Realizing the futility of treating depressive conditions with traditional drugs using the example of their loved ones, George Goldsmith, Ekaterina Malievskaya and Lars Wild founded Compass Pathways (CP).

Synthetic psychedelic psilocybin was chosen as an innovative treatment for depression, found in hallucinogenic mushrooms, - in combination with psychological support. The new drug was named COMP360, and in 2018 US FDA (FDA) approved clinical trials of the drug on volunteers.

What's going on here

Readers have been asking us for a long time to start looking into the financials and business foundations of US issuers.. Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the overview. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

Download the table from the report

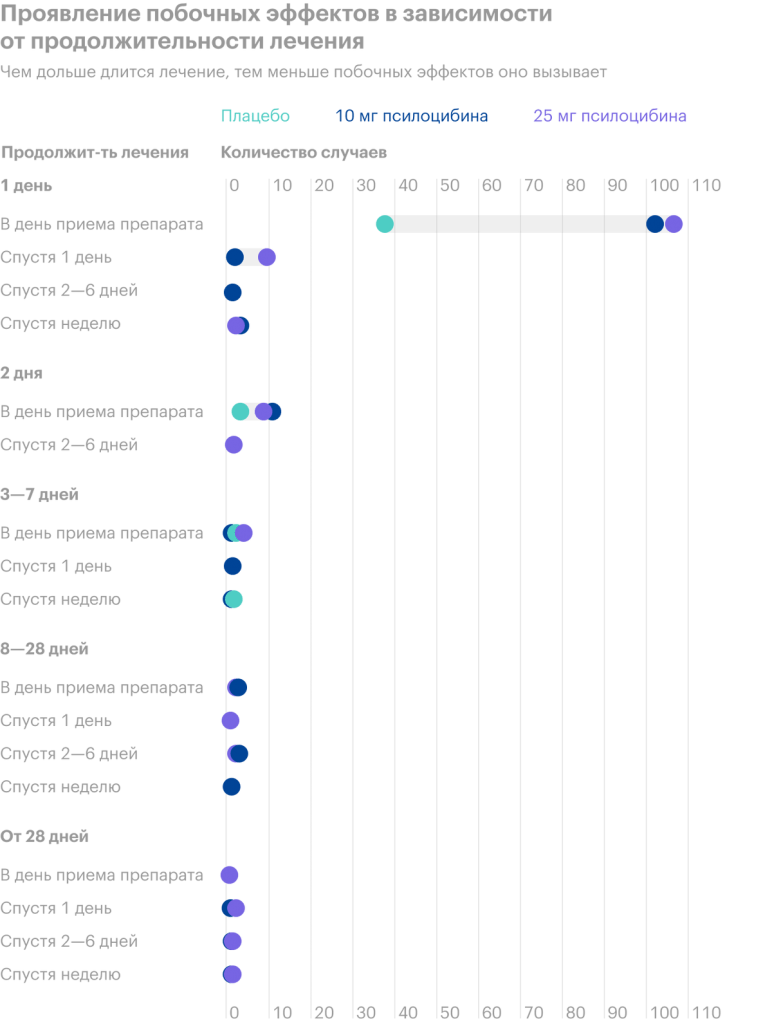

In 2019, CP completed the first phase of drug trials on a group, formed from 89 volunteers. Tests showed good results in almost all subjects, reducing the primary symptoms of the disease within six months after taking the drug.

In 2020, a second group of 216 volunteers was formed for the second phase of testing. The second phase of clinical trials is aimed at finding the optimal dosage of COMP360 for various forms of depressive disorder and in combination with the support of a psychotherapist.

The company plans to publish the results of the second phase of research in the fourth quarter of 2021.

Comparison of markets and prospects

Cannabis producers are interested in the production of marijuana and are not concerned with the mental health of their future consumers.

Nevertheless, the hype around this topic artificially warmed up the market, and share prices of legal marijuana producers were greatly inflated, as a result, in 2020, the share prices of the companies that dominate this sector fell by almost half.

COMP360 will never be freely available and can only be used under the supervision of a physician, accompanied by a specially designed psychotherapy.. For the manufacture of the drug, only synthetic psilocybin is used. It is impossible to obtain a pure extract of a substance without an admixture of other alkaloids from living hallucinogenic mushrooms.. In addition, the drug must comply with the GMP standard..

Over the past decade, a number of studies have been conducted on the treatment of mental illness with psilocybin.. A prolonged positive effect of treatment with this substance was noted., lasting for half a year.

