I bring to your attention an excerpt from Books «What is the name of your God» Sergey Golubitsky about an interesting person, who created something incredible for corporate America and paid for it. Personality ambiguous, instructive story. I recommend!

…..

It is almost impossible to translate the word "chutzpah" from Yiddish. The most common variant - "arrogance" - clearly does not convey the completeness of impressions. You can more or less feel the "chutzpu" by the favorite tale of American lawyers: the boy killed his parents, and then at the trial, with tears in his eyes, he turned to the jury with a request for clemency on that ground, that he is an orphan.

History, with which I will begin the second volume of "Great Scams", unique. And on the scale of material and moral damage, and on the impact on the fate of America, and in its ambiguity, the Michael Milken case cannot be compared with the semi-educated swindlers Charles Ponzi and Barry Minkov, not even with the Swedish match king Ivar Kroeger.

Michael Milken is the era. Michael Milken is a revolution in the economy and consciousness of an entire state. After the Michael Milken affair, America became a different country, where civic cynicism has risen to a new qualitative level. Before Michael Milken, the phrase of the president of the country (Clinton) about that, that he smoked marijuana, but did not drag out, was unthinkable. Milken unveils 'hutspu' world, after which everything became possible under the moon, even careful storage by a clean girl of a dress with stains until better and profitable times.

With all this, Michael Milken was and remains an exemplary family man., a person of high moral principles, surprisingly gentle and caring parent, I guess, the most outstanding philanthropist on our planet and selfless benefactor of truly disadvantaged people. I say this without any irony, sincerely. For over two years I have been carefully studying Milken's biography., however, I still cannot give an unambiguous answer to the question: "Who is he really? Demon or angel?»I'm sure of one thing: with the light hand of Milken then, what started out as an innocent chutzpah, ended with the appearance of a new Golem to the world.

The gloomy mystic Gustav Meyrink wrote about this man-made creature at the beginning of the 20th century.: “Then the legend of the fabulous Golem resurrects before me - about an artificial man, which is here, in the Prague ghetto, once blinded from clay by a rabbi who is well versed in Kabbalah. Putting a parchment with a magic formula in his mouth, he breathed into him the unconscious life of an automaton. And like that, how the Golem became an idol again, just took the parchment from his mouth with the secret signs of life, so all these people - it seems to me - should heartlessly collapse at that moment, when some insignificant idea is erased from one of them, minor impulse or even aimless habit, the other - at least only unclear, unaccountable hope for something vague, indefinite ".

Michael Milken is a phenomenally obsessed man. I do not exclude, what do they, like the medieval creator of the Golem, moved by the best intentions. Not just Milken's theories, but all his actions bear a bright stamp of genius: this also applies to, how during 15 years he kept on a drug needle insanely risky "junk bonds" all the pension and savings funds of the country, and to that, how, after his release from prison, he devoted himself entirely to funding cancer research and nationwide educational programs. In any case, the story of Milken should not be ironic., sarcastic, accusatory or otherwise derisive, as is almost universally accepted by his critics. I will also try to refrain from the hysterical delight and adoration that are hallmarks of Milken's supporters., who today have not changed their attitude to their idol in the least. Most of all I want, for the reader to independently form an idea of this person, whose story is equally relevant in the book "The Great Scams of the Twentieth Century" and in the series "The Lives of Remarkable People".

***

The sixth edition of the fundamental Columbian Encyclopedia says:: "Michael Milken, née Van Nuys, American financier, nicknamed "the king of junk bonds". Worked at Drexel Burnham Lambеrt Inc., where he introduced the use of non-investment grade debt into the practice of corporate takeovers and mergers. At its peak in the 1980s, Milken's personal fortune was legendary.: as reported by government agencies, Drexel paid him 296 million dollars in 1986 and 550 million - in 1987 years. In 1989, a federal court charged Milken with violation of federal securities laws and extortion.. IN 1990 Year Milken pleaded guilty to securities fraud in exchange for the government's refusal of more serious charges of insider trading and extortion. He was fined and sentenced to 10 years of imprisonment.

