Layering – this is a high frequency trading strategy, Where is trader does, and then cancels orders, which they never intend to carry out in the hope of influencing the share price. For example, to buy shares at a lower price, the trader first places orders to sell at or below the market price

High frequency trading, depending on the strategies used, has a different effect on the market condition. Some of them are draining liquidity from the market, other – add liquidity to the market. Many of them are the cause of sudden unexpected movements in market quotations., and also generate new borderline methods of unethical, and sometimes illegal income generation on stock exchanges.

Such a controversial practice is the layering method., the essence of which is to create the possibility of artificially shifting the quotations of purchases and sales of securities in order to force the rest of the exchange market participants to make a profitable deal for the manipulator.

annotation

Subject. The article is devoted to describing the practice of layering (layering), implemented by unscrupulous participants in exchange trading using high-frequency trading algorithms (High frequency trading, HFT robots). Leading trading platforms and financial regulators of foreign countries leiring practice, used to artificially influence the order book (orderbook, exchange glass) in order to make deals at the most favorable prices, increasingly recognized as manipulation. In Russia, signs of such behavior were not reflected in the relevant regulations., which opens up the possibility of leering and undermines the confidence of foreign participants in the Russian stock market.

Objectives. Study the practice of using layering, outlining the stages of its implementation, as well as the legal position of US financial regulators, UK and European Union countries regarding practice, implemented by high-frequency trading algorithms. Methodology. Comparative analysis methods used, juxtaposition, systematizing the collected information.

results. The stages of implementation of the layering practice are considered in detail., the positions of financial regulators of developed countries in relation to fraud are outlined, used by HFT robots, and also reflects the difficulties of identifying and suppressing the use of such practices. The results can be used in theoretical and practical activities in the securities market..

conclusions. There is a need for legislative regulation of leering practice in Russia, taking into account the experience of the world's leading stock exchanges and the legal position of US financial regulators, UK and European Union in the field of the securities market.

Prerequisites for the emergence

The use of NT algorithms for market manipulation became possible for two main reasons..

Firstly, such HFT trading features, as a high ratio of the level of profit to risk and the absence of the need for long-term retention of trading positions, have led to a significant increase in the popularity of high-frequency trading, its active introduction into the modern model of exchange pricing. The result was an increase in market depth and an increase in the level of instant liquidity..

Secondly, with the development of information technology, the speed of transactions in electronic trading has reached such a level, in which the use of a highly efficient trading algorithm allows you to systematically outstrip other market participants when placing and canceling orders, what is the key aspect in leering and spoofing applications

Spufing – bad practice, implying the submission or cancellation of several orders in order to create an artificial price movement in the desired direction.

Despite these reasons, which became the foundation of the popularity of HFT trading, since the widespread use of these algorithms, the level of volatility and the risk of a decrease in the stability of the financial system as a whole have significantly increased.

One of the most volatile in the history of financial markets was the day 6 May 2010 G., when the identified risks were realized. Then the Dow Jones Industrial lost 1 000 points (about 10%), what was the biggest daily drop since the opening of trading [2].

The glitch lasted for about 30 minutes. Fluctuations approximately 300 shares were particularly visible – the price could drop to cents, and then skyrocket to hundreds and thousands of dollars per share.

For instance, shares of the popular consulting company Accenture during this period traded from 0,14 to 42,3 Doll. USA. Later this incident was called "instant collapse" (Flash Crash), as most of the experts agreed – one of the reasons for such a fast and deep market decline was HFT robots, practicing leering.

In the spring 2015 G. US Department of Justice has filed fraud and market manipulation charges against London-based trader Navinder Singh Sarao, who was suspected of organizing the collapse in May 2010 G. [3].

Sarao traded E-mini futures on the Chicago Mercantile Exchange, whose prices change depending on the S index&P500. In particular, he used the practice of leering, in which a large application was split into a series of smaller, but sufficient to influence the order book. As a result, such a series of applications affected the structure Books applications, which created the illusion of downward pressure on the market. When other computers responded to perceived pressure, he bought stocks cheaply and then sold them after prices stabilized.

