This article will be more general and theoretical, than my experience described earlier. But still I hope, someone and it will be useful.

so, in order to determine, do you need registration in an offshore, choose jurisdiction for company registration, I will try to put in this article 6 consecutive questions, which will clearly help to solve the above problems :

1. Is it necessary to register a non-resident company?

2. What will be the costs of registration and annual support of the company?

And let's start with the first question..

1. Is it necessary to register a non-resident company?

Obviously, what needs to be decided first, what do you want to use the new non-resident company for, Do you really need this company?.

Here is a list of reasons for using such a company that I could find in various sources and offer myself. The list is quite wide., but I chose the most "delicious" how to use a company offshore:

1) The experience I described in the previous topic. Company creation, engaged in activities in the financial markets, including using margin lending.

2) As prompted in the comments on the same thread, use of the bridge scheme and trusts.

3) Certainly, An interesting opportunity for company owners in Russia is self-financing, ie. An offshore company may issue

loan to your resident company, returning non-resident company with interest, which are not subject to taxation in the offshore zone and also reduce the tax burden in Russia.

4) Funds for opening a bank account

As they write, using a non-resident company, you can open a current bank account in a freely convertible currency in Western banks, which can be used for any non-cash and cash transactions.

5) Foreign investment

Funds, held in a private bank account abroad in the form of foreign investment can be transferred to the bank account of a resident company.

6) Conditionally anonymous participation in trading and simplification of taxation from transactions with financial assets.

You can buy shares of a non-resident company not as an individual, but on behalf of a non-resident company. Dividends and profit, received from the sale of shares, transferred to non-resident

company, tax-free, provided that the company has an application for exemption from double taxation.

7) Obligations

Opportunity to purchase debt at a discount to subsequent maturity.

Well, rather than a reason, and the opportunity is a representative office of the company in Russia, as a full-fledged legal entity.

The answer to the second question lies in the competence of each individual agency., providing such services.

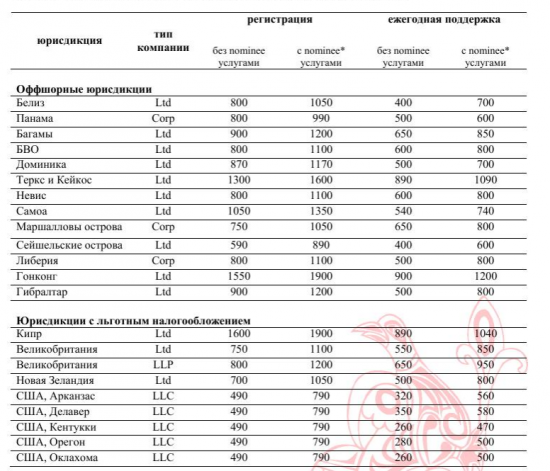

The cost of acquiring a non-resident company consists of one-time costs for registering a new company (company registration cost, independently or with the help of specialists) and annual company support (from the second year ), to be paid annually, starting from the second year after the registration of the company.

Below is a table, received by me from a consulting agency, whose services I used in the process, outlined in the previous article.

Why in the Seychelles?

Yes, because the word offshore sounds somehow vulgar.

Sharing this information, slightly feeling a slightly swaying sensation of "breaking away from the heart", but, maybe, help someone in their endeavors, save someone time and money, to someone, vice versa, the information will seem insignificant - I can not argue with that, that not everyone will be interested in it.

Well,, I think most traders one way or another come up with the idea that, how to put your activity on stream, open a management company or a hedge fund and engage in its activities, along the way, attracting customers and making "added value" at the expense of customers, collect an administration fee and/or success fee, live happily ever after and develop.