IN 1991 year, his term was reduced to two years in prison and the next three years on probation. Milken was banned from doing business for life, securities-related, and after his release from prison he served as a business strategy consultant. However, the Securities and Exchange Commission concluded, that Milken's work was a violation of the probationary period, and initiated a new lawsuit. IN 1998 year Milken achieved the conclusion of a peace agreement with the Commission, giving to the government 42 million dollars, who received as compensation for their consulting services, taking into account interest. Milken suffers from prostate cancer. IN 1993 year he established a fund to finance scientific research to cure his illness. IN 1996 Milken created the "Universe of Knowledge" (University of Knowle), company, providing educational services ".

Despite, that Milken's trial took place over 10 years ago, fierce battles do not stop for a moment and today. Michael Milken is remembered as a disinterested revolutionary hero (almost the brother of comrade Che), taking care of the little ones of this world, then as the last rogue and villain. Proposed to address prosecution of Milken by Attorney General Giuliani (future mayor of New York) in such a row: "Lenin against free enterprise" and "Hitler against the Jews". no more, no less.

I am citing the treatise “Great Personalities and Achievements, destroyed by the base human spirit ": "The energetic financier Michael Milken has transformed America's uncompetitive and depressed economy into a world power.". And further: "What happened to the brilliant heroic personality? Milken and his company did not commit any objective crimes. Vice versa, well-intentioned, they brought innumerable benefits to society. Indeed, parasitic elite, destroying innocent Milken, herself committed destructive crimes not only against Milken and the Drexel company, but also against all Americans ". The following are those, who killed the hero: "Parasitic elite class, dishonest politicians, corrupt media, armed bureaucrats and careerist judges ".

Milken's highly educated apologists try not to beat on emotions and only shift the emphasis towards morality ("Milken is a symbol of greed of the 80s"), constantly emphasizing, that the claims against Milken are not criminal, especially after that, how the public prosecutor went to challenge the extortion articles. As a result, all the so-called Milken crimes were associated with "imperfection of the reporting and accounting system".

Before resigning, President Bill Clinton was about to add Milken to the famous "presidential pardon list", however, at the last moment, under strong pressure from the Securities Commission and the courts, he was forced to exclude the "king of junk bonds" from 130 lucky ones. This is despite the fact, that Mark Rich was pardoned - a cynically monstrous swindler, who stole hundreds of millions of dollars and just fled the country (about him - the next chapter).

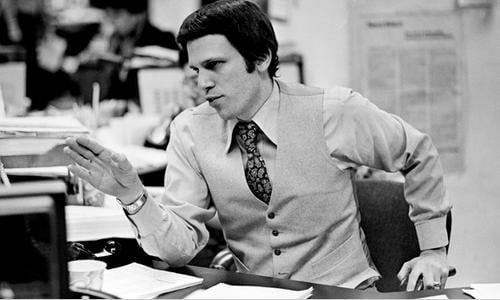

I guess, it's time, finally, figure out, what did Michael Milken actually do. He received an economic education at the prestigious Wharton School (Wharton School). By my own admission, outstanding financial success did not come to him from a particular genius, but thanks to perseverance: Milken has always worked an order of magnitude more, than others. At the institute, he headed the sports support group, was the chairman of the student council, and at night he earned a living as a waiter in the dining room. The latter fact is especially impressive., as Milken comes from a very wealthy family. Engaged in Michael, mostly, in the evenings, and during the day he traded in bonds in one of the largest investment offices of that time "Drexel Bernham Lambert".

Milken studied in Philadelphia, so I had to take regular buses to work. It turned out to be a 15-hour day. On the marketplace, Milken appeared in 4:30 in the morning and stayed there until half past seven in the evening. As chronicler of the hero Jay Epstein writes, Milken had breakfast with sandwich and soda. Dined the same. No cigarettes and coffee, not to mention alcohol.

Milken was less creative in his work., how skeptical. In the early 70s, the corporate debt market consisted almost entirely of highly reliable so-called "investment grade" bonds., which issued selected blue chips - companies with a powerful capitalization and a long history. It turned out, that access to cheap financing was open to only 600-700 companies, everyone else was overboard. Medium and small businesses in America had to be content with short-term loans from commercial banks at an obscenely high interest rate. It was against this state of affairs that Michael Milken rebelled.. At least that is how he himself explains his irresistible revolutionary desire to modernize the debt market and expand it with non-investment grade bonds., so-called "junk bonds", junk-bonds.

