Uber (NYSE: UBER) and Lift (NASDAQ: LYFT) - giants of the passenger transportation industry. Both companies have turned the taxi world upside down, but never learned how to make money. Let's figure it out, what is their value.

What's going on here

Readers have been asking us for a long time to start looking into the financials and business foundations of US issuers.. The idea to compare the Uber and Lyft businesses was proposed by our reader Alex Freeman in the comments to the Upwork investment idea.. Suggest in the company's comments, analysis of which you would like to read.

There are many screenshots with tables from reports in the reviews. To make it easier to use them, we translated them into Google tables and translated them into Russian. note: there are several sheets. And keep in mind, that companies round up some numbers in their reports, therefore, the totals in graphs and tables may not converge.

Download the table from the report

How does Uber make money?

According to the annual report, The company's revenue is divided into the following segments.

mobility. Taxi service: anyone with a car can become an Uber driver, subject to some simple conditions, simply by registering in the company's application. The company receives a percentage of the payment to the driver. segment brings 54,66% company revenue. Segment Adjusted EBITDA — 19,19% from its proceeds.

Delivery. Here Uber receives money from restaurants for being included in the delivery system − 35,04% company revenue. Unprofitable segment, Adjusted EBITDA of the segment is −22.36% of its revenue.

Cargo. Delivery of goods by order of logistics companies by truck drivers, registered with Uber, — 9,07% company revenue. Unprofitable segment, its adjusted EBITDA is −22.45% of its revenue.

Collaboration between Uber technology teams and other companies. Project to develop a self-driving car. The division was sold at the end of 2020, more precisely, spun off into a separate company, in which Uber will have a stake. segment brings 0,89% proceeds, and he is profitable: adjusted EBITDA is −375% of its revenue.

All other revenues. Rental of electric bikes and scooters - in 2020 the company sold this business. He brought 0,34% of the company's total revenue. Unprofitable segment: its adjusted EBITDA is −245.7% of its revenue.

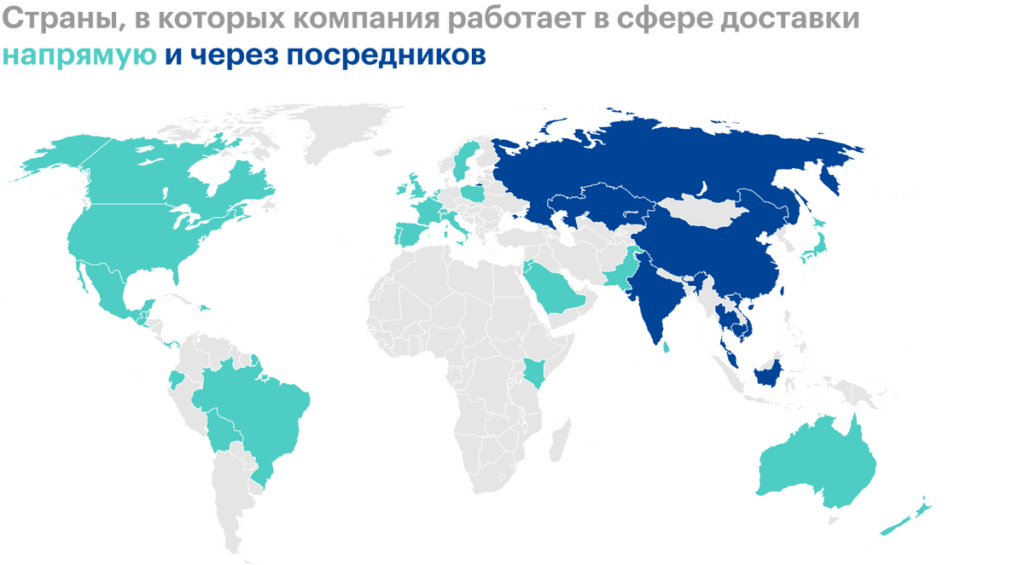

The US and Canada account for 59,35% company revenue, the rest - to other regions of the planet.

