Rusagro Group (MCX: AGRO) — one of the largest agricultural holdings in Russia. The company owns the fourth largest land bank in Russia, and also holds leading positions in key agro-industrial segments: it is a leader in the production of sunflower oil, sugar and pork.

15 In March, the company issued its consolidated FINANCIAL STATEMENTS under IFRS for 2020 year. Amid a surge in demand for consumer products amid the global pandemic, the group hit all-time highs in revenue and EBITDA.

Group results by segment

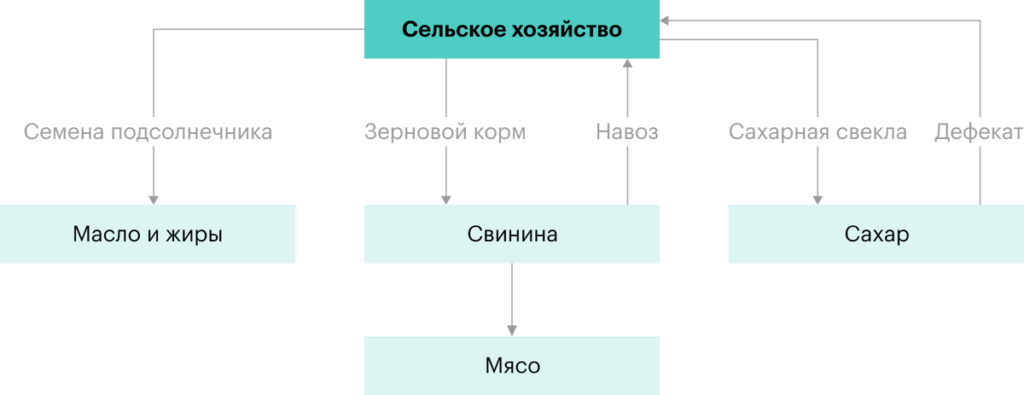

The Group is a vertically integrated holding. The company's business is presented in four segments.

Agriculture. The most profitable segment. Consists of growing and selling beets, cereals and oilseeds.

The strength of a company's vertical integration is, that the products of this segment act as raw materials for other segments.

Despite the decline in sales in tons by 21%, segment revenue increased by 33%: with 25,8 billion to 34,3 billion rubles. This is due to the rapid rise in prices for all types of crops throughout the year.. Segment EBITDA increased by 157%: with 5,9 billion to 15,2 billion rubles, — and the EBITDA margin was 44% - against 23% in 2019.

Harvested crop "Rusagro", million tons

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Sugar beet | 4,3 | 3,5 | 3,5 | 3,9 | 2,9 |

| Cereal crops | 0,9 | 1,2 | 1,1 | 1,0 | 1,2 |

| Oilseeds | 0,2 | 0,2 | 0,3 | 0,4 | 0,3 |

Sugar beet 2016 4,3 2017 3,5 2018 3,5 2019 3,9 2020 2,9 Cereal crops 2016 0,9 2017 1,2 2018 1,1 2019 1,0 2020 1,2 Oilseeds 2016 0,2 2017 0,2 2018 0,3 2019 0,4 2020 0,3

Productivity "Rusagro", tons per hectare

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Sugar beet | 37,8 | 39,1 | 45,1 | 45,1 | 34,6 |

| Cereal crops | 4,7 | 4,2 | 4,0 | 4,0 | 4,9 |

| Oilseeds | 1,5 | 1,9 | 1,8 | 0,4 | 0,3 |

Sugar beet 2016 37,8 2017 39,1 2018 45,1 2019 45,1 2020 34,6 Cereal crops 2016 4,7 2017 4,2 2018 4,0 2019 4,0 2020 4,9 Oilseeds 2016 1,5 2017 1,9 2018 1,8 2019 0,4 2020 0,3

Land for arable land, thousand hectares

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Sugar beet | 98 | 93 | 89 | 87 | 84 |

| Cereal crops | 227 | 245 | 252 | 252 | 244 |

| Oilseeds | 123 | 151 | 169 | 212 | 186 |

| Other crops | 102 | 50 | 45 | 32 | 26 |

Sugar beet 2016 98 2017 93 2018 89 2019 87 2020 84 Cereal crops 2016 227 2017 245 2018 252 2019 252 2020 244 Oilseeds 2016 123 2017 151 2018 169 2019 212 2020 186 Other crops 2016 102 2017 50 2018 45 2019 32 2020 26

