"Child's world" (MOEX: DSKY) Is the largest retailer of children's products in Russia and Kazakhstan, which works in the middle price segment. The company has a 74-year history of development: the first store was opened in Moscow in 1947 year.

About company

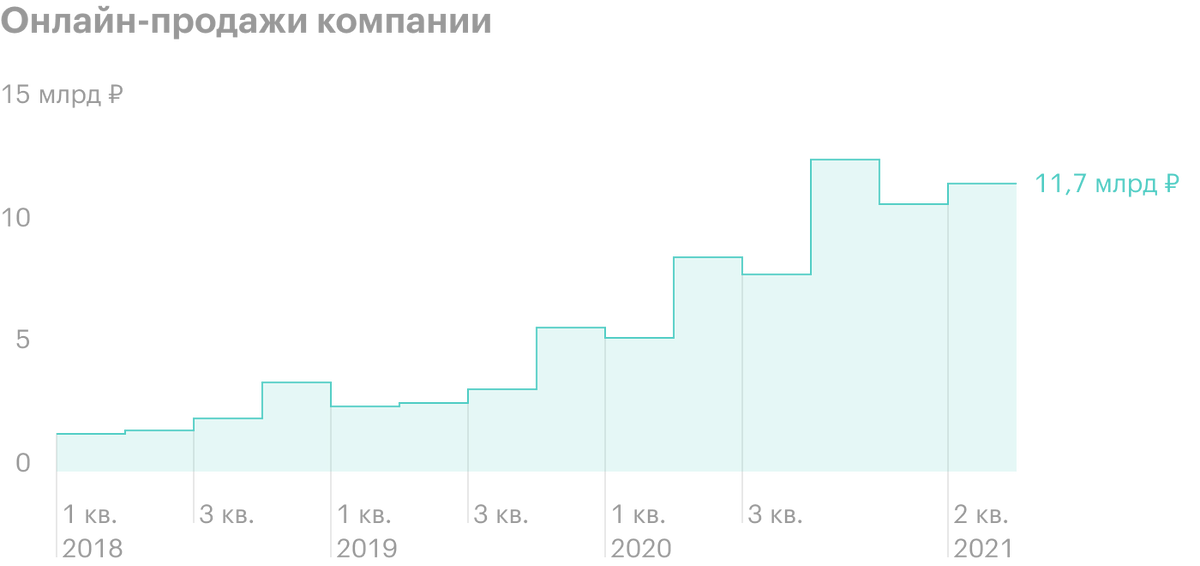

Detsky Mir works equally well as online, and offline.

The group develops its business in the territory of three states: Russia, Kazakhstan and Belarus.

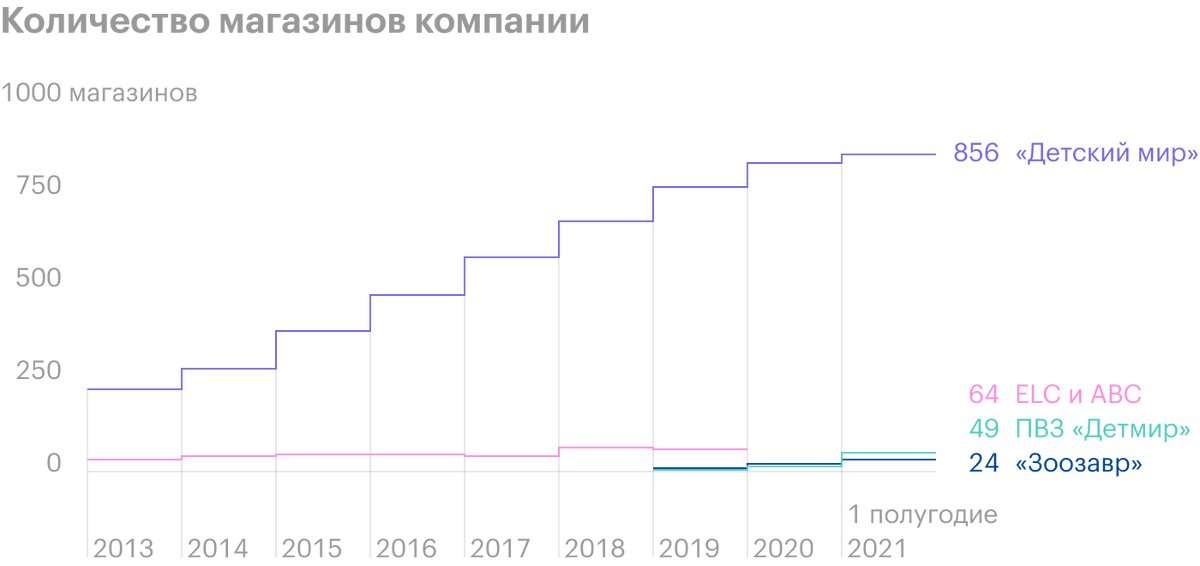

The business of the company consists of several types of stores.

