High Low (HOT@DE) one of the largest construction companies in the world, founded in 1874 in Frankfurt. The company has shares in Thiess, etching, Abertis, Turner, Sedgman, CPB. In Russia, the company is known for the reconstruction of the Sheremetyevo-1 and Sheremetyevo-2 air terminals. More than a half - 50,16% - Hochtief shares are held by the Spanish Actividades de Construccion y Servicios.

What's going on here

Readers have long asked us to start analyzing the reporting and the foundation of the business of foreign issuers.. Suggest in the company's comments, analysis of which you would like to read.

18 February Hochtief releases full year 2020 financials. Hochtief sales decreased by 11,2% compared to last year and amounted to 22.9 billion euros. The pandemic and related restrictions have led to a slowdown in sales and a delay in new orders. The company's result was also influenced by the sale of 50% of Thiess for 1.3 billion euros and the revaluation of the remaining 50%.

In 2020, the main regions for receiving revenue were America - 63% and Asia - 30%. Based on the indicators of the American unit, the main revenue segment is commercial construction, from the segment of general construction works - roads.

EBITDA decreased by 8,1% compared to last year - up to 1.7 billion euros, EBITDA margin was 7.4%. Hochtief earns € 477 million in operating income, decrease by 31,7%.

Mobility restrictions, imposed by governments, led to a decrease in profits of the operator of toll roads Abertis, which has 20% High Low. As a result, Hochtief's nominal net income was €427.2 million compared to a loss of €206.2 million in the same period last year.. Free cash flow decreased by 41,2% - up to 310 million euros - due to a decrease in operating cash flow and a share buyback program.

In fiscal year 2021, Hochtief expects to achieve a net operating income in the range of 410-460 million euros, growth will be 11-25%, adjusted for the disposal of a 50% stake in Thiess. The company will continue to bet on digital transformation and innovation through the creation of Nexplore, implementing AI, industry 5.0 trends and blockchain.

Financial indicators

Revenue fell by 11,21%. Top regions by revenue - Americas and Asia. The largest segment of the American division is commercial construction. EBITDA decreased by 8,17%. EBITDA margin increased by 0.1 percentage points. Operating profit fell by 31,75%. Net loss decreased three times and was replaced by net profit. Free cash flow fell by 41,2%.

