Tata Motors (NYSE: TTM) - Indian car manufacturer. In terms of business characteristics, the company has nothing to do with it., but its prices are facilitated by the company's focus on electric cars. Basically, the lack of semiconductors does not contribute to this, so that the company becomes the new Tesla.

What happens here

Readers have been asking us for a long time to start sorting out the financial statements and business foundations of foreign issuers.. The idea to review Tata Motors was suggested by our reader Andrey Sergeev in the comments to the review of Abercrombie & Fitch. Offer in the comments of the company, analysis of which you would like to read.

The overview contains many screenshots with tables from reports. To make it more convenient to use them, we transferred them to google-sheets and translated into Russian. Direct your attention: there are several sheets. And keep in mind, that companies round off certain numbers in documents, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

According to Tata Motors annual report, 98,53 % company sales give cars and automotive components, and 1,47 % is the money sector.

If you look at the statistics on the machines, then as a percentage of the total number of cars, the structure of cars sold looks like this: 42,8 % - working machines, 36,2 % - commercial vehicles and twenty-one percent - passenger cars.

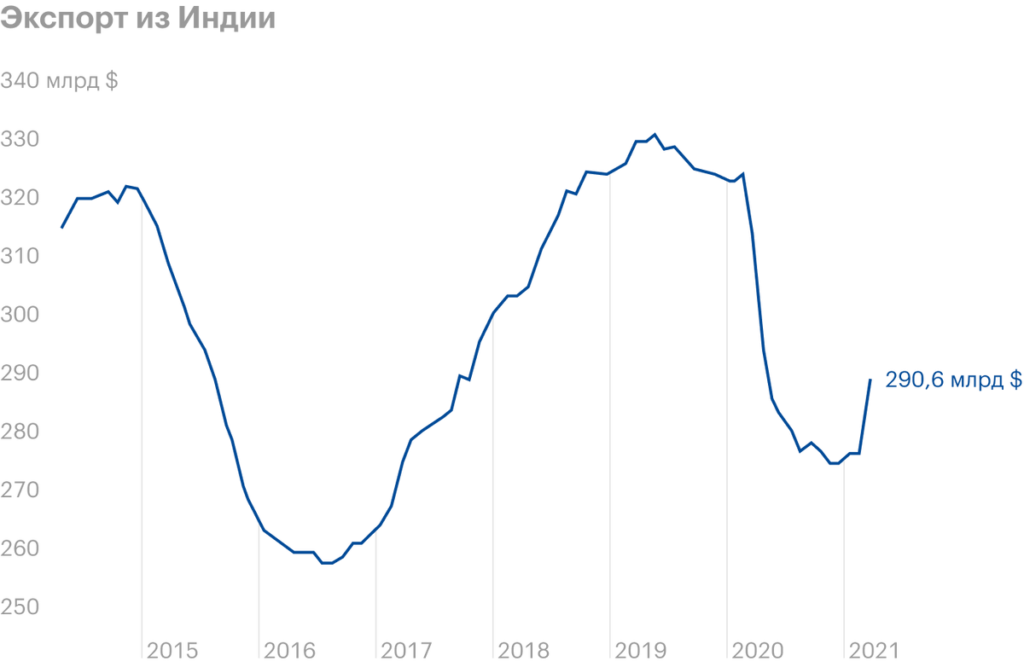

In native India, the company occupies 12,7 % market, but it's not so important, because Tata's sales geography is even wider. India gives 17,9 % proceeds, 11,5 % - China, 16,2 % — England, 19,9 % — USA, 16,6 % various European states and 17,9 % - the rest of the world. The lion's share of the company's assets is located in England.

The company is unprofitable due to several circumstances: in-1-x, "Thank you" coronavirus infection, and in-2-x, the company sells an immense investment program, including in the field of electric vehicles.

