Muenchener Rueckversicherungs (ETR: MUV2) - German reinsurance company. The coronavirus crisis has led to an increase in insurance payments, although revenue increased due to an increase in the size of insurance premiums. But the question arises: what the company will do next with its generous dividend?

What's going on here

Readers have been asking us for a long time to start looking into the financials and business foundations of US issuers.. The idea to review the Muenchener Rueckversicherungs was proposed by our reader Dmitry Makarov in the comments to the Henkel review.. Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the overview. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

MUV2 deals with the monstrously boring, but from this no less important thing is a reinsurance company. Actually, the name of the company in German means "Munich Reinsurance Company". Technically, a reinsurer is an insurer, who insures another insurer. But in fact it is the same insurance business..

The company's report is full of terribly dreary details about the specifics of the insurance business., which add nothing to the picture of the company's business at all. 68% insurance premiums are received by the reinsurance branch MUV2, and 32% — insurance group Ergo Group, owned by MUV2.

Breakdown of revenue - insurance premiums - MUV2 by types of insurance payments: about 40% is life and health insurance, the rest is related to property.

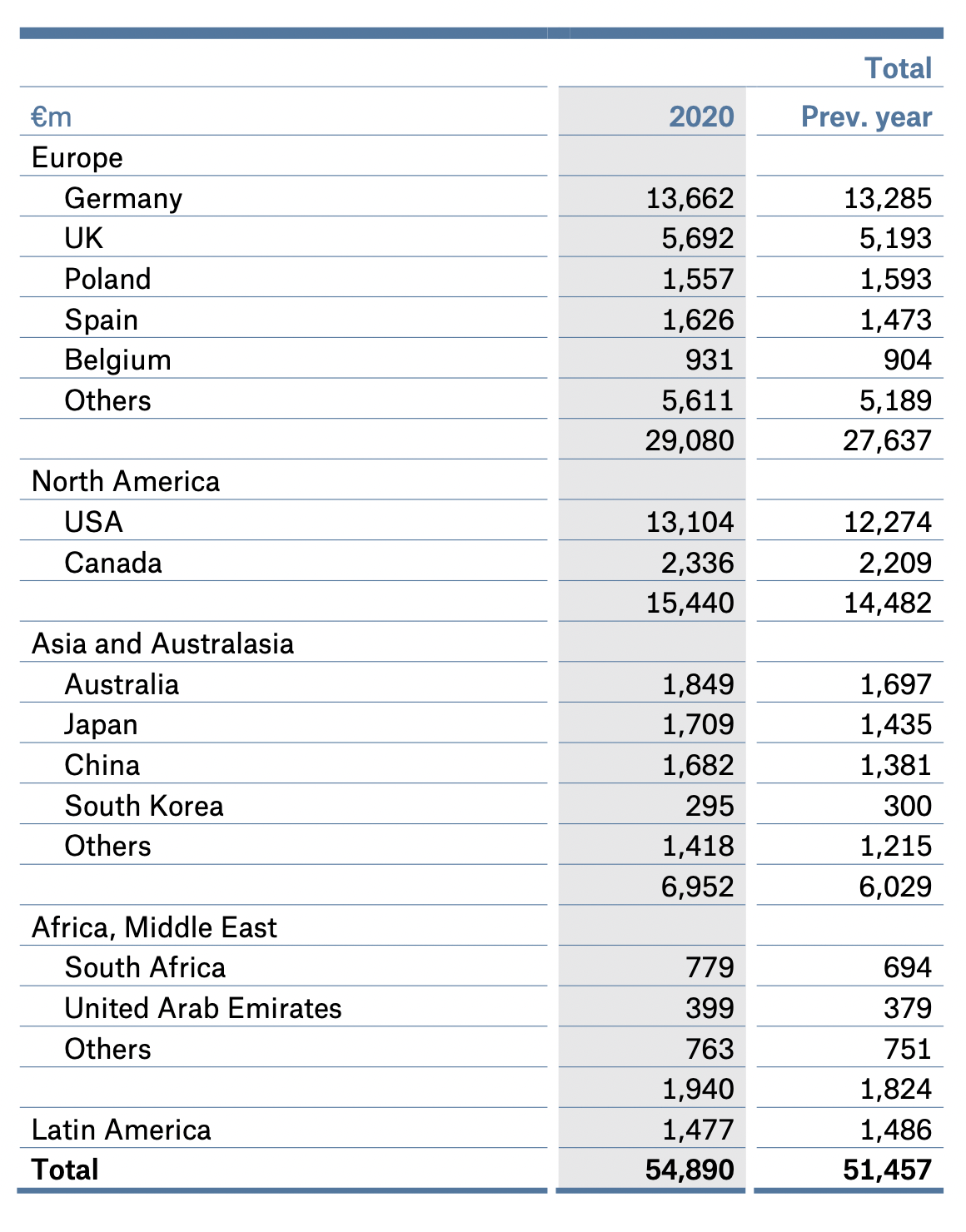

Germany is not the only market for MUV2: the company operates worldwide.

Percentage of the company's revenue by types of insurance premiums

| Life and health insurance | 23% |

| Property accident insurance | 45% |

| ERGO life and health insurance in Germany | 16% |

| Property accident insurance ERGO in Germany | 7% |

| ERGO international sales | 9% |

Life and health insurance

23%

Property accident insurance

45%

ERGO life and health insurance in Germany

16%

Property accident insurance ERGO in Germany

7%

ERGO international sales

9%

Annual income statement, billion euros

| Revenue | Net income | Profit Margin | |

|---|---|---|---|

| 2017 | 62,24 | 0,375 | 0,60% |

| 2018 | 57,34 | 2,31 | 4,03% |

| 2019 | 64,84 | 2,72 | 4,20% |

| 2020 | 66,44 | 1,21 | 1,82% |

Revenue

2017

62,24

2018

57,34

2019

64,84

2020

66,44

Net income

2017

