Exchange option Is a standardized contract, giving the right to its acquirer to make a purchase or sale of the underlying asset (American stocks) at a pre-agreed price on the option exercise date.

Features of stock options:

- exchange instrument with transparent pricing mechanism;

- a convenient tool for hedging open positions on shares;

- loyal deposit requirements;

- limited risks.

Benefits of trading options in:

- trading contracts of one of the largest options platforms – Chicago Options Exchange (CBOE);

- work through simple and easy-to-use trading platforms

- simultaneous option trading, shares and ETF, the ability to build complex strategies;

- deposit from $500.

Options trading conditions:

- Shoulder 1:1.

- Commission for the side of the transaction – $4.00.

- Option Exercise Fee on Expiry Date – $1.00.

- The cost of connecting option quotes – $19.00 / month.

- Uncovered sale prohibited.

You can test options on a demo account. To start working with options in the real market, you need to open an account.

Options history

The roots of modern options go back to the days of ancient Greece. One of the first mentions of the use of options is found in the work of Aristotle, which describes an example of successful speculation, carried out by another philosopher - Thales. He wanted to prove, that despite poverty, a philosopher can easily make money with his mind, he's just not really interested in financial gain.

Fales, thanks to his knowledge of meteorology, suggested, that the olive harvest will be rich next summer. With some amount of money (very small), he rented oil presses in advance from their owners in the cities Millet And Chios, who weren't at all sure, that their services will be in demand during that period of time - that is, Thales acquired the right to use the press in the future, but if I didn't want to, then I could not do it, having lost paid money.

When summer came and the olive harvest really turned out to be rich, Thales was able to make good money by providing the right to use rented presses to everyone.

The authenticity of this story is being questioned by some researchers. (Especially many questions are raised by Thales' ability to predict the olive harvest for six months in advance), the description of the details of the transaction itself is also not clear, but it is often compared to the modern concept of a put option. (put option - more about it further).

Another example of the use of options in antiquity is contained in the Bible - according to the plot, Laban offered Jacob the right to marry his youngest daughter Rachel in exchange for seven years of service. This example illustrates the risk, faced by option traders in the early stages of the development of this financial instrument - the likelihood of refusal to fulfill obligations of one of the parties. As known, after expiration 7 years, Laban Refuses to Marry Rachel to Jacob, inviting him to marry his other daughter.

As with futures, options came into circulation due to the fact, that farmers needed to protect themselves from losses in case of crop failures, and resellers of goods could save money with the help of such contracts (with luck).

The evolution of trade relations led to the emergence of exchanges and speculative trading in assets on them - in the Middle Ages, stock exchanges appeared as in Europe (for example, in Antwerp), so in Asia - for example, Osaka Dojima Rice Exchange.

A well-known example of the use of options and futures is the period of the so-called tulip mania in Holland 1630s. Then the demand for tulip bulbs became very high and exceeded supply.. Therefore, on the Amsterdam Stock Exchange, traders could enter into contracts to buy or sell bulbs at a certain price - in the case of options, it was exactly right, not a duty, which characterizes futures. At the agreed date, the buyer / seller could exercise their right to buy or sell at the agreed price, I could have changed my mind, taking no action.

The next stage in the development of options was the appearance of similar contracts for shares on the London Stock Exchange in the 20s. 19 century (although the first option contract for goods was concluded on this exchange at the end 17 century). Options trading volumes at that time were very small., and in the United States at the end of the century, on some exchanges, such operations were generally prohibited.

To 1973 of the year options trading was conducted in very small volumes (although individual speculators like Jesse Livermore and tried profit from them). The Chicago Board Options Exchange (CBOE) was founded this year, on which active trading in this financial instrument began. The exchange launched standardized trading in options contracts. Helped the development of this type of trade and the US government, by allowing banks and insurance companies to include options in their investment portfolios.

What is a modern option

At the moment, an option refers to the right to buy or sell a specific asset. (it is called basic) in the future at a certain price. Similar to the futures we have discussed in one of the previous materials, with one difference - futures is an obligation to complete a transaction within a specified time frame at an agreed price, and an option is a right. The option buyer can use his right to buy or sell an asset, or maybe not. That's why, versus futures, options are a non-linear instrument, allowing exchange traders to implement flexible strategies.

Like futures, options are traded on the exchange - usually in the same sections . Options usually use the same assets as the underlying asset., as for futures. Besides, the underlying asset of the option can be the futures itself.

