I don't know., how and where did the bulk of those learn to trade, who claims, that a real buyer is needed to sell American options, but I can say, that the majority of these traders have primitive ideas about the circulation of options on the US stock exchanges.

Assertions, that in order to sell an option, there must be a buyer of this option in the market, Show, what are these representations of Baba Glasha, who went to sell her sample wedding dress 1936 of the year, but has not yet waited for a buyer. Waiting waiting, but he's still gone and gone…

I understand, that this is the case on the Russian stock exchange. But you can't extend this distorted experience to the whole world.!

It seemed to me, what people, who call themselves stock market traders, could have a broader understanding of the functioning of the securities market, which are stock options, ETF and futures.

Standardized Options Traded on US Exchanges. When trading options trader can make opening trade on the purchase of options ( Buy To Open) or by selling options (Sell To Open). The closing deals, respectively, will be the sale of options (Sell To Close) and buying options (Buy To Close).

All market options, traded on US exchanges, emitted OCC (The Options Clearing Corporation). It is OCC that provides settlements for option transactions. It is OCC that serves as the guarantor of the execution of transactions on all option contracts., traded on US exchanges, and monitors compliance with the rules for exercising options.

This is a very convenient form of organizing options liquidity.. If option eat, then it is quoted by different exchanges and these quotes are indicated in the quotation tables.

Here are the exchanges, which options quote:

-

- BATS Options Exchange (BATS)

-

- BOX Options Exchange (BOX)

-

- C2 Options Exchange (C2)

-

- Chicago Board Options Exchange (CBOE)

-

- International Securities Exchange (WHEREAS)

-

- ISE Gemini (GEM)

-

- MIAX Options Exchange (MIAX)

-

- NASDAQ OMX BX Options (NOBO)

-

- NASDAQ OMX PHLX (PHLX)

-

- NASDAQ Options Market (NOM)

-

- NYSE Amex Options (NYSE Amex)

-

- NYSE Arca Options (NYSE Arca)

Such option can be bought or sold only because it is in the quotes table, not because there is someone, who is on the stock exchange, like Baba Glasha with her wedding dress, and sells it. The trader's task is, to put a price, satisfying the current market conditions for buying at the ask price and selling at the bid price. Brokers often have a wide spread of 3-5 cents even for highly liquid options, traded with the difference between the bid / ask in 0.01. To get the best price, you should set the average price. As a rule, such an average price allows you to make a deal.

Liquidity is provided by the option price, rather than the presence of a seller / buyer on the market. And the option price is calculated as a function of six variables, affecting the option value.

After the transaction for your broker, an entry on the opening of a position will be made in the OSS register in accordance with the, which deal was executed and which position was opened. Naturally, what a deal Buy To Open opens a long option position, the holder of such a position will be by the buyer options and entry will Long Call/Put. And the deal Sell To Open opens a short position, the holder of such a position will be seller options, and the record about this position will be Short Call/Put.

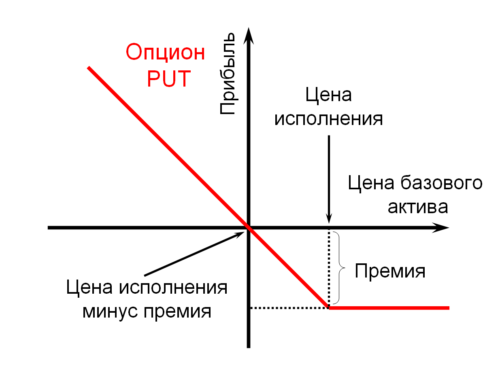

It is common knowledge, what the option buyer has right sell / buy the underlying asset at the strike price at the specified time, and the seller of the option, that, who made the deal Sell To Open, on sale acquires duty buy or sell the underlying asset at the strike price within the specified timeframe.

Therefore, there is no invisible buyer and seller of options when making a deal.. And deals are not duplicated: there is one entry in the OSS register per one opening position, not two for one deal.

When the trade closes, then the corresponding entry is made: Sell To Close when closing a long position and Buy To Close when exiting a short position. And to close these positions, the obligatory presence of a market counterparty is also not required., closing can be done in the same way, as well as opening - according to quotes in the table. And the deal is carried out one, and not between the trader and the “invisible counterparty”.

Option premiums have two parts: internal (Intrinsic Value) cost and time (Time Value) cost. The ratio of these types of value is different and depends on:

-

- Underlying asset prices (Underlying price)

-

- Option strike prices (Strike)

-

- time, remaining until expiration (Time until expiration)

-

- Implicit (alleged) option volatility (Implied volatility)

-

- Underlying asset dividend (Dividends)

-

- Current base interest rate (Interest rate)

The first four parameters determine the value of the option, not all underlying assets have dividends, and interest rates rarely change lately. The main parameter is the price of the underlying asset relative to the strike.. This parameter determines the presence or absence of an internal (Intrinsic Value) cost.

The ratio of the BA price to the strike and the presence of internal (Intrinsic Value) cost options are divided into options "in the money" In The Money (IT), "near the money" At The Money (ATM) and "no money" Out Of The Money (OTM)

- In The Money Options (IT) contain most of the intrinsic value.

- Near the Money Options At The Money (ATM) contain little intrinsic value.

- Out Of The Money Options (OTM) contain no intrinsic value.

If a trader holds an in-the-money or near-the-money option, then he can always sell his option no cheaper than the intrinsic value, if there is no time before expiration, or close to fair value, taking into account the BA price, time, implicit volatility values and rates. The fair value of an option can be calculated using an option calculator. It looks like this for my broker:

FB stock, having large volumes of circulation within the day. And the option volumes for this stock are large, spreads between bid / ask are small, practically minimal. Option trades are executed instantly, sometimes it seems even before, how the order flew to the broker)

But stock, volumes for which are not so large, have small option volumes and there may be a significant spread between the bid / ask on options. Then the trader's task is not to squander the value of his options due to low liquidity on the options.. For a reasonable buy / sell, you should set the price within a framework close to the theoretical value and wait, when will the deal be done. And the deal will be done within 5-10-15 minutes, if the price matches the market fair value, even if there is only one trader in the options market for this BA.

I don't count on, that the above is able to convince those, who is confident in the presence of an “invisible counterparty” on the market, necessary for trade. They mean anyone by this. For many years I have bought and sold options at their fair value and at the quotes in the table, without even knowing, that these simple things may not be clear to someone: options can be bought and sold, because they are issued by the OSS, and not because someone wants to buy them from me or sell them to me. With the advent of exchange-traded standardized options, the seller and the buyer are in no way connected in the options market., they exist each in their own world. Only the buyer decides for himself, what should he do with options, and the seller is liable for the underlying asset, until he closed his short position in options.

Convince supporters of the existence of double trades in the options market, that you can sell options without the presence of a buyer, could real market experience in the US options market. But providing them with market experience is not my task..

Haven't read this for a long time :)

About options