First quarter results for the largest oil company in Russia

Rosneft (MCX: GROW) Is one of the largest and fastest growing energy organizations in the world with a share of global oil production of about six percent and an average growth rate of hydrocarbon production by 7,5 % over the past ten years. The company occupies a dominant position in the Russian Federation: according to the results of 2020, its capacity accounted for about forty percent of all oil and gas condensate production.

In May, Rosneft summed up the results of the first quarter of 2021, which turned out to be diverse. On the one side, Rosneft reduced the volume of production and processing of hydrocarbons on a quarterly basis, on the other hand, received the highest net profit.

I suggest you figure it out, how companies managed to produce and sell less, but earn more.

Main operating characteristics

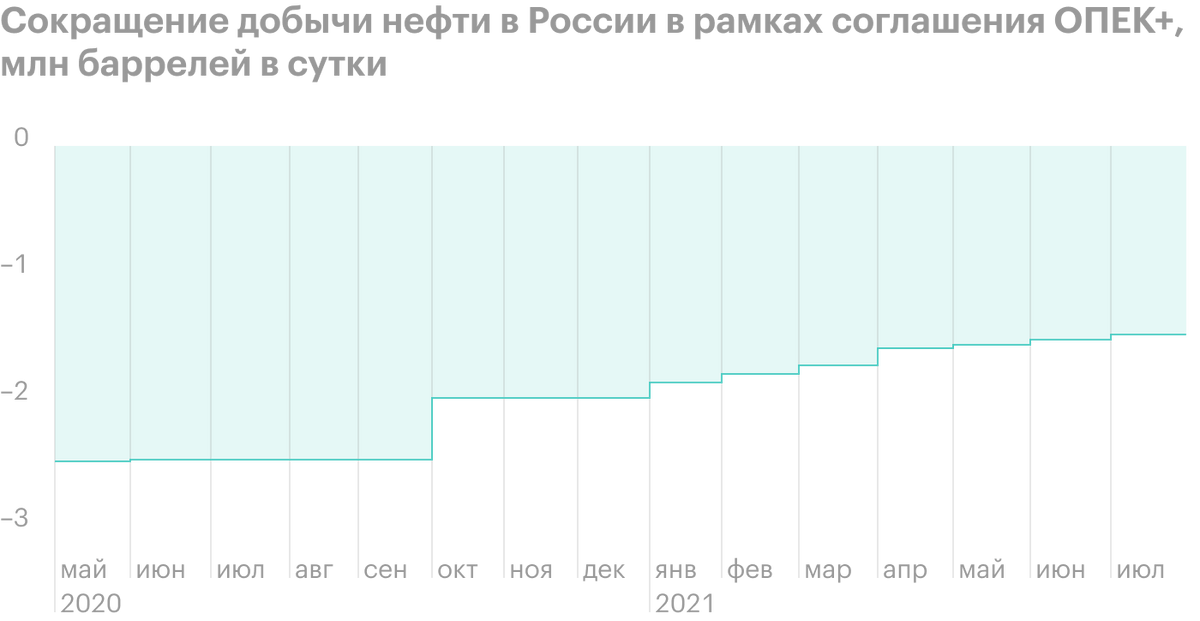

According to the results of the first quarter of 2021, hydrocarbon production fell to a minimum of the last five years. In the 1st 3 months of this year, Rosneft produced seventeen percent less quarterly - 4.76 million barrels of oil equivalent per day due to the criteria of the OPEC + agreement. Production of watery hydrocarbons decreased by nineteen percent quarterly to 3.75 million barrels per day.

Gas production fell by eight percent quarterly to 1.01 million barrels of oil equivalent per day. OPEC+ restrictions do not apply to this sector, because the main reason for the fall is the reduction of oil gas, Highlight?? in oil production. At the same time, natural gas production increased by five percent due to the launch of a compressor station at the Beregovoe field., also due to the increase in production at the Zohr field in Egypt due to the recovery of demand in the region.

