Grubhub (NYSE: GRUB) и DoorDash (NYSE: DASH) - food delivery services from restaurants. Quarantine and coronacrisis led to an increase in sales for both companies, but did not bring them happiness: there is no income as before. And the subsequent possibilities of these businesses are vague.

What do they earn

We have already had analyzes of these companies., so we won't repeat it here., Let's focus on the current situation..

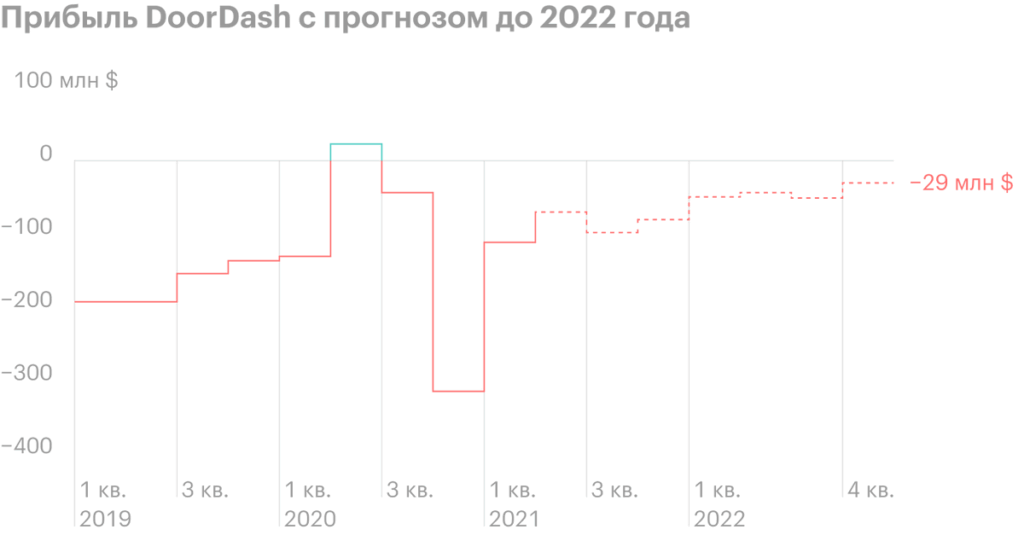

DoorDash's revenue tripled, but the losses decreased extremely non-cardinally, with 129 million dollars to 110 million. Grubhub saw a 50% increase in revenue, but losses also increased - by 127%.

By the way,, Grubhub seems to be going to acquire Anglo-Dutch from Just Eat Takeaway, but the deal is not closed yet.

DoorDash Quarterly Revenue and Profit, million dollars

| Revenue | Profit | Income margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 675 | 23 | 3,41 % |

| 3 neighborhood 2020 | 879 | −43 | −4,89 % |

| 4 neighborhood 2020 | 970 | −312 | −32,16 % |

| 1 neighborhood 2021 | 1080 | −110 | −10,21 % |

DoorDash earnings-per-share characteristics in dollars

| Current | Expectation | |

|---|---|---|

| 2 neighborhood 2020 | 0,52 | 0,52 |

| 3 neighborhood 2020 | 0,30 | 0,28 |

| 4 neighborhood 2020 | 0,25 | −0,43 |

| 1 neighborhood 2021 | −0,11 | −0,08 |

| 2 neighborhood 2021 | — | −0,07 |

Grubhub Quarterly Revenue and Earnings, million dollars

| Revenue | Profit | Income margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 459,28 | −45,41 | −9,98 % |