Challenges and Opportunities

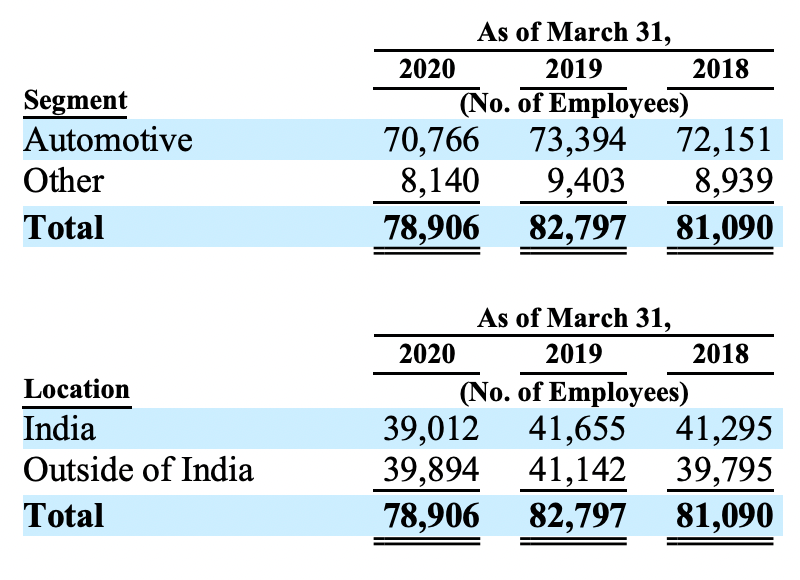

Given the negative situation with the mobility of the population in Asian countries, seems, that the situation with the seasonal sales performance of the company is not the best.

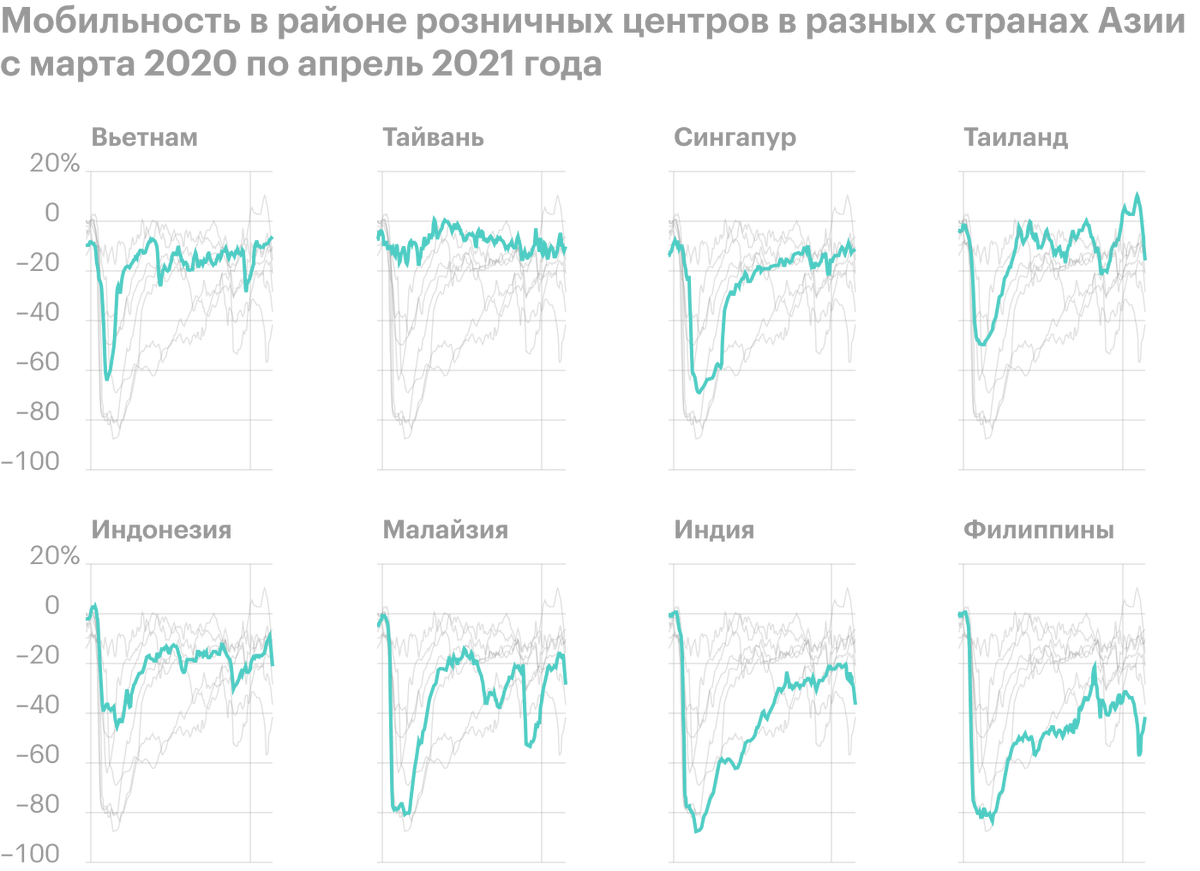

On the other hand, UK manufacturing activity is now on the rise. The company makes a large part of its sales here., and she's a big employer. So that, maybe, Outside of Asia, Tata hasn't fared too badly this quarter..