Although Milken is called not otherwise, as the "king of junk bonds", in fairness I must say, that these securities existed long before him. It was, Really, one important difference: Traditional junk bonds belonged to the same blue chips, who, due to temporary financial difficulties or as a result of changes in market conditions, lost a high rating, Monopoly assigned by Moody's and Standard Poor's. It is no coincidence that such bonds were called "fallen angels", fallеn angеls. Obviously, that in such circumstances, these papers fully justified their "junk" name: because almost never coupon payments were made on them.

Before you start revolutionizing the bond market, Milken developed a theory, which he began to actively promote to clients of "Drexel". The theory rested on "three pillars":

1. There are no high yield securities on the corporate debt market, which is clearly lacking for many investors with increased risk tolerance.

2. Pointless to expect, that blue chips will put high-yield bonds into circulation - they already had a wonderful life under the caring wing of the rating agencies. Therefore, the only way to fill the market with these highest-yielding bonds is to allow middle and junior companies to issue their own debt..

3. Rating agencies, colluding, lay down with bones, just to prevent small and medium-sized businesses from stock market. The main weapon of the fight is the overstatement of the entry bar: for that, to break into the market, need to get an investment grade rating, but to get this rating, you need to match the capitalization, terms of stay in business, the number of employees and so on - conditions, deliberately impracticable for young aggressive firms.

After deep reflection on the current situation, Michael Milken made a revolutionary conclusion: you need to create a parallel bond market bypassing rating agencies! Becoming on the warpath, Milken immediately backed up his actions with a symbolic gesture.: persuaded the management of New York "Drexel" to open a division - wherever you think? - in "Beverly Hills" next door to Hollywood! The solution is incredible, considering, that almost all of the country's financial life, without exception, took place on the east coast, and "Beverly Hills" was not only far away from that place, where is the money, but it was also noted frivolous, in the eyes of stock sharks, the seal of the air lock at the dream factory (Hollywood). Nevertheless, 4 July 1978 of the year, on American Independence Day and your own birthday, 32-year old Milken secured the move of the bond department to California. Together with the position of the head of the department, he received the title of vice president.

All events in Milken's life, besides external justification, almost always had intrinsic motivation, moreover, an increased high proportion of tragedy: the revolutionary symbolism of moving the office to California only complemented the main reason: Michael wanted to be close to his father, who was dying of cancer.

Lowell Milken is the backbone of the California bond department, Michael's younger brother, lawyer by training, bosom friend Peter Ackerman and Richard Sandler, personal attorney. It was in front of this revolutionary cell that an unbearable task was set: to create a new securities market practically from scratch.

Milken assumed, that difficulties will arise not with issuers, and with investors. It is understandable: there is no need to persuade small and medium-sized businesses to issue debt obligations with higher interest rates, how do blue chips do it?: small business dreamed in a dream and in reality about, how to fall into a full-flowing investment stream, from which he was excommunicated due to ancestral stigmata ("I ate little porridge"). But incredible efforts were required to, to persuade the managers of savings banks and pension funds to abandon safe investment-grade bonds, to give preference to unknown gray horses.

Milken began by, that prepared the ideological basis for future changes. Discrediting the established rating system was the first item on the agenda., and Michael put forward four revolutionary theses:

Thesis 1

Question: "What is a bank?»

Answer: "A bank is a set of loans issued by it".

Thesis 2

Question: "Banks issue loans, mostly, three categories - homeowners, farmers and buyers of expensive goods. All of them have only one thing in common: complete inability to pay off debts at the first economic crisis. Asks, how reliable are bank loans?»

Answer: "Completely unreliable".

Thesis 3

Question: “To what extent does the collateral cover the loans provided??»

Answer: “For every 100 Dollars, provided on credit, the bank receives 1 security dollar, from which follows, that loans are practically not guaranteed ".

Thesis 4

Question: "Obviously, that loans cannot be called risk-free, however, bank bonds, these loans, almost always receive the highest investment rating - AAA. What conclusion can be drawn about the value of such a rating system??»

Answer: “The value of the rating system is zero, as it represents pure deception of investors: because anyone can go broke, even the most reliable savings bank ".