0,375

2018

2,31

2019

2,72

2020

1,21

Profit Margin

2017

0,60%

2018

4,03%

2019

4,20%

2020

1,82%

Quarterly report, billion euros

| Revenue | Net income | Profit Margin | |

|---|---|---|---|

| 1 neighborhood 2020 | 13,68 | 0,221 | 1,62% |

| 2 neighborhood 2020 | 16,77 | 0,580 | 3,46% |

| 3 neighborhood 2020 | 16,45 | 0,202 | 1,23% |

| 4 neighborhood 2020 | 17,91 | 0,208 | 1,16% |

Revenue

1 neighborhood 2020

13,68

2 neighborhood 2020

16,77

3 neighborhood 2020

16,45

4 neighborhood 2020

17,91

Net income

1 neighborhood 2020

0,221

2 neighborhood 2020

0,580

3 neighborhood 2020

0,202

4 neighborhood 2020

0,208

Profit Margin

1 neighborhood 2020

1,62%

2 neighborhood 2020

3,46%

3 neighborhood 2020

1,23%

4 neighborhood 2020

1,16%

Despondency and gibberish

Due to the coronavirus, the company was unable to reach 2020 its original earnings expectations of around $2.8 billion: she was more than two times lower, than in 2019.

Corona crisis year was full of troubles, and the company had to fork out for insurance payments - although it did not roll into losses. Considering, that Germany is characterized by a low level of participation in the stock market, MUV2 shareholders can modestly hope for a rise in quotations in the medium term. After all, MUV2 in Germany is something like Rosgosstrakh in Russia - a very recognizable brand. Moreover, the company is relatively inexpensive.: P / E she has 30 and may well grow even more due to increased attention from newcomers, who are looking for on the stock exchange "good, proven companies ".

MUV2 pays 9,8 € dividend per share per year, which with the current value of the shares gives 3,78% per annum. By idea, this should attract a lot of investors into the stock, looking for "higher yields, than on a deposit. But not everything is so simple.

The company is currently paying out-of-pocket dividends.: payments in 2020 amounted to 1.373 billion euros with an annual profit of 1.209 billion euros. Basically, the company has a lot of money: only on the accounts there are 5.615 billion euros, - and they will be enough, to keep paying dividends. But payouts can cut, if the profit situation does not improve. And I wouldn't expect, that the company will borrow a lot of money, to feed payout lovers, - dividends will "cut to hell, without waiting for peritonitis".