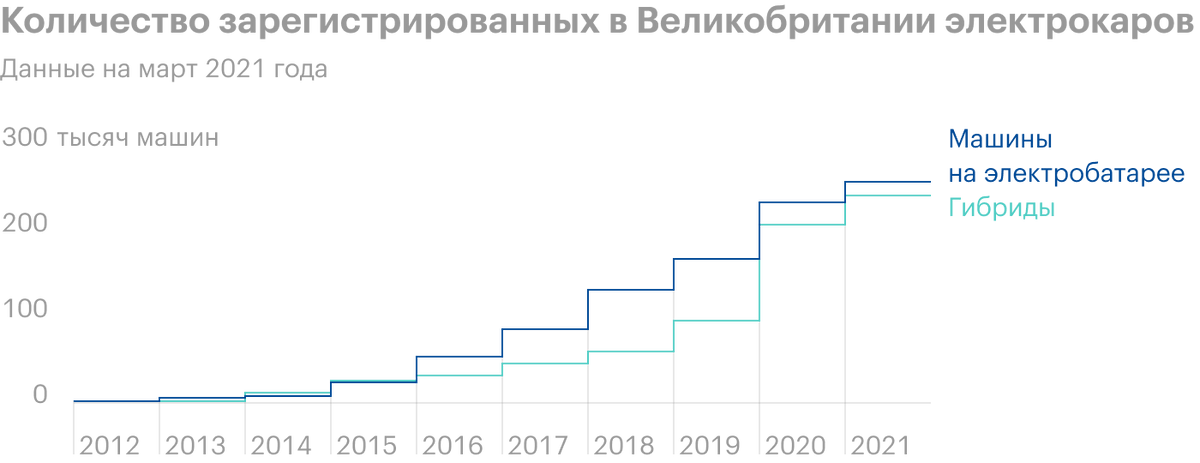

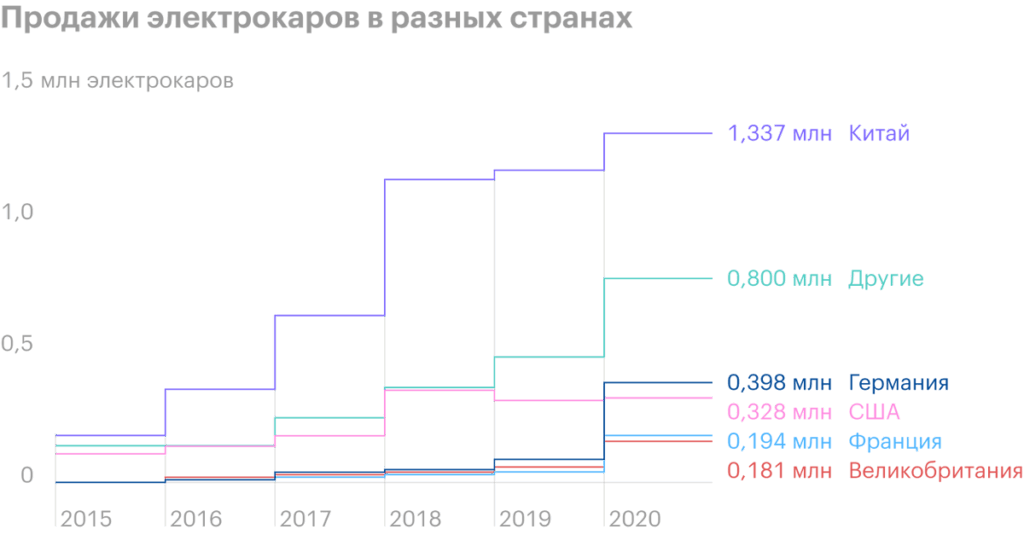

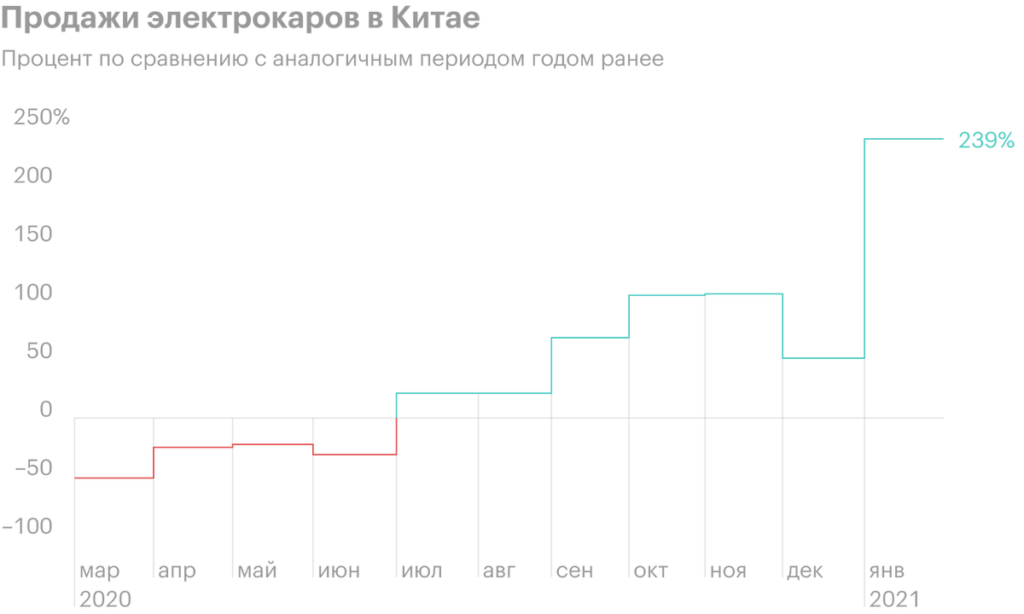

However, all this is not so important., as Tata's extensive investment in electric vehicles, which have already begun to show results. In the previous quarter, electric cars accounted for 53% of all sales. This is all pretty cool, because you need to remember, that the demand for electric cars is growing like in the UK, as well as in other parts of the world.