| 3 neighborhood 2020 | 493,98 | −9,24 | −1,87 % |

| 4 neighborhood 2020 | 503,7 | −67,78 | −13,46 % |

| 1 neighborhood 2021 | 550,59 | −75,46 | −13,71 % |

Grubhub earnings-per-share characteristics in dollars

| Current | Evaluation | |

|---|---|---|

| 2 neighborhood 2020 | −0,17 | −0,17 |

| 3 neighborhood 2020 | 0,16 | −0,06 |

| 4 neighborhood 2020 | −0,41 | 0,08 |

| 1 neighborhood 2021 | −0,56 | 0,00 |

| 2 neighborhood 2021 | — | −0,06 |

Long road ahead

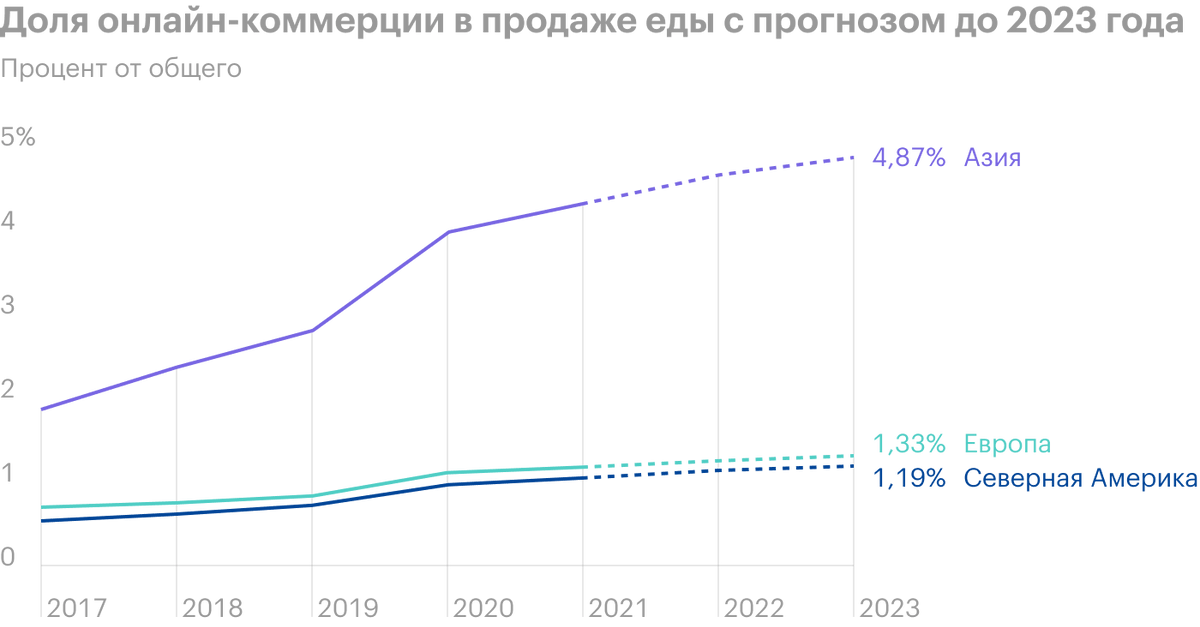

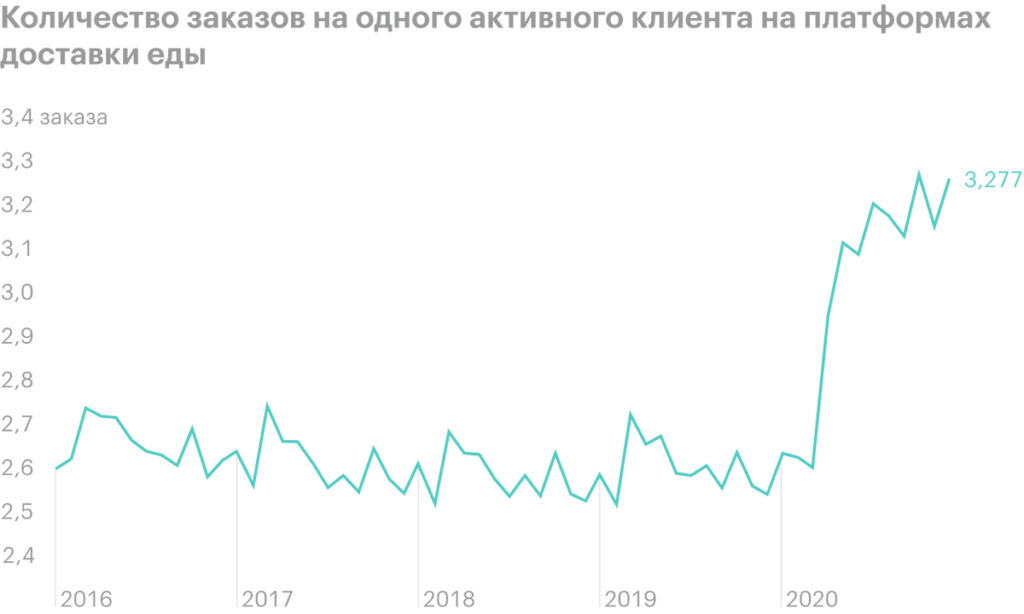

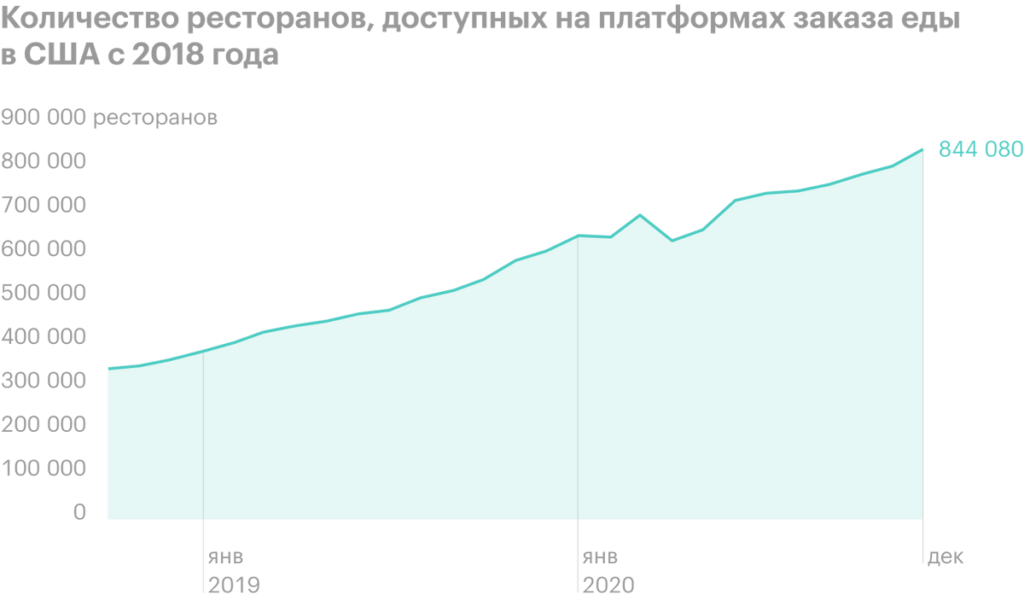

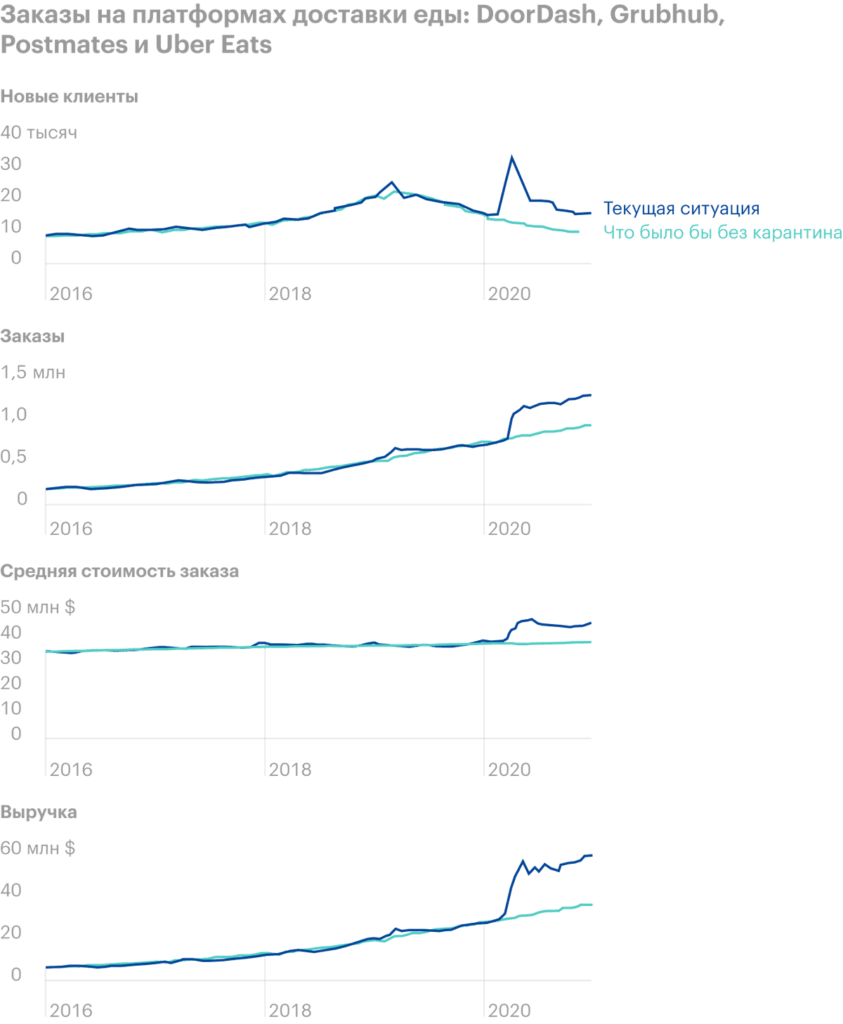

Considering, that the online food and groceries delivery market is only a very small part of food sales, it seems, that both companies have almost limitless growth prospects. And the dynamics of orders on these platforms seems to indicate that, that the sector is promising.