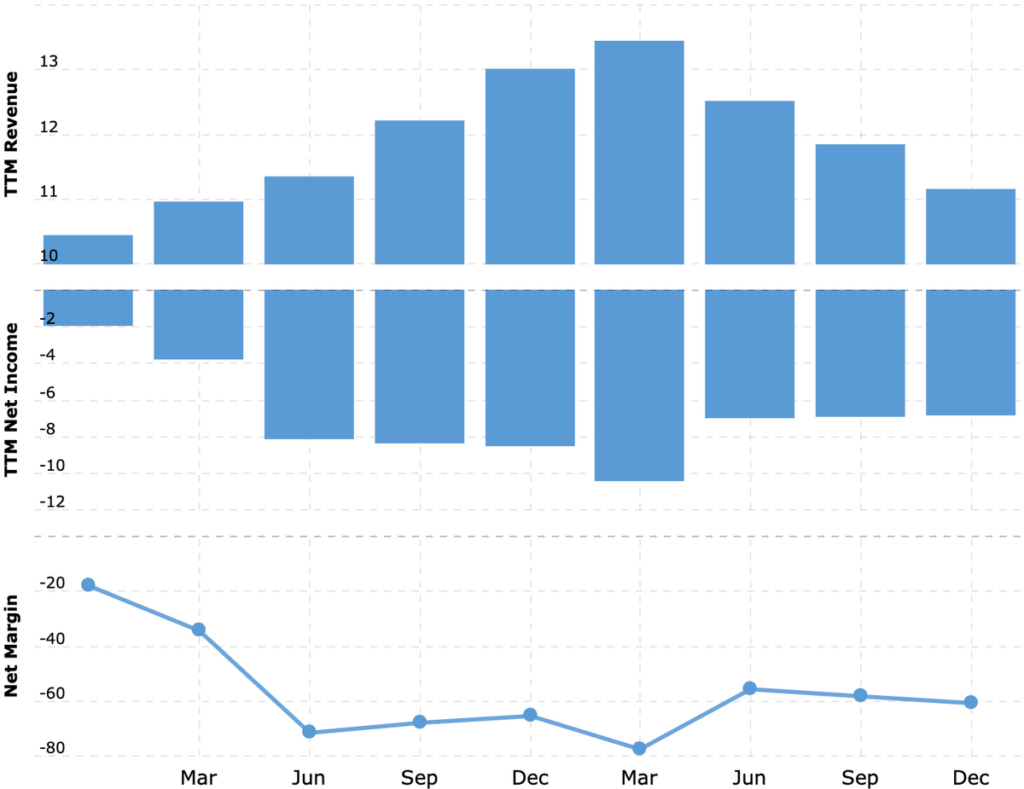

The company is deeply unprofitable on all fronts - do not be deceived by the indicators of "adjusted EBITDA". Indicators, non-GAAP calculated, don't cost anything at all.

Shares of the company in other enterprises, billion dollars

| Didi | 6,3 |

| Grab | 2,3 |

| Yandex | 1 |

| Other | 0,4 |

| All in all | 10,1 |

Didi

6,3

Grab

2,3

Yandex

1

Other

0,4

All in all

10,1

How does Lyft make money?

