrick, the main market strategist of LPL Financial.

The soft financial policy of the regulator and the country's incentives are called the main reasons for the recovery of the securities market. During the onset of the crisis, the National Reserve System lowered the interest rate to low and began to buy bonds from the market at $ 120 billion every month.. The government, on the other hand, announced large-scale support for those in need and sent trillions of dollars to pay citizens..

The stock market began to grow so rapidly, that already at the moment the index S&The P 500 is four percent above the motivated average of 4328 points at the end of 2021.

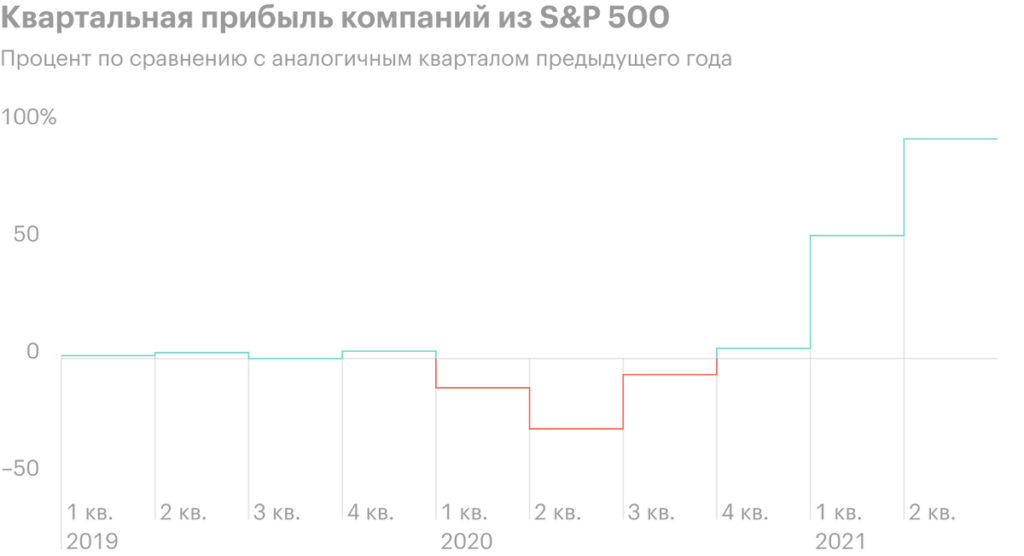

Another stock market rally supported corporate earnings recovery. Compared to the previous year, companies from S&The P 500 reported income growth of fifty-three percent in the first three months and eighty-four percent in the second..

“In this quarter were like fortunes, and a large number of surprises. Companies think, which can reduce the growing industrial costs. Companies profitably use surplus funds and direct them to their growth, immediately maintaining the highest level of circulating stock acquisitions ", - emphasized specialist Goldman Sachs David Costin.

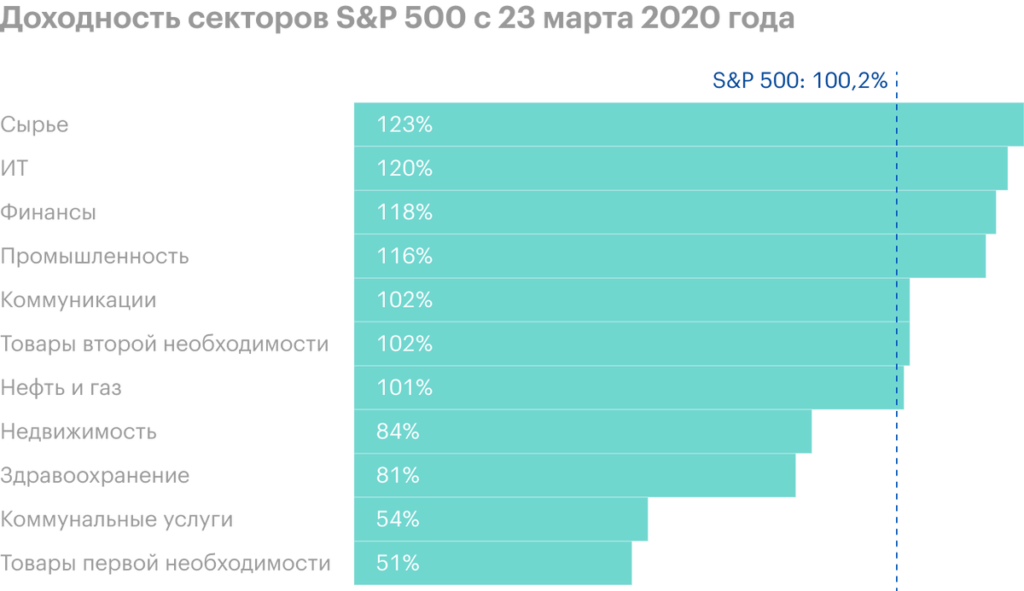

Tech led the recovery initially, which added 120% from March 2020. Companies, such as Amazon, Apple, Facebook и Google, only benefited from quarantine restrictions.

Growth in the tech sector slowed down in 2021, and the baton was taken over by cyclical companies from the real sector of the economy that sank during the crisis. Petroleum, financial, the raw materials and industrial sectors added more than 100% since the start of the pandemic.

After such growth, many do not expect big returns in the stock market.. Main concerns: tightening of monetary policy by the Federal Reserve, slowdown in economic growth and the spread of new strains of COVID-19.

And the lack of significant corrections on the market for ten months is also embarrassing.. "We remain optimistic, but since October last year, we have not seen a pullback even on 5%. Remember, that it could happen at any time", Ryan Detrick of LPL Financial warned.