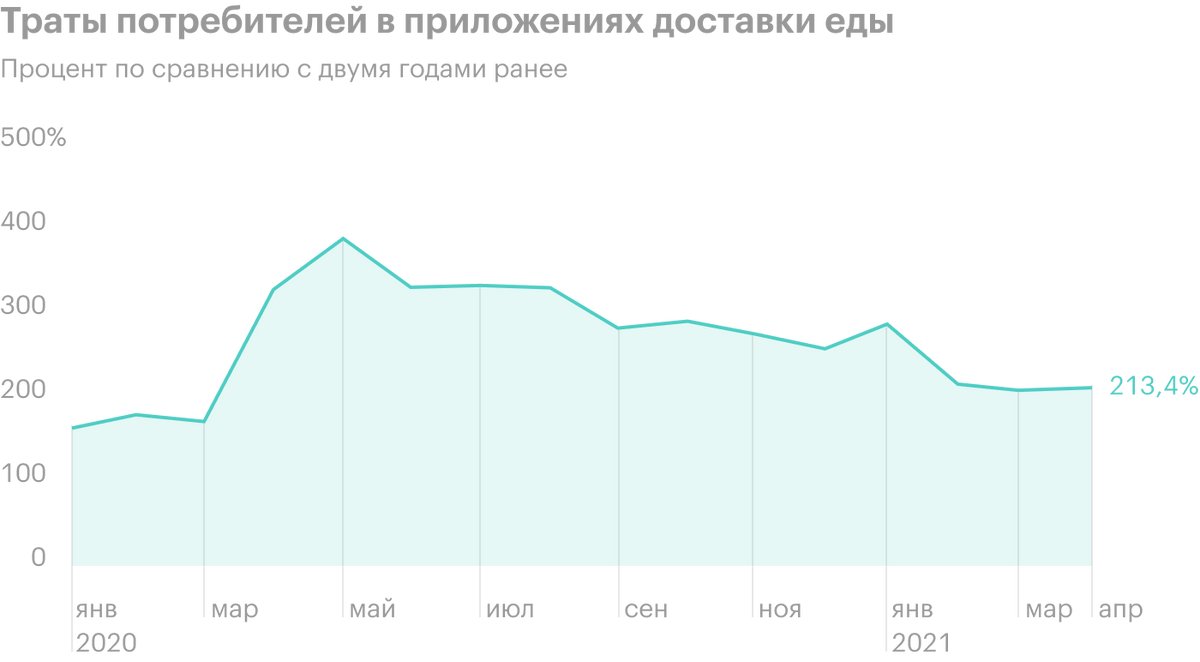

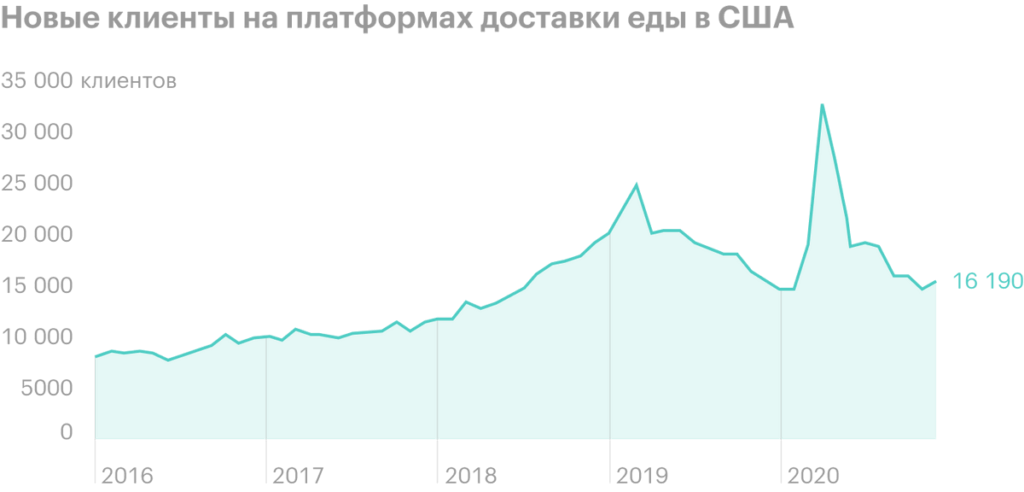

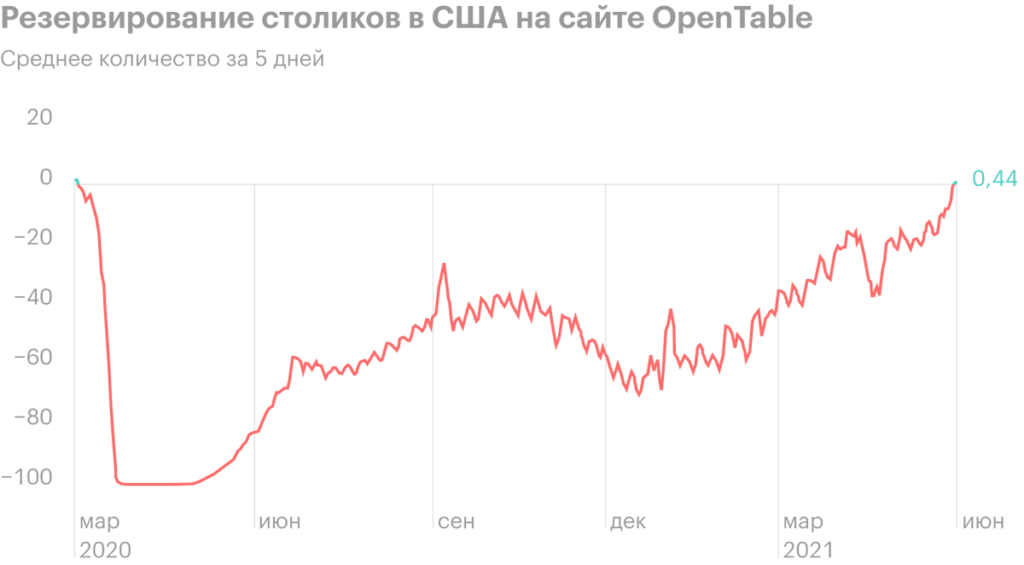

But on closer inspection it becomes clear, that a significant share of the growth in the food delivery sector is due solely to the pandemic and the imprisonment of the inhabitants of the planet at home - without this, growth would have been much more modest.

As the vaccination of the population progresses and quarantine in different countries is lifted, the rate of attracting new customers by these platforms is also falling. So there is a good chance, that the best days of Grubhub and DoorDash are over.

Unresolved issues

Considering, that both services are deeply unprofitable, it would be logical to expect management to try to rectify the situation.

