Recently, with the development of scientific and technological progress and specialized programs for , trader internet, literally, flooded with screenshots of tested grails with beautiful graphs, tables with coefficients and parameters of profitability . Moreover, some coefficients, типа RecoveryFactor, ProfitFactor, MaxDD et al. just idealized, deified, but in fact they just turn into stamps, RecoveryFactor type must be at least 10, with ProfitFactor below 3 nothing to do in the market, etc.. and so on.

Как довольно справедливо заметил выдающийся trader нашего времени Алексей Мартьянов в последнем видеообращении к инвесторам, I quote verbatim:

"… If a bespectacled algorithmic trader comes to you, and starts poking his charts, theoretical equity of its algorithms, then you can immediately give it to [censored] (face)…" :)

Let's try to dispel some of the myths and cliches about the coefficients of the results of historical tests.

—————————————————————————————————-

RecoveryFactor

Let's start with the most untouchable coefficient RecoveryFactor. There is often an opinion that for a good system, it should be at least 7-10. Often, on the Internet there are tested systems with RF more than 20-30-50 and more. Beginners may find this a grail..

But let's remember how it is calculated. Total profit for the entire testing period divided by the largest drawdown. From here it should be clear that the longer the testing period, the more profits will accumulate over the years. Drawdown does not accumulate as profit, it is disposable. And correspondingly, the longer the testing period, the more potentially RF will be.

Let's admit, Ivanov tested the system for a year and received a profit and a maximum drawdown of the same magnitude, which is quite natural for one year.. So RF = 1, which according to the prevailing opinion is very, very little. And Sidorov tested the same system, but for many, many years since 1929 years to the present day and received RF = 50. Petrov thought about it and, according to the prevailing cliches, decided that Sidorov had a system in 50 times better than Ivanov's, although in fact it was the same system.

Also, it is possible that a system with RF = 3 is much better than a system with RF = 12, but just tested on a shorter period.

That's why, inference. Only systems with the same test period can be compared with RF.. No more, no less.

—————————————————————————————————

Profit-Factor

Perhaps, the most popular coefficient among novice algorithmic traders. And he, by stereotypes, shouldn't be less 3.

I already once wrote that the largest PF will be in the case of trading without stops., overstaying — it will be equal to infinity. Until the first no return to the entry price, certainly — when the margin call comes. But PF will remain infinite, what can you be proud of for the rest of your life, remembering the fun trading years. Respectively, than the more distant stop loss in the system, the greater the PF will be, all other things being equal. That is, a large PF simply indicates a trader's propensity to sit out losses..

Let's remember how it is calculated. This is the total profit, divided by total loss during testing.