I'll tell you right away, that he temporarily abandoned the original idea, because. at this stage, eventually, after a detailed study of the issue, I decided to plunge into the standard physicist-physicist do. Although all the information lies on the subcortex and soon I plan to return to this matter, with a lot of knowledge, contacts and, of course, funds.

so, what tasks did I set for myself:

1. Draw up a more or less clear plan-guide on how to register a company and a corporate bank account (as a foreign, and Russian)

To know:

2. Is it mandatory to open a bank account for a company in Russia when interacting with Russian clients??

3. The need for tax registration of a representative office in Russia

4. As well as, certainly, total cost and requirements for the company, planning to engage in Forex activities.

Well, of course, the goal is to create a full-fledged management company / mutual fund / something else with a similar specific activity.

so, friends, first of all, be prepared, that opening a non-resident company with an account and opening a non-resident company, planning to "engage in activities in the Forex market" - two huge differences.

I will note right away: inexpensive and simple solutions to this issue simply do not exist in nature.

Usually, companies, registered in "classic" offshore zones (except for the Bahamas - local companies are prohibited from engaging in financial activities, even at the level of providing consulting services in this area of business), have the right to engage in financial activities, including. The best option in this case, how I learned from tax planners, – registration of a company in the British Virgin Islands. The following words can be used in the company name, how Finance, Investments or Forex.

Well,, BVI times, means BVI. As explained to me, obtaining a license for the BVI became possible from the middle 2010 years after the adoption of the Securities and Investent Business Ac, which provides for the issuance of several categories of licenses at once.

A license can be obtained for an ordinary company, registered in this jurisdiction. The cost of registering a company is about two thousand dollars.. Actually, as in the above Seychelles. Standard rates, if a, certainly, do not take a company in the Netherlands and the like, which are worth $15 000

To obtain a license, it was necessary to fill out special forms and an application, write a business plan and separately prepare a detailed description of the planned activity. All directors and shareholders of a BV company require CVs and certified copies of passports.

From a formal point of view, this was not a problem., were only personal - but they are purely individual, so I won't stop. In addition, I was told, that directors must have some experience in investment activities, which was harder. General experience in finnish. markets - yes, management experience is. Yeah, but that's probably not what it meant.. This became the first stumbling block. Besides, after submission of all documents, nomination of each director (and there were two of us) reviewed and approved by the Financial Commission of the BVI, which made certain adjustments to the goals in terms of time and material costs.

By the way, the cost of services for obtaining a license should be $13 500. Neither much nor little, but overall worth it, as they were included: payment for collection services, help filling out forms, filing documents in the Financial Commission and so on.

Everything was not so difficult, as i expected, however, they soon reassured me - then an enchanting performance will begin.

Each license holder must appoint a representative to the BVI. Functions of an authorized representative - to contact the Financial Commission on all issues, related to obtaining and using a license. The cost of the services of such a representative –$1,800.00 per year plus pay, spent by him on communication with employees of the Financial Commission, if such a need arises during the year. BUT, as it turned out from the conversations on the sidelines, such a need arose quite often. You also had to pay a fee, the amount of which depended on the categories of licenses obtained (margined/non-margined/markets, etc.)

There was another interesting jurisdiction, where is it possible to obtain a license for financial activities, - this is Belize. The terms and conditions are about the same., as in the British Virgin Islands. BUT, authorized capital of a Belize company, operating in the FOREX market, is about $ 100 000. Moreover, this amount is frozen, and cannot be used until, while the company exists.

Well,, think that's all? An no.

If the company has a license for financial activities, then the list of banks, where can she open her account, Certainly, quite extensive, but not all banks are ready to work with such companies.

The cost of services for opening an account in a foreign offshore bank -1 300$

Certainly, a non-resident company in the vast majority of jurisdictions is not required to have a bank account, but how can you work without it?? And how to work without an account in a Russian bank. Talking with friends from the Central Bank, I learned about the magic letter (I don't remember the number), which calls for special attention to the registration of bank accounts in Russian banks by non-resident companies.

So-called, an account for investment operations and a regular settlement account are opened for various. banking procedures (different set of submitted documents). Go to a prospective commercial bank and ask the Legal Entities Department for instructions on both accounts for non-residents and you, in the vast majority of cases, will answer, that some investment accounts have never been heard of, although legally there is such a possibility and more, the process of opening such an account does not take much time.

Originals :