Revenue by years, billion euros

| 2016 | 19,908 |

| 2017 | 22,630 |

| 2018 | 23,882 |

| 2019 | 25,851 |

| 2020 | 22,953 |

2016

19,908

2017

22,630

2018

23,882

2019

25,851

2020

22,953

Revenue by region, percentage of total

| America | 64% |

| Asia | 30% |

| Germany | 4% |

| Rest of Europe | 2% |

America

64%

Asia

30%

Germany

4%

Rest of Europe

2%

Segments of the American Construction Division

| Transport | 16% |

| Commercial building | 40% |

| Education | 11% |

| healthcare | 16% |

| Hotels | 3% |

| Industry | 2% |

| Public construction | 4% |

| Sport | 8% |

Transport

16%

Commercial building

40%

Education

11%

healthcare

16%

Hotels

3%

Industry

2%

Public construction

4%

Sport

8%

US General Construction Segments

| Roads | 44% |

| Bridges | 9% |

| Transit | 20% |

| Airports | 21% |

| Water | 6% |

Roads

44%

Bridges

9%

Transit

20%

Airports

21%

Water

6%

EBITDA of the company and its marginality, billion euros

| EBIDTA, billion euros | EBIDTA margin | |

|---|---|---|

| 2016 | 1,104 | 5,5% |

| 2017 | 1,320 | 5,8% |

| 2018 | 1,413 | 5,9% |

| 2019 | 1,892 | 7,3% |

| 2020 | 1,749 | 7,4% |

EBIDTA, billion euros

2016

1,104

2017

1,320

2018

1,413

2019

1,892

2020

1,749

EBIDTA margin

2016

5,5%

2017

5,8%

2018

5,9%

2019

7,3%

2020

7,4%

Profit and free cash flow, million euros

| Operating profit | Net profit | free cash flow | |

|---|---|---|---|

| 2016 | 361 | 320,48 | 901 |

| 2017 | 452 | 420,74 | 1033 |

| 2018 | 521 | 543,00 | 1161 |

| 2019 | 699 | –206,25 | 528 |

| 2020 | 477 | 427,24 | 310 |

Operating profit

2016

361

2017

452

2018

521

2019

699

2020

477

Net profit

2016

320,48

2017

420,74

2018

543,00

2019

–206,25

2020

427,24

free cash flow

2016

901

2017

1033

2018

1161

2019

528

2020

310

Balance sheet indicators

Hochtief assets declined by 10,64%, up to 16.9 billion euros, - this is due to the sale of a 50% stake in Thiess. The capital of the company decreased by 60,3% - up to EUR 963 million. Decrease driven by buyback program and increase in stake in CIMIC, exchange rate effects and other changes outside the income statement. Assets decreased by 10,64%, capital fell by 60,3%.

Assets and capital of the company, billion euros

| Assets | Capital | |

|---|---|---|

| 2016 | 14,077 | 2,571 |

| 2017 | 13,349 | 2,534 |

| 2018 | 15,645 | 2,411 |

| 2019 | 19,005 | 1,595 |

| 2020 | 16,982 | 0,963 |

Assets

2016

14,077

2017

13,349

2018

15,645

2019

19,005

2020

16,982

Capital

2016

2,571

2017

2,534

2018

2,411

2019

1,595

2020

0,963

Debt load

Hochtief's total debt increased by 1% - up to 5.2 billion euros. In 2020, the company received additional loans in the amount of 2.1 billion euros, and also repaid the issue of corporate bonds for 750 million euros, reduced trade payables and dealt with other liabilities. The company's debt payments will peak in 2024.

The volume of net profit decreased by 40,4% - up to 618 million euros. The proceeds - 1.3 billion euros from the sale of a stake in Thiess - were used to pay off obligations of a BICC subsidiary, investor compensation, increase in share in CIMIC, reduction of factoring and currency effects.

Total debt of the company by years, billion euros

| 2016 | 2,662 |

| 2017 | 2,417 |

| 2018 | 3,170 |

| 2019 | 5,166 |

| 2020 | 5,212 |

2016

2,662

2017

2,417

2018

3,170

2019

5,166

2020

5,212

Net profit, billion euros

| 2016 | 0,703 |

| 2017 | 1,265 |

| 2018 | 1,564 |

| 2019 | 1,529 |

| 2020 | 0,618 |

2016

0,703

2017

1,265

2018

1,564

2019

1,529

2020

0,618

Market

World's largest economies adopt stimulus packages in response to pandemic and accompanying economic crisis.

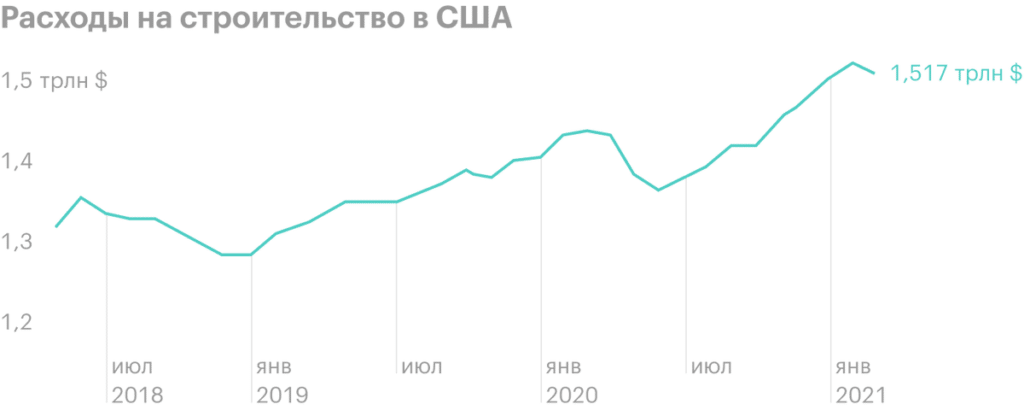

In March, the US considered a plan, involving investments in various infrastructure projects in the amount of $2.3 trillion. And besides this, that in the United States, spending on private construction in December last year has already risen to a maximum value of 1.49 trillion dollars.