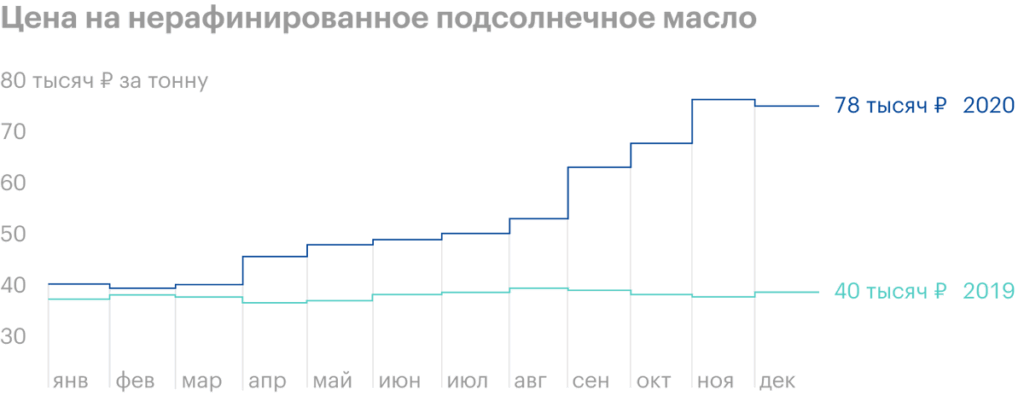

Oils and fats. The holding produces fat and oil products: sunflower oil, margarine, mayonnaise, meal and industrial fats.

Segment revenue increased by 22%: with 62,3 billion to 76,2 billion rubles. This is due to an increase in prices by 6-17% in the domestic and world markets and an increase in the share of marginal products in total production..

EBITDA increased by 177%: with 3,7 billion to 9,4 billion rubles. The main driver of growth is the sale of a large share of products, made from cheaper sunflower seeds 2019 of the year. EBITDA margin increased by 7 percentage points: with 5 to 12%.

Meat. The company is engaged in the cultivation and sale of pork products. Segment sales increased by 26%: with 25,8 billion to 32,4 billion rubles. Pig farms in the Tambov region reached full capacity, and increased exports of meat and offal by 105% in 2020 year. EBITDA increased by 34%: with 4,8 billion to 6,5 billion rubles. EBITDA margin was 20% - against 19% in 2019 year.

Pork production "Rusagro", thousand heads

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Grown heads | 1825 | 1773 | 1821 | 2081 | 2563 |

| Sent to the slaughter | 843 | 1193 | 1460 | 1880 | 2295 |

Grown heads 2016 1825 2017 1773 2018 1821 2019 2081 2020 2563 Sent to the slaughter 2016 843 2017 1193 2018 1460 2019 1880 2020 2295

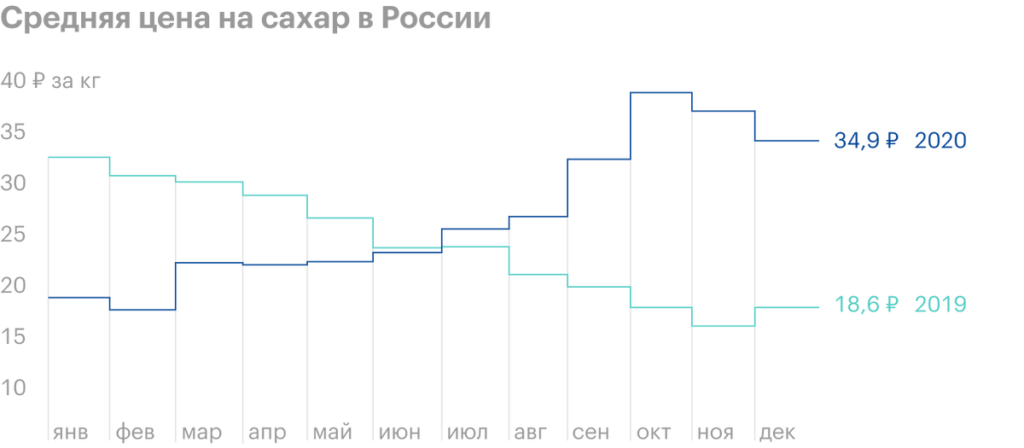

Sugar. The company produces sugar from sugar beet. For 2020 year Rusagro produced 764 thousand tons of sugar 881 thousand tons per 2019 year. This is due to a poor beet harvest in Russia as a whole for the year and a decrease in the acreage of Rusagro under sugar beet by 4% in favor of more cost-effective products.