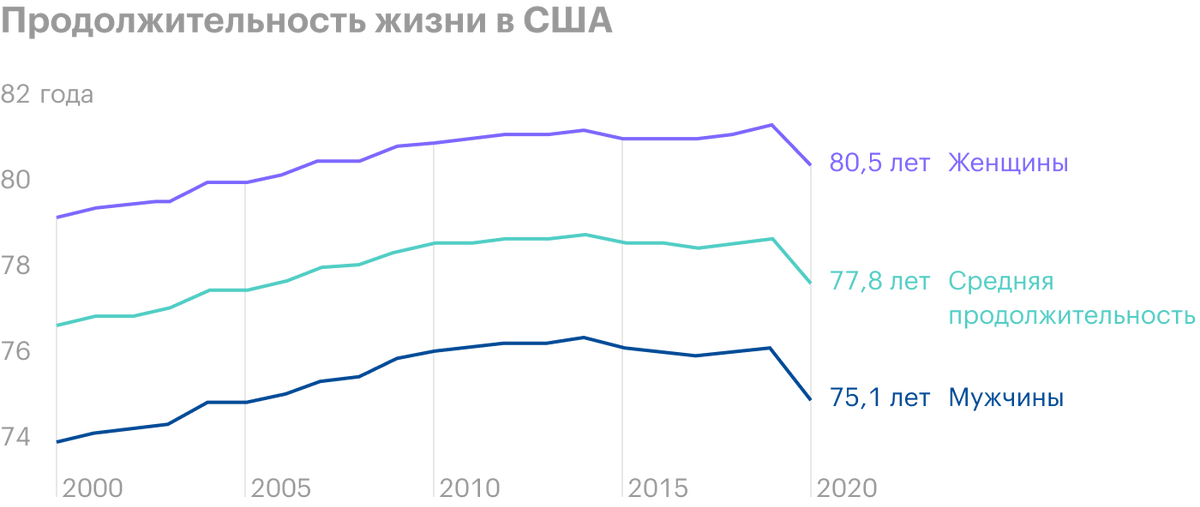

A new jump in deaths and incidents with coronavirus is quite possible this year, so I wouldn't comfort myself with that, that “2020 was an exceptional case, and then everything will be fine". In the same America, which is an important market for MUV2, life expectancy has fallen for all categories of the population - in this regard, in the medium term, the company may have a new wave of insured events.

Understandably, that MUV2 will challenge many of them: probably many insurance plans were drawn up before the pandemic or even before, how the coronavirus appeared. There is a high probability, that the company will dispute many deaths as "coronavirus", and on this basis refuse to pay. But as soon as the number of such cases exceeds the critical mark, and there will be a lot, maybe, courts will begin to look more favorably on people, requiring insurance payments. The same applies to violations in business., related to the corona crisis.

The share price increased by 37% thereby, that the company began to earn twice less, - this creates risks of correction. There are no guarantees, that in 2021 the company will not have a new wave of insured events.