Likewise with futures, the option has an exercise date (expiration). By the way of execution, options are divided into American and European. American orders can be executed at any time before the expiration date., and European only strictly on this date.

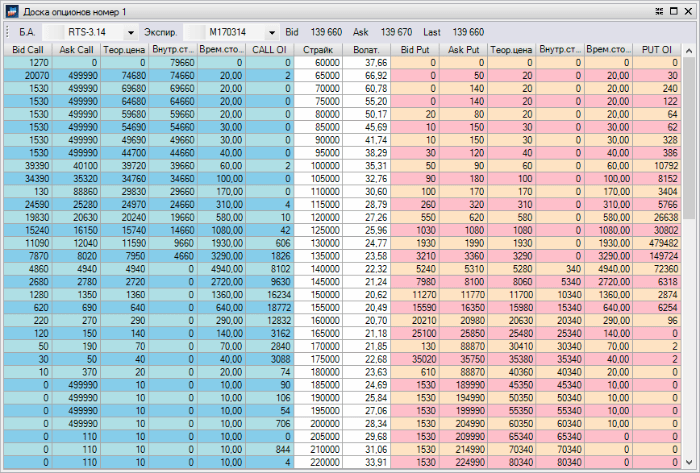

For the convenience of displaying all parameters of options, they are usually traded using a special interface in the terminal., which is called the options board.

How it works

Options are of two types - call (call option) and way (put option). Call Option Buyers (they are also called holders) acquire the right to buy the underlying asset in the future at a certain price - this is called the strike price. Respectively, call option sellers (or subscribers) sell such a right to the buyer for a certain amount of money, called option premium. If the buyer decides to exercise his right, then the seller will be obliged to deliver the underlying asset to him at a predetermined price, having received money in return.

In the case of a put option, the holder, on the contrary, acquires the right to sell the underlying asset in the future at a certain price, and the seller, respectively, sells such a right to the buyer for money. If the buyer later decides to exercise his right, then the seller of the put option will be obliged to accept the underlying asset from him and pay the agreed amount for it.

It turns out, that four transactions can be concluded for the same underlying asset with the same maturity:

- Buy the right to purchase an asset;

- Sell the right to purchase an asset;

- Buy the right to sell an asset;

- Sell the right to sell an asset.

If by the time of the expiry date the market price of the underlying asset increases (R>P), then the buyer's income of the call option will be:

Ds = (R-P) x K-C,

where Р is the market price of the asset as of the date of the end of the contract, P - asset price, appointed in the contract, strike price or strike price, K - the number of assets under the contract, C - option purchase price (option premium).

If, by the time the contract ends, the market value has decreased (R<P), then the owner of the option will refuse to buy assets and at the same time will lose the amount, equal to the option price: Ds = -C.

Let us illustrate with an example. Let's say an investor wants to enter into an option contract such as a put to sell 100 shares of any issuer at a price 100 rubles apiece after six months, Considering, that the present value of the asset is 120 rubles. Investor, buying an option, expects the share price to fall over the next 6 Months, the seller of the option, on the contrary, hopes so, that the price at least will not fall below 100 rubles.

The option seller is more at risk here. (subscriber) - if the stock price falls below 100 rubles, then he will have to buy an asset by 100 rubles, although the current price on the market may already be lower. The option buyer's income will be even greater., because he will buy cheap shares on the market and sell them at a previously agreed upon higher price - and the other party to the transaction will be forced to buy them from him.

As with futures, the exchange acts as an intermediary and guarantor of the execution by the parties to the transaction of their obligations, which blocks security deposits on the accounts of the seller and the buyer, thus guaranteeing the fulfillment of the agreed conditions.

Why are options needed

Options are used to both profit from speculative transactions, and for hedging risks. They allow the investor to limit the risk of financial loss to only a certain amount., which he pays for the option. At the same time, the profit can be any. This distinguishes options from futures, where regardless of whether, Did the investor's assumptions about market conditions come true?, he is obliged to complete the transaction according to the agreed conditions on the agreed day.

Options are a risky investment, however, their plus is, that the risk is known in advance - the investor risks losing only the option price.

Due to this feature, options are very popular among speculators (which bring liquidity to the market, what we wrote about in our past materials), and investors get a flexible tool for building complex trading strategies.

Options have come a long way for hundreds of years. Born in the world, which was not at all like the current, they have changed in order, to meet the challenges of modern investors and traders. Now, due to flexibility and the ability to obtain acceptable results, this financial instrument is at the peak of its popularity, and its use is constantly growing.