Have you ever thought about the intricacies and strategies of trading MOC Imbelants on NYSE? Understanding its mechanics becomes vital for beginners and experienced traders as, how this form of trading is gaining momentum. Join us on this all-round journey, in which we cover every aspect of trading MOC Imbelants on the NYSE.

MOC Imbelants trades on the NYSE: Overview

When we talk about trading MOC Imbelants on the NYSE, we dive into one of the most interesting aspects of the stock market world. Himself term may sound like something mysterious, but it plays a key role in modern trading strategies.

Fundamentals of MOC Imbelants

MOC Imbelants is based on complex strategies and trading algorithms. Their evolution over the years has brought them to the forefront of trading on the NYSE.. Traders used manual tactics in the past, but with the advent of the digital age, algorithms and sophisticated tools have become the gold standard.

Historical context

The trading history of MOC Imbelants is rich in stories of traders, who took the bull by the horns.

Trade development of MOC Imbelants

Trade in MOC Imbelants has become more sophisticated over time. Many traders and investors have recognized its potential and have integrated it into their investment strategies..

Key Trading Strategies MOC Imbelants

Adopting the right mentality

Successful trading requires more than just knowledge and experience, but also the right mentality. Mood and confidence in your decisions – important components of success.

Technical analysis

Using various indicators and charting tools, traders can predict market movements and make informed decisions.

Understanding Market Depth

Market Depth provides information about supply and demand for specific stocks. This can be a useful tool for determining the best times to enter and exit positions..

Challenges and Solutions

Overcoming psychological barriers

Stock trading can be emotionally challenging. Learn to manage your feelings and make rational decisions in critical situations – key to successful trading.

Dealing with financial setbacks

No one trader not immune from loss. It's important to know, how to manage risks and how to recover from financial setbacks.

Adapting to technological change

Modern technologies are constantly changing, and traders need to be aware of new tools and software products.

Benefits of trading MOC Imbelants

High return potential

One of the main draws of the MOC Imbelants trade – it is an opportunity to obtain high returns compared to traditional investment strategies.

Flexibility and diversification

MOC Imbelants trading provides traders with the opportunity to diversify their portfolio, investing in different instruments and market sectors.

Risk Management in Trading MOC Imbelants

The Importance of Stop Loss Orders

One of the key aspects of successful trading – is the ability to limit losses. Stop-loss orders allow traders to pre-determine the level of loss, which they are willing to accept, and automatically close the position when this level is reached.

Risk-reward assessment

Before entering a trade, it is important to evaluate the potential profit and possible losses. A well thought out risk/reward ratio can make your trading strategy more sustainable.

Impact of economic indicators

Impact of global events

Global Events, such as political crises, wars or economic crises, can have a significant impact on market trends. Understanding this will help traders better adapt to changing conditions..

Reaction to economic announcements

Regular economic reports, such as unemployment data, inflation or central bank rate decisions, can cause significant fluctuations in the market. Be aware of these announcements and understand their potential impact on your portfolio – the key to success.

Practical advice for beginners

Choosing the Right Broker

There are many brokers on the market, and choosing the right one can be a daunting task. It is important to consider commissions, platform and tools provided when making a decision.

The role of lifelong learning

The market is constantly changing, and traders must adapt, to stay competitive. Teaching, seminars, webinars and reading relevant literature can help you stay on trend.

Market On Close (MOC) order

– it is an order, which can be sent during the day during the trading session, but will be executed in the last trade at close. Throughout the trading day, exchanges accumulate MOC orders and bring them together in the last trade (print) trading day.

Closer to the close of the main trading session in highly liquid stocks, it often happens that large sellers and buyers have not been able to fully fulfill their daily orders. No later than twenty minutes before the close of the exchange, they, according to the rules of the exchange, place a public order to buy or sell large packages, which can be hundreds of thousands, or even millions of shares. This order is executed in the last seconds of the market and is included in the final exchange trades., often causing little additional movement towards the order. According to the rules, such orders go to news for specific promotions, and traders can see it. Traders, working on this strategy, open their positions on the side of large orders and close them using MOC orders.

NYSE rules

- All MOC orders, PLACE (Limit on Close) must be exhibited no later than 15:45 EAST, unless an imbalance is published in the promotion, when an order is placed against the direction of the imbalance.

- After 15:45 EST MOC / LOC orders are accepted only towards the opposite side of the last published imbalance. For example, if in 15:50 EST publishes imbalance with the side of the reverse side of the first imbalance declared in 15:40 EAST, only MOC / LOC orders are accepted, compensating imbalance released in 15:50 EAST. If imbalance is not published, no MOC / LOC orders after 15:45 do not accept.

- MOC / LOC orders cannot be canceled or shortened after 15:45 EAST.

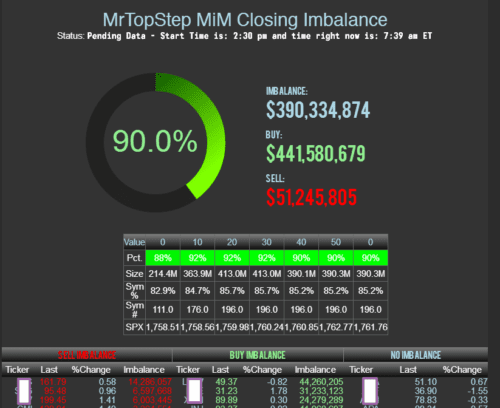

What is imbalance?