Based on research data, FDA clears CP to use psilocybin with psychological support for future clinical trials.

Investors

Several venture investors invested in the company at the initial stage: ATAI Life Sciences AG, share in CP — 29,06%; PayPal and Palantir co-founder Peter Thiel, share in CP — 7,54%; McQuade Center for Strategic Research and Development LLC, share in CP — 5,84%.

ATAI Life Sciences AG is working in the field of finding alternative drugs for the treatment of depression and anxiety disorders. One of the goals of the holding is to return prohibited substances to the legal sphere.. This applies primarily to psilocybin. The ATAI holding includes the technology division Innoplexus, which, using AI and big data, helps CP conduct clinical trials.

Known for his investment acumen, PayPal co-founder and first FB investor Peter Thiel has invested in more than just CP, but also invested in ATAI, evaluating the future of these companies as the most promising. In particular, he noted, that "the advantage of ATAI and CP is, How do they relate to mental health?: very seriously".

До IPO, from 2016 to September 2020, Compass Pathways Raised $ 196.5 Million.

IPO Compass Pathways

IPO took place in September 2020. The company reported a net loss and no revenue, which is quite typical for a biotechnology company at the stage of clinical trials of a drug.

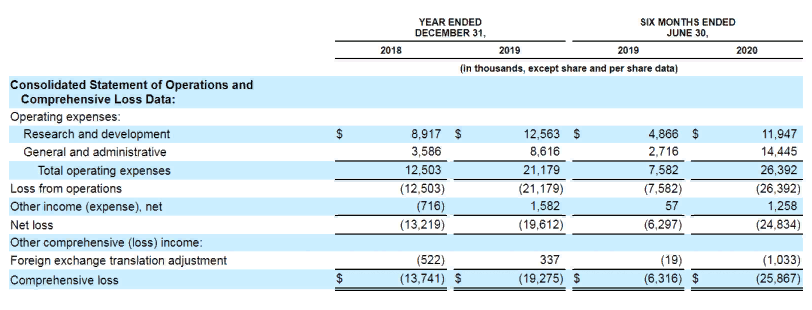

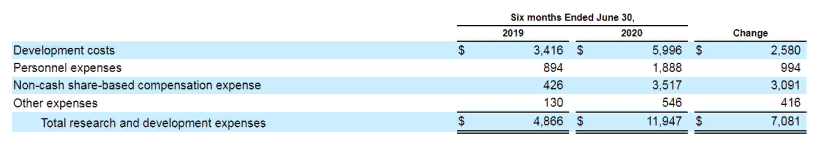

The company's money is spent on research and development. For the first 6 months of last year, CP's net loss amounted to $24.8 million. For previous years, 2018 And 2019, the loss was $13.2 million and $19.6 million.

Spending for the first half of 2020 is higher, than spending for the entire previous year 2019. This is due to the more costly second phase trial of COMP360., to be completed by the end of this year.

Initial placement on Nasdaq more than successful. Thanks to the IPO, the company increased its capitalization to $2 billion, sold 35 930 331 share worth $146.6 million. CP management believes, that the amount received will be sufficient for the development and capital expenditures of the company until the end of the fourth quarter of 2022 or until the final part of the third phase of testing.

Demand for CP shares is unstable and is accompanied by bursts of interest in the asset immediately after the IPO. The company's stock is currently trading at its October lows. 2020.

However, in September, on the first day of trading on the Nasdaq, shares started trading 17 $ and by the end of the day the price rose by 70%, having reached the price 29 $.

Competitors

While Compass Pathways has no serious direct competitors, which would, doing synthetic psilocybin, developed a drug in combination with psychological support for the treatment of resistant depression and were in the second phase of successful clinical trials of the drug.

However, there is a company from the USA, which uses live psilocybin, but for other - non-medical - purposes. Silo Wellness Company (SW) offers retreats to Jamaica. SW has its own plantations there, where the company grows hallucinogenic mushrooms and produces spray.

One of CP's investors, holding ATAI, also deals with psychedelics, but Compass Pathways managed to convert this strong competitor, consisting of 11 companies, into a partner, who is currently not only an investor in CP, but also included in the COMP360 clinical trial process.

If all stages of research for CP are successful and COMP360 is certified, serious players can join the competition, That, including, produce drugs for the treatment of mental illness. And these are giants., как GlaxoSmithKline, Merck, AstraZeneca, Eli Lilly, Johnson & Johnson, Forest Laboratories, Sanofi-Aventis, H. Lundbeck, Bristol-Myers Squibb.

