Total (NYSE: TOT) - French oil and gas company, geological exploration, Prey, processing and marketing of hydrocarbons, as well as petrochemicals and energy. The company uses oil refineries with a capacity of approximately 2 million barrels per day, primarily in Europe.

TOT sells processed products in 65 States, manufactures commercial and specialty chemicals. In addition, the company owns nineteen percent of the Russian gas organization Novatek..

9 February Total made public its financial statements for the full 2020 year.

Monetary characteristics

Comprehensive revenue of the company fell on 32,3 % - to 119,7 billion dollars. The oil production fell by eight percent in relation to the previous year and amounted to 1341 barrels per day due to fulfillment of restrictions under the OPEC + deal. The average cost of oil sales dropped by 38,1 %, gas cost - by 23,7 %.

According to the results 2020 Years Major Revenue Segments Total: oil refining and petrochemistry — 45,2 %, Advertising activity - 28,6 %. The largest regions in 2020 year: Europe and Central Asia — 36,1 % in 2020.

The decrease in the selling price and the decrease in the volume of oil refining led to a drop in the profitability of refining a barrel of oil from 5,48 to 0,45 $. As a result, the loss on operating income amounted to 5,5 billion.

Unsullied cash spending decreased by 18,8 % - to 1,9 billions - amid growing other income of the company. The share in the income of affiliated companies decreased by 86,7 % - to 452 million. Due to a decrease in the cost of oil prices and a decrease in demand due to coronavirus infection, the company recorded an asset impairment in Canada - direct losses exceeded 7,2 billion dollars. Total's Free FX Flow Drops Sixty-Four Percent Due to Decrease in Operating FX Flow.

This year, the company expects, that production will remain measured thanks to the restoration of production in Libya. but, according to the management, the oil situation remains uncertain and depends on the recovery of global demand. Total will continue to work in the direction of LNG, waiting for sales to grow by ten percent in 2021 year.

Immediately with the reporting, the company presented a refreshed development strategy for a ten-year period.. Within its framework, Total plans to transform into an energy company, which relies on LNG and RES. As expected, in 2021 year, the share of renewable energy will account for more than twenty percent of the organization's investments.

Monetary characteristics of the company, billion dollars

| Revenue | Operating profit | Unsullied profits | Free currency flow | |

|---|---|---|---|---|

| 2016 | 127,925 | 5,731 | 6,196 | −0,123 |

| 2017 | 149,099 | 10,532 | 8,631 | 9,588 |

| 2018 | 184,106 | 16,582 | 11,446 | 11,339 |

| 2019 | 176,249 | 16,228 | 11,267 | 13,402 |

| 2020 | 119,704 | −5,584 | −7,242 | 4,779 |

Major revenue segments, billion dollars

| 2019 | 2020 | Percent change | Percentage share in 2020 | |

|---|---|---|---|---|

| Exploration and production | 38,590 | 23,456 | −39,22 % | 14,83 % |

| Oil refining and petrochemistry | 116,973 | 71,588 | −38,80% | 45,27% |

| Marketing Activity | 66,887 | 45,232 | −32,38% | 28,60% |

| Gas processing and power industry | 20,992 | 17,632 | −16,01% | 11,15% |

| Corporate segment | 0,135 | 0,240 | 77,78% | 0,15% |

| Intercompany segment | −67,328 | −38,444 | −42,90% | — |

| Total | 176,249 | 119,704 | — | 100,00% |

Combined production of liquids and gas by region (kboe/d)

| Volume | share | |

|---|---|---|

| Europe and Central Asia | 1,039 | 36,19% |

| Africa | 0,629 | 21,91% |

| Middle East and North Africa | 0,624 | 21,73% |

| America | 0,353 | 12,30% |

| Asian-Pacific area | 0,226 | 7,87% |

| Total | 2,871 | 100,00% |

Balance sheet indicators

Total assets decreased by 2,6% - to 266,1 billion. This is mainly due to a decrease in current assets from 85,2 billion to 79,6 billion dollars. The capital of the company decreased by 11% - to 106 bln - due to a decrease in the paid surplus and retained earnings.

The total debt of the company increased by 23% - to 77,6 billion. Total committed to credit lines, allowing it to draw on significant liquidity reserves. As of 31 December 2020 years, this loan money amounted to 14,9 billion, out of which 11,2 billion the company did not use. 55% payments on long-term financial debt of the company fall on the period after 2026 of the year. Net debt increased by 19,3% - to 37,13 bln - due to the growth of total debt. Net debt to equity ratio increased from 20,7 to 25,9%.