Challenges and Opportunities - 2

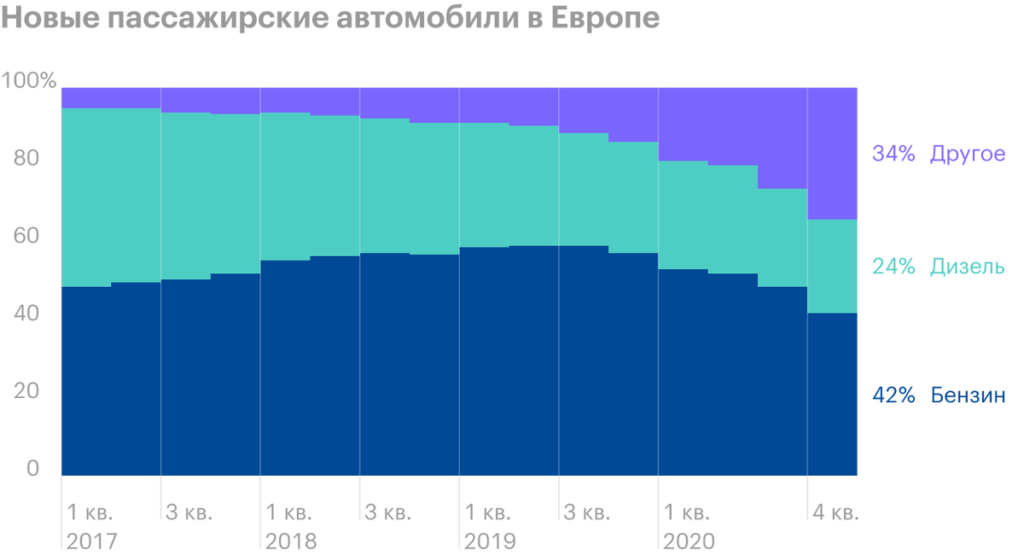

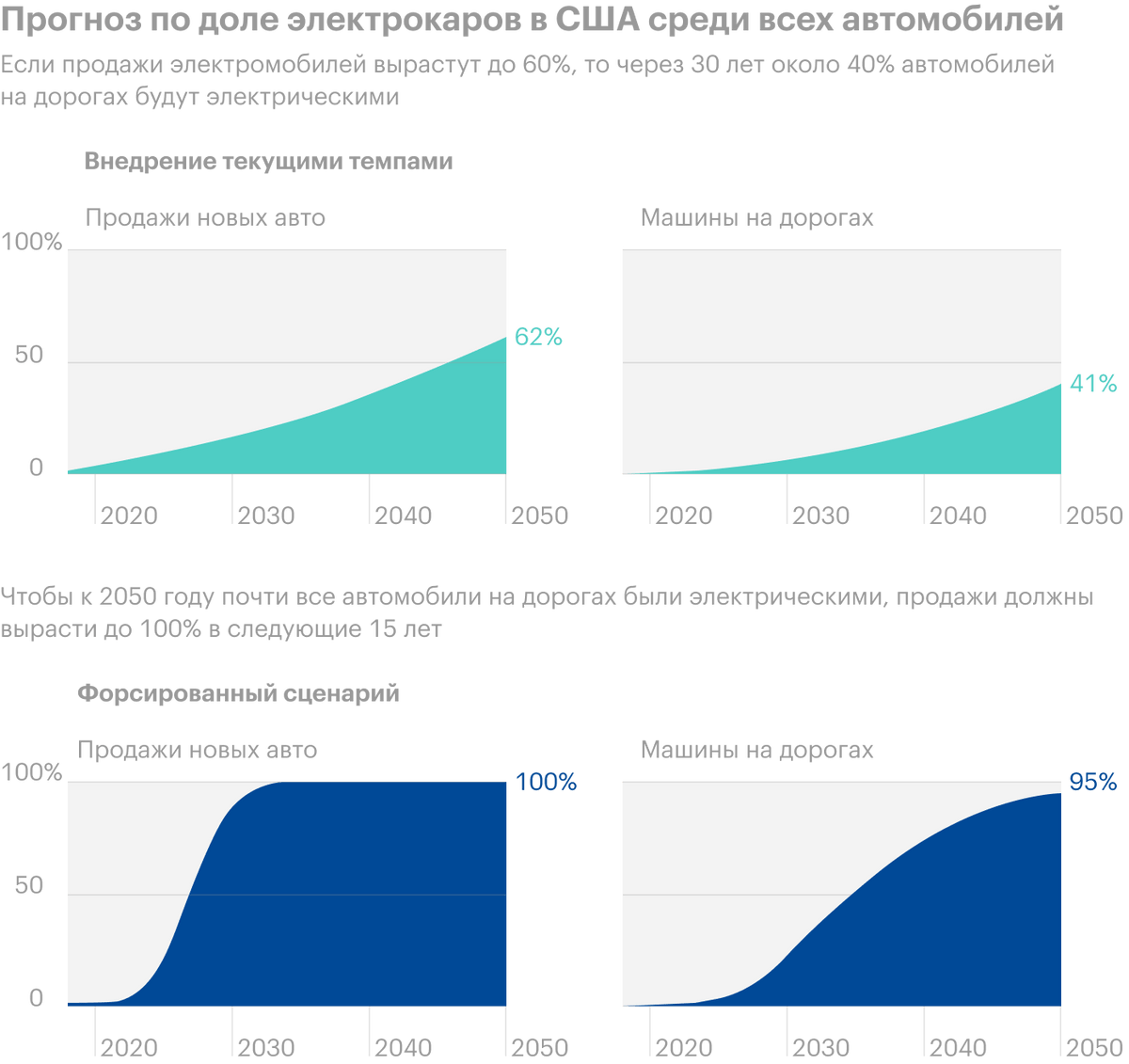

Important to consider, that now radical progressives are at the helm in the United States, who advocate compliance with the 2015 Paris Climate Accords. And just according to the goals of these agreements, at the current rate of introduction of electric cars on US roads, they do not fit into the emission reduction program by 2050.. After all, to meet, you need to increase the rate of input one and a half times.

Therefore, we can expect, that in America they will introduce all new crazy benefits for owners of electric cars. Well, or at least that ESG investors will pump up the capitalization of Tata, to encourage the transition of other automotive companies to the production of electric cars. And financial institutions allied with them will issue loans to Tata on preferential terms - how does it work, we already talked about ESG in a longread.