The future of the antidepressant market

According to WHO assessment, Worldwide, at least 264 million people suffer from some form of depression.. Recent developments, related to the pandemic and job cuts, do not add optimism and, probably, lead to a new surge of anxiety and depressive disorders (TDR) in different age groups. Currently up to 40% of people, suffering from moderate to severe TDR, do not feel better when treated with traditional antidepressants.

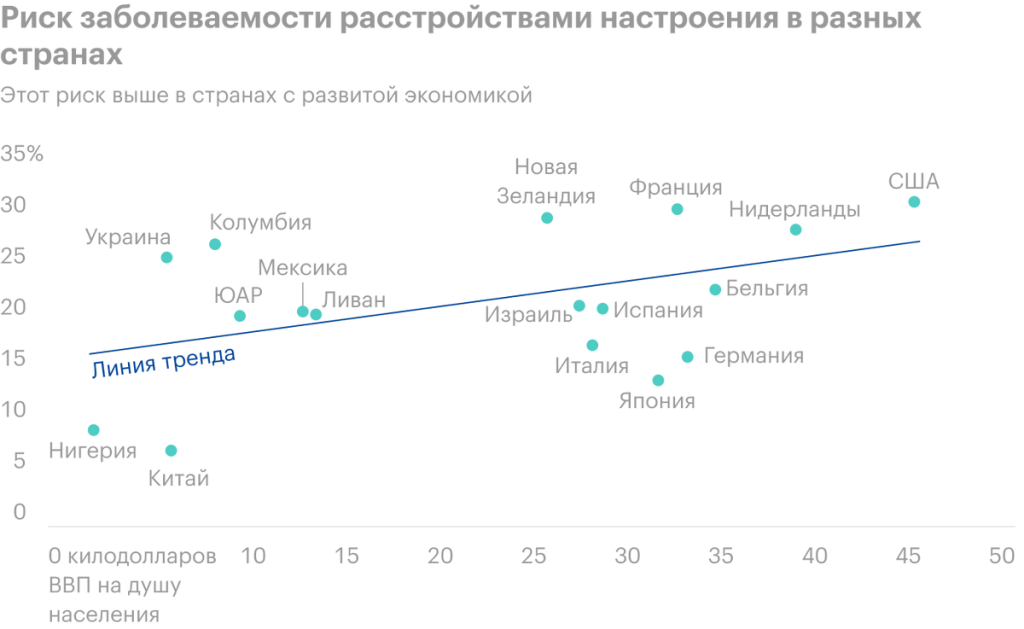

It means, that for 100 million people a new psilocybin treatment could be the only way to get relief from mental pain. According to WHO research, the increase in the number of diseases of the MDD directly depends on the standard of living of the population. The higher the comfort zone, the more TDR sufferers.

Company risks

Hurry up. Compass Pathways, maybe, hurried to become a public company, missing out on the opportunity to spend two or three more rounds of fundraising, what is so characteristic of a promising startup.

Shareholders are now optimistic about the positive results of the second phase of human clinical trials of COMP360., who suffer from resistant depression.

There is no certainty. One hundred percent certainty in the success of the COMP360 before passing all the stages of testing cannot be. But this is a normal position for any startup., and while the company has no reason to assume a negative test scenario - on the contrary, the drug helps to stop the primary symptoms of resistant depression with prolonged action.

Will have to wait. After the third phase of testing, it will take another 3-5 years before, when final approval for the use of COMP360 will be received from the FDA-USA.

Will have to wait, while partners are found. Compass Pathways does not yet have partnerships with major manufacturers of traditional antidepressants. On the other hand, CP develops innovative drug, which can be produced by any pharmaceutical company under license from Compass Pathways.

Resume

Compass Pathways is still a startup, who developed a promising and innovative medical product. US Food and Drug Administration (FDA), calling COMP360 a "breakthrough" in the treatment of resistant depression, almost blessed the future of an innovative drug.

When buying CP shares, it is important to consider the fact, that investors believed in the success of the startup, by increasing the capitalization of the company by IPO from 1 up to 2 billion dollars. The company now has enough money, to complete all three phases of drug trials without saving.

Given CP's lack of revenue, it is difficult to calculate the future of the company in any time period, so investing in Compass Pathways shares will be a private decision, based on the opinion and evaluation of the drug from the FDA and investor confidence in CP.

Interesting for medium-term forecasting may be the reporting period of CP for the fourth quarter of 2021, which coincides with the end of the second phase of testing. You can count on the growth of the company's stock quotes on positive expectations at the end of this year.