Sonic Automotive (NYSE: SAW) - American car dealer. Coronavirus 2020 was not without problems for the company, but things are getting better. And the company can be bought by its major competitor.

What's going on here

Readers have long asked us to start analyzing the reporting and the foundation of the business of foreign issuers.. The idea to review Sonic Automotive was proposed by our reader Alex Freeman in the comments to the Yeti Holdings review.. Suggest in the company's comments, analysis of which you would like to read.

What do they earn

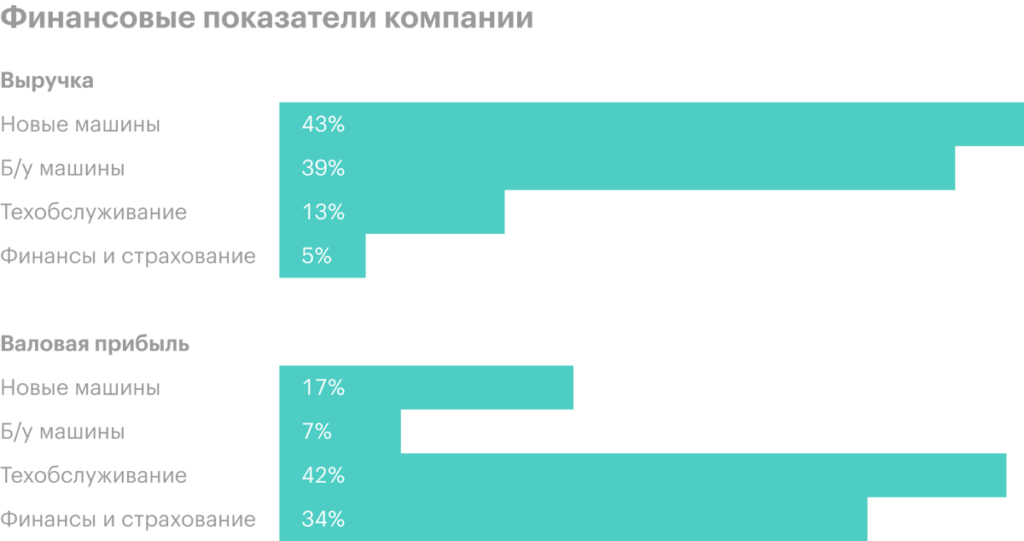

This is a car dealer network. According to the annual report, The company's revenue is divided into the following segments:

- Sale of new cars.

- Sale of used cars, including wholesale.

- Sale of spare parts and repair.

- Auto loans and insurance.