However, simply state, that the current rating system is flawed, was not enough. Therefore, Milken went further and provided a solid scientific basis for his theory.. Milken saw the flaw in the rating system in, that she took into account only the indicators of the past and completely ignored the cash flows in the future. Annual balance, history of quarterly earnings reports, correct payment of dividends and regular obligations on bonds - all this, certainly, Okay, but only there are no guarantees, that nothing will change tomorrow: reliability in the past does not mean reliability in the future. Michael Milken made an incredible effort, to instill this thought in the minds of portfolio managers, whom he met during his many speeches at seminars and conferences, organized across the country. “For a correct assessment of the company's reliability in the future, - Michael preached, - it is necessary to take into account not only past achievements, but also growth prospects. If a respectable company with a long history of positive achievements has no growth prospects, then no rating out of three "A" will help her ".

As an illustration, Milken cited the stories of steel and shipbuilding companies.: seemingly unsinkable colossus with gigantic capitalization and assets sank and found themselves among the "fallen angels" at the first change in market conditions.

Growth companies are another matter, growth companiеs, operating in promising areas - electronic equipment, telecommunications, aircraft industry. However, it is precisely these companies that have been ordered access to cheap borrowing in the field of corporate debt.. As a result, promising businesses are forced to vegetate on short-term and expensive bank loans..

Who is this heartless watchman, blocking the road to America's brighter future with his rough ink? - Rating system. Milken saw his task in restoring justice and creating such conditions, in which small and medium American businesses could fully develop and borrow at decent interest rates. Obviously, that in order to attract investments in a much more risky business of "junk bonds" it was necessary to increase the coupon rate in comparison with that, what was offered for blue-chip debt. Milken rightly believed, that for small and medium-sized businesses the increased rate will not be a problem, since in any case bonds were much more attractive than a bank loan.

Main task: get portfolio managers to break the bad habit of only investing in investment grade bonds. The increased rate alone was clearly not enough here.. The fact, that portfolio managers are hired people, And, besides vanity impulses and high performance bonuses, they are driven by career considerations. Judge for yourself: investing the money entrusted to him in the share, savings or retirement fund in investment grade debt, portfolio manager could lose the bonus, when, if this or that company defaulted and did not pay its debts. However, the manager was not fired., because he could always hide behind the recommendations of the agency Standard Poor's: "Here, pier, see - AAA rating, who could have guessed, that they will go broke?»

Quite a different matter, when the manager at his own peril and risk purchased securities not just with a low rating, but without any rating at all! Happen, God forbid, default, and the manager went straight to the employment exchange. What Milken Drew From, what you need to find such managers, for whom real investment results would prevail over career fears. Better, if the fate of the investment company itself depended on these results. Michael immediately spotted "his clients": these are small and medium-sized investment companies, exhausted in unbearable competition with large funds and teetering on the brink of bankruptcy. The only chance for these "kids": constantly demonstrate to investors increased portfolio returns. And this can be done just due to the high coupon rates of Michael Milken's "junk bonds". The people reached out to the revolutionary, and Milken proceeded to seduce.

Only now the secret meaning of the choice of "Beverly Hills" as the headquarters of "junk bonds" became clear.: because Hollywood is the dream of middle Americans, to whom, without a doubt, owned all provincial portfolio managers. A hypnotic action was required, similar to Ostap Bender's lecture about New Vasyuki, and Milken performed it wonderfully, naturally, at the level, which the great local schemer never dreamed of (is it not a distant relative of Mikhail Milken, the legendary Ostap Ibrahimovich?).

Show, which Milken organized annually for portfolio managers, coming from all over the country, striking in scope and low taste, however, this was exactly what the modest workers of the exchange world liked: Milken's events promoted a "beautiful life", thereby setting the perspective: this is what you need to strive for! Directly at the Los Angeles airport for the Milken Annual Festival attendees (that's what it was officially called) met by luxurious limousines and delivered to the apartments. The delegates ate at the expensive and prestigious restaurant Chasen’s. Such stars entertained them, like Frank Sinatra, Kenny Rogers and Diana Ross. For the most promising clients, who controlled serious investment portfolios, a "special program" was developed: in the bungalow № 8 Beverly Hills Hotel hosted parties featuring "promising future movie stars", which Milken borrowed from his business partner's modeling agency. There was even an idea to charter the Concorde supersonic liner and send the festival participants straight to the Wimbledon tennis tournament, but something in this regard did not stick together, and had to be abandoned.

