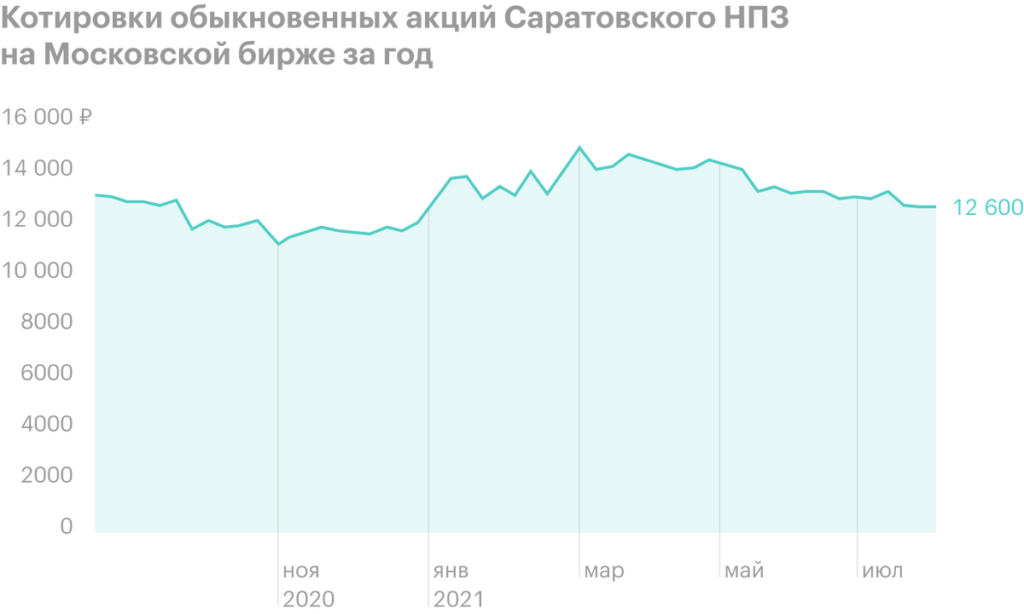

With this article, we begin a series of publications about the Rosneft organization and its public subsidiaries.. In it, we will consider the Saratov Oil Refinery (MCX: KRKN, KRKNP).

About Saratov Refinery

Saratov Oil Refinery was founded in 1934 year, in 1994 privatized and since then alternately entered into similar vertically embedded oil producing organizations, like "Sidanko", TNK-BP, and with 2013 enters Rosneft.

The company's business is quite simple and understandable: she is engaged in oil refining on a tolling basis. In other words, the customer - Rosneft - is the owner as a raw material, and resulting processed goods, and the Saratov Refinery receives remuneration for the provision of services. Eventually, only a couple of characteristics affect the company's business: the size of oil refining and the cost of processing.

The design capacity of the plant is 7 million tons of oil per year. In fact, slightly less is recycled: the size of the manufactured product measuredly depends on the size of processing. Worth considering, that in the fourth quarter of odd-numbered years, repair work is carried out at the plant, so in these years the recycling rate is even lower 6 million tons. In general, refining volumes are at approximately the same levels over the past years..

Urals oil is processed at the refinery, also oil from the Saratov and Orenburg fields. In the structure of their production, a significant part is occupied by diesel, vacuum gas oil, petrol and oil. With 2018 the plant produces gasoline of the modern ecological standard "Euro 6". Processed goods user — Moscow.

The depth of oil refining at the plant is about eighty percent, what a good indicator, but it is slightly below the average for Russia, which, as a result 2019 year was about 83%. The company names increasing the depth of refining as one of its strategic goals. The plant also names an increase in the selection of vacuum gas oil among the promising areas., production of new grades of road bitumen and overall increase in operational efficiency.