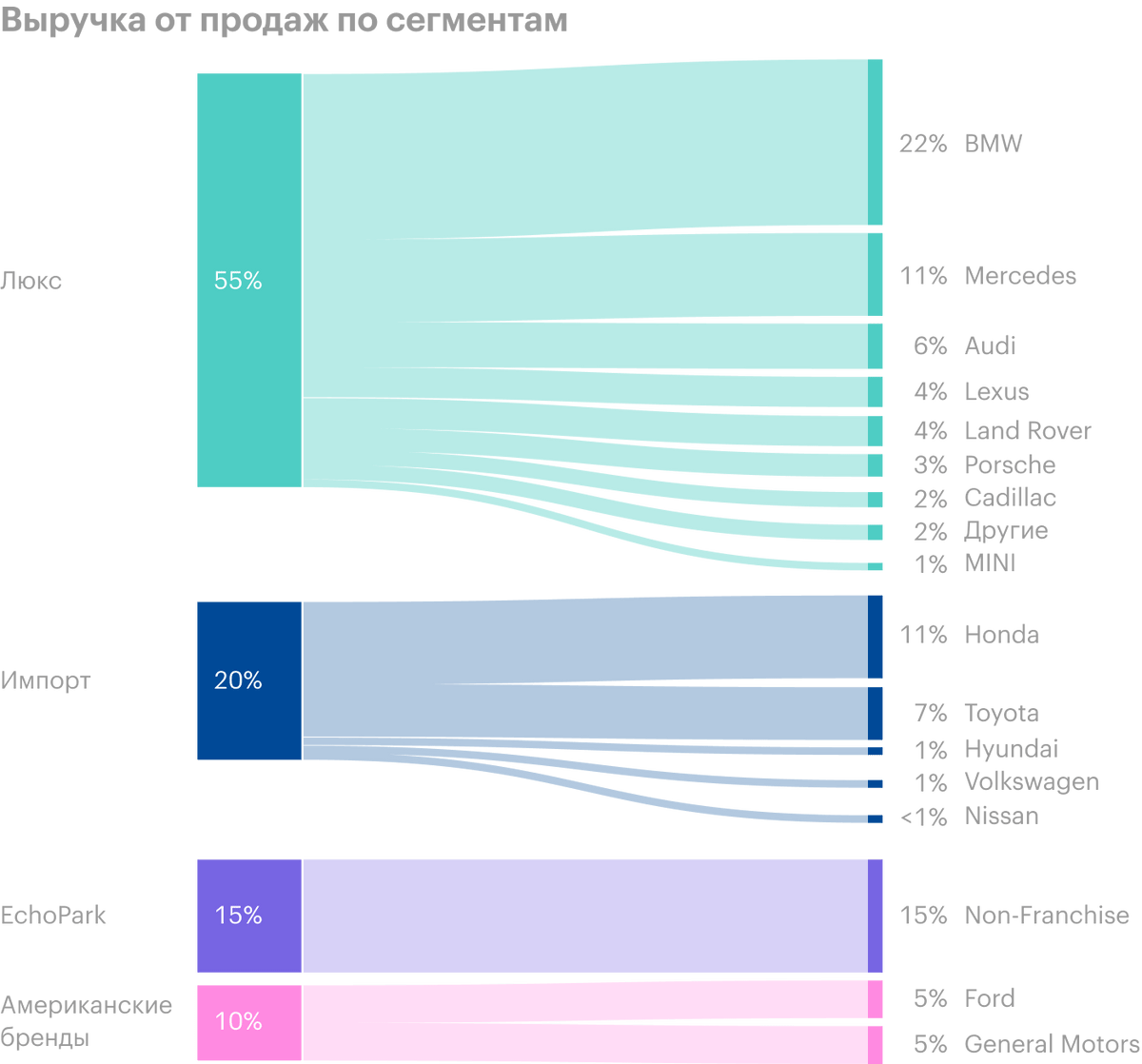

The proportions of each segment in revenue and earnings vary greatly. The report even states, what percentage of sales come from which types of cars. The company operates only in the USA.

Company's annual income statement, billion dollars

| Revenue | Net income | Profit Margin | |

|---|---|---|---|

| 2017 | 9,87 | 0,09289 | 0,94% |

| 2018 | 9,95 | 0,0516 | 0,52% |

| 2019 | 10,45 | 0,14454 | 1,38% |

| 2020 | 9,77 | −0,05066 | −0,52% |

Revenue

2017

9,87

2018

9,95

2019

10,45

2020

9,77

Net income

2017

0,09289

2018

0,0516

2019

0,14454

2020

−0,05066

Profit Margin

2017

0,94%

2018

0,52%

2019

1,38%

2020

−0,52%

“Let's go, let's not be sad"

The damned coronavirus hit the company's business hard in 2020 and led to heavy losses. They were not related to operations, but the company had to record a decrease in the value of assets. All is well now, and Sonic Automotive consistently generates profits, albeit not very big: total margin in the area 2% from proceeds.