"Child's world". Basic group format, which is large stores of goods for children in large cities with an area of about 1500 square meters.

Marketplace. One of the most promising retailer directions, with 2018 year it grew in 7,8 Times.

PVC "Detmir". New network format, which is designed for small towns and combines an ultra-small area retail store in 160 square meters and a point for issuing online orders.

"Zoosaurus". Pet supplies stores.

ELC и ABC. Store formats, who sold toys for children before 10 years, they were closed in 2020 year.

As of 30 June 2021 years at the retailer 929 stores.

Shareholder structure. The company has one major shareholder - Altus Capital, who acquired his share in 2021 year at a price in 160 rubles per share. It belongs to him 29,9% Shares, rest 70,1% are in free circulation.

Development strategy. The company has set itself the following goals before 2024 of the year:

- Increase the share of the online segment in total revenue to 45%, present value - 29,3%.

- In four years, the retailer plans to open 230 new stores "Detsky Mir", 800 PVZ "Detmir" and 500 shops "Zoozavr". In this way, network to 2024 year will grow to 1082 stores "Detsky Mir", 816 PVZ "Detmir" and 520 shops "Zoozavr".

- Maintain a moderate debt burden, net debt / EBITDA less 2. Present value - 1,4.

- Provide shareholders with a high dividend yield.

Financial results and dividend policy

Children's World is a story of growth, which every year exceeds its old indicators, setting new record values for yourself.

Financial results, billion rubles

| Revenue | EBITDA | Net profit | Annual dividend | |

|---|---|---|---|---|

| 2017 | 97 | 10,7 | 4,844 | 6,85 R |

| 2018 | 110,9 | 12,7 | 5,694 | 8,84 R |

| 2019 | 128,8 | 14,7 | 6,542 | 10,62 R |

| 2020 | 142,9 | 17 | 6,749 | 11,15 R |

| Average annual growth | 13,8% | 16,6% | 11,7% | 17,6% |

Revenue

2017

97

2018

110,9

2019

128,8

2020

142,9

Average annual growth

13,8%

EBITDA

2017

10,7

2018

12,7

2019

14,7

2020

17

Average annual growth

16,6%

Net profit

2017

4,844

2018

5,694

2019

6,542

2020

6,749

Average annual growth

11,7%

Annual dividend

2017

6,85 R

2018

8,84 R

2019

10,62 R

2020

11,15 R

Average annual growth

17,6%

According to dividend policy, the company must distribute at least 50% net profit according to international financial reporting standards (IFRS), the actual ratio is 100% net profit under Russian accounting standards (RSBU). Detsky Mir pays dividends twice a year: behind 9 And 12 Months. The company strictly adheres to this principle and only once moved away from its dividend policy.: due to coronavirus, they decided to split the final dividends for 2019 a year in two parts, the remainder was paid in 1 Half 2020 of the year.

Dynamics of dividend payments in rubles

| 9 Months 2017 | 2,97 |

| 12 Months 2017 | 3,88 |

| 9 Months 2018 | 4,39 |

| 12 Months 2018 | 4,45 |

| 9 Months 2019 | 5,06 |

| 12 Months 2019 | 3,06 |

| 6 Months 2020 | 2,5 |

| 9 Months 2020 | 5,08 |

| 12 Months 2020 | 6,07 |

9 Months 2017

2,97

12 Months 2017

3,88

9 Months 2018

4,39

12 Months 2018

4,45

9 Months 2019

5,06

12 Months 2019

3,06

6 Months 2020

2,5

9 Months 2020

5,08

12 Months 2020

6,07

Arguments for

Rapid expansion. For 3 year, the total number of the company's stores will grow by 2,5 Times.

Dividend Policy and Net Debt. Due to the low debt burden, the company with 2017 distributes among the shareholders all the earned net profit under RAS.

New points of growth. To 2024 the network of pick-up points "Detmir" and "Zoozavr" will grow by more than 10 once. In 2 quarter 2021 years, these networks have shown growth of more than 100% compared to the same period last year.

Entering new markets. The company plans to further develop in the CIS market, therefore, Children's World may appear in Kyrgyzstan and Armenia.

Strong business model. In a problematic 2020 year, "Children's World" was able to quickly rebuild, increasing online sales and becoming the largest player in its market. Detmir.ru market share among online stores of children's goods in 2020 year was 64%.

Arguments against

Weak fertility rates. The number of children born in Russia in 2020 year has become the minimum since 2002 of the year. Besides, Rosstat, based on his demographic forecast before 2035 of the year, expects a decrease in the child population from 27 million to 18-23 million people.

Risk of dividend reduction. In the event of a strong increase in debt, Detsky Mir may reduce payments and switch to distribution among shareholders 50% net profit under IFRS according to the policy.

Outcome

Detsky Mir manages to maintain double-digit growth rates and high dividend yield. The company has a strong development strategy up to 2024 of the year, with the help of which it plans to strengthen its leadership in the children's goods market and take first place in the pet goods market.