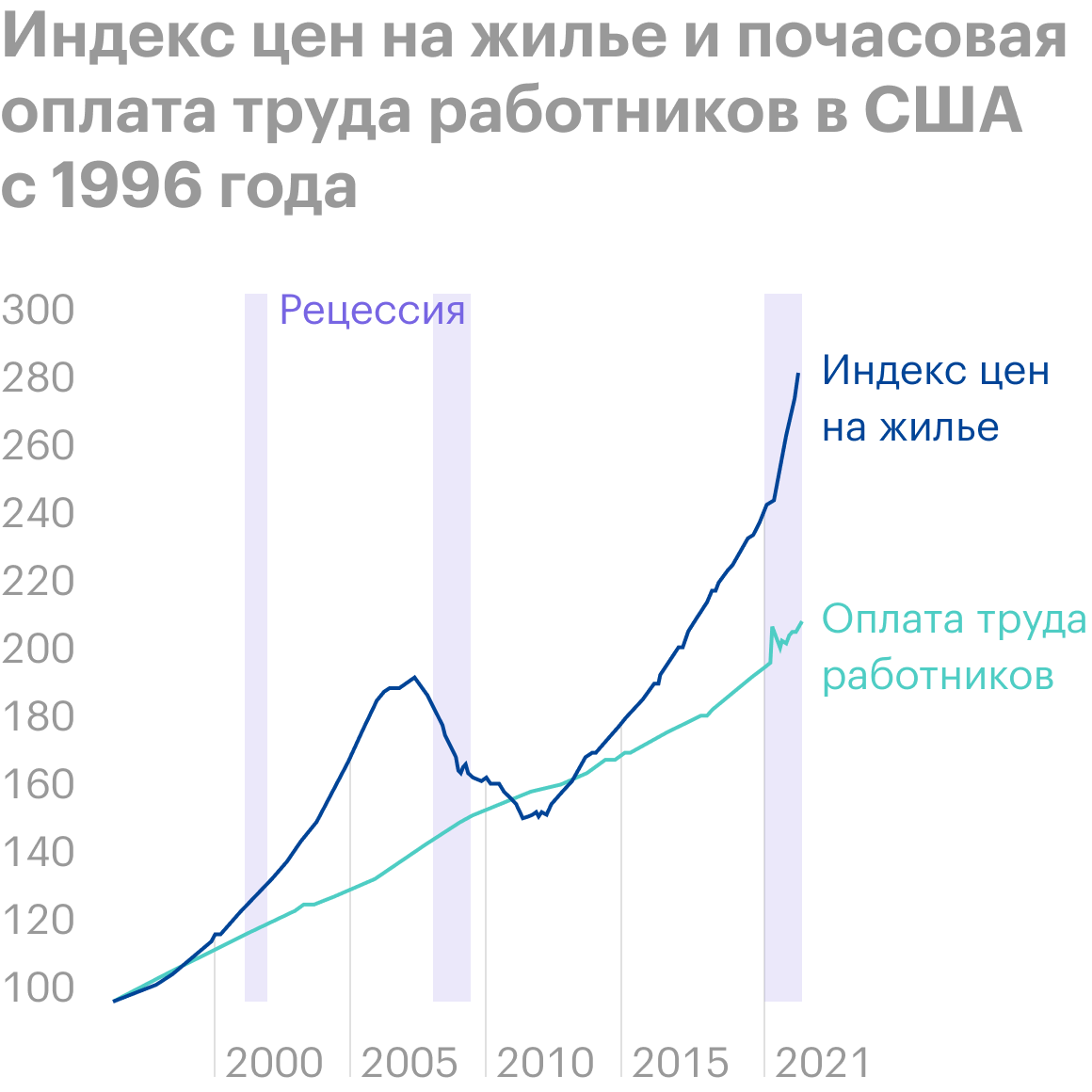

Lennar (NYSE: LEN) - American home building company. The increase in real estate prices greatly increases the attractiveness of this business.. However, it may turn out, that this growth will soon slow down, for the reason that, that houses in the mass of their own are acquired by the rich.

What happens here

Readers have been asking us for a long time to start sorting out the financial statements and business foundations of foreign issuers.. The idea to review Lennar was suggested by our reader Leonid Mikhalev in the comments to the Home Depot review., Lowe’s и Toll Brothers. Offer in the comments of the company, analysis of which you would like to read.

The overview contains many screenshots with tables from reports. To make it more convenient to use them, we transferred them to google-sheets and translated into Russian. Direct your attention: there are several sheets. And keep in mind, that companies round off certain numbers in documents, therefore, the totals in graphs and tables may not converge.

Download the table from the report

The worst year

We have already analyzed the company's business in some article., therefore we will not repeat ourselves here and go straight to the essence.

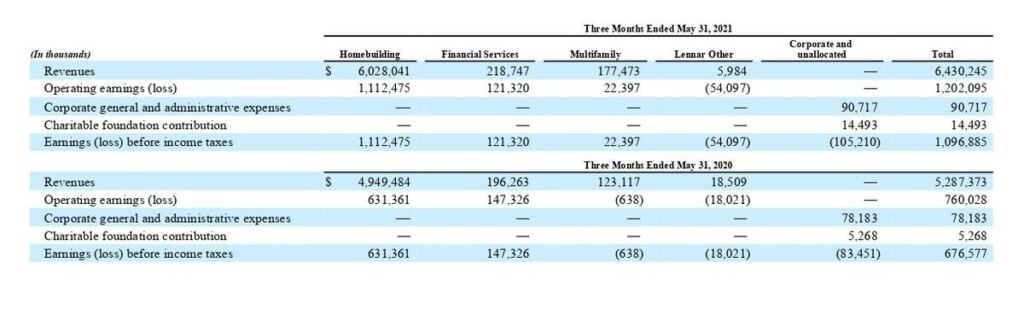

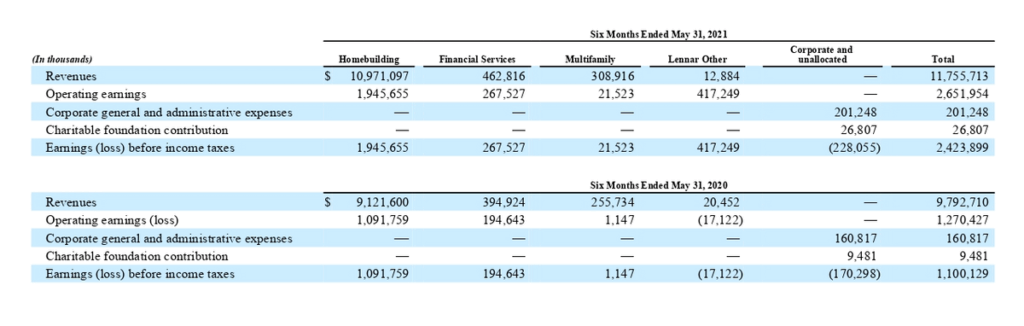

At the very beginning of the coronacrisis, it was not so clear, how the epidemic is affecting Lennar's business. At the moment, you can tell without hesitation, that nothing bad happened, sales have grown and everything is unbeatable. Not so long ago, the company released a report for the last quarter. Sales increased in all sectors, apart from the "Other", -there is a decline in revenue, apart from everything else, and therefore, that the company sold its own solar panel business, so the revenue base in the sector has become smaller.

