Tyler Technologies (NYSE: BACK) - American software vendor. The company's business is very stable due to the focus on serving government structures.. But there are questions about the current value of the company.

What's going on here

Readers have been asking us for a long time to start looking into the financials and business foundations of US issuers.. The idea to review Tyler Technologies was proposed by our reader Dmitry Nazimov in the comments to the analysis of Renewable Energy Group.

Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the overview. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

The company provides services to state and municipal enterprises in the field of IT and not only.

In most segments of the company, sales are divided into two parts.

Enterprise management. These are functions for managing the educational process, accounting department, legal document flow, workflow planning, cadastral and technical records.

Evaluation and taxes. This is the automation of real estate appraisal. This also includes outsourcing such things., how: physical inspection of commercial and residential real estate, data collection, computer analysis of real estate value, preparation of property tax documentation, education in related fields and intermediary functions between taxpayers and local jurisdictions.

Relevant segments, how much does each type of service give. According to the company's annual report, its revenue is divided into the following segments.

Maintenance — 41,9%. This includes technical support services for the company's customers., using its software, as well as software from some other companies.

Subscriptions — 31,4%. This is the payment of customers for the use of the company's cloud capacities.. Also in this segment, the company is engaged in filling out and managing legal documents.. Tyler's income here is not formed from a subscription, and from commissions.

Software Services — 16,7%. In this segment, the company is engaged in software installation, personnel training at client enterprises, consulting and programming.

Maintenance, software subscriptions and services, in fact, one segment: customers from one segment are also customers from another. Gross margin of “single segment” — 49,2% from its proceeds.

Software licenses and royalties — 6,5%. This is a sale of the right to use the software by the company's clients with the possibility of changes in the code, as well as receiving royalties from the sale of Tyler software by third parties. Segment gross margin — 51,8% from its proceeds.

Appraisal services — 1,9%. These are evaluation services, which the company provides separately from the rest of its divisions at the request of customers. Segment gross margin — 24,5% from its proceeds.

Physical goods and more — 1,6%. This is the company's services for the sale and installation of computer equipment, purchased from third party vendors, at customer enterprises. Segment gross margin — 30,3% from its proceeds.

Also, the company's revenue can be viewed through the prism of "renewable" and "non-renewable" services.. Renewable are subscriptions and contracts, which are extended with a greater or lesser degree of predictability. Non-renewable are services, which are rendered on a one-time basis. Renewable services now amount to 73,2% proceeds, and non-renewable 26,8%.

The company operates not only in the USA, she also provides services in Canada, australia, UK and Caribbean States. But, Unfortunately, the company does not say, exactly how much do American customers bring, and how many are foreign.

Chipping is a profitable topic

Target market capacity of the company, at first sight, Impressive: Tyler's original market is $30 billion. Added to this is the market for case management software with a capacity of approximately 900 million, which Tyler entered with the purchase of NIC. It is worth noting, that this market is very stable, as you can see from Tyler's revenue and earnings figures.

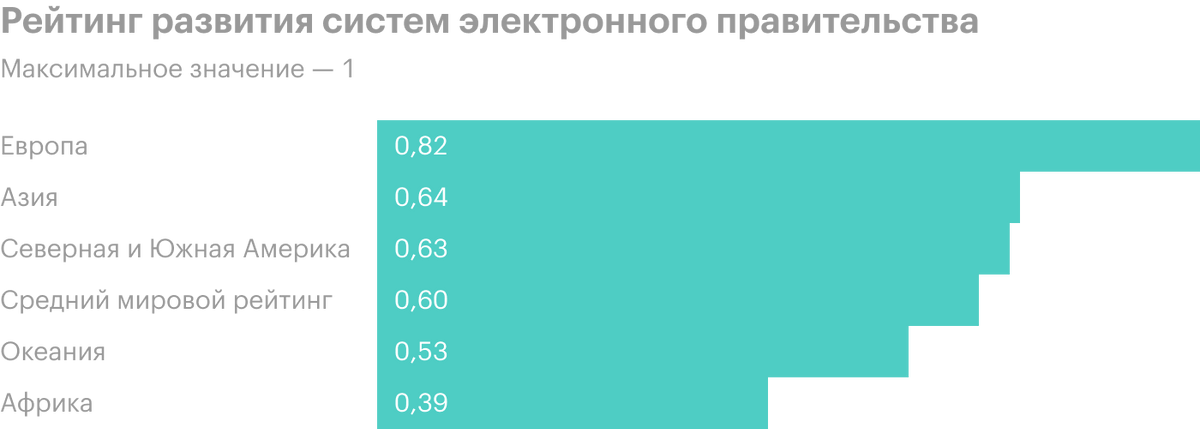

The coronavirus pandemic with the massive transfer of everything online has again actualized the issue of the need to digitalize government procedures in countries around the world.. Moreover, various options for online management have already been worked out in different countries before the pandemic.: take, for example, e-government in Estonia or the Chinese "social rating" system. But, certainly, the pandemic has accelerated this process.