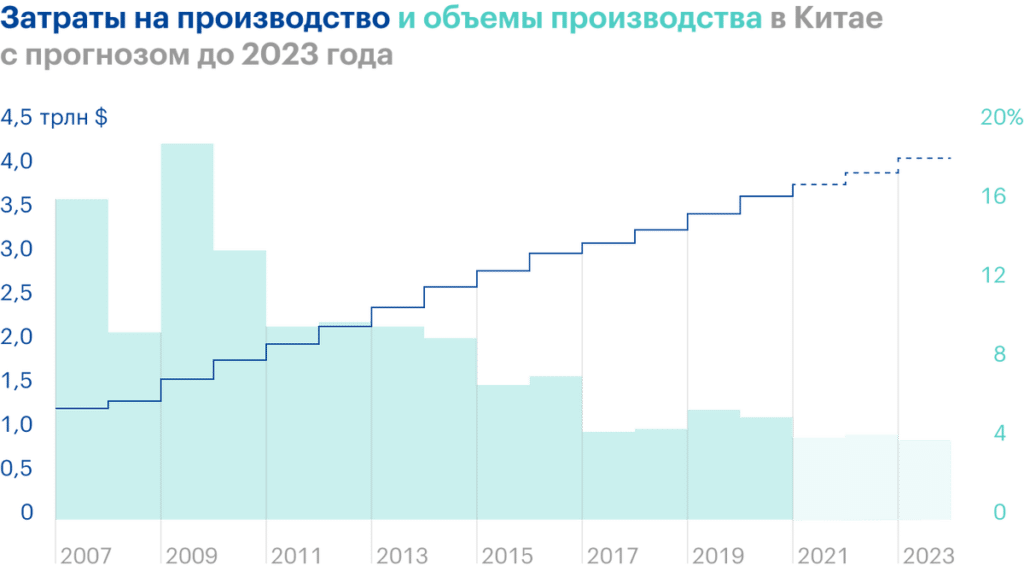

In the Asian region, Hochtief's second largest revenue earner, growth driver is China. In March this year, Beijing announced its five-year development plan for the country - until 2025.. It also aims: doubling GDP by 2035, one of the elements of development will be urbanization. Creation of super-large urban agglomerations should ensure sustainable growth of regions. According to forecasts until 2023, China's construction industry will grow by about 4.5% annually.

The Hochtief team also made optimistic forecasts for the current year.. The company has identified project tenders worth more than 570 billion euros and pledged 180 billion euros for public-private partnership projects, created through government stimulus packages. Therefore, we can expect a stable cash flow from Hochtief in the coming years..

Comparison with analogues

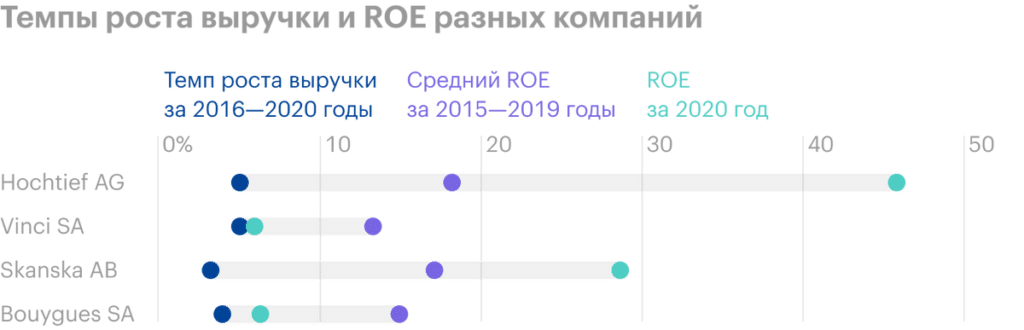

As a comparison, consider the largest European construction companies: Vinci, Skanska, Bouygues. To assess the effectiveness of companies, we have chosen three indicators: revenue growth rate over the past 5 years, ROE, average ROE over 5 years.

We added average ROE values for five years, as Hochtief is now actively pursuing a share buyback program, what distorts ROE.

Revenue growth rates for all companies are low. Based on ROE values and revenue growth rates, can be expected, that in case of favorable market conditions, Hochtief will be more effective than its closest competitors.