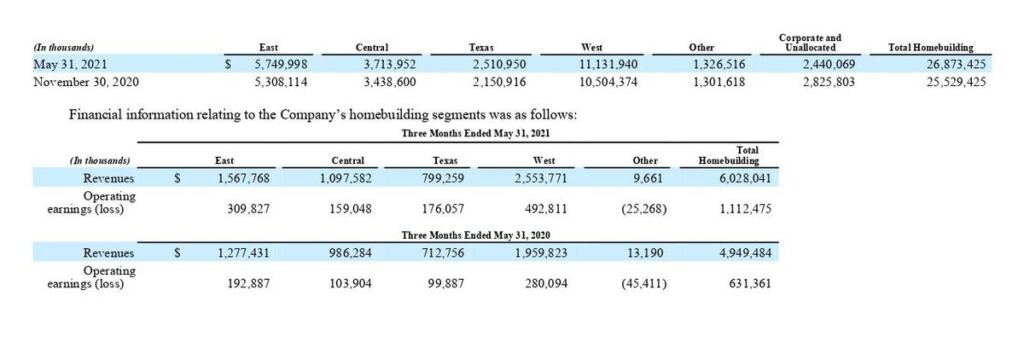

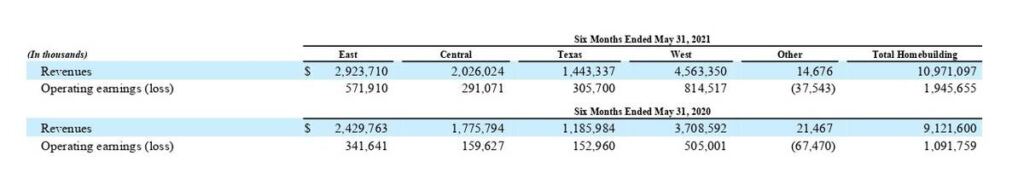

In addition, the company's sales showed significant growth in all regions of the United States., except for the sector with the construction of real estate in urban areas in California. Most likely, hard quarantine in the state in the first half of this year had a bad effect here, when the authorities were fencing restaurants, who violated the ban on work.

In general, the company relatively simply survived the corona crisis and increased its financial characteristics.