The volume of oil refining and manufactured products by years, million tons

| Processing volume | Volume of production | |

|---|---|---|

| 2016 | 5,89 | 5,64 |

| 2017 | 5,78 | 5,56 |

| 2018 | 6,71 | 6,50 |

| 2019 | 5,62 | 5,43 |

| 2020 | 6,25 | 6,10 |

Structure of production of processed products for 2020 year, thousand tons

| Diesel fuel | 1837 |

| Vacuum gas oil | 1327 |

| Fuel oil | 1176 |

| High octane gasoline | 1070 |

| Other types of gasoline | 197 |

| Low-viscosity marine fuel | 131 |

| Other | 359 |

1837

Financial indicators

The company's revenue and net income are unstable, but overall there is an upward trend. The revenue structure clearly shows, that the processing of raw materials is the main activity of the plant.

The company is completely debt-free - moreover, it's not near zero debt, namely, the lack of borrowed money.

Another interesting feature is the ever-growing accounts receivable. Its size is growing significantly from year to year and has already reached enormous proportions.: as of the end of the first half 2021 years is already 27 billion rubles. This amount is large in itself., but she looks even more impressive in comparison: this is approximately twice the capitalization of the company and in 9,5 times the net income 2020 year.

That is, it turns out, that the company is constantly profitable, but this is more likely on paper - in reality, a significant part of the money settles in the parent company, although it is listed as a debt to the Saratov refinery.

Revenue, net profit, net debt and receivables by year, billion rubles

| Revenue | Net profit | net debt | Receivables | |

|---|---|---|---|---|

| 2017 | 11,8 | 2,58 | 0 | 11,0 |

| 2018 | 13,5 | 3,72 | 0 | 15,1 |

| 2019 | 14,9 | 4,41 | 0 | 18,8 |

| 2020 | 11,7 | 2,82 | 0 | 23,3 |

| 1п2021 | 8,59 | 3,68 | 0 | 27,0 |

Revenue structure for 2020 year

| Processing of raw materials | 99,44% |

| Services of loading processed products into water transport | 0,36% |

| Excessive storage of petroleum products | 0,01% |

| Other services | 0,19% |

99,44%

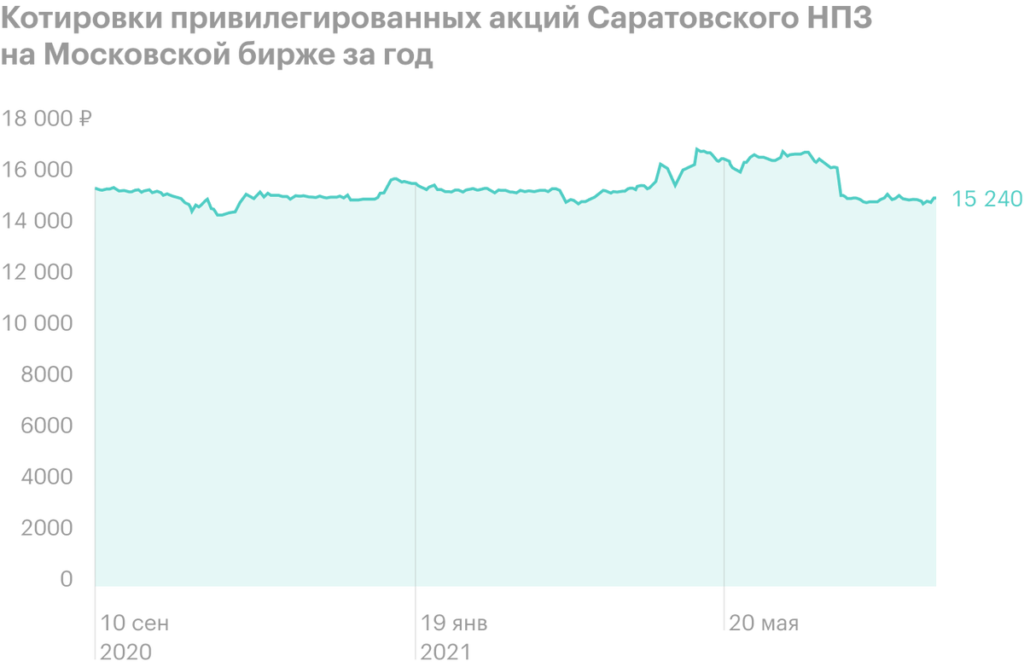

Share capital and dividends

The share capital of the company consists of approximately 750 thousand ordinary and 250 thousand preferred shares. About 91% ordinary shares and 84,5% of the total capital of the Saratov Refinery belongs to LLC RN-Pererabotka, a subsidiary of Rosneft.

