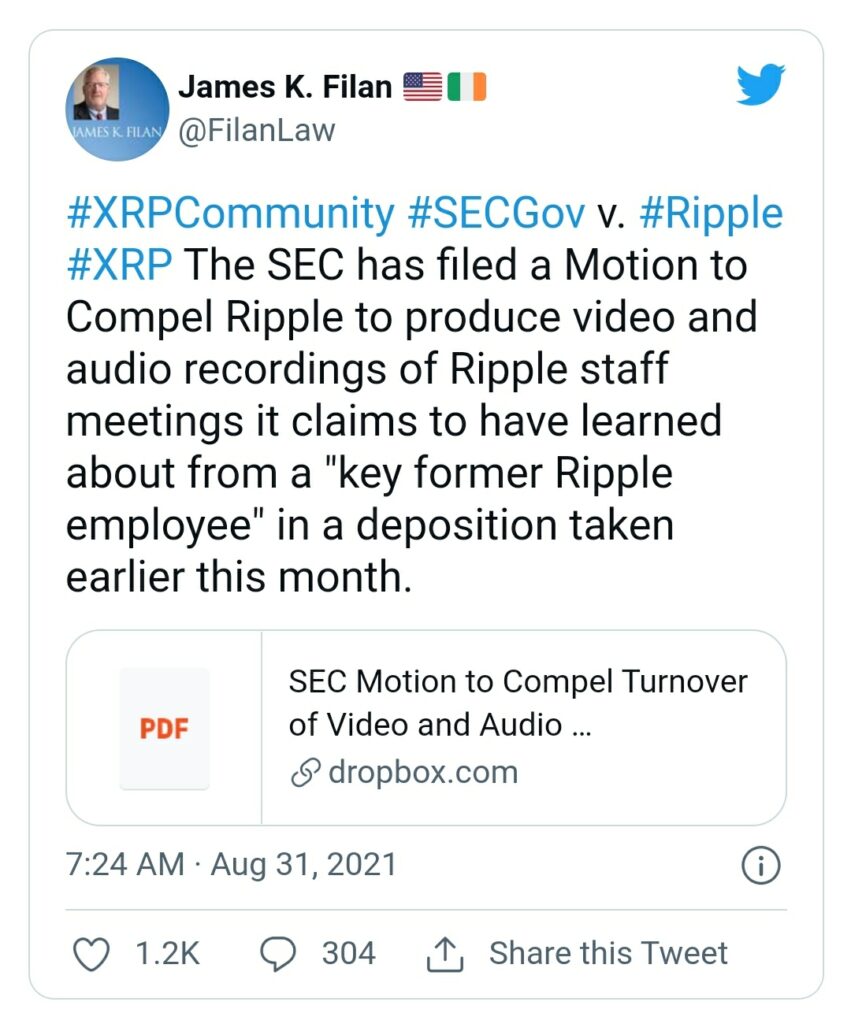

Fintech company Ripple to provide US Securities and Exchange Commission (SEC) internal audio- and videos. Reported by U.Today.

31 in August, the regulator filed a corresponding petition.

We are talking about recordings from general meetings, starting from the fourth quarter 2014 of the year, meetings with SBI [Holdings] and friend. Ripple and Japanese financial conglomerate partnered in 2016 year. As part of the agreement, they created a joint venture SBI Ripple Asia.

In December SBI Holdings stated, that the Commission's claim will not affect the status of the XRP token in Japan.

According to the publication, the array of records also includes discussions by Ripple employees of the SEC investigation (22 December 2020 of the year), the company's prospects in the light of the fall in XRP prices (26 February 2018 of the year) and centralization of cryptocurrencies (30 Martha 2020 of the year).

The parties will discuss the exact volume of documents during the meeting..

In the beginning of September 2021 of the year, Justice of the Peace Sarah Netburn ordered the California-based company to give the regulator access to employees' messages in the Slack messenger.

Earlier, the court upheld Ripple in the issue of disclosing SEC documents. The regulator is instructed to submit them with a minimum number of revisions..

At the end of August, the fintech company demanded that the Commission provide information about the operations of its employees with bitcoin., Ethereum and XRP, and also requested documents from the Binance cryptocurrency exchange.