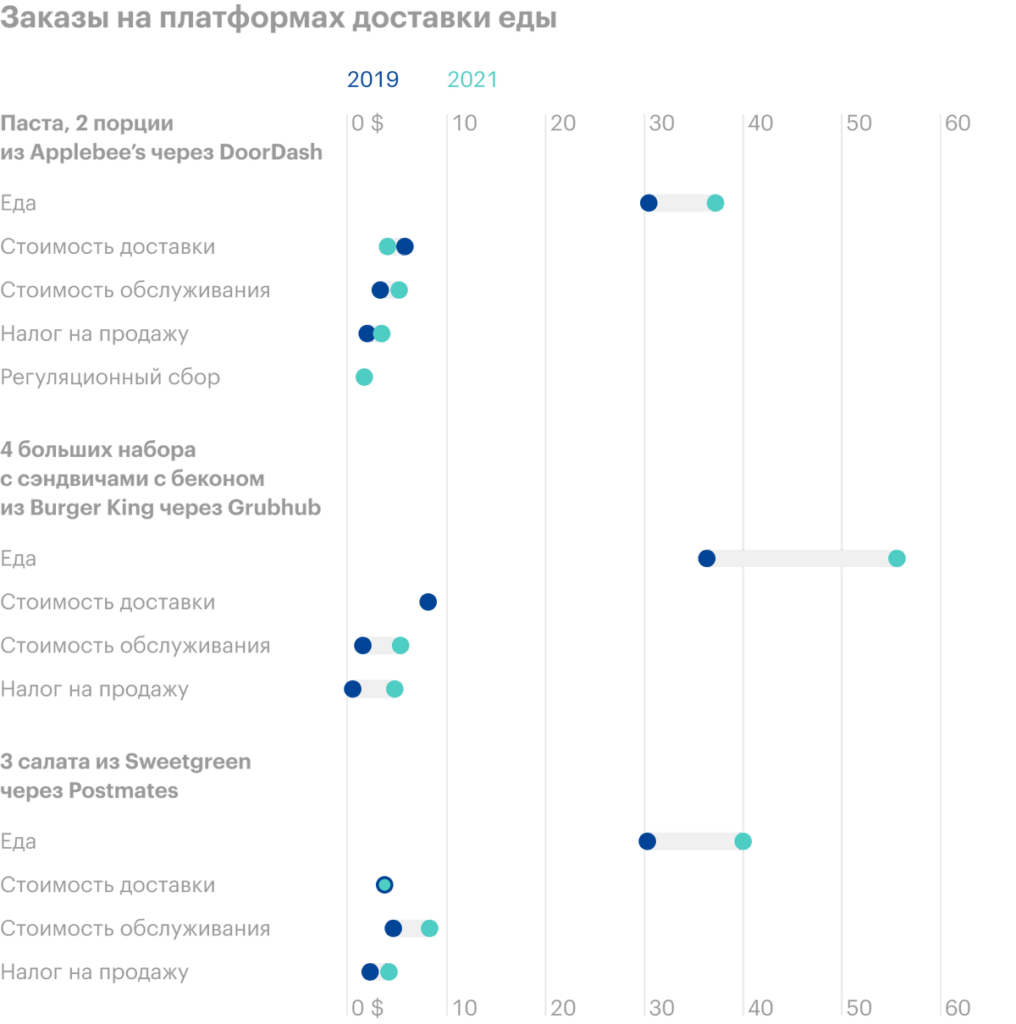

Companies gradually raise prices - this significantly reduces the attractiveness of delivery for customers, because the difference in price is very significant. Terms of Service, By the way, not satisfied with the restaurants themselves: it is more profitable for the largest of them to launch their own delivery service, what they, probably, and will do.