Dividends

Hochtief dividends are usually paid at a rate of 65% of nominal earnings as decided by the board of directors. At the end of 2020, the company approved dividends in the amount of 3,93 € per share, which brought shareholders a return of 5%. In addition to dividends, the company returned 168 million euros to shareholders through a share buyback program.

The company's dividend payout ratio is at a comfortable level, leaving resources for development. The average return on stocks over 5 years is 4.66%, and the dividend growth rate is 8,61%.

| Dividend per share | Dividend yield | Payout ratio, percentage of operating profit | |

|---|---|---|---|

| 2016 | 2,60 | 52% | 1,93% |

| 2017 | 3,38 | 52% | 2,50% |

| 2018 | 4.98 | 60% | 6,17% |

| 2019 | 5,80 | 61% | 7,66% |

| 2020 | 3,93 | 51% | 5,04% |

Dividend per share

2016

2,60

2017

3,38

2018

4.98

2019

5,80

2020

3,93

Dividend yield

2016

1,93%

2017

2,50%

2018

6,17%

2019

7,66%

2020

5,04%

Payout ratio, percentage of operating profit

2016

52%

2017

52%

2018

60%

2019

61%

2020

51%

Company multipliers

Most Hochtief group multiples point to share price declines relative to peers. Coefficient P / BV indicates revaluation. In terms of P / E, P / S, EV / EBITDA has upside potential to medium levels - so the company can be considered for a purchase at current levels.

| Company | P / E | P / BV | P / S | EV / EBITDA |

|---|---|---|---|---|

| High Low | 12,56 | 8,10 | 0,24 | 3,25 |

| Vinci | 28,71 | 2,47 | 1,00 | 10,49 |

| Skanska | 9,74 | 2,48 | 0,60 | 7,14 |

| Bouygues | 19,02 | 1,28 | 0,38 | 5,03 |

| Mean | 17,51 | 3,58 | 0,56 | 6,48 |

| Potential to rise or fall | 39% | −56% | 131% | 99% |

High Low

P / E

12,56

P / BV

8,10

P / S

0,24

EV / EBITDA

3,25

Vinci

P / E

28,71

P / BV

2,47

P / S

1,00

EV / EBITDA

10,49

Skanska

P / E

9,74

P / BV

2,48

P / S

0,60

EV / EBITDA

7,14

Bouygues

P / E

19,02

P / BV

1,28

P / S

0,38

EV / EBITDA

5,03

Mean

P / E

17,51

P / BV

3,58

P / S

0,56

EV / EBITDA

6,48

Potential to rise or fall

P / E

39%

P / BV

−56%

P / S

131%

EV / EBITDA

99%

What's the bottom line?

Hochtief Shows Expected Decrease In Key Financials For 2020 Due To The Impact Of The Pandemic. The sale of a 50% stake in Thiess had a significant impact on the company's bottom line. Weak point of the company, and other companies in the construction industry, — low profit margin.

Despite good prospects for the construction market in the US and China, there is no need to expect a significant increase in financial indicators, again due to low marginality. But the company is the most efficient among the closest analogues, it has a discount on most multiples and a good dividend history. Therefore, we can recommend Hochtief shares for purchases at current levels for long-term investments..

Average ROE

| High Low | Vinci | Bouygues | Skanska | |

|---|---|---|---|---|

| 2020 | 46,35 | 6,28 | 7,01 | 29,12 |

| 2019 | −12,98 | 16,27 | 11,68 | 19 |

| 2018 | 43,64 | 15,82 | 13,73 | 15,66 |

| 2017 | 37,70 | 16,91 | 13,28 | 15,75 |

| 2016 | 15,91 | 15,62 | 9,00 | 21,41 |

| 2015 | 10,74 | 13,9 | 5,16 | 18 |

| Mean | 19,002 | 15,704 | 10,57 | 17,964 |

High Low

2020

46,35

2019

−12,98

2018

43,64

2017

37,70

2016

15,91

2015

10,74

Mean

19,002

Vinci

2020

6,28

2019

16,27

2018

15,82

2017

16,91

2016

15,62

2015

13,9

Mean

15,704

Bouygues

2020

7,01

2019

11,68

2018

13,73

2017

13,28

2016

9,00

2015

5,16

Mean

10,57

Skanska

2020

29,12

2019

19

2018

15,66

2017

15,75

2016

21,41

2015

18

Mean

17,964