Annual revenue and profit, billion dollars

| Revenue | Profit | Profit Margin | |

|---|---|---|---|

| 2017 | 12,65 | 0,8 | 6% |

| 2018 | 20,57 | 1,68 | 8% |

| 2019 | 22,26 | 1,83 | 8% |

| 2020 | 22,46 | 2,44 | 10,85% |

Revenue

2017

12,65

2018

20,57

2019

22,26

2020

22,46

Profit

2017

0,8

2018

1,68

2019

1,83

2020

2,44

Profit Margin

2017

6,34%

2018

8,17%

2019

8,24%

2020

10,85%

Quarterly revenue and profit, million dollars

| Revenue | Profit | Profit Margin | |

|---|---|---|---|

| 3 kV. 2020 | 587 | 658,62 | 11% |

| 4 kV. 2020 | 682 | 872,82 | 13% |

| 1 kV. 2021 | 533 | 989,12 | 19% |

| 2 kV. 2021 | 644 | 820,28 | 12,73% |

Revenue

3 kV. 2020

587

4 kV. 2020

682

1 kV. 2021

533

2 kV. 2021

644

Profit

3 kV. 2020

658,62

4 kV. 2020

872,82

1 kV. 2021

989,12

2 kV. 2021

820,28

Profit Margin

3 kV. 2020

11%

4 kV. 2020

13%

1 kV. 2021

19%

2 kV. 2021

12,73%

There is nowhere more opportunistic

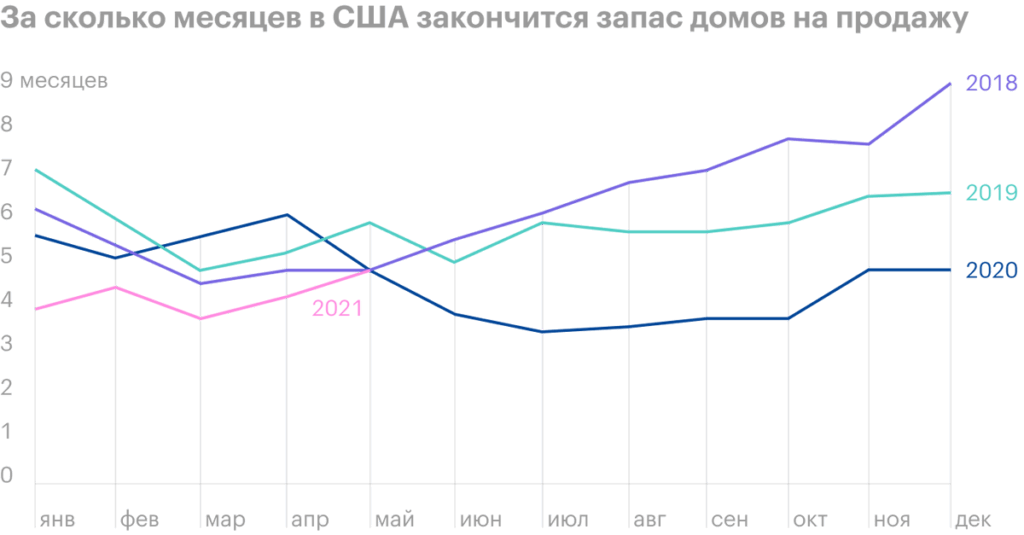

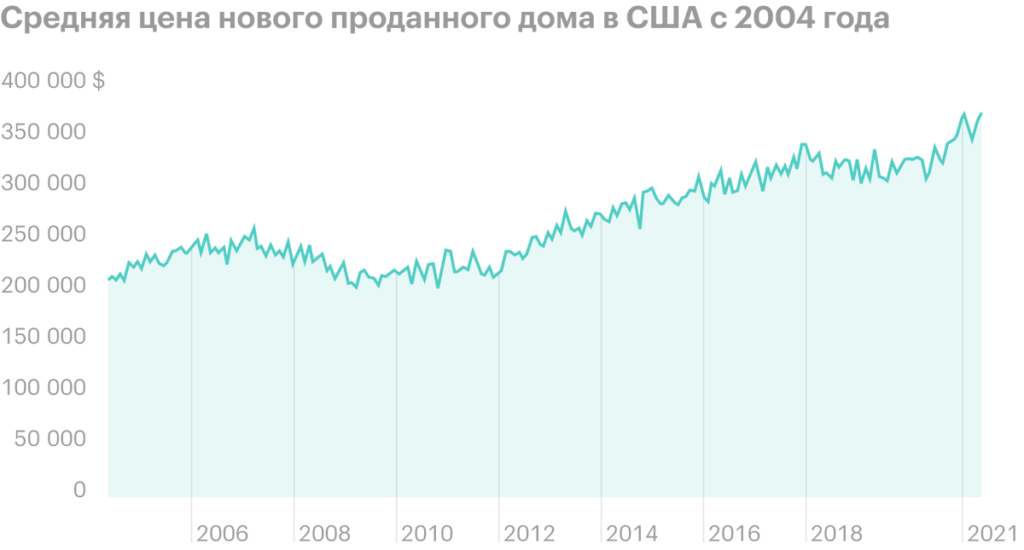

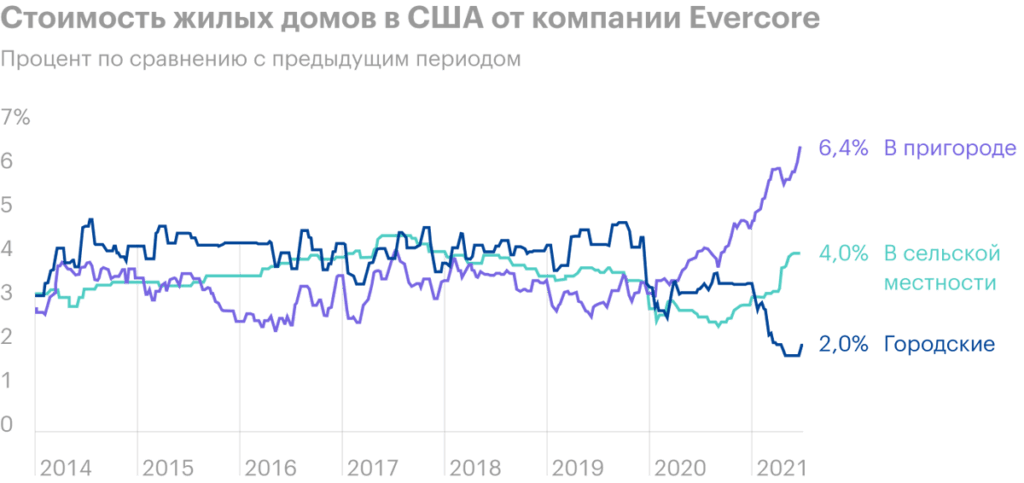

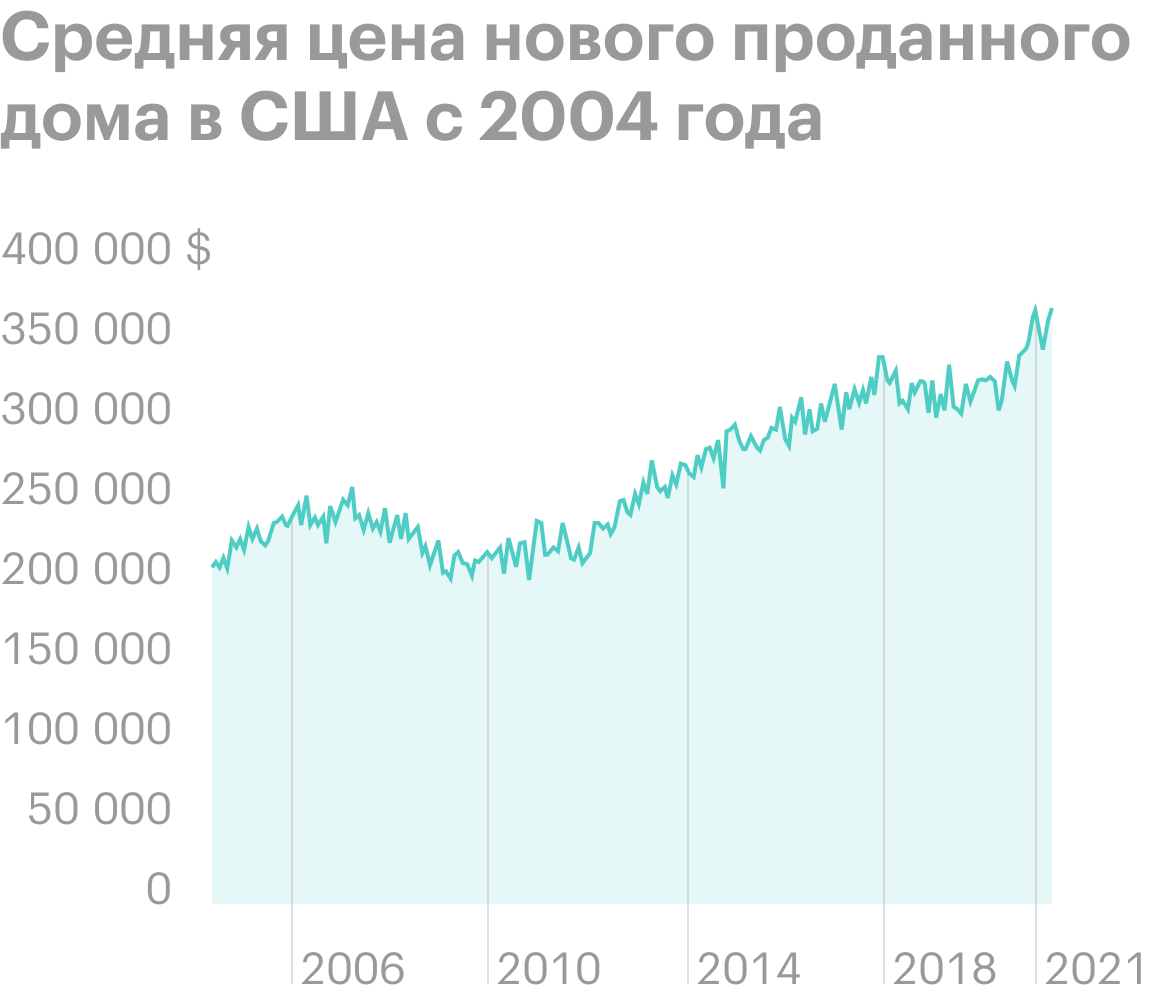

In the US, there is a shortage of homes for sale and an increase in demand - this leads to higher prices and higher profitability of building houses. The biggest rise in prices occurs in the suburbs, what, certainly, contributes to the growth of sales of such companies, as Lennar, building single-family houses. Many of the houses for sale today have not even begun to be built..

In the comments on the idea for the Louisiana-Pacific building materials manufacturer, our reader Alex Freeman wrote, that many analysts "compare the current real estate boom with the situation before the mortgage crisis of 2007" and therefore "begs the conclusion, that the US home market will face the same fate.”. I consider it useful to expand and illustrate here my answer to him, why is it not.

