"Magnet" (MCX, LSE: MGNT) — the largest grocery retailer in Russia by the number of stores and the second largest grocery retailer in terms of revenue. The company is one of the largest private employers in the country with over 300,000 employees..

About company

Magnit's business is present in all federal districts, except Far Eastern. It has the widest territorial coverage among competitors.: Clients of Magnit — 85% Russian families from more than 3800 settlements.

The company is constantly expanding its network of stores, by the end of the 1st half of 2021, their number reached 22 344, and sales area — 7.75 million square meters. Under the umbrella brand "Magnit" there are several formats of stores:

- "At home" - shops within walking distance with an assortment of about 6.5 thousand commodity items. This is the most numerous format on the network.

- "Family" - supermarkets of a much larger area with an assortment of almost 14 thousand commodity items.

- "Extra" - superstores, in fact, these are converted hypermarkets, in which the assortment exceeds 25.5 thousand commodity items.

- "Cosmetic" — drogerie, that is, stores with non-food products, such as cosmetics, hygiene products, household products. Assortment — about 10 thousand commodity items.

- "Pharmacy" - stores with medicinal and non-medicinal products with about 4.8 thousand commodity items.

Besides, the company is testing several new formats:

- "My price" - discounters with a small assortment of about 1750 commodity items.

- "City" — shops with a café area and an assortment of 3200 commodity items, mostly consisting of takeath meals. These stores are designed for major cities.

- GO is a good old kiosk format with 300 items.

"Magnet" introduces clustering: key clusters include the metropolis, town and village. The essence of the innovation is to customize the assortment in stores of the same format, depending on the location: for example, in the stores "Cosmetics" for the metropolis a wider range of cosmetics and perfumes, and in shops for the village - goods for the home and for children.

The company has an extensive logistics infrastructure: 39 distribution centers with a total area of 1.7 million square meters and almost 4.4 thousand trucks.

Magnit calls itself the only grocery retailer with vertical integration: it has 17 own production of food and agricultural products. This is the largest mushroom complex in Russia, confectionery factories and other. For example, the company covers 88% domestic demand for nuts and dried fruits due to its own production. In total, the assortment of "Magnit" is about 2.5 thousand items of goods of its own brands (STM), which give about 10% retail revenue. The company plans to increase the share of STM to 25% by 2025.

Besides, Magnit is actively working with suppliers – for example,, concludes contracts for more profitable, direct import. The share of direct import goods in retail revenue is 7%.

The company supported the market trend and began to develop e-commerce: launched its own delivery service and entered into partnerships with Delivery Club, "Yandex-food" and Wildberries. Delivery is carried out both from existing stores, and from specially opened darkstores. According to the results of the first half of 2021, delivery is available in 106 cities from 62 regions of Russia, performs an average of 15 thousand orders per day.

43 million people are registered in the company's loyalty program, 70% purchases are made using loyalty cards. This helps to better understand customer needs, predict demand. The company also launched partnership projects with Tinkoff banks, VTB, "Post Bank" for the issue of co-branded cards with increased bonuses when shopping in the stores of the network.

"Magnet" does not stop there and tries to build an ecosystem around the client: you plan to create a super application, unifying loyalty program, purchase history, delivery and additional services. One of the first steps on this path was the launch of the Magnit Pay payment service., according to the results of the first half of 2021, 5 million virtual cards of the service have already been issued. Recently launched a credit broker.

The retailer invests a lot in development – what is called, on all fronts: except for the opening of new stores, many older ones are being redesigned, digital transformation is actively underway, even created a business accelerator MGNTech.

The main strategic goal of the company is to strengthen leadership in the segment, with increasing market share while maintaining profitability. Recently, Magnit has been able to do this.: market share is growing, comparable sales came out of the red. Besides, in the summer, the company concluded one of the largest M deals&A in the retail market - bought the Dixie network of almost 2.5 thousand stores and 5 distribution centers for 97 billion rubles. This will allow Magnit to further increase market share., including seriously — in strategically important metropolitan regions.