Amid this ecstatic backdrop, portfolio managers, honored to celebrate at the Milken Festival, have been subjected to a well-calibrated brain and psychological attack: speeches at conferences and seminars were distributed strictly according to directions. First, representatives of "promising fast growing companies" told potential investors about the merits of their business and about dizzying ups in the very near future.. Then solid political and public figures appeared. (not lower than mayor or senator) and talked about the importance of growth companies for the entire economy of the country and the prosperity of the American people. After that, a battalion of eminent economists was promoted to the forefront., and those on the fingers showed, that the total yield of "junk bonds" in the investment portfolio is always higher, than deposits in low-yield debt with an AAA rating.

At this stage, the listeners were already fully ripe for that, to throw out all the blue chips from the portfolio entrusted to them and go under the banners of Drexel and Milken. However, to be sure, two more blows were struck.: first the CEO of some new company, achieved impressive success and national adoration (say, Ted Turner from CNN) frankly admitted, that he owes everything in his life to "junk bonds" (by the way, in Milken's entourage, these securities were never called that - only "high yield bonds"). At the end of the day, the magician and wizard Michael himself appeared and summed up one of his famous emotional and extremely convincing toasts.

The result of the festivals exceeded all expectations: first hundreds of millions flowed into Milken's "junk bonds", and then billions of dollars. Before the eyes of the astonished and angry public of the traditional financial beau monde, a completely new market was flourishing.. New and hostile, because he was diverting funds from big capital.

Now is the time to reveal the mechanics of the successful functioning of the "Milken machine". I see, what if there were no real facts, then no "film stars" would be able to turn portfolio managers from the path of the true. In fact of the matter, that the facts were. Facts and achievements. Let's say, in 1986 year none of the companies from Milken's nest, issuer of high-yield debt, was not in default: every one of them regularly paid for their current obligations! Unbelievable, but the fact. Besides, unprecedented liquidity was provided for the entire junk bond market. This meant, that at any time it was possible not only to buy these securities, but also sell easily. Moreover, at an almost unchanged price. This instilled in portfolio managers confidence in the future and recruited more and more clients for Milken..

How did Milken manage to achieve such impressive results?? No wonder they say, that the devil is in the details! It was in the mechanisms of regulation of the market of "junk bonds" that the legally piquant aspect was discerned.. Almost the entire Milken market was built on artificial imitation. This was done in two ways.. Firstly, Michael enlisted the support of a very narrow circle of financial tycoons, whose public reputation made, at least, scowl of clean people. Together with Milken, they made the "trash" soup: Ivan Boeski, first-class wall street robber (it was he who brought Milken to justice!); "Subversive quadriga": Carl Icahn, Ronald Perelman, Tee Boone Pickens and Victor Posner - people, which every blue-chip CEO personally hated (why - you will soon find out!); Saul Steinberg, owner of the largest offshore insurance conglomerate; Fred Karr and Karl Lindner (two more "insurers").

This whole company, together with Drexel himself, provided 70 % liquidity of the junk bond market. In simple human terms, a group of trustees bought and sold securities from each other. Milken's California department alone conducted 250 thousand (!!!) transactions with securities monthly! Transactions were carried out between hundreds and thousands of coded accounts without specifying the names of buyers and sellers. And here is the paradox: the system worked! And it worked amazingly well, without giving even the slightest disruption. The junk bond market has amazed even the most seasoned Wall Street veterans with its stability and income. As a result, Milken's junk bonds went up 900 companies, whole industries flourished, which are the pride of the American economy today: cable TV (already mentioned by CNN and its creator Ted Turner), telephony (MCI is the main competitor of ATT monopoly), regional airlines, biotechnology, health insurance and distance learning companies. No cheap financial investments, provided by Milken, they would never have been able to unwind in such a short time.

If junk bonds were only used to finance promising new directions, Milking, Sooner or later, erect a monument, not sent to 10 years behind bars. Moreover, despite numerous minor offenses, That, of course, accompanied the activities of the California department. In the words of an unnamed Wall Street worker: “There is not a single investment company, which at least once did not violate the strict rules of the SEC ". Problems, but, therein, that junk bond financing was mostly used for a completely different purpose - for the LBO.