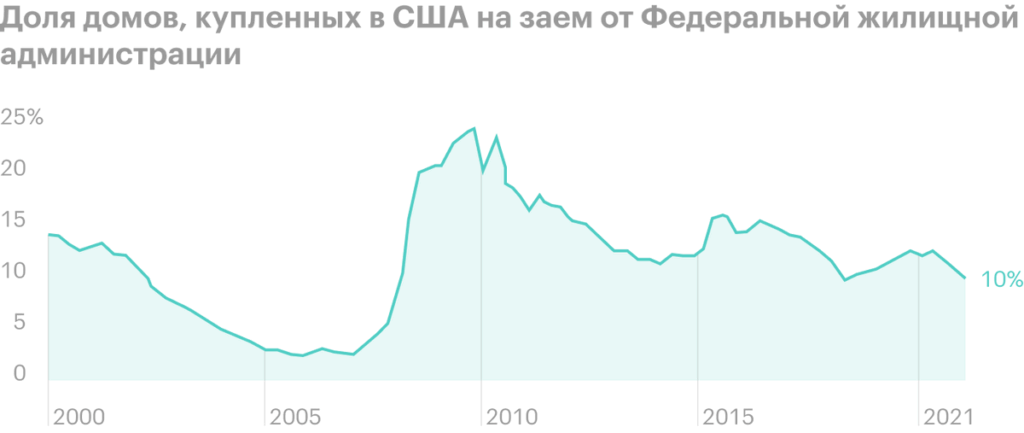

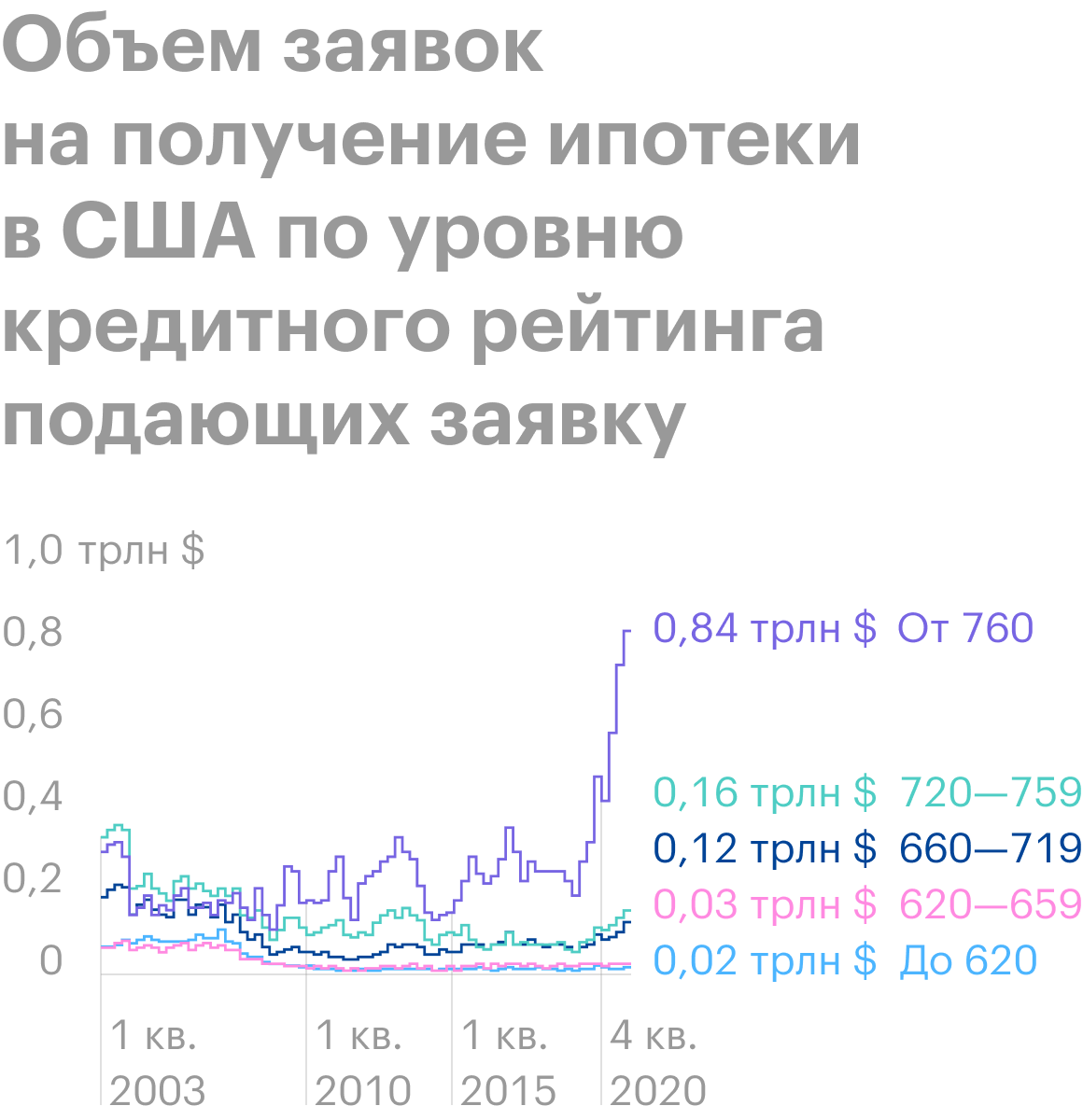

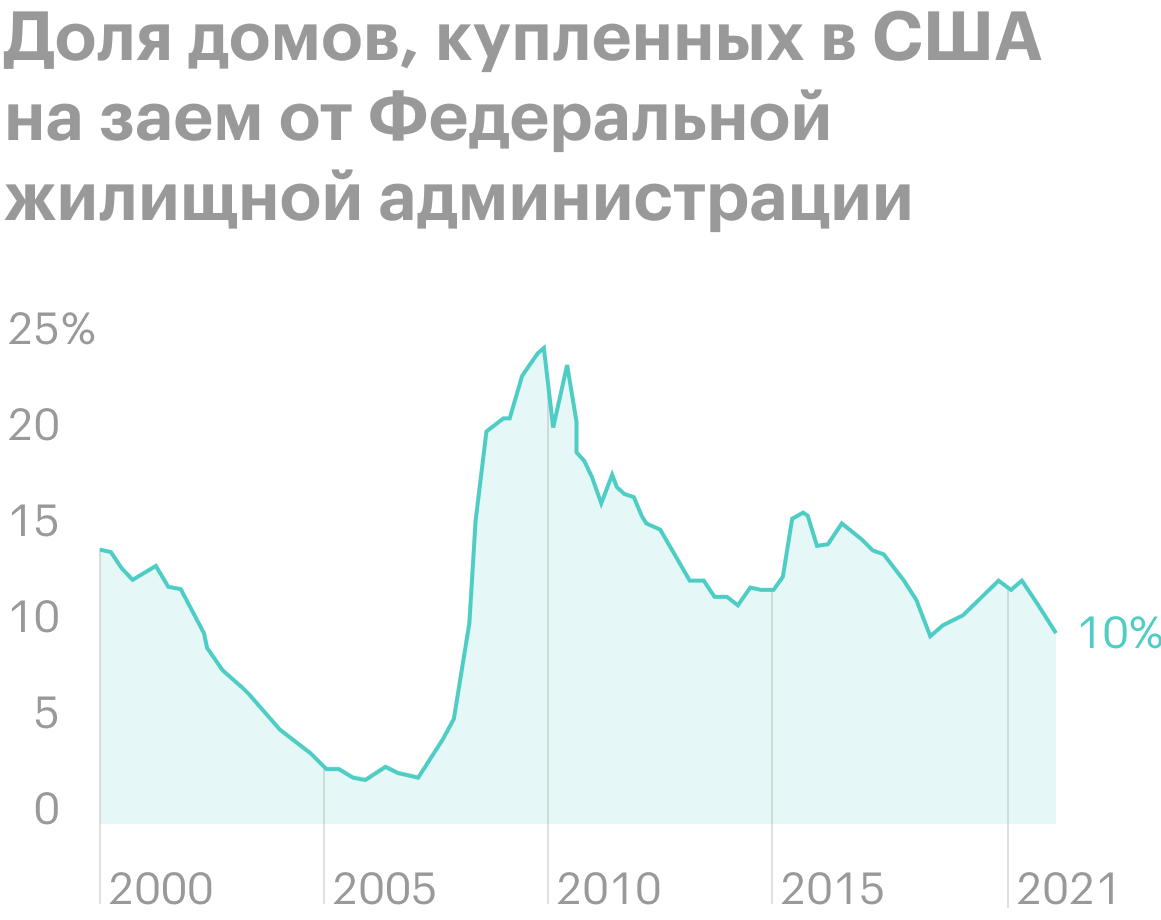

Firstly, this time the majority of mortgage borrowers are people with a high credit rating. For example, share of those, who bought a house on a loan from the US Federal Housing Administration - such loans are usually issued to people with a low credit rating - in the general structure of home buyers is now small, although higher, than just before the start of the mortgage crisis. All in all, houses are now bought mainly by those, who can afford it.

