For owners of electronic vehicle control systems (THAT) you will not envy. Don't bump into anyone, and anyone who wants to ram you. Nonetheless, DAS Producers' Shares Are Among the Growth Leaders on the New York Stock Exchange.

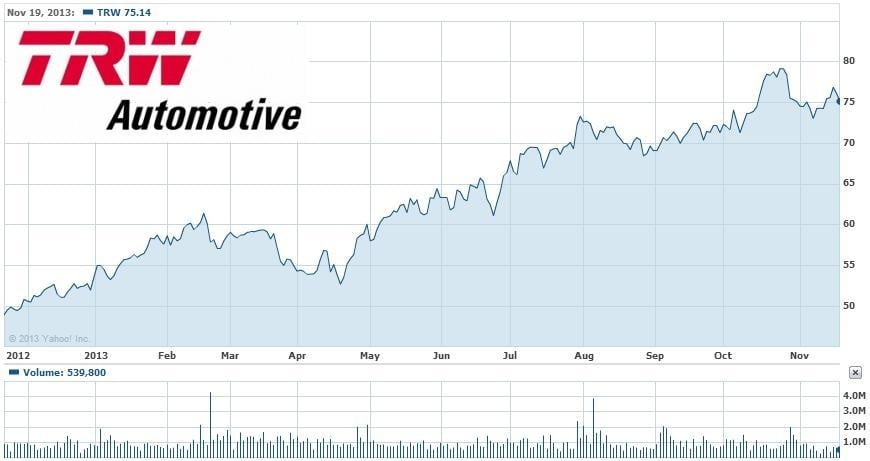

For example, TRW Automotive Holdings Corp. (Nyse: TRW) in a year have risen in price by 66% And, probably, will grow by another 20% during two months.

Electronic car control systems - smart car

Of car control systems, collision warning is the most pleasing.. Such systems are available with and without automatic brakes.. Think, the future belongs to cars on autopilot.

How auto pilot works?

Collision warning devices are connected to the warning device. Medium range radar frequency 24 gigahertz is placed on the front of the machine, measuring distance and relative speed in all weather conditions. On the wind stele, behind the rearview mirror, a camera with a viewing angle is installed 21 degree and recognition radius 80 m at speeds up to 260 km per hour, which connects to the notification device. Sometimes camera-based systems support Lane Departure Warning. The combination of a radar and a camera significantly increases traffic safety.

The camera has a wide range of functions, including pedestrian recognition, passenger cars, trucks, motorcycle, speed limit signs, including under different lighting conditions, classification of objects, signal about a possible departure from the lane.

We have traffic jams, and learned to treat them in the USA. So far, only the prevention of accidents in traffic jams through the speed limit is possible, not leaving the lane and a stable distance with the vehicle in front (Traffic Jam Assist).

For the driver, the most useful feature of TRW products is the ability to brake against his will.. Automatic emergency braking system (AEB) combines the functions of a driver assistant (DAM) and electronic control of driving stability (ESC).

Not all vehicles are equipped with a warning brake. Radar frequency 24 or 77 gigahertz is used for more than just such extreme braking, but also for a number of others, more budget functions. These include adjusting the vehicle speed to match the vehicle ahead. ("Adaptive cruise control"). Collision mitigation braking is also required (Collision Mitigation Braking, CMB), which helps to reset 20 km per hour. Few, но приятно. The better the whole system works from improving the quality of the radar, which is better at recognizing static obstacles.

Another useful feature of the same radar is, what in combination with a camcorder, recognizing moving objects, data processing from sensors and electronic power steering (EPS) an emergency steering system is obtained (ESA).

Active seat belt tensioning in case of an accident (ACR), unbuckling his buckle (ABL). They are activated during turns, which are tracked using GPS.

Pedestrian protection system (PPS), acceleration sensor (RAS) on car suspension, information from which is analyzed by the electronic control center (ECU) by software, distinguishing a collision with a person or object (for example, garbage container) from road depressions and potholes. If collision cannot be avoided, the height adjustment drives raise the bonnet to, to soften the blow for the pedestrian (bumping into a raised hood, he will feel the blow more evenly).

TPMS systems in a smart car

More 70% cars have at least one under-pumped wheel, eliminating which can reduce fuel consumption by 2%. Hybrid rubber pressure control system (TPMS) compares information from sensors, mounted on the wheel, with data from anti-lock braking system or steering control. Wheel sensors have a lifespan 10 years and work on batteries. A more expensive version of this system (indirect pressure control, iTPMS) notifies the driver about a possible drop in pressure in the event of a long-term mismatch of the wheel contours. The advanced version of iTPMS displays information about the, which wheel is damaged.

In addition, the company's arsenal includes remote controls for locking and unlocking car doors and pressure sensors., which are used to define, is there any damage to the body and doors of the car in a collision. Safety Domain ECU (SDE) based on a dual-core microcontroller with a frequency 120 gigahertz is designed to integrate new software solutions in the field of security with increased fault tolerance.

An additional benefit of TRW RAS is, that no special adapters are required, to install sensors. TPMS can be used at low temperatures down to minus 40 Degrees.

Along the way with intelligent systems, TRW manufactures front and rear brake calipers, compatible with hydraulic brakes, shoe brakes. On the rudders, seat belts and airbags account for a little more 21% selling, on parts for drive and suspension, transmission pumps, buckles and other details - more 10%. The rest is electronic drive systems, brake and steering automatics.

Financial performance of TRW

There are a number of factors in favor of buying TRW shares:

- Business conditions TRW positive. Growth in US car production in the last quarter of 6% in year, release rate - 15,7 million per year; continued growth in other regions. Particularly visible in Europe and Brazil. Cars as a connection - are needed even at not the best time for the economy. TRW sales show growth by 6% in year.

- Increase the reverse program выкупа акций on 1 billion dollars.

- Strong multipliers. Q3 Price to Earnings, multiplied by four, is 12,6 and can grow to 18. net debt (debt minus cash) - Total 22% share capital. Market value of all 73% from assets. Based on the indicator of reporting income for 9 months, we consider the economic value of the enterprise to the predicted annual profit before taxes, interest and amortization - 5,5.

- Revision of the company's annual forecast for Revenue upward (to 17,1 billion dollars). Quarterly sales growth, not related to positive effects of foreign exchange rates, Reached 176 million dollars. IN 2014 year you can expect sales in the amount of 17,78 billion dollars. Net profit margin in the last reporting quarter 4,4%, average for nine months - 5,1%. Nine month profitability gives predicted earnings per share 7,3 dollar, relative to which shares are traded for only 10,3 times more expensive.

- Diversification of the sales structure between the two regions: North America - 36% proceeds, Europe - 42,5%.

- Large corporate clients (Volkswagen - 23,5% selling, Ford - 17,6%, GM and Chrysler - by 10%, Renault / Nissan, Daimler, BMW, Fiat - po 4%). Brand companies value their reputation and are unlikely to purchase from Chinese manufacturers, such as Shenzhen Haidian Technology, Shenzhen Jetson Electronic Technologies, Guangzhou Angotan Auto Parts, Dongguan Richtek Electronics.

Author Mikhail Krylov