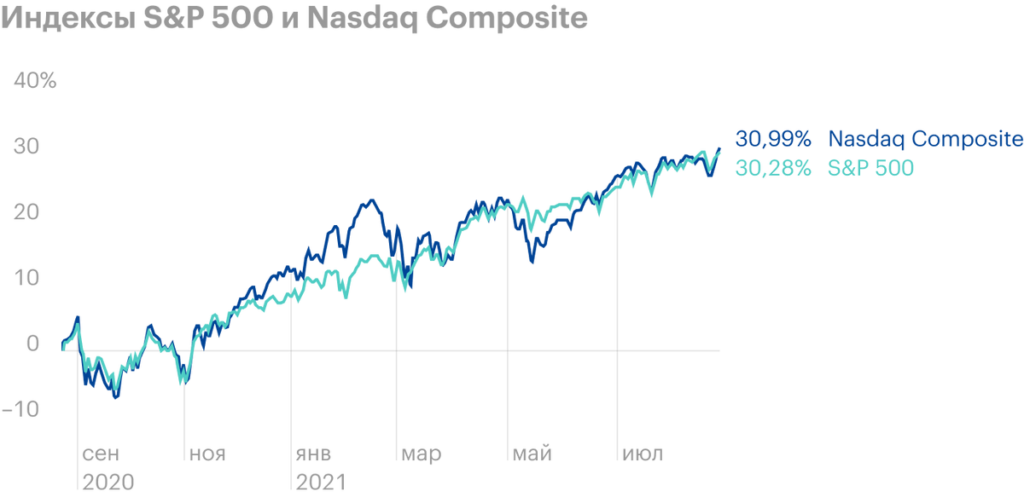

24 august stock index Nasdaq Composite closes above 15K for the first time. Nasdaq up half a percent in one day, to 15 020 points, a S&P 500 and Dow Jones - on 0,2 And 0,1 %, to 4486 and 35 366 points.

This time the index set a new record without the support of the main technology giants Apple and Microsoft.. On Tuesday, Apple shares plunged 0,1 %, to 149,6 $, and Microsoft shares 0,7 %, to 302,6 $.

Shares of other companies from the FAANG group rose insignificantly. The cost of Netflix paper has not changed much, 553,4 $, and Facebook shares added 0,6 %, to 365,9 $. Papers of the largest trading company Amazon have risen in price by 1,2 %, to 3298,4 $, which is ten percent below the maximum.

And here are the shares of Alphabet, parent organization Гугл, are at a historical high. During the day, the paper rose by 0,9 %, to 2825,2 $.

From relatively large organizations, pulling?? Nasdaq top, can be distinguished by Airbnb. The company said, which will accommodate at its own expense 20,000 migrants from Afghanistan for an indefinite period. Airbnb shares up 10% on Tuesday, to 161,4 $.

During the last trading session, 313 stocks from the S index&P500 has grown. This is not a bad symbol., after all, in the past few years, the main indicators have grown in almost everything due to large technology companies. For example, Apple and Microsoft shares 5 years have grown more than in 5 once, at 460 and 421%. To compare: broad market index S&P 500 for the corresponding time period increased by 107%.

Wells Fargo added positive to financiers. Leading specialist Bank Christopher Harvey raised his motivated level on S&P 500 at the end of the year from 3850 to 4825 points. Growth potential - 7,7 %. Since the beginning of the year, the index has grown by 21%.

"For the last 31 year there were nine cases, when the yield S&P 500 exceeded 10% in the first eight months of the year. In the past four months, the index has gained another 8,4%. In none of these cases has the return been negative in recent months.”, Harvey said.

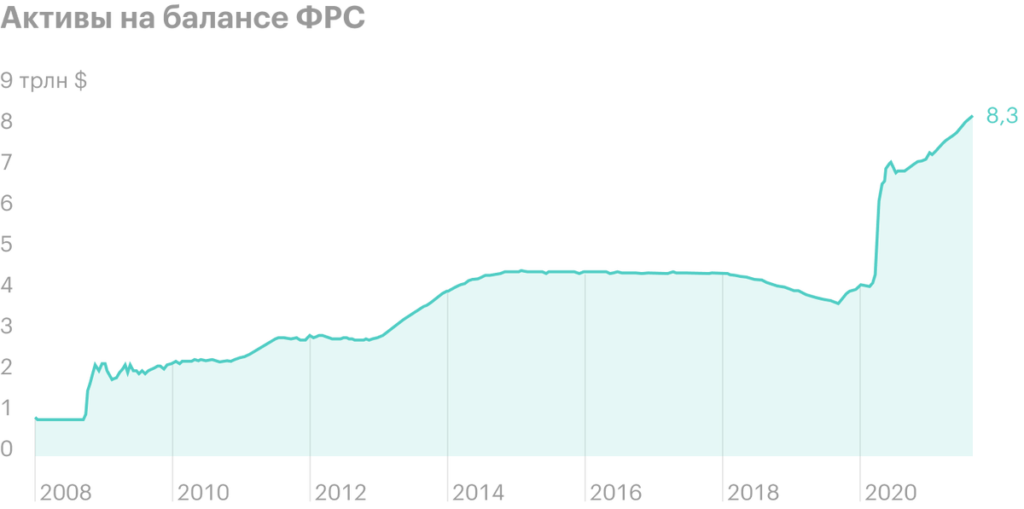

For next year, the analyst gives a more restrained forecast: "We believe, that monetary policy will be less flexible by the second half of 2022, than now".

Regarding the position FED spoke out at Goldman Sachs. The bank considers, that the Fed will announce a reduction in bond purchases in November. According to Goldman Sachs, the regulator will reduce purchases by $15 billion with a probability 45%. Now the Fed is supporting the markets, monthly purchases of Treasury and mortgage bonds totaling $120 billion.