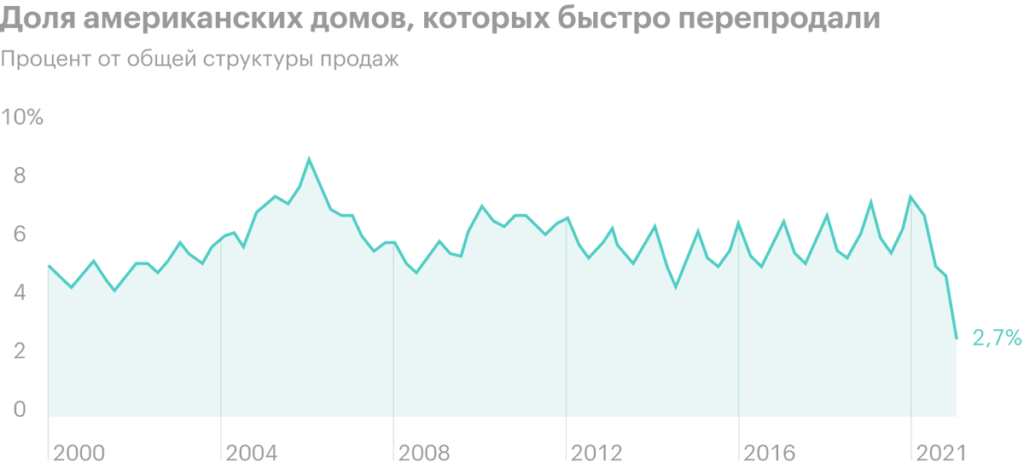

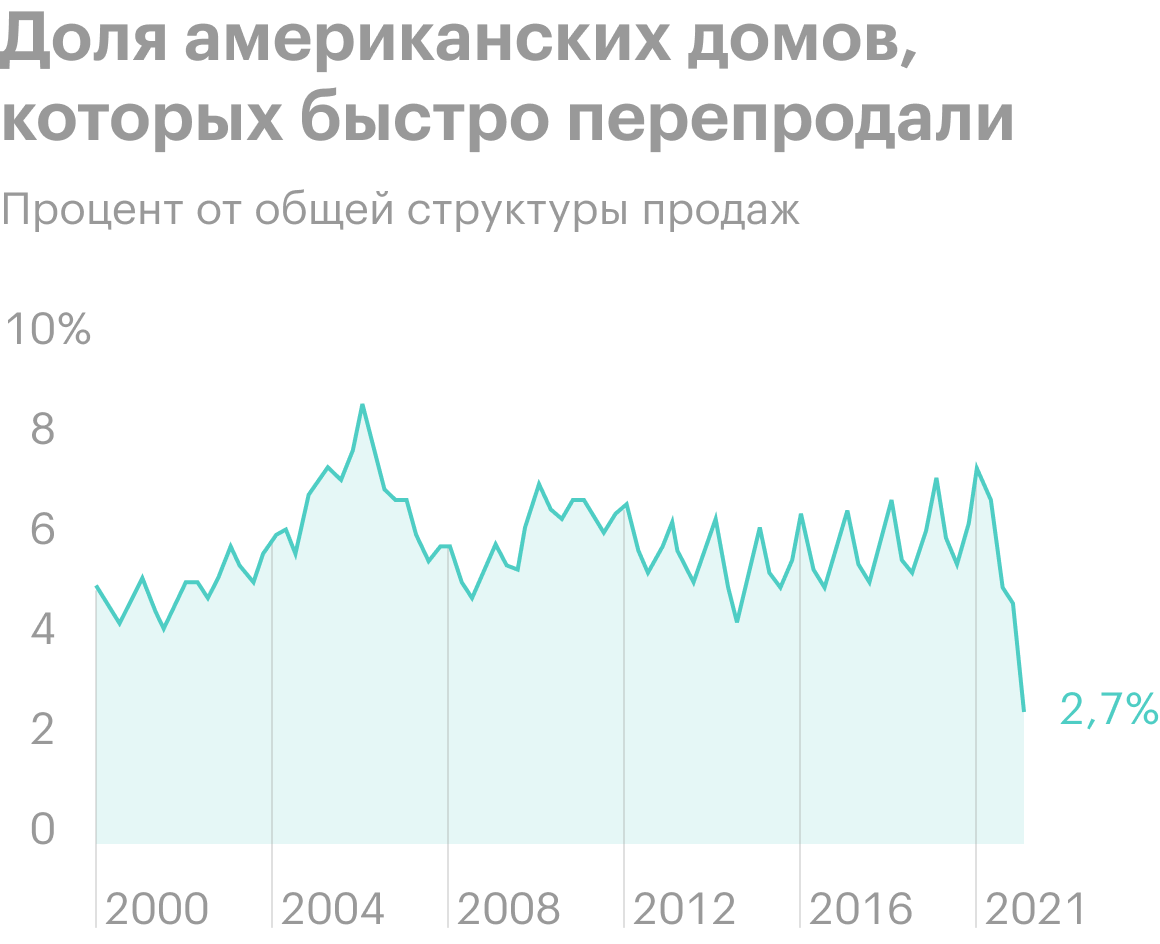

Secondly, share of those, who buys houses for the sake of "quick resale", - there were a lot of such speculators before the mortgage crisis - now it is very low relative to the general structure of house sales. Houses are now mostly bought or to live in, or to rent, not for that, to "make good money quickly", what would be one of the signs of a bubble.

