In the world of electric vehicles, the name Tesla stands alone, Symbolizing Innovation, Sustainability and growing financial stability. Understanding, how Tesla earns and allocates its finances, can give an idea of what, What Makes This Company Successful.

Main sources of income

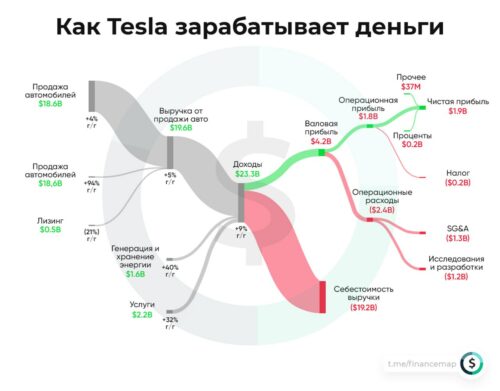

At the forefront of Tesla's financial success is, undoubtedly, Car Sales. According to the latest data, Car Sales Brought Companies $18,6 billion. But that's not the only source of income. Income from services and other operations, including energy generation and storage, Amounted $1,6 billion, showing the diversification of the business beyond just car production.

Costs & Profits

Like any large company, Tesla Faces Colossal Costs. The largest expense item is the cost of revenue, which amounted to $19,2 billion. This includes production costs, materials, logistics, etc.. In spite of this, Gross profit in $4,2 billion and operating profit in $1,8 billion indicate strong operational efficiency and the company's ability to keep costs under control.

Net Profit and Future

The result is Tesla's net profit of $1,9 billion. This number reflects the financial health of the company and its ability to generate returns for investors. While Tesla continues to expand its operations and research, Her income is also growing, which makes the future of the company very promising.

conclusions

Tesla's income and expense chart is a testament to the company's resilience in the dynamic and competitive electric vehicle sector. Tesla's strong focus on innovation and ability to adapt to a changing market helps it stay at the forefront of the industry. With this data in front of your eyes, we can only imagine, What new horizons will open up for the company in the coming years?.

Statistics for the Tesla earnings season

- Since its IPO in 2010 Tesla published 13 quarterly reports.

- On average, Tesla beats analysts' expectations for earnings in 9 from 13 quarters.

- On average, Tesla shares rose in price by 10% after the publication of the quarterly report.

Interesting facts about Tesla stock

- Tesla stock is the most expensive stock in the world by market capitalization.

- Tesla stock is one of the most volatile stocks in the market.

- Tesla stock is often mentioned in the media and social media.

Here are some specific examples:, How Tesla shares reacted to the publication of the company's quarterly reports:

- In the quarter, Ended 30 June 2023 of the year, Tesla reported a profit of 1,26 USD per share, which exceeded analysts' expectations in the amount of 1,11 USD per share. Tesla shares rose in price by 13% After the report is published.

- In the quarter, Ended 31 Martha 2023 of the year, Tesla reported a profit of 0,93 USD per share, which also exceeded analysts' expectations. Tesla shares rose in price by 8% After the report is published.

Generally, Tesla is one of the most successful companies in the world, and its shares are among the most popular on the market. Tesla stock often fluctuates in price, But in general, they show growth.