AppHarvest (Nasdaq: APPH) - an extraordinary agricultural startup from the eastern part of the United States. The company has one of the largest hidden farms in 150 hectares, where he grows tomatoes all year round with the support of automation of actions with the introduction of AI, robots and machine learning. The company calculates, that her farms will be in 30 times more productive than conventional open-type farms.

Where does the money come from

AppHarvest grows and sells crops: vegetables, fruits, leafy greens. As of August 2021 the company launched a farm in Kentucky and is building two more.

Morkhed. Main farm, where bull's heart tomatoes and carpal tomatoes grow. For the first quarter 2021 sold over 1700 tons of tomatoes per 3,8 million dollars.

richmond. Indoor farm in 150 hectares, in which AppHarvest will grow fruits and vegetables. Construction started 12 February 2021 of the year, full commissioning is scheduled for 2022.

Berea. Farm c 37,5 hectare, on which leafy greens will be grown. Construction started 8 Martha 2021, full commissioning is also scheduled for 2022.

What good

In the first quarter 2021 the company showed its first revenue in 2,3 million dollars, and in the second, the revenue reached 3,1 million: the farm in Morhead is already bearing fruit.

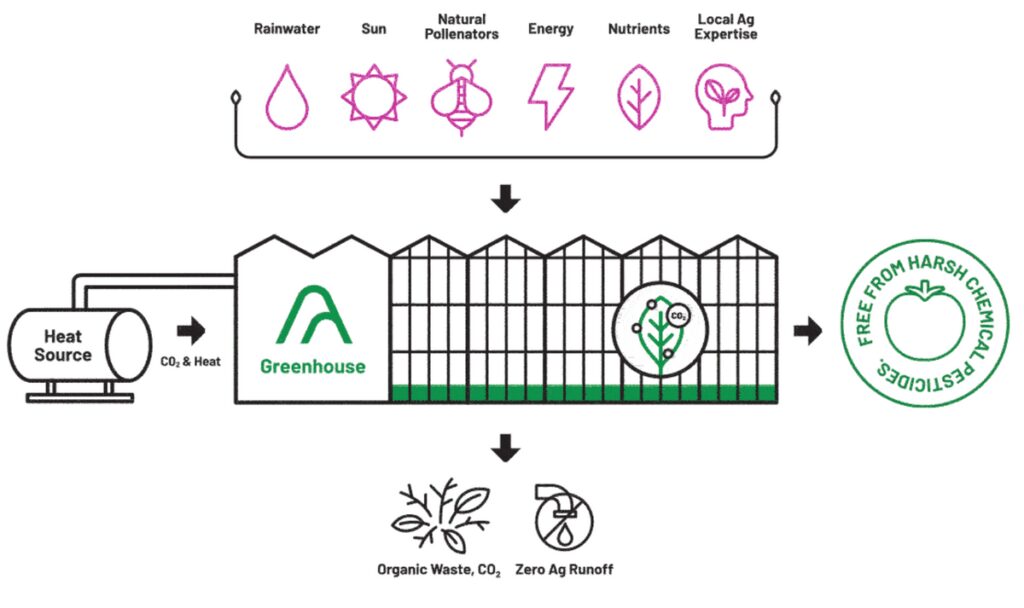

The company declares its main advantage the environmental friendliness and high productivity of its own covered farms in comparison with traditional open-type farms. Differences between AppHarvest farms and conventional farms:

- instead of tap water, recyclable rainwater is used for irrigation;

- a hybrid lighting system is applied: sunlight, LED- and sodium lamps. The combination of different light sources allows for harvest all year round;

- a system of 300 touch sensors, which monitor the microclimate and control the level of illumination, humidity and carbon dioxide. Thanks to this, AppHarvest plans to collect 30 times more yield per acre of land than open farms;

- fine climate control also serves as a pest control system: greenhouses do not use pesticides;

- the company uses natural pollination and contains 500 hives, in each of which lives up to 125 bees, able to pollinate more 700 thousand plants.