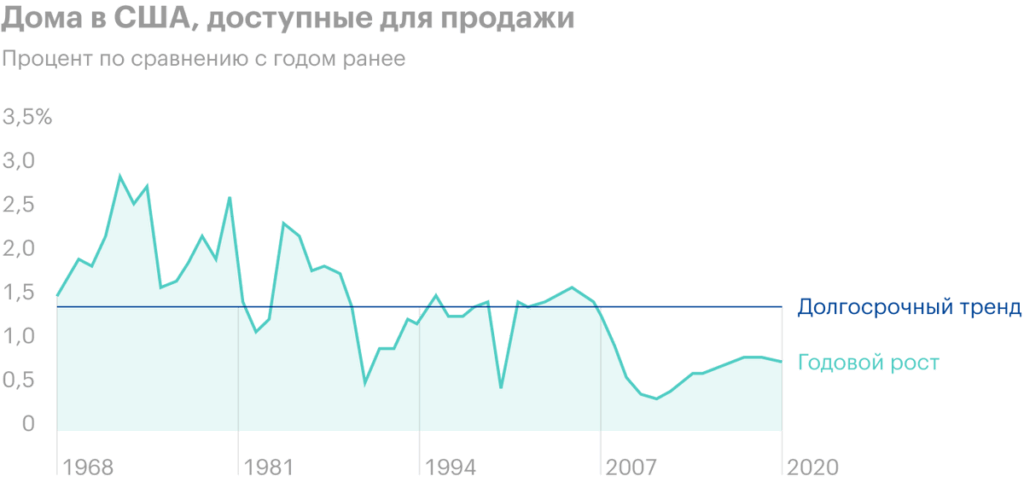

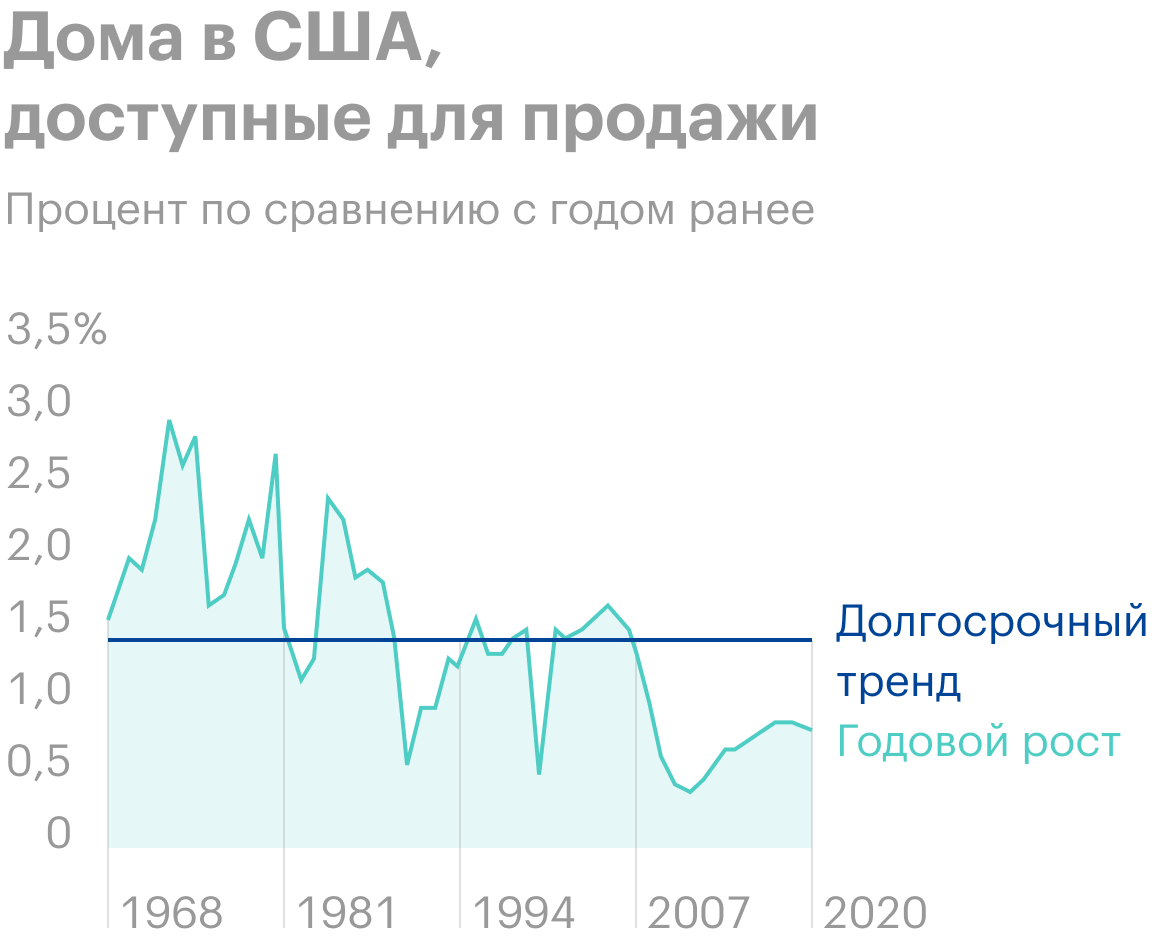

Thirdly, the rise in prices in the market today is not due to speculation, but a simple lack of houses. Moreover, this disadvantage appeared due to a very long decline in the number of houses under construction in the United States.. All these are the consequences of the policies of large house-building companies., which, after the mortgage crisis, increased their market share and reduced supply on it. Deficit, certainly, artificial - but the demand is real. Hence the rise in prices..

In sum, all of the above means a positive for Lennar. As long as circumstances turn out like this, that the company, probably, will continue to outperform analysts' forecasts. But there is one caveat.