The company does not lag behind global trends: in the summer of 2020, she presented the strategy of sustainable development until 2025. Its main directions: reduction of greenhouse gas emissions, water and energy consumption, increasing the percentage of recyclable packaging used, increase employee engagement and reduce staff turnover.

Market share of the largest grocery retailers in Russia in 2020

| X5 Retail Group: "Pyaterochka", "Crossroads", "Carousel", "Chizhik" | 12,8% |

| "Magnet" | 10,9% |

| "DKBR Mega Retail Group Limited": "Dixie", "Bristol", "Red and White", "Victoria", Megamart, "First thing" | 6,6% |

| "Ribbon" | 2,7% |

| Auchan Retail Russia | 1,5% |

| "Traffic light" | 1,3% |

| Metro Cash & Carry | 1,2% |

| GC «Okey»: "OK", "Yes!» | 1,1% |

| «Coin» | 0,8% |

| «Tasteville» | 0,8% |

12,8%

Market share of the company by year

| 2016 | 8,1% |

| 2017 | 9,0% |

| 2018 | 9,1% |

| 2019 | 9,4% |

| 2020 | 10,9% |

8,1%

Number of stores of the company by year

| 2017 | 16 298 |

| 2018 | 18 348 |

| 2019 | 20 725 |

| 2020 | 21 564 |

| 1п2021 | 22 344 |

16 298

The number of stores of the company by type in the 1st half of 2021

| At the house: "At home", City, "My price" | 15 348 |

| Drogheri | 6527 |

| Supermarket: "Family", «Extra» | 469 |

15 348

Indicators of comparable sales of the company by year

| LFL sales | LFL traffic | |

|---|---|---|

| 2017 | −3,0% | −3,1% |

| 2018 | −2,5% | −2,6% |

| 2019 | 0,4% | −2,3% |

| 2020 | 7,4% | −5,9% |

| 1п2021 | 5,2% | 10,0% |

Share of own production in domestic demand of certain categories of goods

| Macaroni | 13% |

| tomatoes | 22% |

| Cucumbers | 22% |

| Leaf salads | 43% |

| Cupcakes | 51% |

| Rolls | 74% |

| Mushrooms | 85% |

| Nuts and dried fruits | 88% |

13%

Financial indicators

Magnit's revenue is growing, but net profit gradually decreased until 2019, after which it resumed growth. net debt, vice versa, grew until 2019, then decreased, but over the past six months, it has grown somewhat again.

More than two-thirds of the company's revenue comes from the most numerous and popular formats of convenience stores among customers., what distinguishes "Magnet" from "Lenta", the basis of the business of which is the hypermarkets that are losing popularity.