Imbalance in trade – is the difference between the volume of purchases and sales of a certain asset. For example, if the number of orders to buy shares of the company exceeds the number of orders to sell, talk about consumer imbalance.

Causes of Imbalances

- News & Events: Events in the world or a company can cause a sharp demand

Publication of imbalances

- If imbalance (difference between MOC / LOC buy and sell orders in stocks) more 50000 shares as of 15:45 EAST, and as of 15:50 EST then the exchange publishes them in 15:45 IS и 15:50 EAST – imbalance size and side.

- If in 15:45 EST imbalance was published, and in 15:50 imbalance has become smaller 50000 Shares, then “no imbalance” is published

- To calculate imbalances, MOC and LOC orders are added. LOC orders are taken into account only those, the limit price of which to buy is higher than the price of the last deal, and for sale - the limit price of which is lower than the price of the last deal. LOC orders with a price equal to the price of the last deal are not taken into account.

Пример Imbalances :

If in stock X in 15:45 received MOC-buy orders for 600,000 shares and MOC-sell orders for 250,000 Shares, then the exchange publishes “Buy MOC imbalance 350,000 shares”

After 15:45 only MOC sell orders are accepted for this promotion, compensating Buy MOC imbalance.

For example, for 10 minutes, MOC sell orders were accepted for 100 thousand. shares and in 15:50 the exchange publishes “Buy MOC imbalance 250,000 shares”.

Let's say the current daily volume in shares X is 1,5 million. shares and the value of imbalance is significant and exceeds 15%.

In this situation, the day trader sends a MOC sell order 1000 shares and buys in the last minutes of trading 1000 shares X, trying to buy at a price as low as possible. After 15:59:59 (usually in 16.00-16.03) the last deal with a huge volume is made, where all MOC orders are consolidated.

If the imbalance still persists and MOC buy orders are more than sell orders, then the price of the final deal will be higher, so that the required number of sell orders took part in the deal and the long position of our day trader will be closed with a profit.

What is imbalance on the NYSE?

Imbalance arises at the NYSE, when the number of orders to buy or sell shares exceeds the other side of the market. This may be the result of the news, large institutional orders or other factors.

When the NYSE releases imbalance information?

The NYSE usually releases imbalance data before the market opens and before it closes.. It helps traders understand, which stocks can be more volatile at the beginning or end of the trading day.

Rules for publishing imbalances on the NYSE

- Transparency: NYSE strives for maximum transparency, providing real-time imbalance data.

- Data protection: Although information on imbalances is available, The NYSE also takes steps to prevent misuse of this information and market manipulation..

- Regular updates: In addition to publications before opening and closing, information about significant imbalances can be published during the trading day.

Risks Of Imbalances:

It happens, that despite the significant imbalance, the final transaction is made at the price, the opposite of the expected. There is also a small risk of failure in the order transfer system., when will the position remain, which will have to be closed at unfavorable prices at the post-trading session.

The exact time of publication of imbalances

- Before the market opens: NYSE begins publishing preliminary data on imbalances in 8:30 morning east time. This gives traders about an hour, to analyze the data before trading in 9:30 morning.

- Before the market closes: The latest data on imbalances before the market close is published in 3:50 pm eastern time, what provides traders 10 minutes for decisions before the market closes at 4:00 evenings.

Imbalance examples and their interpretation

- Buyer's imbalance: Let's admit, information is published on the NYSE, that the company's shares “BUT” have imbalance in 10,000 shares to buy. This may indicate that, that there is a significant number of applications for the purchase of these shares, exceeding the number of bids for sale.

- Sales Imbalance: If the company's shares “B” show imbalance in 5,000 shares for sale, this may speak of, that shareholders want to get rid of their shares faster, than there are those who want to buy them.

The Importance of Portfolio Diversification

Variety of assets to mitigate risk

Spreading investments across different assets can help reduce the overall risk of a portfolio. For example, when one asset goes down, another may grow, compensating for losses.

Strategic reallocation of assets

Over time and depending on market conditions, traders may need to re-evaluate their portfolio allocation and make adjustments.

Final remarks

Long Term Thinking in Trade MOC Imbelants

Although some traders prefer short-term speculation, important to understand, that the trade in MOC Imbelants could also bear fruit in the long run. The appropriate strategy may depend on individual goals and risk appetite..

FAQ

How to start trading MOC Imbelants on the NYSE? First you need to choose a reliable broker, register an account and master the basic principles of the market. Many Brokers offer demo accounts, which allow beginners to get acquainted with the platform and practice without real money loss.

What is MOC in stock trading? MOC (Market-on-Close) – this is a trade order type, which is executed at the end of the trading day at the market price. This is one way to automate trading decisions and manage risk..

What are the risks associated with trading MOC Imbelants? Like any trading strategy, MOC Imbelants Has Its Risks. This may include market fluctuations, Economic news, technological changes and many other factors. It is important to conduct a thorough analysis and apply risk management strategies.

What tools does a trader need to trade MOC Imbelants? Traders may need different tools, including technical analysis software, news feeds to keep track of current news, as well as access to market depth to understand supply and demand for certain stocks.

Conclusion

MOC Imbelants trade on the NYSE – is a complex and multifaceted process., requiring knowledge, experience and the right attitude. Awareness of market trends, deep understanding of tools and ability to manage risks – key components of success in this area. We hope, that our article helped you better understand this topic and gave you useful tips for your trading career.