Implementation mechanism

As said before, leering implementation mechanism is based on the specifics of filing applications in the trading system. To illustrate this practice more clearly, it is advisable to consider the investigation, initiated by the UK Financial Conduct Authority (U.K. Financial Conduct Authority, FCA) regarding Michael Coscia (Michael Coscia) – trader, traded commodity futures on the Intercontinental Exchange (ICE) [4].

The FCA investigation claims, that Michael Coscia used manipulative leering trading practices during the 6 September to 18 October 2011 G., during which he systematically submitted a series of orders without the intention of making transactions, thereby manipulating the balance of supply and demand.

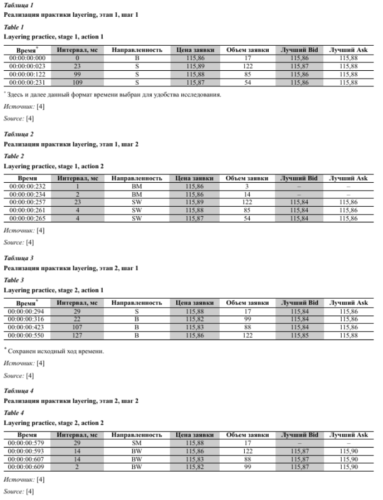

To understand the leering mechanism, we will consider in detail the stages of its implementation, reflecting actions in the table, consisting of the following columns:

- Time – time of filing an application in the order book in the format “hours: minutes: seconds: milliseconds " (for ease of perception);

- Interval – difference between the moments of submission of the current and previous applications, milliseconds (ms);

- Orientation – direction of application: B – purchase requisition, S – sales order, BM – executed purchase requisition, BW - canceled sell order, SM - a completed sell order, SW - canceled sell order;

- Bid price – price of one lot of instrument;

- Application volume – number of lots;

- Best Bid – the best bid price for a certain moment to buy (best buy order price);

- Best Ask – the best selling price for a given moment (best sell order price).

Stage 1. During this period of time, in accordance with the trading algorithm, the following actions were performed:

• relatively small purchase requisition 17 lots were set at the price 115,86, which corresponds to the price of the best buy order, or better Bid;

• the first relatively large order of the opposite direction is placed at a price three basis points higher than the best Bid and one basis point higher than the best Ask; two subsequent large sell orders are placed with a decrease in price by one basis point at intervals of approximately 100 ms.

The structure of the order book after the actions performed according to the described algorithm is shown in Table. 1.

In fact, a large sell order created an artificial panic effect., and a series of large bids – false resistance level, as a result of which the spread narrowed to the smallest value, which forces the participants to decide to place bids in the same direction, that is to sell. Since the spread has become minimal, participants need to submit orders for sale at the best Bid, which ultimately will lead to the execution of the Layer's order at a price 115,86 – below, than the price, by which he could buy without using the specified actions. After the execution of a buy order, all large orders are sequentially withdrawn at short intervals in the reverse order from the order.

Stage 2. To sell a previously accumulated position (in our case – 17 lots, previously purchased at a price 115,86 for every) a similar algorithm is consistently implemented in the opposite direction (tab. 2):

• an order is placed to sell a previously accumulated position at 115,88, which is two basis points higher than the price of the best sell order (Ask);

• the first false buy order is submitted at a price two basis points below the best Bid,

subsequent false buy orders shift the spread in the desired direction for the layer (tab. 3);

• at the time of execution of the initial layer order, the best Bid is 115,87; deals are concluded at a price in the range 115,88-115,89; the best Ask equals 115,90 (tab. 4). As soon as the original request is executed, the participant removes a series of purchase requisitions.