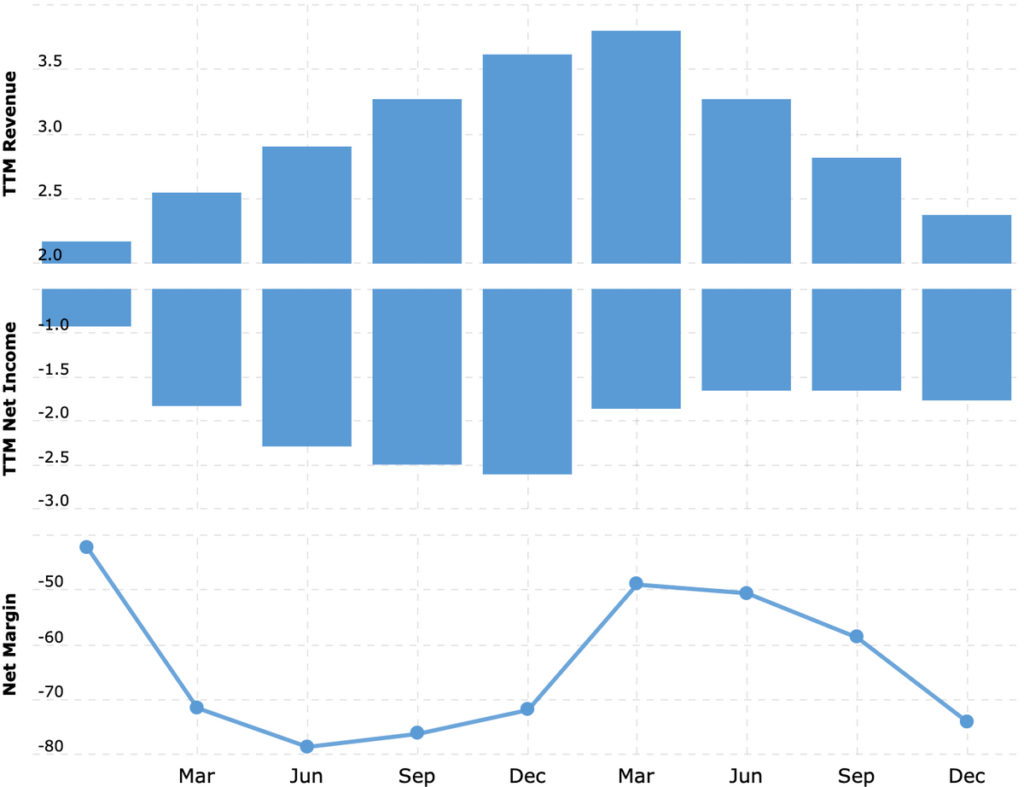

The company's annual report is useless: there is no segmentation. Lyft's core business is the same, like Uber, - app for drivers. Another company rents cars for users, as well as bicycles and scooters. The company is also working on the creation of auto-controlled cars. Lyft only works in the US and Canada. Same way, like Uber, unprofitable company.

