Greetings, dear colleagues and friends!

What the coming year of the horse has in store for us — 2014 in monetary matters? What euro exchange rate forecast for 2014 year analysts give? What other financial turmoil will fall on our heads, which are not the most favored by luck.?

However, I'm kidding. As Nietzsche said

Everything, what does not kill, makes us stronger

And as Mikhail Zadornov says

If a person wants to live, then medicine is powerless. And if a person wants to live well, even legislation is powerless

Now I bring to your attention a forecast of the euro exchange rate for 1 And 2 quarters 2014 year from world banks. This is the interbank Eurodollar conversion rate, which at the time of this writing ( 19.01.2014 is 1.35 — i.e 1 euro = 1,35 dollar).

Generally, analysts believe, what in 2014 year in the euro / dollar pair, the US currency will take a head start, as the US economy recovers faster, than the European. This opinion is shared by strategists at Morgan Stanley and Citigroup.. it is also important, that the quantitative easing program is expected to end soon FED USA. This will most likely happen in the first quarter. 2014 of the year.

Morgan Stanley gives this euro exchange rate forecast for 2014 year, rather, on 1 half of it – 1,25.

But Europe is not giving up! As ECB President Mario Draga says, the eurozone economy is stabilizing and very soon it will start to show GDP growth of at least 1,1%, which is not such a bad indicator for the Old World. ECB, probably, will continue its stimulating policy and keep the interest rate at the level 0,25%.

However, investors have little faith in the strengthening of the euro. Basically, forecasts for the eurodollar currency pair indicate expectations of the exchange rate in the area 1.25-1.3. Such euro exchange rate forecast for 2014 year can be explained by the, that the Eurozone is unlike the United States — multidimensional space. Constantly stronger participants, for example, Germany, less organized pigs, how it was in 2012 And 2013 year: Spain, Portugal, Greece… Therefore, there is nowhere to expect some kind of stability and positive. but, market is market, and UniCredit believes, what's in the middle 2014 year, the exchange rate of the euro against the dollar will be 1.36.

Name of bank Forecast for Q1. 2014 G. Forecast for the II quarter. 2014 G.

Royal Bank of Scotland 1,22 1,21

HSBC 1,32 1,22

Merrill Lynch 1,24 1,23

Barclays Capital 1,26 1,24

BNP Paribas 1,26 1,25

Morgan Stanley 1,27 1,25

Wells Fargo 1,29 1,27

UniCredit 1,35 1,36

Swiss credit 1,31 1,33

JP Morgan 1,32 1,34

On the chart below you see, that at the time of this writing, EURUSD is in the upper area of the expectations corridor, so the general trend is obvious — weakening of the euro against the US currency.

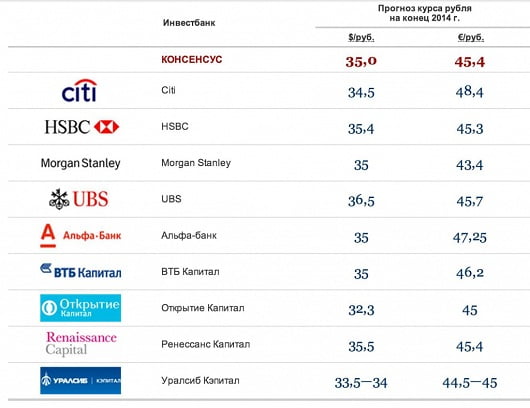

And a little later we will consider, how do they see the exchange rate of the Russian ruble 2014 the same analysts of world banks and why they expect devaluation and weakening of the Russian currency.

Yes, here's another pictorial on our topic:

May God grant you health, at least until the next blog update .