As a result, for 609 ms, that is, a little more than half a second, Layer's profit from virtually risk-free operations was 0,34 Doll. Using high-performance equipment, DMA access to the servers of the trading platforms, the financial leverage is significant, and the potential profit can reach large volumes.

Considering the example, leering can be defined as the submission of a unidirectional series of orders to the trading system with a minimum price difference to shift the Bid spread – Ask in the desired direction and subsequent execution of your own order in the opposite direction in order to make a profit.

What is the Difference Between LAYERING and Spoofing?

Spoofing and Layering are both forms of market manipulation, when a trader uses visible bad orders, to fool other traders about the true supply or demand levels in the market.

Some regulators use the terms spoofing and layering interchangeably, while others, including FINRA, use "overlay" to describe the entry of multiple bad orders at multiple price levels and "spoofing" to describe the entry of one or more bad orders at the top of the order book only.

When replacing patterns, the trader enters one visible order or a series of visible orders, who either create a new best bet or offer, or significantly increase liquidity, displayed at the existing best rate or offer. During the validity period of this first order (ov) or within a short time after its cancellation, the same trader makes a deal on the opposite side of the market. The model is manipulative, because the execution is at a better price, what a trader could get in the absence of (s) orders. This is true no matter, whether a purchase is being executed (sales) at the best rate (offers) before the sequence, at the midpoint or at the new price of the best offer (rates), established by an order for counterfeiting. In any of these scenarios

Laying– this is a spoofing option, when a trader enters multiple visible orders on the same side of the market at multiple price levels, which leads to the removal of the middle point of the spread from these several orders, the same trader makes a trade on the opposite side. market. Yet again, pattern manipulative, because the execution is at a better price, what the trader could get in the absence of the first orders.

If a trader enters orders with multiple price levels, which sequentially set a new best rate or offer as they are entered and remain in effect after new orders are entered, as shown in the picture above, the same pattern could be described as fake or bundle.

Legislative regulation

Until recently, manipulation practices, based on the use of HFT robots, did not fall under the attention of financial regulators and stock exchanges. The regulation that existed prior to the introduction of such practices was mainly aimed at establishing framework concepts, defining the essence of manipulation and separating it from ordinary market behavior.

Only in 2009 G. regulators began to discuss the impact of HFT practices on the course of exchange trading and form their own legal position regarding the ability to manipulate the market.

IN 2011 G. European financial regulator (ESMA) initiated the revision of legislation, regulating the area of unfair market conduct, by proposing a draft of the Market Abuse Regulation (MAR), which updates and tightens the current rules of the Market Abuse Directive (MAD), adopted in 2003 G. MAR Directive c 2014 G. was approved by the European Parliament and entered into force 3 July 2016 G., replacing MAD. MAR, unlike MAD, will apply not only to regulated markets, but also to OTC trading platforms for OTC derivatives. MAR expands the scope of the concept of market manipulation on strategies, aimed at destabilizing and slowing down the trading system, including unfair HFT practices.

UK regulator based on the National Financial Services and Markets Act (FSMA) [5] gave signs of high-frequency trading algorithms, which can give false or misleading signals, violating FSMA provisions, namely:

- sending several orders to one side of the order book at different prices, which are better than currently available;

- sending an order to the other side of the order book, which is the real intention of the client to complete the transaction;

- instant withdrawal of all original orders from the order book immediately after the last order is executed.

At the request of the FSMA, all exchanges and OTC trading platforms must identify cases of such behavior and notify the regulator about it., who will conduct a comprehensive analysis and apply sanctions against clients, involved in such transactions.

At the same time, DMA providers3 must build a proper customer control system., detecting and preventing leering and spoofing. Otherwise, sanctions will apply against DMA providers as well..

In Dodd's Law – Frank (Dodd – Frank Act), adopted in 2010 G. in USA, a ban on the use of spoofing has been introduced [6]. Spoofing means "entering or canceling multiple buy or sell orders to create a deceptive view of market depth and entering or canceling orders to create artificial price movements.". As you can see from this definition, in the USA unfair HFT practices, be it leiring or spoofing, united in one group.