Company indicators, billion dollars

| Capital | Assets | Total debt | net debt | |

|---|---|---|---|---|

| 2016 | 101,547 | 230,978 | 56,987 | 27,121 |

| 2017 | 114,037 | 242,631 | 52,436 | 15,424 |

| 2018 | 118,114 | 256,762 | 53,435 | 21,657 |

| 2019 | 119,305 | 273,294 | 62,893 | 31,124 |

| 2020 | 106,085 | 266,132 | 77,615 | 37,139 |

Comparison with competitors

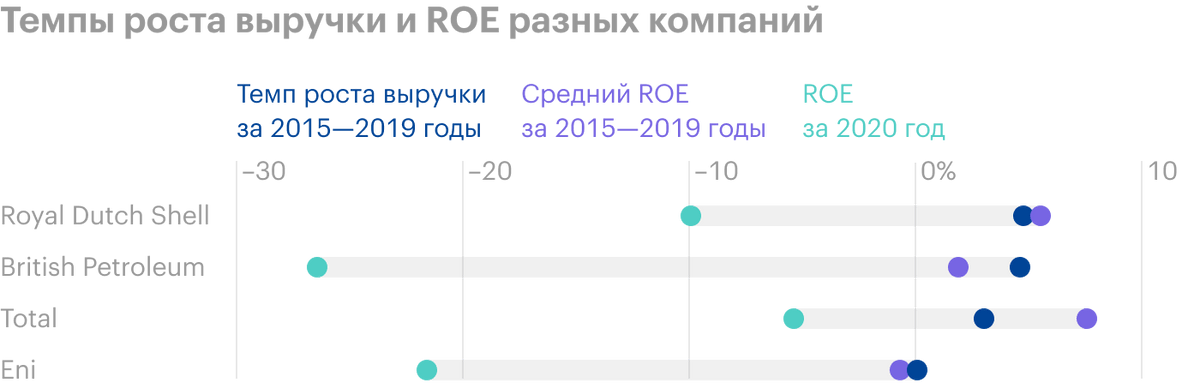

Consider the largest European oil and gas companies: Royal Dutch Shell, British Petroleum, Eni. To assess the effectiveness of companies, we have chosen three indicators: revenue growth rate for the last 5 years, ROE, average ROE for 5 years.

Researched oil and gas companies are not growing, revenue growth rates for all companies are low. Total suffered the crisis with minimal damage 2020 year. Based on average ROE values, can be expected, that in case of favorable market conditions Total will be more effective than competitors.

Revenue of companies, billion dollars

| 2015 year | 2019 year | |

|---|---|---|

| Royal Dutch Shell | 272,156 | 344,877 |

| British Petroleum | 222,894 | 278,387 |

| Total | 149,743 | 176,249 |

| Eni | 76,557 | 77,315 |

Dividends

The company pays dividends based on operating cash flow as determined by the Board of Directors on a quarterly basis.. Based on the results of the first half of the year 2020 years, the company confirmed the possibility of paying dividends, provided that the oil price remains above 40 $ per barrel.

For 2020 year the company paid 0,66 dollars per share per quarter. It is also worth noting, that the company paid its current dividends by increasing its debt load. The dividend payout ratio in recent years has been approaching 100%, which in the long run may adversely affect the stability of these payments. Average annual total stock returns over the past 5 years is 6,81%.