Earnings per share

| Current | Forecast | |

|---|---|---|

| 3 kV. 2020 | 2,12 $ | 1,55 $ |

| 4 kV. 2020 | 2,82 $ | 2,36 $ |

| 1 kV. 2021 | 3,20 $ | 1,71 $ |

| 2 kV. 2021 | 2,65 $ | 2,38 $ |

| 3 kV. 2021 | 3,27 $ |

3 q. 2020

Current

2,12 $

Forecast

1,55 $

4 q. 2020

Current

2,82 $

Forecast

2,36 $

1 Q. 2021

Current

3,20 $

Forecast

1,71 $

2 Q. 2021

Current

2,65 $

Forecast

2,38 $

3 Q. 2021

Current

Forecast

3,27 $

Yes, but

There are several alarming moments in the structure of demand for real estate in the United States.

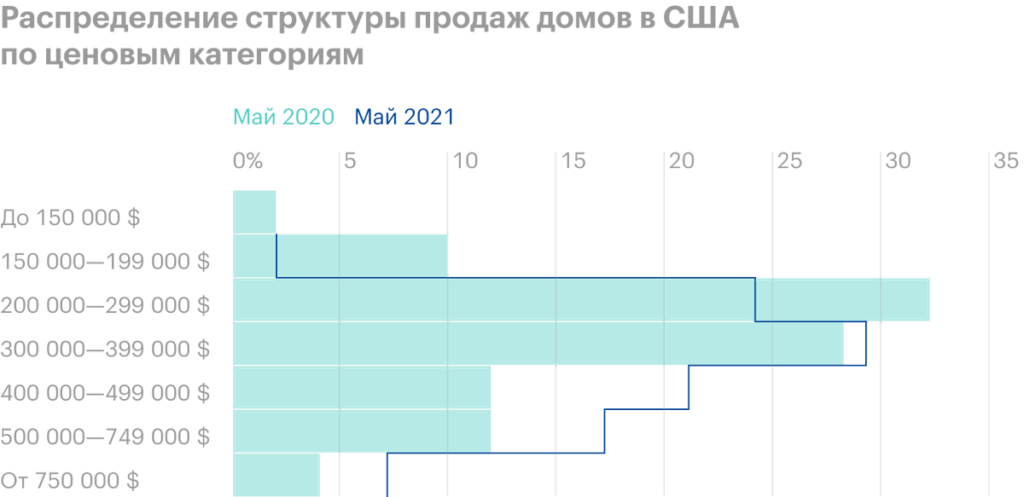

Firstly, the greatest growth in sales fell on the not the cheapest category of houses. The average price of a house Lennar is now just about 413 thousand dollars, which is a lot. Secondly, most mortgage loans are taken by people with the highest credit ratings.