Revenue, net profit and net debt by year, billion rubles

| Revenue | Net profit | net debt | |

|---|---|---|---|

| 2017 | 1143 | 35,5 | 108,1 |

| 2018 | 1237 | 33,6 | 137,8 |

| 2019 | 1369 | 17,1 | 175,3 |

| 2020 | 1554 | 33,0 | 121,4 |

| 1п2021 | 822,2 | 22,9 | 136,1 |

Revenue by store type for Q2 2021

| At the house: "At home", City, "My price" | 76,5% |

| Supermarket: "Family", «Extra» | 12,1% |

| Drogheri | 8,3% |

| Wholesale | 2,5% |

| Other formats | 0,6% |

76,5%

History and share capital

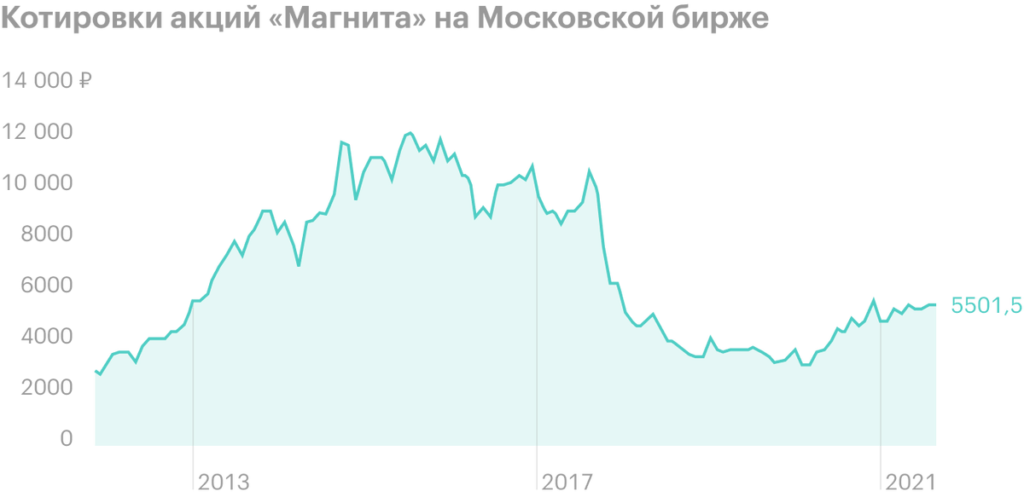

"Magnit" traces its history back to 1995, when businessman Sergey Galitsky founded JSC "Tander", engaged in wholesale sales of household chemicals and perfumes. A few years later, the company changed the concept and began to engage in grocery retail.. In 2000, the brand "Magnit" appeared, meaning "low fare store", in 2006 the company became public. Magnit actively developed and in 2013 became the leader of the grocery retail market, overtaking the revenue and number of stores of the main competitor - X5 Retail Group, in 2014, capitalization exceeded a trillion rubles.

The company of the second half of the 2010s is a very instructive story about, that even an industry leader can go limp if he stops meeting investors' expectations., then stock prices can fall greatly. Besides, pressure on quotations was exerted by the sale of most of the stake by the head of the company Sergey Galitsky to VTB Bank. In its turn, the bank sold a large stake in Magnit to the investment company Marathon Group businessman Alexander Vinokurov, which gradually increased its share to 16,7%. These two companies remain magnit's largest shareholders., and the volume of shares in free float is 63% as of mid-September 2021.

Share capital structure of the company

| VTB | 17,3% |

| Marathon Group | 16,7% |

| Gordeychuk V. E. | 1,1% |

| Top Management | 0,2% |

| Lavreno Limited | 0,2% |

| Other shareholders | 1,5% |

| Free float | 63,0% |

17,3%

Dividends and dividend policy

The company has a dividend policy, but for the investor it is quite useless, since it does not have a specific formula for calculating dividends. In reality, Magnit regularly pays dividends, increasing them from year to year and providing a fairly attractive yield. But the problem is, that in recent years, payments exceed the company's net profit, which is not very good, and it can hardly last that long.

Dividends, dividend yield and profit share, paid in the form of dividends, "Magnit" by year

| Dividend per share | Dividend yield | Profit share on dividends | |

|---|---|---|---|

| 2016 | 278,13 R | 2,5% | 48% |

| 2017 | 251,01 R | 4,0% | 70% |

| 2018 | 304,16 R | 8,7% | 92% |

| 2019 | 304,19 R | 8,9% | 181% |

| 2020 | 490,62 R | 8,9% | 152% |

Why stocks can go up

Leadership and expansion. Magnit is one of the leaders of the grocery retail market, but the company does not stand still, expanding your business and increasing market share. In addition, soon the results of the absorbed "Dixie" will also begin to be consolidated in the reporting., which will further increase financial performance, and this can become the basis for the growth of the company's stock quotes.