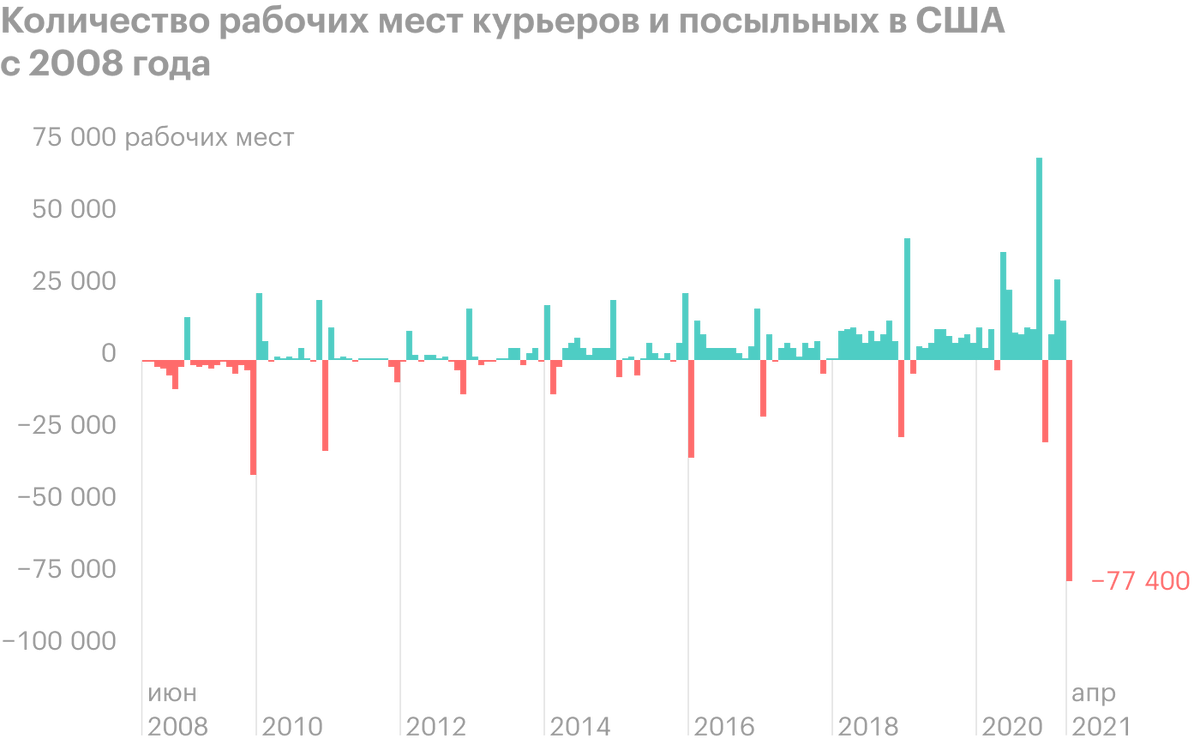

Companies are also motivated to raise prices due to the likely increase in personnel costs. This whole business is based on the low-paid labor of an army of couriers.. The US labor market is gradually recovering, and people are leaving the delivery industry for higher-paying areas. For this reason, companies, maybe, will have to increase the reward for couriers, which threatens with even greater losses.

Again, restaurants in the US are gradually opening.. And of course, more people will prefer restaurants to delivery - which is no longer good for DoorDash and Grubhub. But much more important.

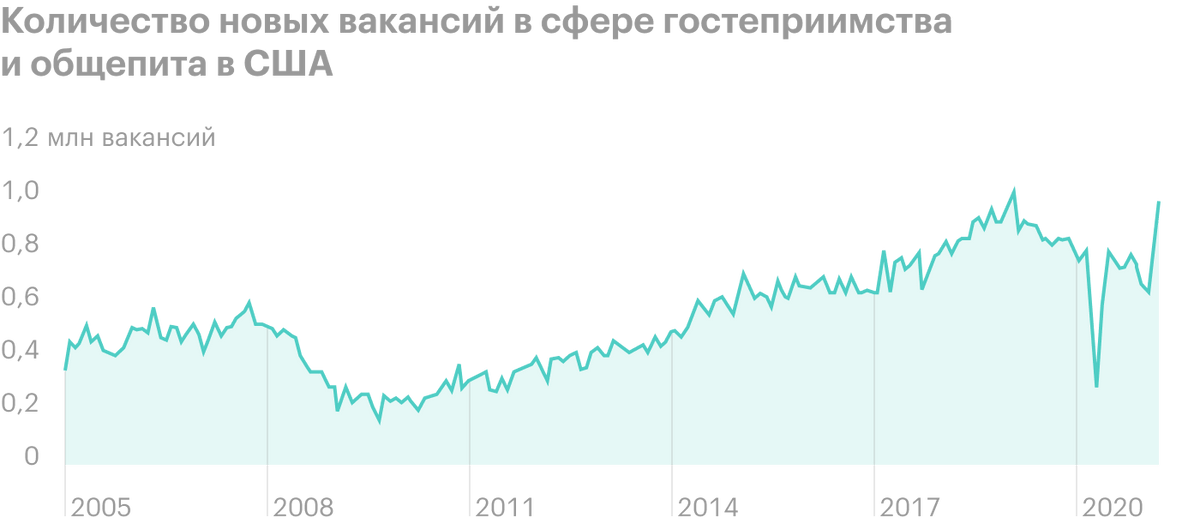

Service in the food industry is low-skilled and hard work, where delivery services compete directly with other employers for employees. Also, in restaurants, staff have much more opportunities to receive tips., than in delivery., - another reason to leave the slender ranks of couriers for many DoorDash and Grubhub employees.

Restaurants are suffering from a shortage of employees now for a number of reasons - it is not clear, how food delivery services in such conditions will remain attractive for potential employees. Rather the opposite, they will have to raise the salaries of couriers with clear consequences for the margins of their business.