According to dividend policy, the formula for calculating the amount of dividends on ordinary shares is not defined, and for the privileged is 10% net profit with clause, that the dividend per preferred share cannot be less than the dividend per common share..

In reality, dividends on ordinary shares are not declared or paid., and preferred payments are made in accordance with the dividend policy and are made once a year.

Dividends by years

| Dividends on pref. share | Dividend yield | Share of net profit | |

|---|---|---|---|

| 2016 | 1051,46 R | 10,6% | 10% |

| 2017 | 1035,34 R | 8,6% | 10% |

| 2018 | 1490,13 R | 13,6% | 10% |

| 2019 | 1766,52 R | 11,0% | 10% |

| 2020 | 1132,93 R | 7,5% | 10% |

Why stocks can go up

Dividends. One of the main motivations for buying shares of companies on the Russian stock market is dividends.. The return on preferred shares of the Saratov Refinery has been quite decent over the past few years, and the dividend policy is strictly observed, so these stocks can be a good choice for investors.

Cheap stable business. Even in shock for the oil and gas and transport industries 2020 year the company's services were in demand. Although the revenue has decreased, it didn't fail, which once again confirms, that the Saratov Refinery is a stable business, at the same time very cheap in terms of multipliers.

Hope for the best. Due to the significant undervaluation of the Saratov Refinery, its stock quotes have great upside potential - if investors feel, that the situation with the weak points of the company began to improve. Maybe, the trigger for such changes will be a unified approach to dividends of state-owned companies approved by the government in the amount of 50% from adjusted net profit.

Why stocks might fall

Not the best investor relations. Saratov Refinery does not pay much attention to its attractiveness in the eyes of investors: his website is just a page from 2012 of the year, where you can only download archives with documents, IFRS financial statements ceased to be published from 2015 of the year. There is only RAS reporting, there are no presentations for investors. It is unpleasant, but secondary. More important is, that the bulk of the money is withdrawn from the company through receivables - and there is no end in sight to this trend.

Lack of prospects. By and large, the company does not develop. Yes, some measures are being taken for the technical re-equipment of the plant, to improve operational efficiency, but this does not drastically affect the volume of oil refining or financial performance. Quite possibly, that in 5-10 years the volume of refining and revenue will remain at approximately the same levels, as in recent years.

Risks of accidents. Oil refining is a technologically complex and rather dangerous production., so, Unfortunately, there are risks of man-made accidents, which can lead to a partial or complete stoppage of production and even to lawsuits.

Saratov refinery multipliers

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| 2017 | 3,78 | 10,9% | 0 |

| 2018 | 2,01 | 13,7% | 0 |

| 2019 | 2,60 | 14,2% | 0 |

| 2020 | 4,70 | 8,4% | 0 |

| 1п2021 | 2,89 | 12,4% | 0 |

Eventually

Saratov Refinery is an oil refinery in the structure of "Rosneft". His business is stable and profitable, preference shares pay regular dividends with good returns.

But if you look, it turns out, that business is more likely to stagnate, not developing, and a significant part of the profits does not reach the company. This is why stocks are cheap.

As a result, preferred shares of the Saratov Refinery may be of interest to conservative investors with a dividend strategy, and both types of shares can serve as a kind of option to change the situation in the company for the better in terms of its transparency and development. This is worth considering, but at the same time do not forget, that there are a large number of companies on the Russian stock market that are much more transparent and have a positive attitude towards their minority shareholders.