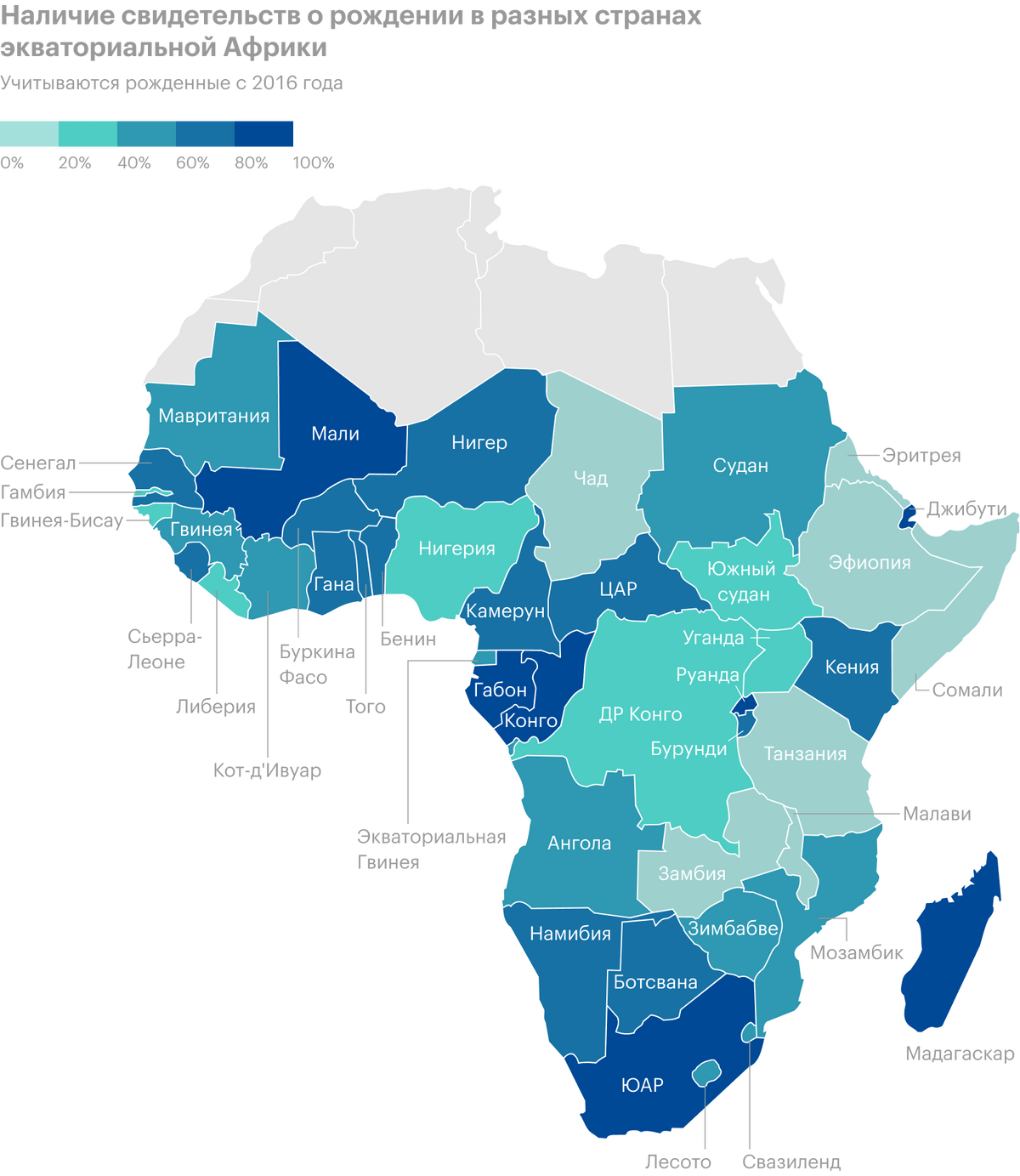

Despite significant progress in this area, there is still a lot of work to do. For example, in many African countries, the possibilities of the state are so small, that they can't even handle such a simple thing, as fixing the fact of a person's birth. I think, in ever-developing countries, Tyler has great potential to implement its systems.

Digitizing government activity and keeping records online is not a luxury, but the need: South Korea, thanks to the presence of a huge database of all ministries and regions, was able to take targeted measures to combat the coronavirus pandemic and dispense with a comprehensive quarantine, which would kill the economy.

The problem is, what Tyler takes 3,55% from this market, but with its capitalization of over $18 billion, it costs 58,41% market. In my opinion, the company's assessment is somewhat inadequate, especially considering her P / E at the level 94,5. Probably, Tyler management understands this and will actively expand in the coming years through the purchase of similar systems and start-ups as in North America, as well as in other countries.

It is difficult to predict how quotes will behave in this case.. At all, Investors often react to such news by selling stocks.: in the event of the acquisition of a new asset, the company has less money, which is logical. But, may be, in the case of Tyler, they will take such news with enthusiasm, counting, that the company is moving towards capturing a fairly marginal and stable market. After all, governments of all levels for the most part are really stable customers, from which you can take at exorbitant prices, taking advantage of people's lack of technical savvy, working in them. So Tyler's high score is just a kind of advance payment for expected success..

Tyler's main strength in the eyes of investors is the stability of its business: 98% of the company's customers renew their subscription and service contracts. And unlike many IT startups, Tyler does not lose money., but earns, and for a very long time. Even inflated P / E is better than his absence.

Resume

Tyler is an interesting issuer in a promising niche. But the company is very expensive, and the main opportunities for expanding its business, probably, imply extensive spending. Therefore, here I would invest at my own peril and risk..