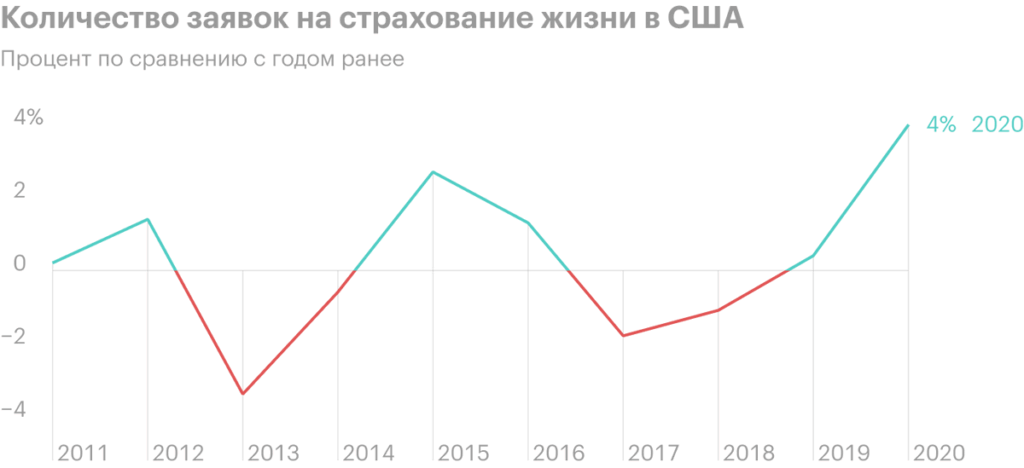

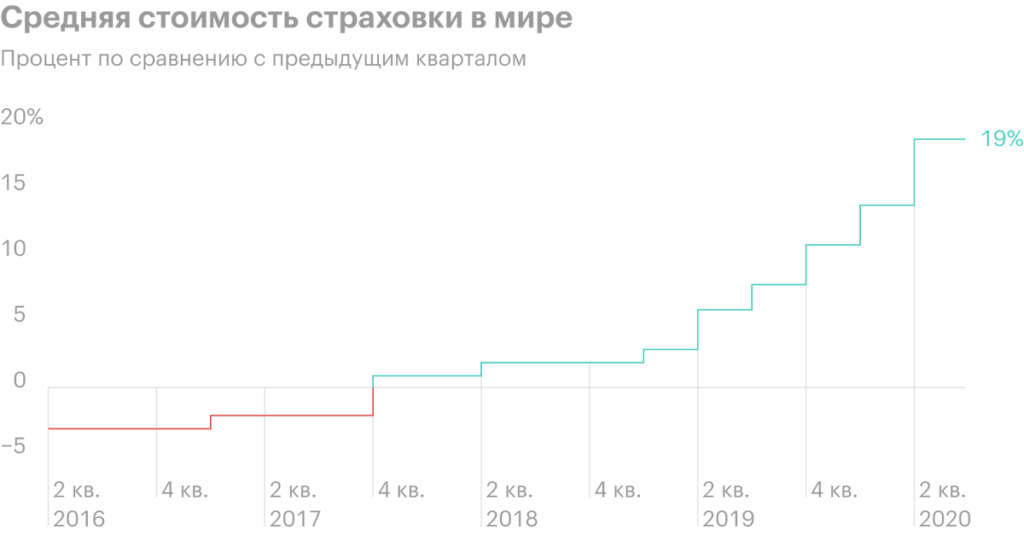

Coronacrisis created not only risks for the company, but also opportunities. Youth in the United States began to actively spend on life insurance. And even more: the pandemic has become a good reason for many insurance companies to increase their premiums, what, By the way, noticeable in MUV2 revenue growth. And the death risks of insurance plan holders due to coronavirus are actually not very high.: no matter how terrible it may sound, most of the people who die from the coronavirus, who does not have life insurance. So that, may be, I exaggerate the danger for MUV2.

Earnings per share in euros

| Current | Forecast | |

|---|---|---|

| 1 neighborhood 2020 | 1,57 | 1,36 |

| 2 neighborhood 2020 | 4,14 | 3,42 |

| 3 neighborhood 2020 | 1,44 | 1,17 |

| 4 neighborhood 2020 | 1,48 | 1,43 |

| 1 neighborhood 2021 | — | 3,09 |

Current

1 neighborhood 2020

1,57

2 neighborhood 2020

4,14

3 neighborhood 2020

1,44

4 neighborhood 2020

1,48

1 neighborhood 2021

—

Forecast

1 neighborhood 2020

1,36

2 neighborhood 2020

3,42

3 neighborhood 2020

1,17

4 neighborhood 2020

1,43

1 neighborhood 2021

3,09

Resume

Risks of investing in MUV2, in my opinion, significantly exceed the possible advantages. The likelihood of a cut in dividend payments is very high, but the company's ability to grow profits is very limited and depends on a lot of factors. All of them are outside the company's control area.. The most important thing for her is the answer to the question, will a bad year happen, which will lead to an increase in insurance claims, or not. So I wouldn't invest in those stocks.