I decided to test another hypothesis, developed by academics, market research. This time, so-called, momentum investing. Some strategies, ostensibly, зарабатывающие 10-30% annual are given here

And here, there are links to various academic studies of the site with different logarithms, square roots, integrals and other incomprehensible mathematical formulas, proving that only the lazy does not make money on this inefficiency.

All in all, the essence of momentum investing is as follows:

Momentum is based on speculation, что инструменты, who have recently overtaken the market, will continue like this for a while, and they, who lagged behind the market, will lag further. Although practitioners have been using this principle for decades, the idea has won the recognition of the academic community only in the past 20 years. Momentum contradicts the efficient market hypothesis, but his evidence is too obvious, to ignore them.

And the methods are applied, about, such:

We choose, for example, 10 Shares, которые за 12 previous months showed the best profitability and 10 Shares, which showed the worst profitability. Respectively, 10 we buy the best, and 10 we sell the worst. We hold for a month, and then we repeat the same procedure.

Проверить это — just spit, for example, in Velslab. We write 2 strategies — one for long, the other for the shorts, and then we test, combining these two strategies into a combination.

}

}

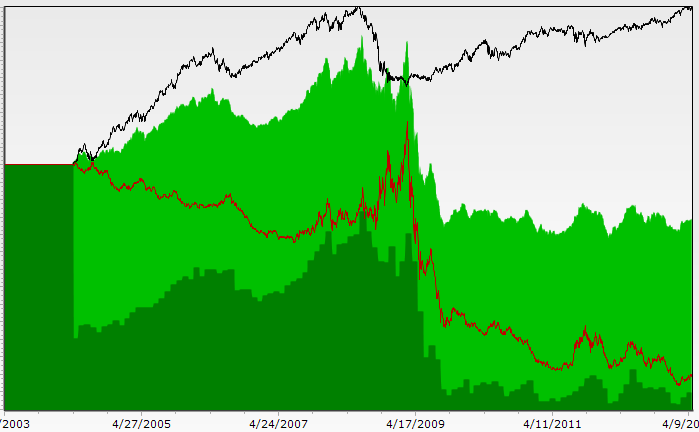

But here's the problem — well, I just can't make a profit for the last 10 years. I tried on different sheets. And on the SP-500, и на Russell1000, and on combined and everywhere, approximately the following picture is obtained:

Черная линия — лонги, and red –shorts.

What am I doing wrong? Why do academics manage to make money on paper before 30% per annum, but on my tests, even at a loss, I remain? :)

PS. Do not forget to see how the top has changed 100 best trading sites!