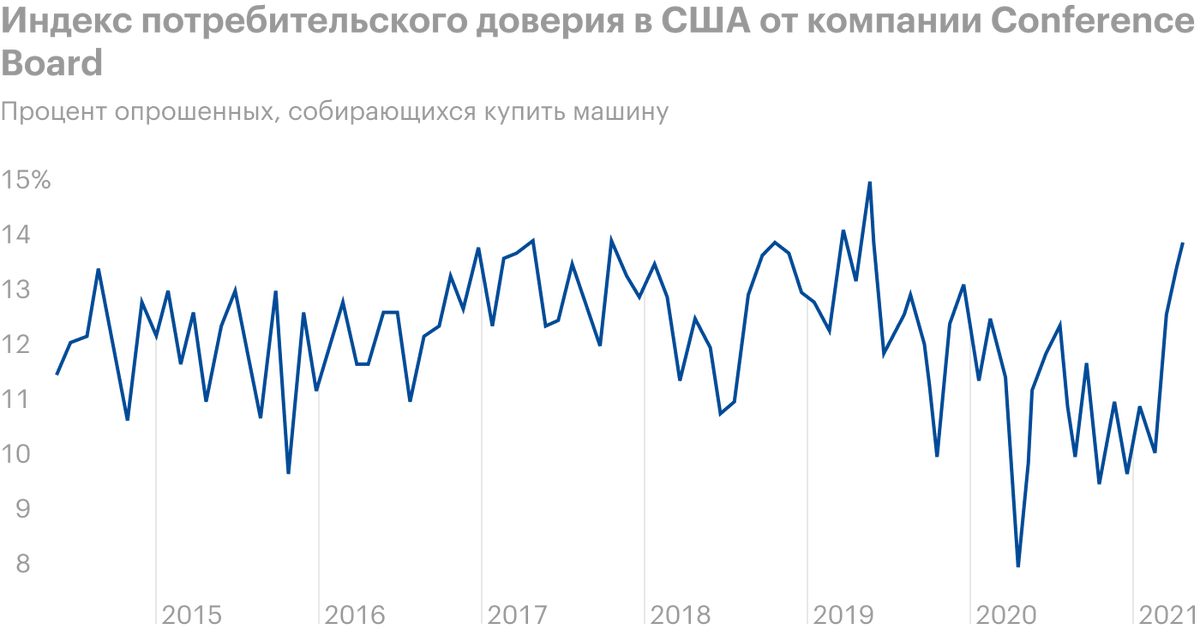

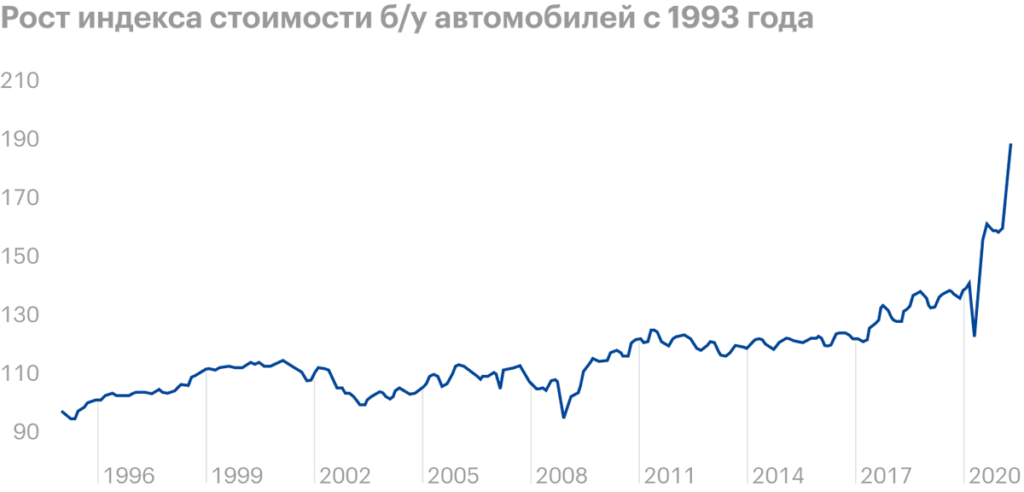

At the same time, the circumstances for the company are more than positive.. According to a number of indirect signs, it can be assumed, that there is a great demand for the company's products and services.

This is also helped by the fact, that America is a country, not very friendly to pedestrians, except for places like this., like New York. Therefore, a car in the USA is not a luxury, and the vehicle. Therefore I would expect, that the positive situation for Sonic will continue for a long time.

There is another moment, which can play a positive role for quotes.