Features of detection and methods of suppression

The considered HFT trading is one of the most time-consuming and difficult areas of the financial market to analyze.. The volumes of information generated by trading algorithms are not only difficult to process, but it is also often difficult to store and display. Regulators should have such data storage and analysis systems, which, in terms of power and cost, are comparable to HFT robots of traders.

Direct market access, DMA – high-speed access to stock exchanges, which allows you to directly interact with the trading system without using the intermediary services of brokers, as a result, the speed of information exchange between the trading platform and the end client increases.

Despite all the difficulties in processing and analyzing information, in 2014 G. US Securities and Exchange Commission (SEC) introduced a new trading data analysis system – National Exam Analytics Tool (NEAT). It allows experts to analyze aggregate trading data over five years at high speed..

For example: the SEC team analyzed more than 17 million transactions of one investment company for 36 hours. Previously, experts had to manually write code for millions of registered transactions, which increased the likelihood of errors and significantly increased the time of investigation and analysis.

Today NEAT is the main instrument of the SEC in the ongoing research of HFT trading.. Self-regulatory organizations, such as FINRA, using our own developments, analyzed before 50 billion market events daily [7-13].

Despite experience in processing and analyzing market information, to develop a new platform, which will be able to successfully store and process the increasing data flow, as well as reduce costs and improve operational efficiency, FINRA uses third parties – developers of platforms for Big Data analysis.

The efficiency of the mentioned data analysis systems is reduced due to two main problems:

- the lack of data in the SEC and FINRA in the context of client identifiers;

- too low accuracy of indicating the time of the submitted applications (time of setting or change (withdrawing) applications, usually, specified in thousandths of a second, whereas trading robots allow you to send hundreds of thousands and millions of applications per second) [14-17].

With 2012 G. SEC is developing The Consolidated Audit Trail (CAT) – centralized database, which should collect and identify each application, cancellation, modification and execution of a transaction with all shares and options listed in the US markets. The system will collect more 58 billion records of orders from all American stock and options markets daily (85% bids on the stock market and 99% in the options market are canceled). More 2 000 companies and 19 exchanges will provide data in a unified format.

The new order report format will have to contain a unique end customer number and a more accurate price step (for this, it is also planned to synchronize the clocks of market participants). The cost of this project is estimated at 4 billion dollars, and the launch of the new database will take place no earlier than 2017 G.

Summing up, it is worth noting, that leading financial regulators are increasingly paying attention to HFT trading, playing a significant role in the mechanism of exchange pricing. The use of high-frequency robots by unscrupulous participants to manipulate the market forces regulators to fight them in two main directions.: the introduction of penalties and a decrease in the economic feasibility of using this kind of manipulation by increasing commission fees.

Criteria can serve as a basis for the application of penalties, absorbed certain quantitative indicators, for example, the maximum volume of outstanding orders for each instrument (with correction factors, taking into account the level of liquidity of securities), which can be calculated by the regulator or trading platforms on a monthly basis.

At the end of the month to bidders, exceeded the established thresholds of this criterion, measures from differentiated penalties can be applied, expressed as a percentage of the volume of applications, until suspension from trading for a certain period.

Additional commission fees may be based on criteria, taking into account the relationship between the volumes of canceled and submitted applications. Exceeding the set thresholds, for example 50% (that is, every second application is withdrawn), an additional commission should be charged in the amount of a specified percentage of the volume of applications, canceled or changed since the criterion was triggered.

It is important to note, that the introduction of surcharges should be done after careful statistical analysis, since not all actions of high-frequency robots, related to cancellation of submitted applications, are manipulative. An ill-considered introduction of additional fees can lead to an outflow of bona fide participants, which will cause a decrease in commission income of trading platforms and the level of market liquidity in general.