The company relies on artificial intelligence and robots, which will help her grow and harvest fresh vegetables all year round. 8 April 2021 AppHarvest acquired Root AI developer, which provided the company with its trained robotic assembly Virgo. It identifies the ripeness of the fruit with the help of cameras and harvests the crop at the most opportune moment..

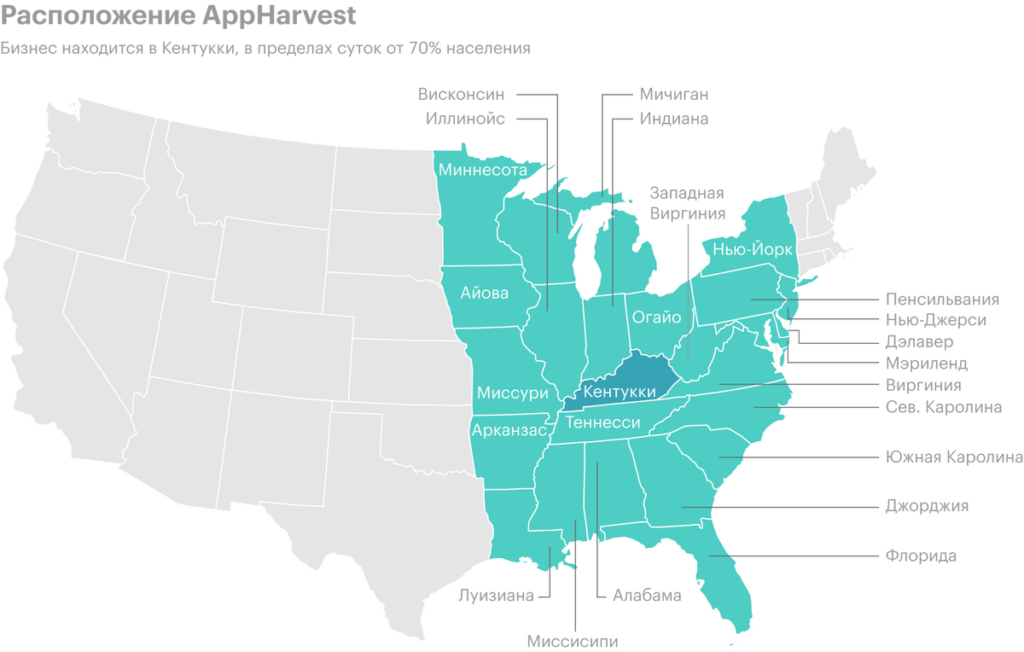

AppHarvest has an important geographical advantage: the business is located in the heart of the United States and in just one day of driving can deliver freshly harvested products to stores, which cover 70% population of the country. Such a logistics model, according to the company's calculations, cuts fuel costs for transportation by 80% - this emphasizes AppHarvest's adherence to the ESG trend principles.

28 June 2021 AppHarvest included in the index Russell 2000 - a well-known American benchmark for small cap companies.

To increase the company's sales helps the distribution agreement with Mastronardi - one of the largest suppliers in North America. Thanks to this partnership, AppHarvest tomatoes are already on sale at Walmart., Publix, Costco, Kroger и Target.

The largest share in the structure of owners is 18,3% - owned by Jonathan Webb - CEO and founder of the company, which the, obviously, believes in his own business. 37% shares accounted for by institutional investors, including Vanguard and BlackRock funds with positions in 59,5 And 29,5 million dollars respectively.

