Regarding the article by Artem Kramin in the previous post.

I am sure, many do not understand that a profitable system itself is a rather loose concept, conditional and relative. Let's admit, for example, that there is a system that consistently earns 100 years, but having drawdowns of duration 3-5 years. Yes, for a long-liver, maybe she's a good robust system, but for a person, which is temporarily on the market and fell just for these five years of drawdown, this system, unprofitable of course. This is shown very well in the article, although probably, many did not pay attention:

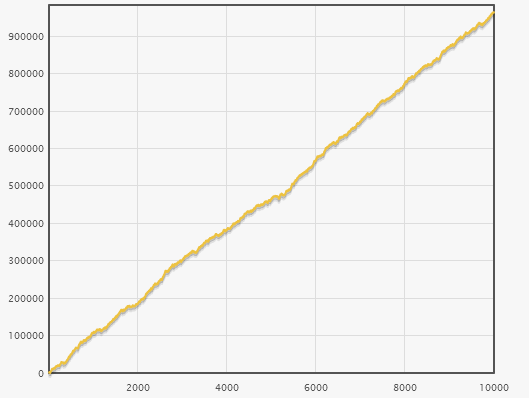

The author writes: "You can reach a more or less stable result if you increase the distance to 10.000 deals:" (and we will assume what is this equity for 100 years)

And this is a profitable system.

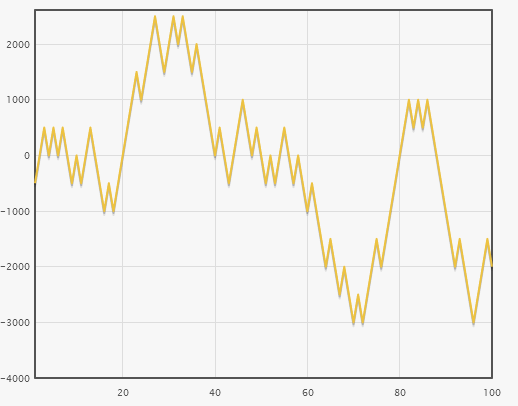

But for some smaller internal gap in 5 years (we already get such a curve: (the author had it 100 deals)

And this is a losing system, despite the fact that the system is the same.

The same can be written for shorter time intervals.. For example, in the interval 10 years this is a profitable system, хотя был убыточный год и trader, who traded this very year traded a losing system.

So the author described everything correctly (in my opinion, not claiming to be true). Of course there are profitable, robust systems, but not everyone will be able to earn by trading on it for very many reasons. After all, everyone wants" fast and a lot ''. And these people are just 99%, as the author writes. This is what I thought about reading this article and therefore agreed with the author, although he never chewed it up to the end, but the conclusion is obvious.