Production of hydrocarbons in the first three months, million boe per day

| 2017 | 5,79 |

| 2018 | 5,71 |

| 2019 | 5,9 |

| 2020 | 5,75 |

| 2021 | 4,76 |

2017

5,79

2018

5,71

2019

5,9

2020

5,75

2021

4,76

Production of aqueous hydrocarbons in the first three months, million barrels per day

| 2017 | 4,62 |

| 2018 | 4,57 |

| 2019 | 4,74 |

| 2020 | 4,64 |

| 2021 | 3,75 |

2017

4,62

2018

4,57

2019

4,74

2020

4,64

2021

3,75

Gas production in the first three months, million boe per day

| 2017 | 1,17 |

| 2018 | 1,14 |

| 2019 | 1,16 |

| 2020 | 1,11 |

| 2021 | 1,01 |

2017

1,17

2018

1,14

2019

1,16

2020

1,11

2021

1,01

Due to the reduction in the size of hydrocarbon production, the volumes of refining at their own and solidarity with colleagues oil refining enterprises of Rosneft also fell.. Crude oil refining decreased by eight percent to 26.35 million tons. Approximately 84% processing fell on Russian factories and sixteen percent - on foreign.

Production volumes of oil refining and petrochemical products decreased by eight percent quarterly to 25.65 million tons. Of these, 23.24 million tons accounted for the creation in the Russian Federation, 2,41 million tons - to factories in Germany.

It should be noted, that in Germany, in the first three months of 2021, the volume of production of oil refining and petrochemical products fell by almost eighteen percent due to the introduction of a subsequent lockdown from February to April. To somehow make up for the usual, Rosneft carried out serious repair work at German enterprises at the beginning of the year.

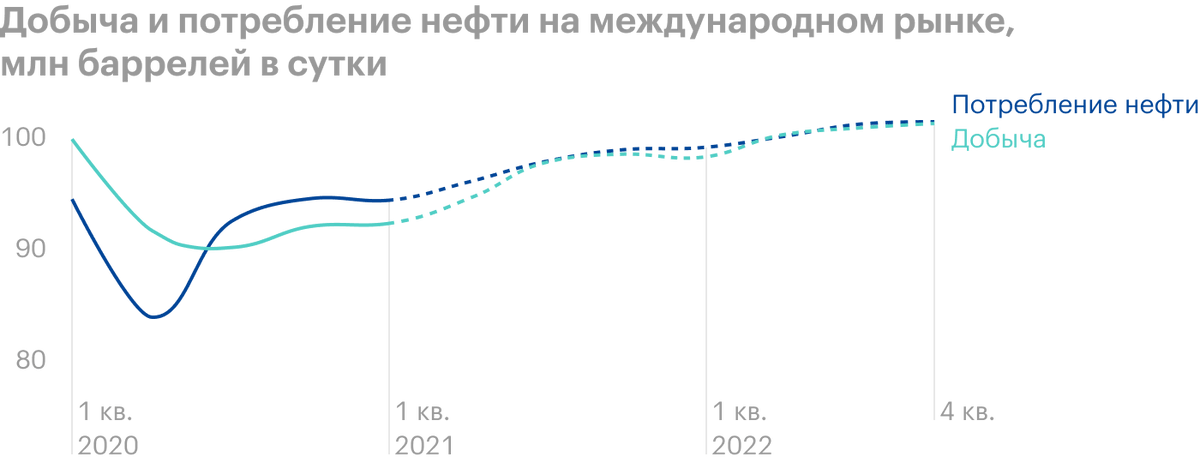

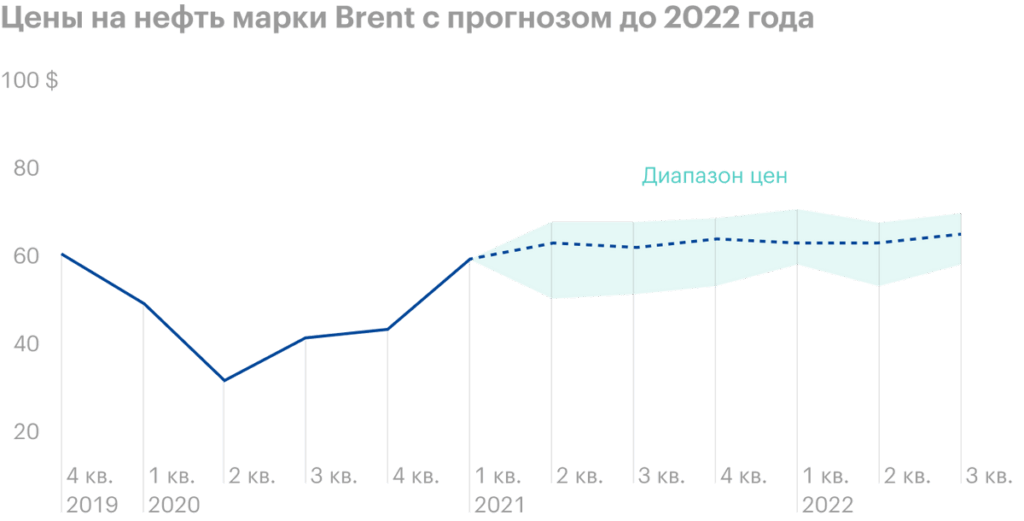

Despite a significant drop in the volume of production and processing of hydrocarbons, average cost for hydrocarbons, thanks to the operation of the OPEC + agreement and the restoration of the global economic system after quarantine, are at local maxima and, according to forecasts, will soon show steadily growing dynamics.