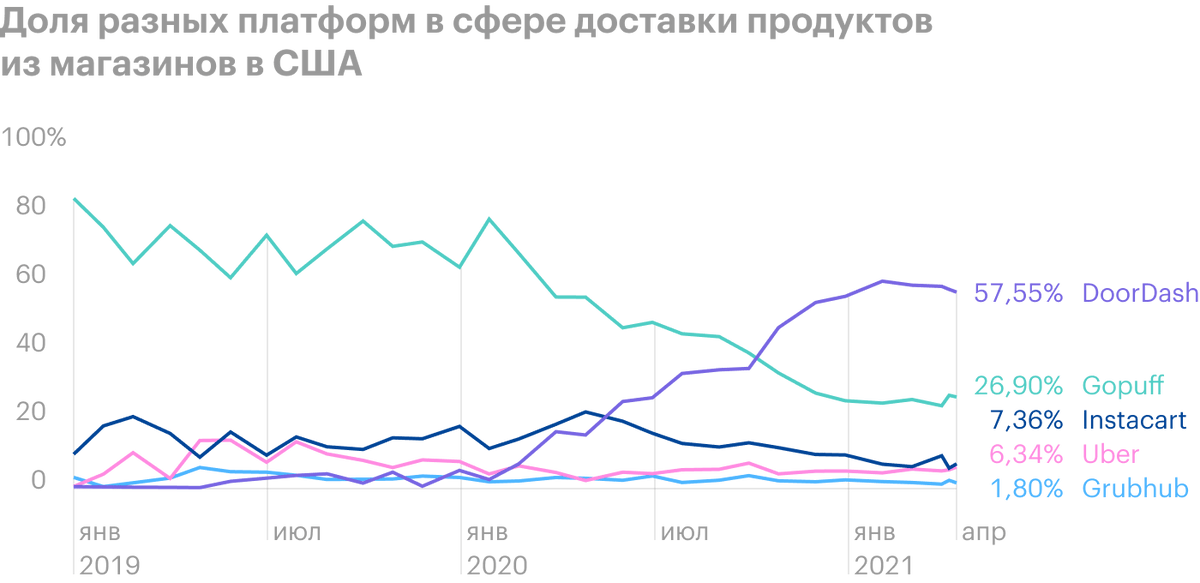

Also, hoping to increase margins, companies are actively expanding in the field of delivering groceries from stores - here, for the time being, DoorDash remains the undisputed leader.. However, the success of this event seems extremely doubtful and the results are not yet visible here: delivery of goods from the store - it's about the same, what is food delivery from restaurants, where is the profitability, absolutely incomprehensible.

As a result, we have an industry with very low or even negative margins., in which all participants are forced to run in an endless race to the bottom, competing with each other on price and operating at a loss.

Ordering tacos from Abelardo's in different ways in dollars

| food cost | Cost of delivery | taxes and fees | Total | |

|---|---|---|---|---|

| Grubhub | 8,16 | 3,49 | 3,47 | 15,12 |

| by Dash | 8,16 | 1,99 | 4,29 | 14,44 |

| Uber Eats | 8,16 | 1,99 | 3,07 | 13,22 |

| Pickup | 9,46 | 0 | 0,91 | 10,37 |

food cost Grubhub 8,16 by Dash 8,16 Uber Eats 8,16 Pickup 9,46 Cost of delivery Grubhub 3,49 by Dash 1,99 Uber Eats 1,99 Pickup 0 Taxes and fees Grubhub 3,47 by Dash 4,29 Uber Eats 3,07 Pickup 0,91 Total Grubhub 15,12 by Dash 14,44 Uber Eats 13,22 Pickup 10,37

Reasons for the shortage of employees in the field of catering and retail as a percentage of the total number of survey participants

| Unemployment benefits in the United States in the amount of 300 $ | 30% |

| Economic Stimulus Payments for Citizens | 24% |

| Employees are looking for a higher paying job | 21% |

| Fear of getting coronavirus at work | 12% |

| Young parents cannot afford a babysitter | 12% |

Resume

Both companies look like an extremely dubious investment: there is no profit here and, maybe, will never be. Grubhub, certainly, close to realizing the dream of any unprofitable startup - to be sold to another investor, - but the deal is not closed yet.

Although investors, obviously, have not lost their appetite for industries, showing high rates of revenue growth, — and both companies are still above average. In addition, there is always a high probability of a new large-scale quarantine with the closure of restaurants - such a misfortune will give a second wind to the business of both issuers. Finally, Uber's megalomania could have positive implications for companies: Uber may well buy both companies to strengthen its position in the delivery market. So if you look from a purely speculative position and not rely on business indicators, then you can speculate on the shares of both companies.