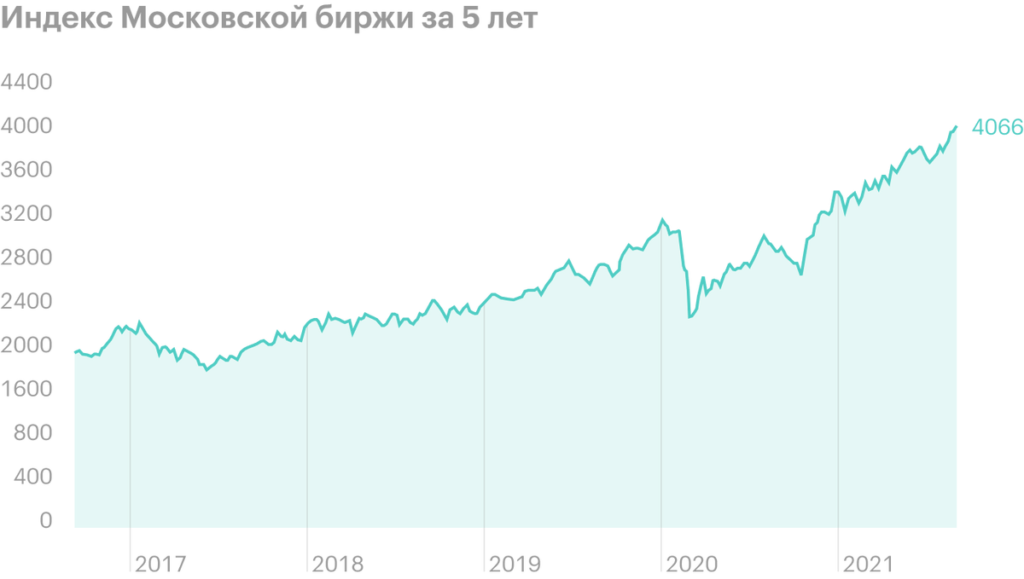

Defense sector. Stock indices – as in Russia, and in other countries - take historical highs against the background of almost continuous growth over the past year and a half. In such a situation, many investors are afraid of a correction and choose protective sectors for investments., to which, undoubtedly, includes the essential goods sector.

Improper multipliers. Magnit has pretty decent animators.: seems, the company managed to reverse the unsuccessful trend, increased profitability and reduced the debt burden compared to 2019. Yes, "Magnet" is not cheap on the multiplier P / E, but such a price seems justified relative to public competitors.

Why stocks might fall

Sector so-so. In the review of "Tape" we have already discussed in detail, that the grocery retail sector is not the most attractive: incomes of the population are falling, the state is trying to interfere in pricing, and the competition is huge..

The Costs of the Leadership Battle. "Magnit" is trying to fight for leadership in the industry with X5 Retail Group, because of which the company has to bear large capital costs, as well as significantly spent on M transactions&A. See, how against the background of rising interest rates in the economy, the company will be able to service the debt, which will have to increase significantly due to the purchase of "Dixie". Besides, Magnit may have problems with the integration of a former competitor into its business. And in general, the purchase may be ineffective and, vice versa, start pulling "Magnet" down.

Magnit animators by year

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| 2017 | 18,2 | 13,7% | 1,18 |

| 2018 | 10,7 | 13,2% | 1,53 |

| 2019 | 20,4 | 9,1% | 2,03 |

| 2020 | 17,0 | 18,0% | 1,11 |

| 1п2021 | 13,1 | 23,5% | 1,04 |

Multipliers of public grocery retailers for the 1st half of 2021

| P / E | ROE | Net debt / EBITDA | |

|---|---|---|---|

| X5 Retail Group | 19,3 | 37,5% | 1,00 |

| "Magnet" | 13,1 | 23,5% | 1,04 |

| "Ribbon" | 8,61 | 12,7% | 2,31 |

| "OK" | Lesion | Lesion | 2,33 |

What's the bottom line?

Magnit is a grocery retailer, who is trying to catch up with the market leader. The company is actively developing as intensively, and extensively: opens new stores, tries new formats, engaged in digitalization, tries to create an ecosystem and buys competitors. All this allows you to increase financial performance and market share.

"Magnit" managed to reverse the negative trend of financial indicators of the late 2010s, but big deal M&A can bring as positive, and negative consequences. And the food retail sector, although it is considered protective, but with a lot of problems and a lot of competition.

Besides, some concerns are caused by the dividends of "Magnit". On the one side, they are attractive to investors for their profitability, but, with another, in recent years exceed the company's net profit. In the future, this may create problems or in the form of an increase in the debt burden., or due to the sale of the company's shares, which investors can arrange, dissatisfied with dividends with reduced yields.