Analysis of the company's dividend payments

| Dividend per share | Payout ratio | Dividend yield | |

|---|---|---|---|

| 2016 | 2,70 $ | 170,75% | 5,30% |

| 2017 | 2,81 $ | 85,85% | 5,08% |

| 2018 | 2,95 $ | 70,44% | 5,64% |

| 2019 | 2,16 $ | 67,38% | 5,22% |

| 2020 | 3,83 $ | — | 7,38% |

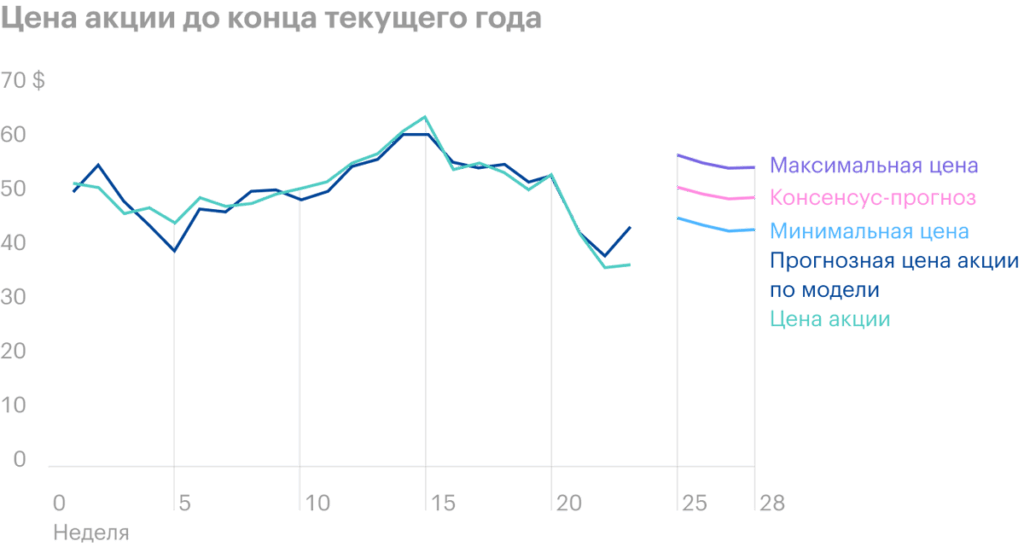

Factorial model of the company's share price

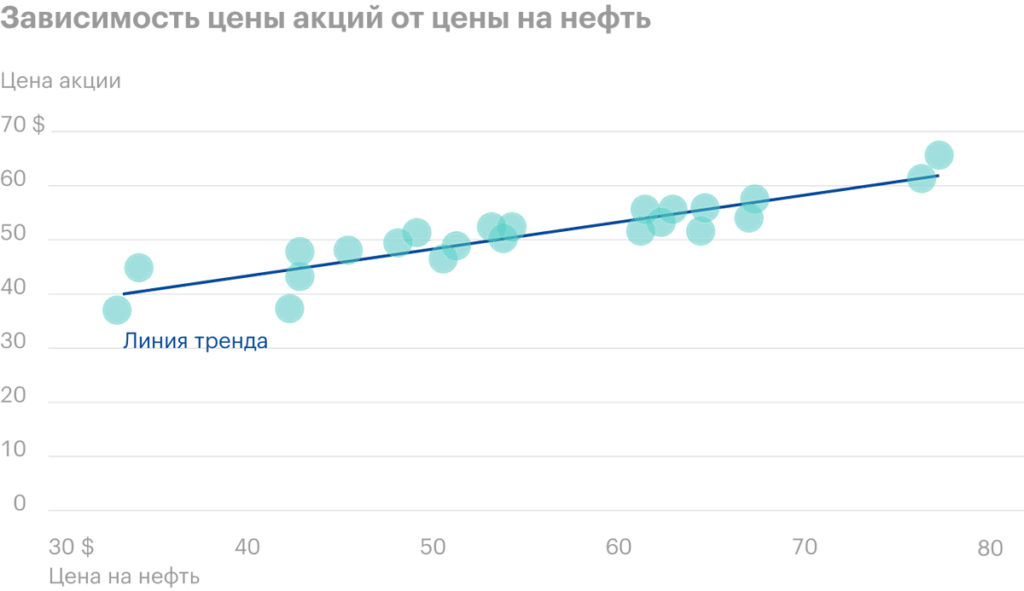

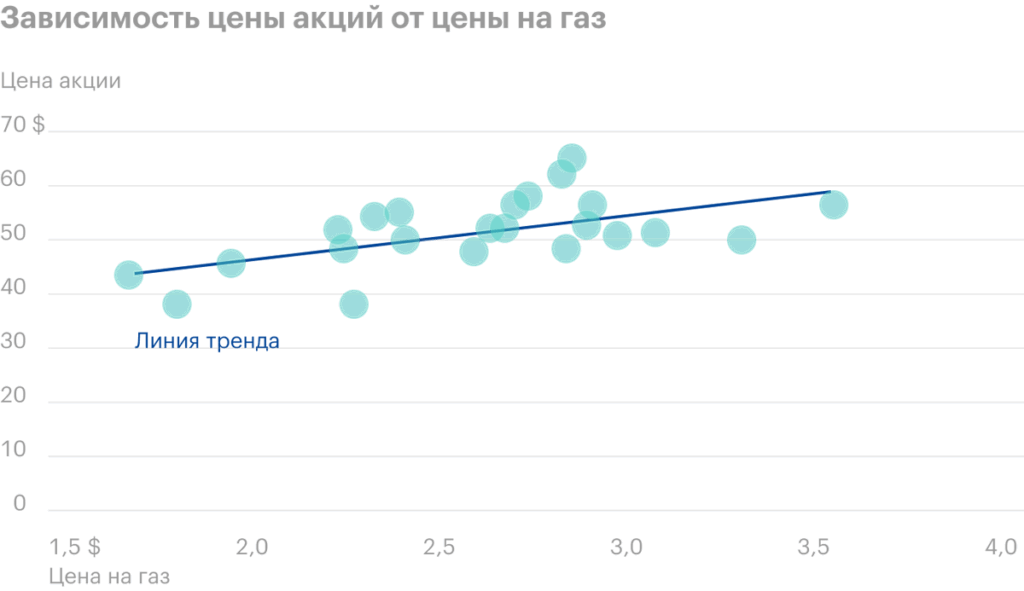

To determine the factors, affecting the price of the company's shares, build a correlation matrix. Over the past five years, the greatest dependence of the average share price is observed on the average oil price, average gas price, company revenue, rates FED.