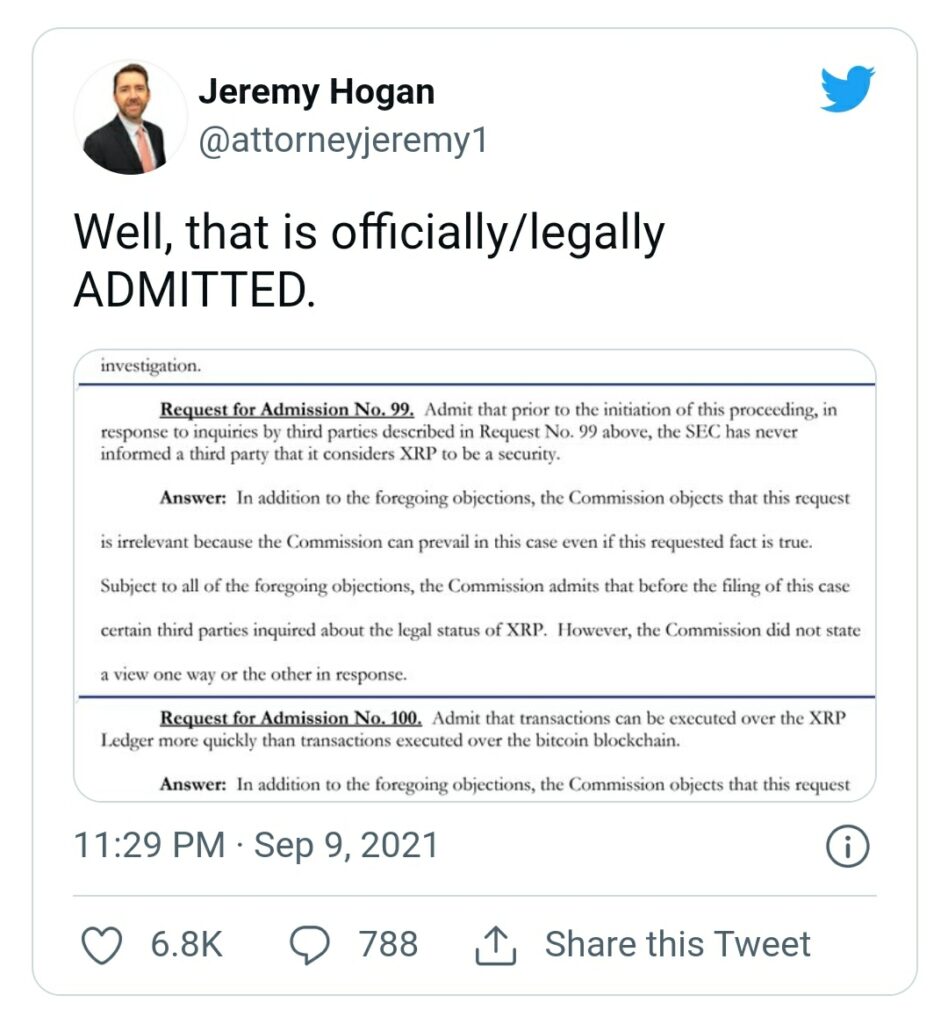

9 September lawyer Jeremy Hogan drew attention to the SEC clarification. According to the documentation, before going to court, the regulator did not publicly call XRP a security.

“The Commission recognizes, that prior to filing the case, certain third parties were interested in the legal status of XRP. However, in response, the Commission did not express its opinion in one way or another ”, - the document says.

“The Commission recognizes, that prior to filing the case, certain third parties were interested in the legal status of XRP. However, in response, the Commission did not express its opinion in one way or another ”, - the document says.

Recall, in December 2020 of the year, the SEC accused Ripple and its executives of an unregistered sale of securities under the guise of XRP tokens on $1,3 billion. Later, the regulator adjusted the claim, focusing on the actions of Brad Garlinghouse and Chris Larsen.

In July 2021 of the year, the company achieved a summons to the court of the ex-director of the department of corporate finance of the department, William Hinman. During the meeting, he said, what warned Ripple about the risk of XRP being recognized as a security.