Need more Lithia

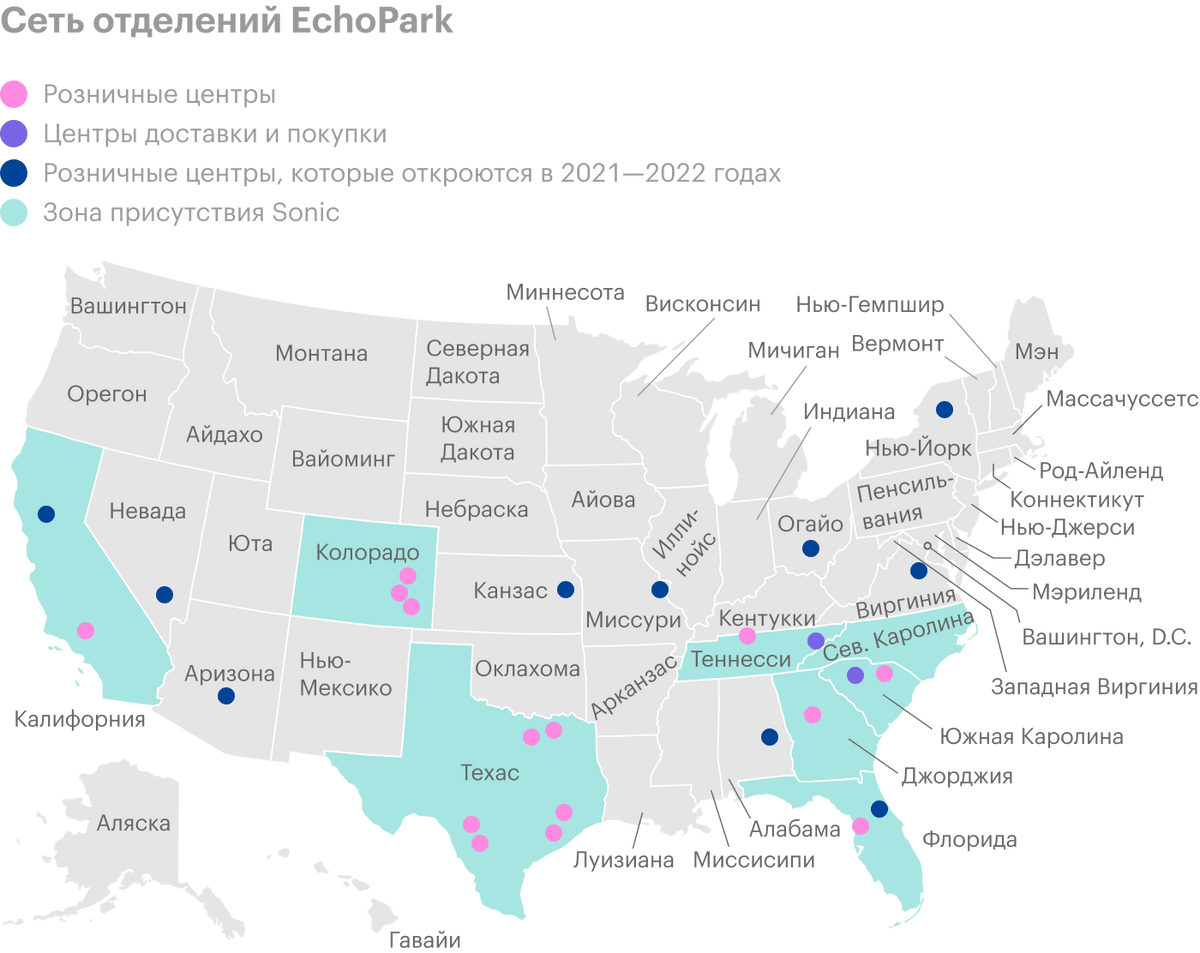

Lithia Motors car dealers are spending huge amounts of money to acquire competitors. Sonic has a very good business record and has its own fairly effective, when compared to CarMax, division of sales of budget used cars. It seems to me, that buying Sonic would be in Lithia's interests. Well, Sonic quotes will be good from this.

Company quarterly earnings report, billion dollars

| Revenue | Net income | Profit Margin | |

|---|---|---|---|

| 1 neighborhood 2020 | 2,31 | −0,19913 | −8,63% |

| 2 neighborhood 2020 | 2,11 | 0,031 | 1,47% |

| 3 neighborhood 2020 | 2,55 | 0,05999 | 2,35% |

| 4 neighborhood 2020 | 2,8 | 0,05748 | 2,05% |

Revenue

1 neighborhood 2020

2,31

2 neighborhood 2020

2,11

3 neighborhood 2020

2,55

4 neighborhood 2020

2,8

Net income

1 neighborhood 2020

−0,19913

2 neighborhood 2020

0,031

3 neighborhood 2020

0,05999

4 neighborhood 2020

0,05748

Profit Margin

1 neighborhood 2020

−8,63%

2 neighborhood 2020

1,47%

3 neighborhood 2020

2,35%

4 neighborhood 2020

2,05%

Average number of used car sales per Sonic dealership per month

| Average performance of competitors | 83 |

| 3 neighborhood 2020 | 104 |

| 4 neighborhood 2020 | 101 |

Average performance of competitors

83

3 neighborhood 2020

104

4 neighborhood 2020

101

Average number of used car sales per EchoPark dealership per month

| Indicators CarMax | 295 |

| 3 neighborhood 2020 | 491 |

| 4 neighborhood 2020 | 402 |

Indicators CarMax

295

3 neighborhood 2020

491

4 neighborhood 2020

402

Long ago and far away, in my ol’ common labor shoes

The vast majority of Sonic's sales are in Texas.. This state has been hit hard by the freeze., and although household spending there seems to have recovered quite quickly, still there is some probability, that the consequences of freezing temperatures in the form of huge electricity bills can affect the willingness of Texans to spend money on such expensive things, like a personal car.

Company sales by state

| Texas | 28% |

| California | 26% |

| Colorado | 10% |

| Tennessee | 7% |

| Florida | 7% |

| Alabama | 7% |

| North Carolina | 5% |

| Georgia | 3% |

| Virginia | 2% |

| Maryland | 2% |

| South Carolina | 2% |

| Nevada | 2% |

Texas

28%

California

26%

Colorado

10%

Tennessee

7%

Florida

7%

Alabama

7%

North Carolina

5%

Georgia

3%

Virginia

2%

Maryland

2%

South Carolina

2%

Nevada

2%

Resume

29 April, the company shared a report for the past quarter. The results in the report are very good., but so far the market has not reacted to them in any way. I believe, that Sonic is a very good medium-term investment option.