One of the conditions for constructing a regression model is the independence of the action of factors, and collinearity and multicollinearity violate this condition.

The price of oil is the most significant variable, she explains 91% changes in share price. Fed rate is collinear with oil price, and since the price of oil is more closely related to the price of a stock, she was not included in the model. Revenue also cannot be included in the model due to multicollinearity, correlations of independent variables, which makes it difficult to evaluate and analyze the overall result. Between the price of oil and gas there is correlation, but she is weaker, than their impact on the share price, and therefore these variables are included in the model.

Correlation matrix

| Average share price | Average oil price | Fed rate | Revenue | Average gas price | t | |

|---|---|---|---|---|---|---|

| Average share price | 1 | — | — | — | — | — |

| Average oil price | 0,912988 | 1 | — | — | — | — |

| Fed rate | 0,757307 | 0,748744 | 1 | — | — | — |

| Revenue | 0,880764 | 0,9223 | 0,86069 | 1 | — | — |

| Average gas price | 0,576119 | 0,488444 | 0,333067 | 0,451312 | 1 | — |

| t | −0,07963 | 0,120629 | 0,456197 | 0,186643 | −0,28341 | 1 |

Let us analyze the form of dependence of the share price on the price of oil and gas. As we see, dependencies are linear, so we can specify the model in the form of multiple linear regression:

y = β0 + β1 × Х1 + β4 × Х4 + u

As a result of calculations, the resulting model has the form:

y = 19,229 + 0,448 × X1 + 2,428 × X4

Where y is the share price, х1 — oil price, x4 - price of gas.

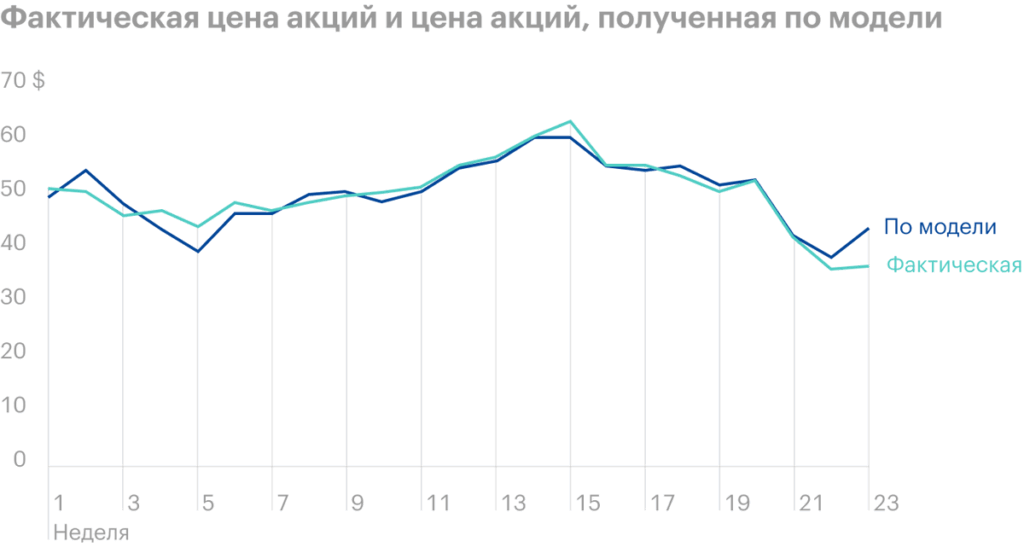

The coefficient of determination for this model is 0,855, which means, what is the price variation for 85,5% attributable to variations in oil and gas prices, and on 14,5% - other factors, which are not included in the model.. The multiple regression model is adequate, because the significance of Fisher's F-test is less 0,05 and the model is significant at the level 95%. For clarity of the constructed model, we will predict the price of shares using the regression equation and compare it with the actual prices per share.

To predict the price of a share until the end of the year, forecast data on the price of oil and gas is required. As forecast data, we used the data, published by the US Energy Information Administration (EIA).

As a result, we concluded, that the share price by the end of this year will be in the range of 49-51 $, which does not imply a big upside compared to the current price.

What's the bottom line?

Total financial results for 2020 the year, as expected, turned out to be weak against the background of falling oil prices and revaluation of the company's assets. Nevertheless, the company remains efficient and with a low level of debt.. The constructed factorial model of the Total stock price determined a high dependence on oil and gas prices and made it possible to predict the range of stock prices by the end of the current year..

The resulting forecast prices allow us to consider Total shares for purchase at current levels for long-term investment in order to receive dividends. At the same time, the continued uncertainty in the oil market and a rather high dividend payout ratio will require a balanced approach to determining the share of these shares in investor portfolios..