Creation of refined products and petrochemical products in the first three months, million tons

| 2017 | 27,35 |

| 2018 | 26,77 |

| 2019 | 26,17 |

| 2020 | 28 |

| 2021 | 25,65 |

2017

27,35

2018

26,77

2019

26,17

2020

28

2021

25,65

Key financial indicators

The fall in sales of oil and oil products partially offset the increase in oil prices by the first quarter of 2021 by 23%. As a result, Rosneft's sales revenue decreased by only 1% — up to 1737 billion rubles.

Operating expenses of Rosneft decreased by 10% — up to 1494 billion rubles. Production costs fell 2 times - up to 111 billion rubles, and transport and other selling expenses 30%, up to 151 billion rubles. Expenses, related to export duties, decreased by 39% due to a decrease in the volume of exports of oil and oil products, as well as falling export duty rates.

As a result, operating profit increased by 2,4 times — up to 243 billion rubles — against the backdrop of a low base in the first quarter of 2020.

Financial expenses decreased from 80 up to 58 billion rubles qoq. This is due to the revaluation of the fair value of financial assets. The final results were seriously affected by the currency revaluation due to the devaluation of the ruble. Rosneft received a profit on foreign exchange differences in the amount of 5 billion rubles - against a loss of 177 billion rubles for the same period last year.

As a result, instead of a net loss of 156 billion rubles, Rosneft received a net profit of 149 billion rubles., which was a record result in recent years.

Financial performance of the company, billion rubles

| Revenue | Operating profit | Net profit | |

|---|---|---|---|

| 2017 | 1410 | 135 | 11 |

| 2018 | 1722 | 200 | 81 |

| 2019 | 2077 | 341 | 131 |

| 2020 | 1758 | 101 | −156 |

| 2021 | 1737 | 243 | 149 |

Revenue

2017

1410

2018

1722

2019

2077

2020

1758

2021

1737

Operating profit

2017

135

2018

200

2019

341

2020

101

2021

243

Net profit

2017

11

2018

81

2019

131

2020

−156

2021

149

Dividends

Rosneft's net debt increased by 2% for the first three months of 2021 — up to 3846 billion rubles. The main reason for the growth is the reduction of money in accounts and their equivalents by 20%, up to 658 billion rubles.

Despite rising net debt, the company's debt burden by the ratio "net debt / EBITDA" decreased from 3,1 to 2,9 thanks to EBITDA growth in the first quarter of this year.

Net debt dynamics, billion rubles

| 31 December 2017 | 5012 |

| 31 December 2018 | 3559 |

| 31 December 2019 | 3600 |

| 31 December 2020 | 3785 |

| 31 Martha 2021 | 3846 |

31 December 2017

5012

31 December 2018

3559

31 December 2019

3600

31 December 2020

3785

31 Martha 2021

3846

Debts

The dividend policy for 2015 provides for dividend payments of at least 50% from IFRS net profit. In this case, payments must be made at least 2 once a year.

22 April 2021, the Board of Directors of Rosneft recommended that shareholders pay as final dividends based on the results of 2020 the minimum in recent years 6,94 P per share, which corresponds 50% from IFRS net profit.

Dividends per share in rubles for the year

| 2016 | 5,98 |

| 2017 | 10,48 |

| 2018 | 25,91 |

| 2019 | 33,91 |

| 2020 | 6,94 |

2016

5,98

2017

10,48

2018

25,91

2019

33,91

2020

6,94

What's the bottom line?

OPEC + agreement remains key, which limits the production and processing of hydrocarbons at Rosneft enterprises. Nevertheless, an agreement between the largest oil-producing countries made it possible to stabilize demand and prices on the international market., therefore, the company received record profits quarter-on-quarter, despite the decline in production.

Since August 2020, restrictive measures have been gradually easing, and by April 2021, Russia managed to reach an agreement with the OPEC+ countries to increase production by a million barrels per day.

Since hydrocarbon prices are at local highs, demand remains stable, and the restrictions are easing, we can confidently expect an improvement in the financial results of Rosneft in the second quarter.