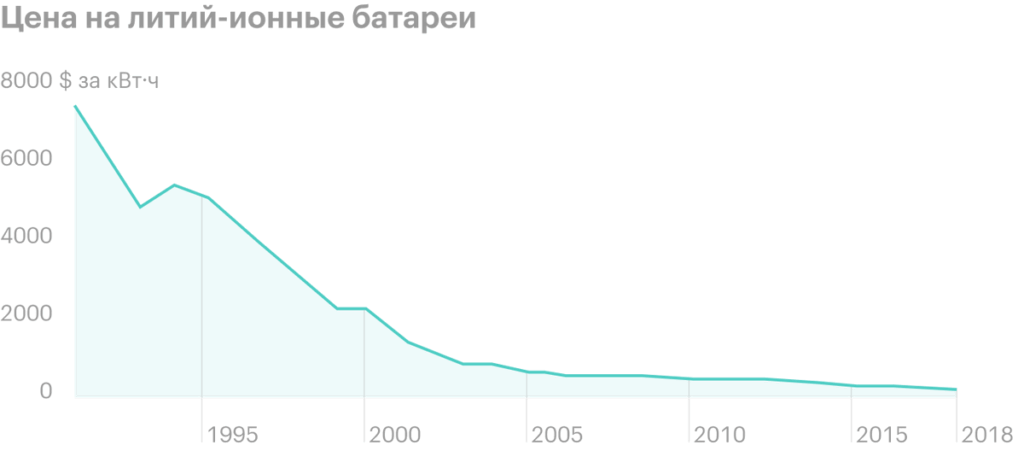

But as for the technology of electrification of vehicles, here the cost of batteries for electric cars plays into the hands of Tata. The price of batteries is constantly dropping, and their production is growing, what will make electric cars more and more affordable. Or so investors prefer to think. Tata is increasingly positioning itself as an electric car company, what, probably, will affect its quotes. As we said in the analysis of General Motors, pretending to be a "new Tesla" can be useful to increase the value of shares. AND, need to say, Tata is doing well: in the absence of serious business success, the company's shares grew by as much as 253% almost entirely thanks to the electric car hype.

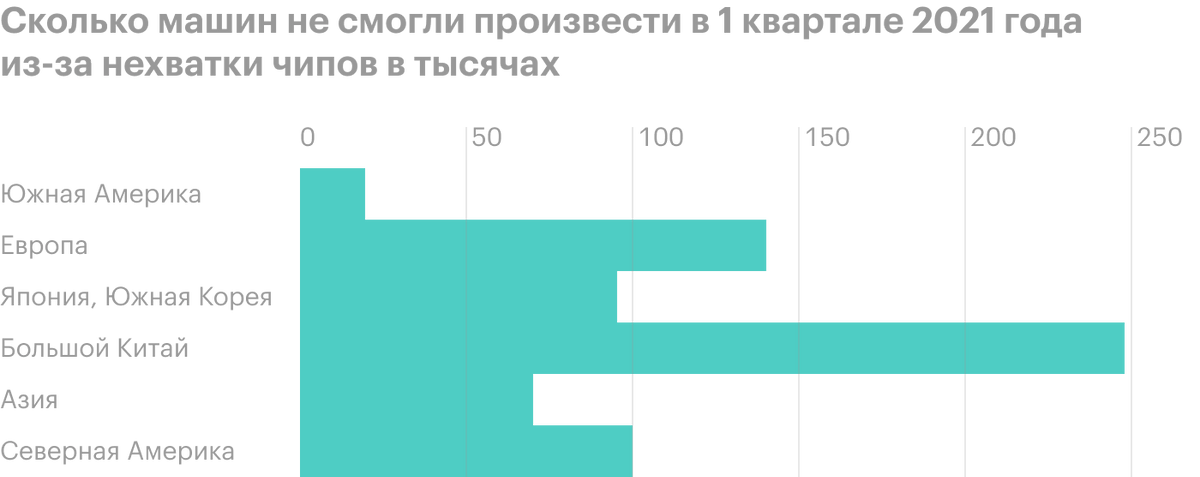

But there's a little problem here.. Electric cars are even more demanding on the availability of electronic components, for the production of which semiconductors are required. And as you remember, our idea with KLA, as well as news, semiconductor shortage in the world. In this regard, many automakers stop work, because the right components don't arrive on time, and without them the car can not be collected. So Tata recently stopped production at a number of factories in the UK., because the right semiconductors are not delivered to them on time. For this reason, you need to be prepared to, that production troubles will be reflected in the company's report in the next quarter. May quarterly report will describe the situation, probably, at the beginning of April, before the closure of factories in the UK.

Resume

18 May Tata Motors releases Q4 2021 report — the company is already in fiscal 2021. I wouldn't expect anything out of the ordinary from him., and how a business company does not arouse my special interest.

But, maybe, with these shares it will be possible to win back the boom in investor interest in electric cars. Still, there are not very many “clean” manufacturers of electric cars on the stock exchange., so this is where Tata can grow, simply because "well, here's another company, except Tesla ». The fashionable orientation of the company's business, combined with its wide international presence, can attract many fans of "bright and promising" into the stock..