Behind this macabre acronym lies the corporate establishment's biggest nightmare - Levеragеd Buy-Out., "Credit ransom" - jackal attack on a wounded lion. The role of the lion was played by the "blue chips", and the jackal was just the guys from Milken's pack, first of all, the aforementioned "subversive quadriga". The meaning of a loan buyout: small, but a very impudent company buys a controlling stake in some pillar of the economy with a billion-dollar capitalization and a hundred-year history. However, the raider does not use his money. (and where did he get such amounts!), but takes them on credit. The loan is secured by the shares of the victim company.. As the reader has already guessed, the money for the loan came from "junk bonds". Michael Milken designed for Boesky, Posner and Ikana with comrades a wonderful mechanism, which allowed, after a successful raid, to easily cover debt on "junk bonds": the attacked blue chip was completely torn apart in that sense, that her juiciest assets were immediately sold out. Most of the money received ended up in the pockets of the raiders, the rest went to debt service.

Miami businessman Victor Pozner was reputed to be the most disgusting raider, risen in age 20 years in real estate speculation. He had a couple of elementary education classes and a mighty experience of destroying traditional businesses.: he bought shares, gained control of the company, ripped it off as sticky and threw it out into the street along with all the minority shareholders and employees. In "Drexel" Posner got the nickname "Midas vice versa": unlike the Phrygian king, Posner, at the slightest touch, turned gold into mud. His most scandalous raid was the attack on the Fischbach engineering and construction company.. The entire operation took place under the financial control of Milken., which not only ensured the placement of Posner's junk bonds, but also took a direct part in the "parking" - a criminally punishable thing, well known to our domestic entrepreneur. In the broadest sense, parking involves the temporary transfer of funds without documentation to friendly structures. In the Fischbach story, Ivan Boeski bought shares for Posner at Milken's request.

Whatever it was, but it was credit redemption with junk bonds that forced the entire economic, the financial and political establishment join forces and act as a united front against Michael Milken and Drexel. First, the Senate and Congress received hundreds of complaints from the most influential entrepreneurs and public figures.. Countless investigations have begun, as a result of which already in November 1986 years in Congress 30 legislative initiatives, imposing restrictions on investments in unrated ("Trash") bonds. IN 12 states passed laws, prohibiting credit redemption.

Then criminal proceedings went into action. The fight was led by the state prosecutor Rudolph Giuliani, famous for his relentless fight against the Italian mafia. The first to roll into the horn of Ivan Boeski. He managed to bargain with the government 3 years in prison and a fine 100 million dollars in exchange for any necessary evidence against Milken. The accountant Boeski Setrag Muradyan and the chief trader Milken himself - Jim Dahl. But even so, from 98 accusations, nominated against Milken, not a single one survived to the trial. In exchange for a promise to abandon the prosecution of Lowell's brother, Michael Milken agreed to plead guilty to 6 paragraphs, in which there was no insider trading, no bribes, no racketeering, no illegal manipulation of market prices (all these charges were in the Boesky case), but only giving false testimony in the case with the company "Fischbach", hidden ownership of MCA shares (parking), mail fraud, help with filing a false tax return and aiding Boeschi. However, these six points were enough for that., for 40-year-old judge Kimba Wood to give Milken 10 years in prison, one billion one hundred million dollars fine (!!!) and a lifelong ban on financial transactions.

* * *

Milken sat down 22 months. Immediately after his release, he was diagnosed with prostate cancer in the last stage with a prognosis of one year of life. Milken became a full vegetarian, took up yoga, meditation and ... again achieved the impossible: the disease receded!

Milken established the largest non-governmental cancer research institute, in which he invested more than one hundred million dollars, and also created an agglomerate of educational companies - "Knowledge Universe". Milken's most recent philanthropic initiative is called the Center for Accelerating Medical Decisions..

An interesting ending for the chapter, opening the second volume of "The Great Scams of the Twentieth Century", isn't it true? I just wanted to demonstrate to the reader, that in real life there are no unambiguous judgments, let alone sentences.