What's wrong

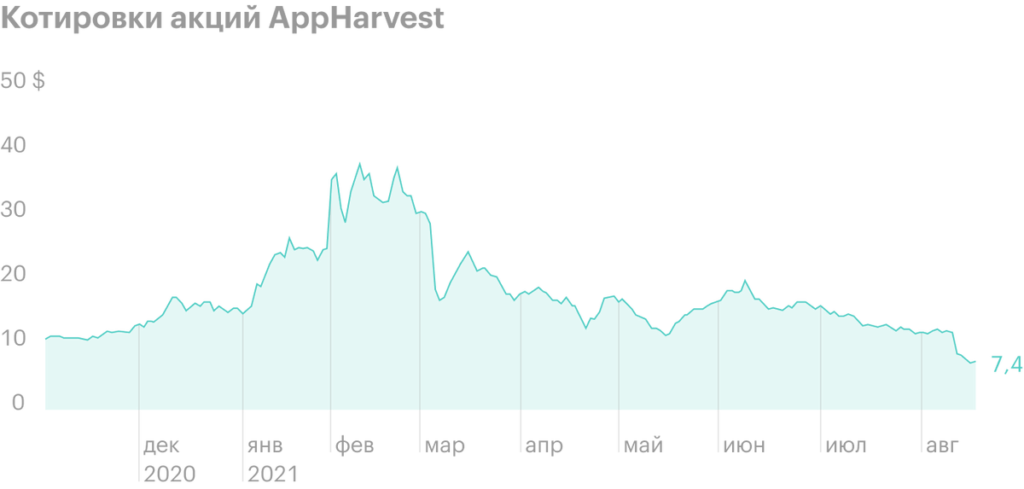

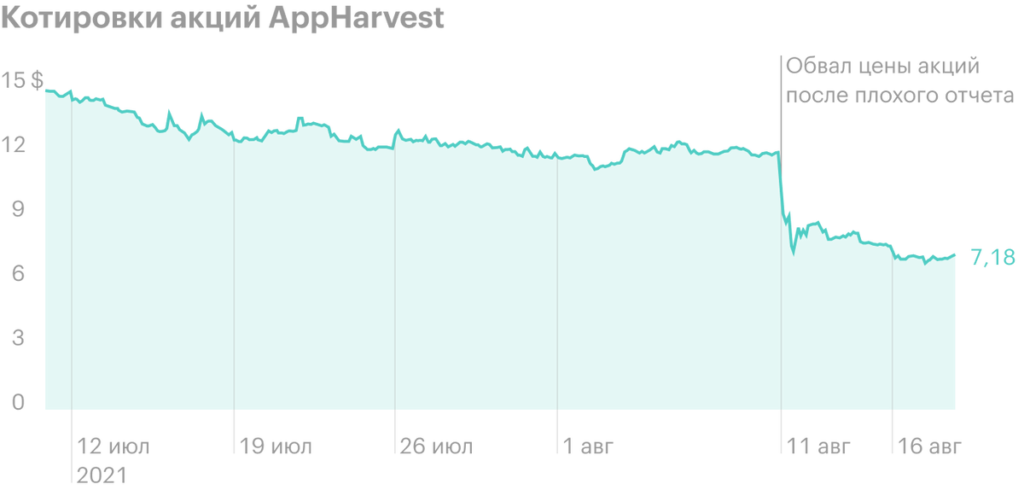

The risks of investing money in AppHarvest will best illustrate my example: after a poor Q2 report, the stocks in the portfolio lost more than 40% its value. The main negative factor was a sharp decrease in the company's revenue forecast by 2021 year from 20-25 million dollars to 7-9 million.

Market expectations are now extremely high - neutral and positive reports of many companies lead to a fall in prices., and a significant negative from a loss-making startup like AppHarvest can lead – as happened – to that point., that since the June high in 21 $ the price will plummet to the area 7 $.

Any failure of AppHarvest gives an edge to competitors. The closest example is Aerofarms., That 26 Martha 2021 announced its entry to NASDAQ with an estimate of 1,2 billion dollars through merger with SPAC Spring Valley Acquisition.

Several law firms at once – Block & Leviton, Bragar, Eagel & Squire, Portnoy Law Firm – launched investigations into AppHarvest's violation of securities legislation. The reason was a sharp decrease in the revenue forecast for the year - more than twice. If the bad faith of the forecasts is confirmed, then this will hit the company's image hard and negatively affect the share price..

What's the bottom line?

AppHarvest is interesting, but an extremely speculative investment with huge risks. It is worth remembering the considerable losses of the company and the current market conditions., ruthless to business, which does not meet high expectations. After the fall, the stock trades at an attractive price, but there are no guarantees, that it will not continue to sink. Making a purchase decision, it is worth remembering about diversification and gaining a share carefully.