In Russia, such practices are still outside the legal framework.. Legal restrictions do not focus on the specifics of filing and canceling applications, which significantly complicates the procedures for investigating such actions and bringing unscrupulous participants to justice.

List of abstracts:

1. Iskyandyarov RR. Spoofing practice: manipulation or efficient use of market inefficiencies? // Economics and Management in Mechanical Engineering. 2015. № 5. C. 56-59.

2. Kirilenko A., Kyle A.S., Samadi M., T of salt. The Flash Crash: The Impact of High Frequency Trading on an Electronic Market. Available at: http://www.cftc.goV/idc/groups/public/@economicanalysis/documents/ file/oce_flashcrash0314.pdf.

3. CFTC Charges U.K. Resident Navinder Singh Sarao and His Company Nav Sarao Futures Limited PLC with Price Manipulation and Spoofing. Available at: http://zuberbuehler-associates.ch/blog/wp-content/uploads/2015/04/Spoofing-Tactics.pdf.

4. Yeiskov A. Prohibited Trading. URL: http://fomag.ru/ru/news/derivatives.aspx?news=1482.

5. Financial Services and Markets Act. CHAPTER 8. Part VIII. Penalties for Market Abuse. Available at: http://www.legislation.gov.uk/ukpga/2000/8/pdfs/ukpga_20000008_en.pdf.

6. Dodd – Frank Wall Street Reform and Consumer Protection Act, Section 4c(a), 5(c). Available at: https://www.sec.gov/about/laws/wallstreetreform-cpa.pdf.

7. Dark Liquidity and High-Frequency Trading. Available at: https://clck.ru/A5Nhu.

8. Are High-Frequency Traders Anticipating the Order Flow? Cross-venue evidence from the UK market. Available at: https://www.fca.org.uk/static/documents/occasional-papers/occasional-paper-16.pdf.

9. High-Frequency Trading Activity in EU Equity Markets. ESMA Economic Report, 2014, no. 1. Available at: https://www.esma.europa.eu/sites/default/files/library/2015/11/esma20141_hft_activity_in_eu_equity_mark ets.pdf.

10. Order Duplication and Liquidity Measurement in EU Equity Markets. ESMA Economic Report, 2016, no. 1. Available at: https://www.esma.europa.eu/sites/default/files/library/2016-907_economic_report_ on_duplicated_orders.pdf.

11. Analysis of High-Frequency Trading at Tokyo Stock Exchange. JPX Working Paper, March 2014. Available at: http://www.jpx.co.jp/corporate/research-study/working-paper/files/Summary_JPX_wp_en_No.4.pdf.

12. Allison I. Do High Frequency Trading Algorithms Create More Volatility Than Humans? Available at: http://www.ibtimes.co.uk/does-high-frequency-trading-create-more-volatility-humans-1554579. (accessed April 13, 2016)

13. Securities Houses Turn to AI for High-Frequency Trading. Available at: http://asia.nikkei.com/ Markets/Equities/Securities-houses-turn-to-AI-for-high-frequency-trading. (accessed April 5, 2016)

14. Japan to Probe Impact of High-Speed Trading, Consider New Rules. Available at: http://asia.nikkei.com/Markets/Tokyo-Market/Japan-to-probe-impact-of-high-speed-trading-consider-new-rules. (accessed April 11, 2016)

15. Commission delegated regulation of 25.4.2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council as regards organisational requirements and operating conditions for investment firms and defined terms for the purposes of that Directive. Available at: https://ec.europa.eu/transparency/regdoc/rep/3/2016/EN/3-2016-2398-EN-F1-1.PDF.

16. Securities and Exchange Commission (Release No. 34-77551; File No. SR-FINRA-2016-007). Available at: https://www.sec.gov/rules/sro/finra/2016/34-77551.pdf.

17. Bats Receives SEC Approval for Client Suspension Rule. Available at: http://cdn.batstrading.com/resources/press_releases/Bats-Client-Suspension-Rule-Approval-FINAL.pdf.