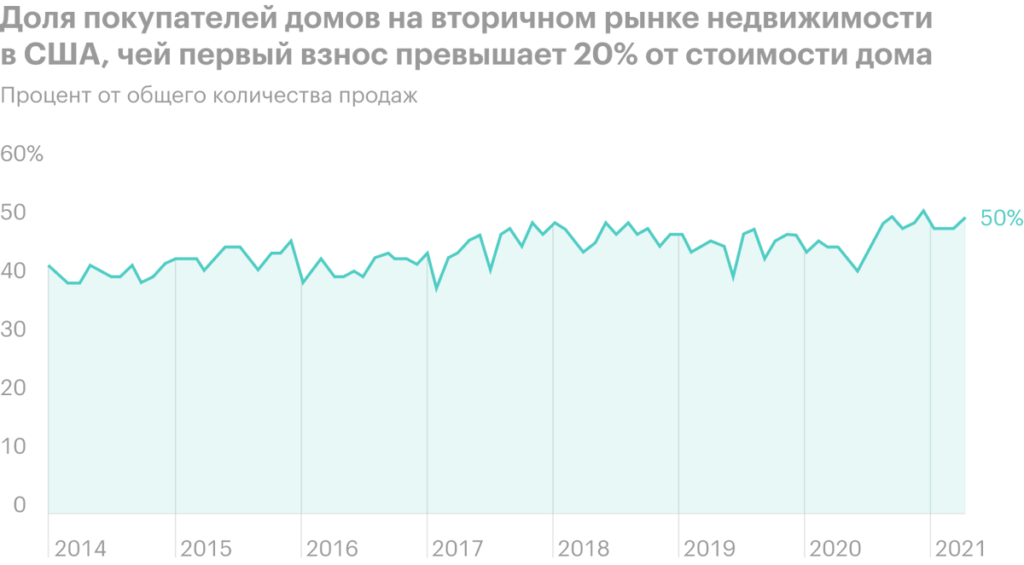

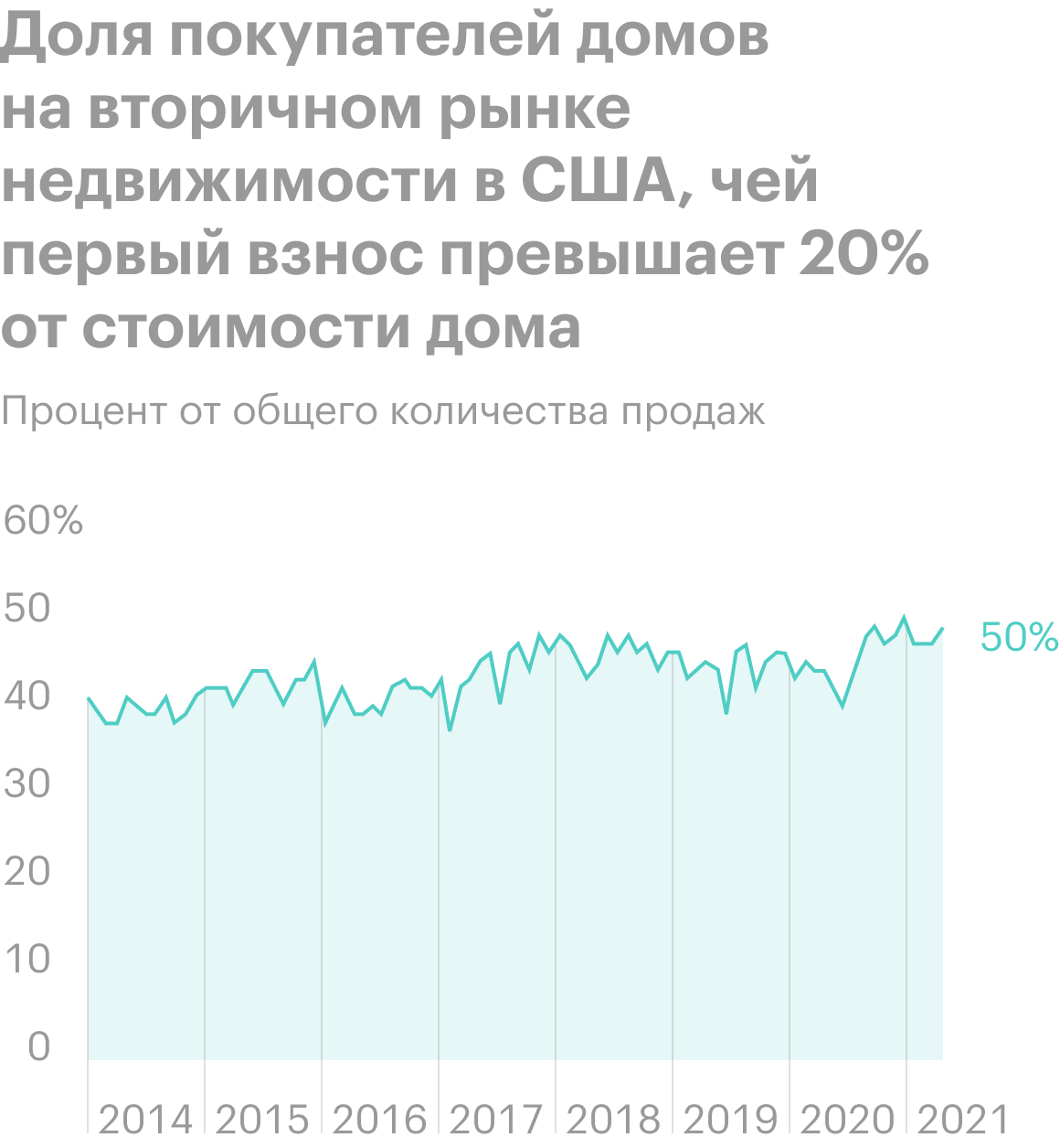

If you look at the structure of sales of houses in the secondary market, where prices are slightly lower, than new housing, - an extremely large proportion of those buyers, who has a down payment on a mortgage of at least 20% from the value of the house, - but normal 7% or less. This indicates that, that a significant proportion of buyers with money are doing great.

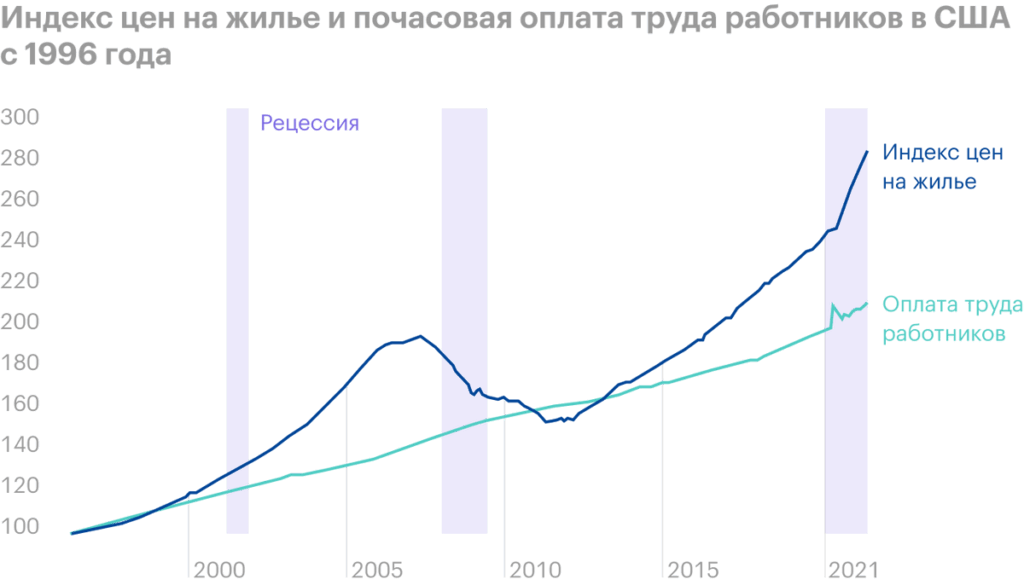

And this is all against the backdrop of the coronavirus crisis, high unemployment and a stark gap between wildly rising property prices and much more modest income growth.

Real estate sales growth in 2020-2021, seems to be, came at the expense of the poor. Maybe, soon this audience will finish buying houses and then the question will arise: will it be possible to maintain the current level of sales at the expense of the mass consumer, who does not have a lot of money for a down payment and a more modest credit rating?

Houses are extremely expensive these days, which negatively affects the intentions of the bulk of consumers. Also consider the looming US rate hike on the horizon., leading to higher mortgage rates, and this will reduce the attractiveness of buying a house for many.

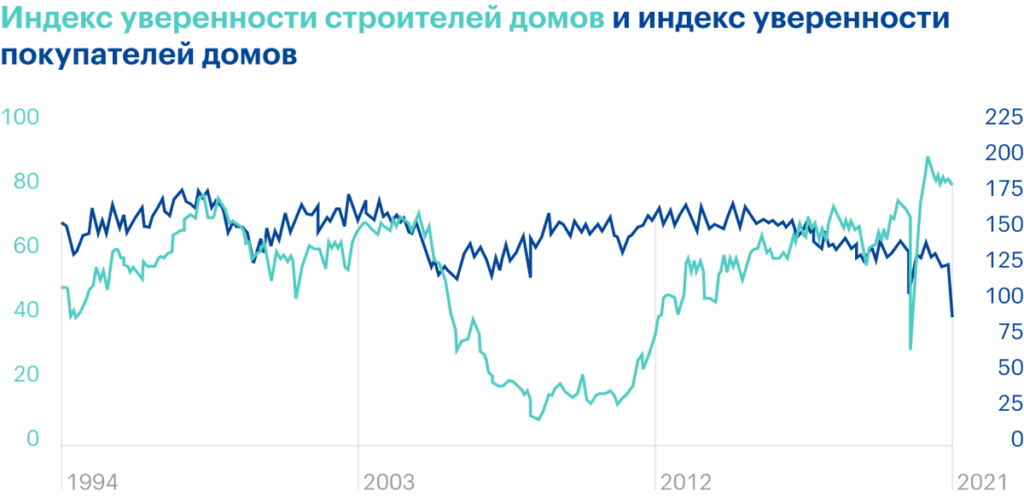

Maybe, it will turn out like this, that the company's sales will drop in the near future, because now you can see a serious discrepancy in assessing the current situation in the real estate market between home builders and potential buyers. Maybe, I, as always, I blow water and the company's sales will not weaken.

In any case, this point should be taken into account. Against this background, the problem of a sudden rise in the price of building materials is not so dramatic for the company: increased costs can be reflected in the price. The main problem is probability, that sales of houses at the company will fall simply because, that its main audience has already bought houses for investment or other purposes and will not maintain the current level of demand.

The company pays 1 $ dividends per share per year - with the current value of the shares, this is approximately 0,99% per annum. The company spends about $309 million a year on this.. Basically, it's a bit, Total 9,22% from its profits over the past 12 Months, and only some extraordinary circumstances could force the company to cut payments. But still, one should take into account the possibility of such a cut and the subsequent fall in shares..

Resume

Lennar is a good option, to try to capitalize on the growth in demand for homes in the US. However, you should be prepared for, that demand will soon begin to fall for objective reasons.