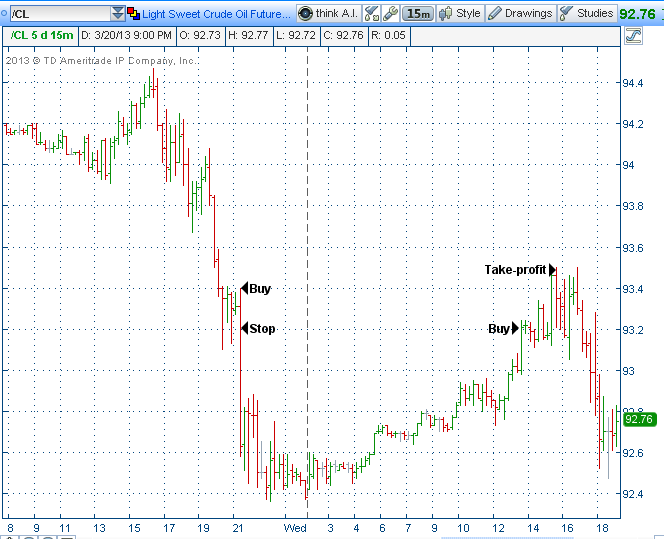

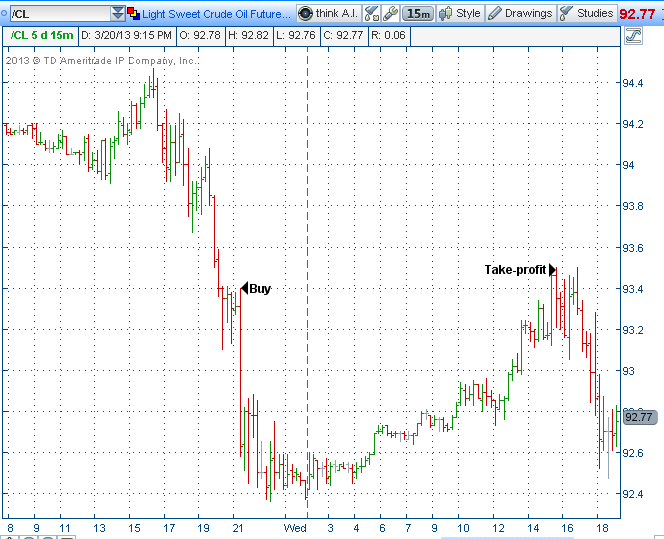

Let's look at a specific example of an oil futures:

———————————-

Иванов

-Bought 1 oil contract for 93,40

-Stop loss triggered by 93,20

-I went to Long Po 93,20

-Fixed profit on 93,50

Total:

profit — 300 Dollars

lesion — 200 Dollars

PF = 1.5

——————————–

Sidorov

-Bought 1 oil contract for 93,40

-sat out the drawdown and took profit at 93,50

Total

profit — 100 Dollars

lesion — 0 Dollars

PF = infinity

——————————–

Output: both players earned 100 Dollars, but Sidorov's PF, which means that the system is an infinite number of times better than that of Ivanov????????

Although, in fact, Ivanov's system is infinitely more literate than Sidorov's.

——————————————————————————————————–

Maximum drawdown.

`` Drawdown more 30% this is suicide ''….. & quot; To win back the drawdown 50%, you need to earn 100%" etc. and so on…….

Let's remember what Max Drawdown is. — this is the distance from the previous peak in account equity to the next low.

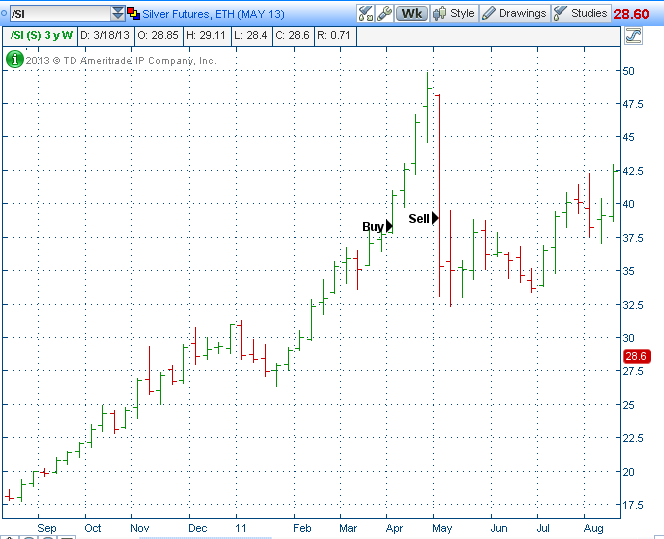

Let's look at an example again. Let's admit, having on the account $25000 entered a long position in silver futures at 38.00 with a stop 37.50. Because 1 point of silver is 5000 Dollars, then the risk 0,5 corresponds to 2500 Dollars.

After opening a position, the price rose sharply to 50 and then suddenly collapsed so that they did not have time to react and took profit on 39, Earning 5000 Dollars. Like, fine — profit 5000 dollars at risk 25000.

But this is where the fun begins. — since the peak is from $25000 initial reached $60000, and after fixing the profit, it decreased to $30000, then it means Landing 50%.

I.e, seems to have earned, and have not even been in the red, and such an indicator as MaxDD will now leave a shameful mark on the system. With such a MaxDD system, no investor will invest money, and on the forums they will point a finger. But MaxDD could be more than 50%…….. And 80%, and even 95%….

Draw your own conclusions :)

——————————————————————————

Continuation of the clichés and myths in the development of trading systems follows…..