Segment revenue decreased by 10%: 28,1 billion against 31,2 billion rubles a year earlier. EBITDA increased by 59%: 6,4 billion against 4 billion rubles a year earlier - sugar prices rose in 2020 year due to low yield expectations. EBITDA margin jumped by 10 percentage points and amounted to 23%.

Rusagro sugar production, thousand tons

| 2016 | 810 |

| 2017 | 984 |

| 2018 | 773 |

| 2019 | 881 |

| 2020 | 764 |

2016 810 2017 984 2018 773 2019 881 2020 764

Dynamics of the main financial indicators

Sales at the end of the year increased by 15%: growth from 138,2 billion to 159 billion rubles is a record revenue of the company during its existence. Revenue growth was driven by improved operating performance in all business segments, except sugar, and the weakening of the ruble against world currencies, because 32% the company's sales come from exports.

The cost of the group increased by 10%, growth from 110,5 billion to 121,1 billion rubles, - a smaller proportion relative to revenue is due to the fact, that the company partially used cheaper raw materials, which is left with 2019 of the year, for the production of final products.

Group EBITDA increased by 65%. Growth since 19,3 billion to 32 billion rubles is also a record for the company, and the EBITDA margin was 20 against 14% compared to 2019 year.

Net profit increased by 150%: with 9,7 billion to 24,3 billion rubles. Net profit margin was 15% - against 7% in 2019 year.

Balance sheet indicators

Group assets grew by 15%: with 239,5 billion to 276,1 billion rubles. Key change from 2019 year - an increase in the volume of money and deposits in accounts with 2,1 billion to 11,9 billion rubles. Stocks in warehouses increased from 44,6 billion to 63,3 billion rubles. Fixed assets increased from 80,6 billion to 87,5 billion rubles through capital investments in the meat segment of the business — the construction of new pig farms and the creation of a large cluster in Primorsky Krai. The development of the Primorsky cluster is a strategic capital project of the group to increase pork exports to Asian countries.

Capital increased by 18% — with 106,8 billion to 126 billion rubles — due to an increase in retained earnings.

Liabilities increased by 13% — with 132,7 billion to 150 billion rubles — due to the growth in the volume of short-term bank loans from 31,8 billion to 51,8 billion rubles.

Dividends

According to dividend policy, Rusagro sends at least 25% net income under IFRS. For the last 5 years the company has never paid the lower threshold. In December, the group's CEO announced the possibility of a policy review, which involves raising the minimum bar to 50% from net profit.

The company pays dividends twice a year. In March, the Board of Directors approved the final amount of payments for 2020 year in size 140 million dollars. Including interim dividends for the first half 2020 years in the amount 25,6 million dollars total payments will amount to 50% from net profit, which is similar 2019 year. Dividend yield on quotes at the beginning of April was 8%.

What's the bottom line?

Due to the pandemic and declining oilseed and sugar beet yields, food prices have risen steadily over the 2020 of the year. IN 2021 growth of inflation in Russia will be positive factors for the company, which the, according to the research holding "Romir", exceeds the official 3 Times, and the weakening of the ruble against world currencies. The company intends to increase expansion in the world markets in the segments of meat and agriculture.

Risk factor for the company - the impact of weather on the volume of the crop. According to the Ministry of Agriculture of the Russian Federation, weather conditions at the beginning 2021 years can reduce the yield of major crops, which will affect several segments of the company's business at once. To reduce risk, the company actively invests in business diversification and its geography. Besides, Rusagro actively develops the segment of products with high added value through its own brands.

Rusagro shares could be an excellent opportunity for portfolio diversification in the face of an economic downturn and recession. Active M&A-company activities and growing exports give room for growth both in domestic, as well as in international markets.

According to Ortex, since March 2020 on March 2021 CEO of the company Maxim Basov acquired Rusagro shares for the amount 2,5 million dollars. This may be an indicator, that management is confident in the stability of the company and the benefits from the implementation of future projects.