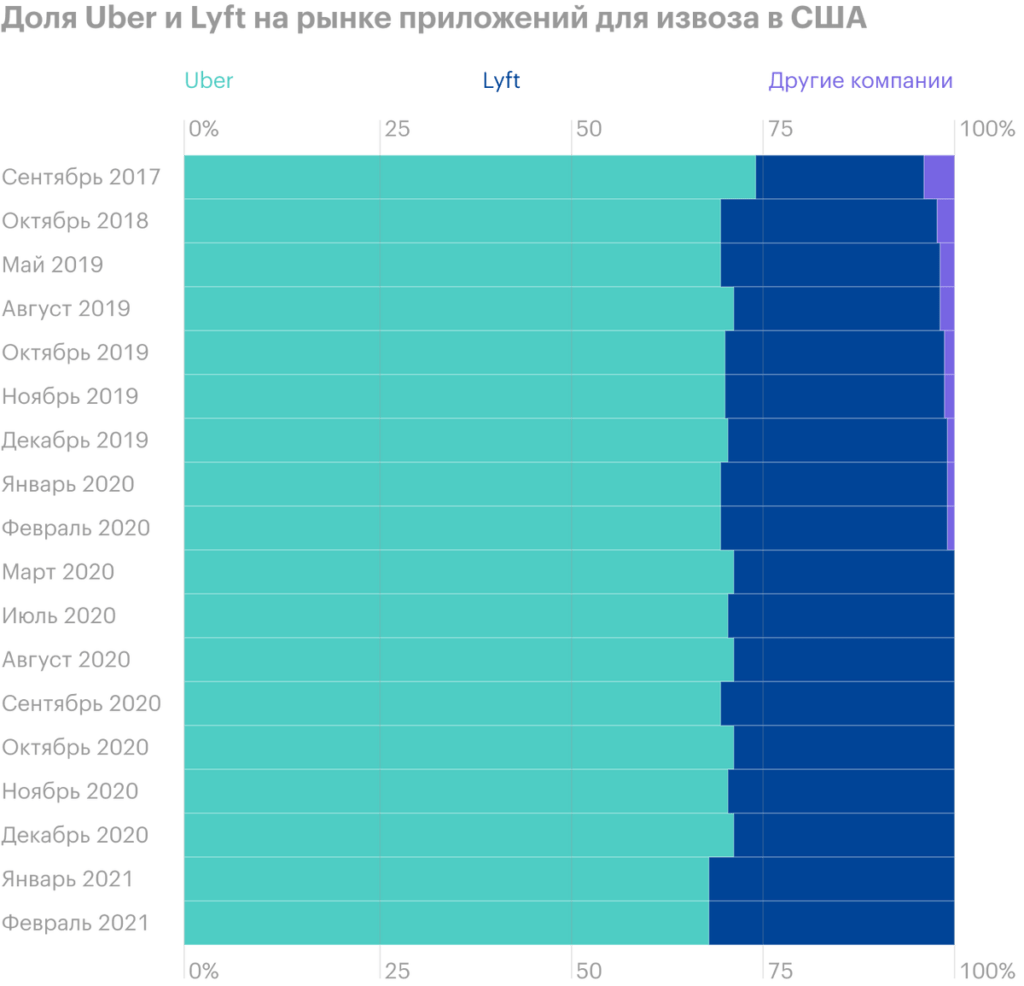

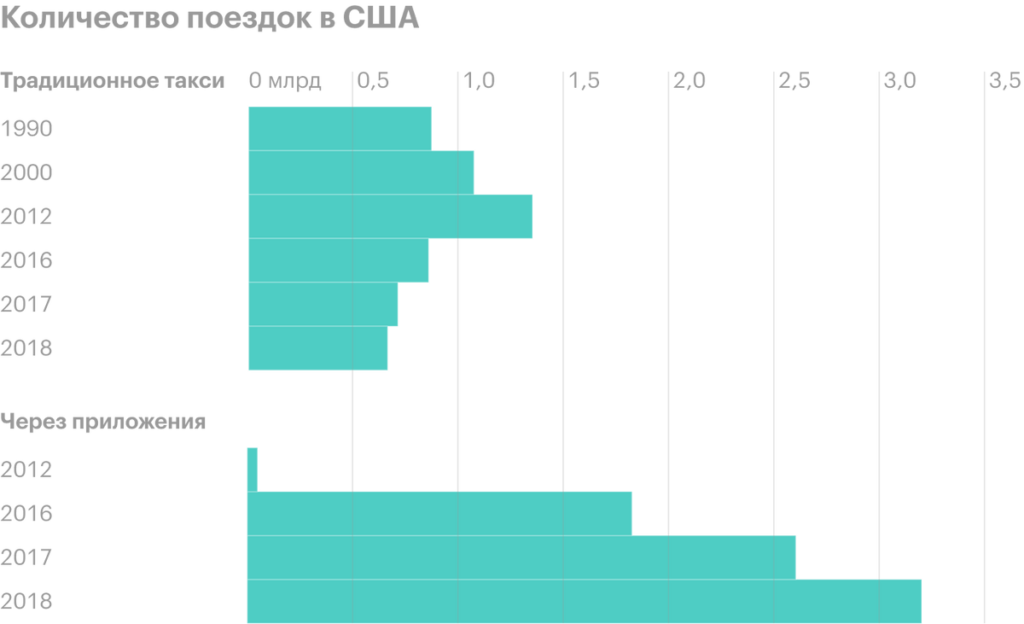

Uber vs. Lyft

Lyft is not a serious competitor to Uber: the revenue of the first is five times less, than the second. Within the US market, there is a duopoly situation between the two companies: together the companies hold almost the entire market, but the proportion of none of them increases significantly over time.

Also, Lyft does not show a desire to actively expand outside the developed countries of the Western Hemisphere and, moreover, is engaged in almost only a cab and a little more food delivery - but not even close on the same scale., that Uber.

At the same time, Uber is clearly showing ambition., close to those, what shows Amazon: penetrate into many different areas. In theory there is a possibility, that Uber will decide to buy Lyft, to finally consolidate its control over this market. But, given the low and even negative margins of this business, I think, that Uber will develop other areas, in particular the delivery of goods.

Although I wouldn't completely rule out that possibility.: there is an alternative point of view, what, by buying Lyft, Uber will finally be able to dictate prices to the US passenger market and finally turn a profit.

The market may react positively to the news, that Uber is buying Lyft. On paper, Uber's plans look very cool.: capture a significant portion of a huge $13.8 trillion market, where the company still occupies 0,49%. With such an eye, Uber's capitalization doesn't look insane, 120 billion dollars is 3,77% market. Megalomb ideas, even completely insolvent from an economic point of view, are in great demand and respect on the stock exchange - so, maybe, this scenario is just being implemented.

And still, who will win?

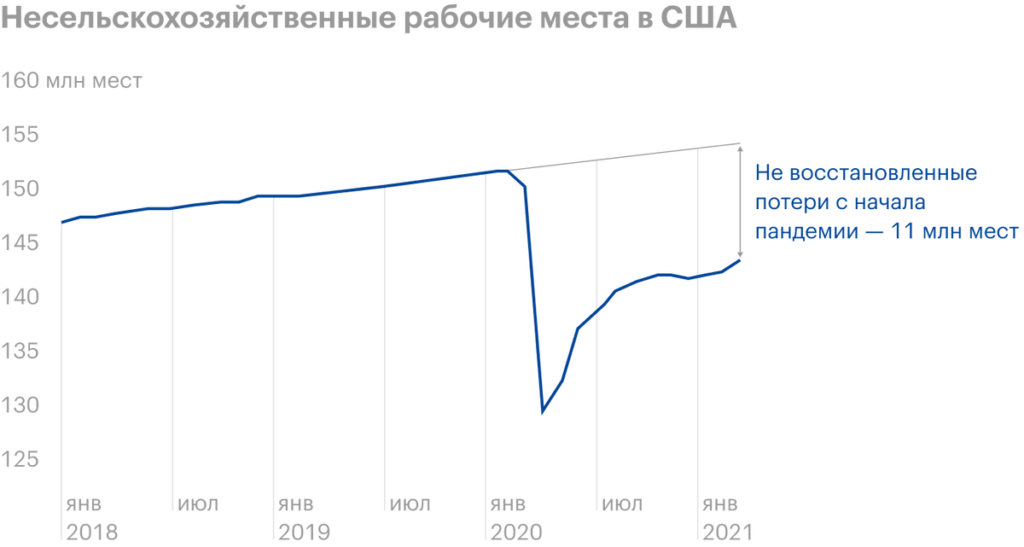

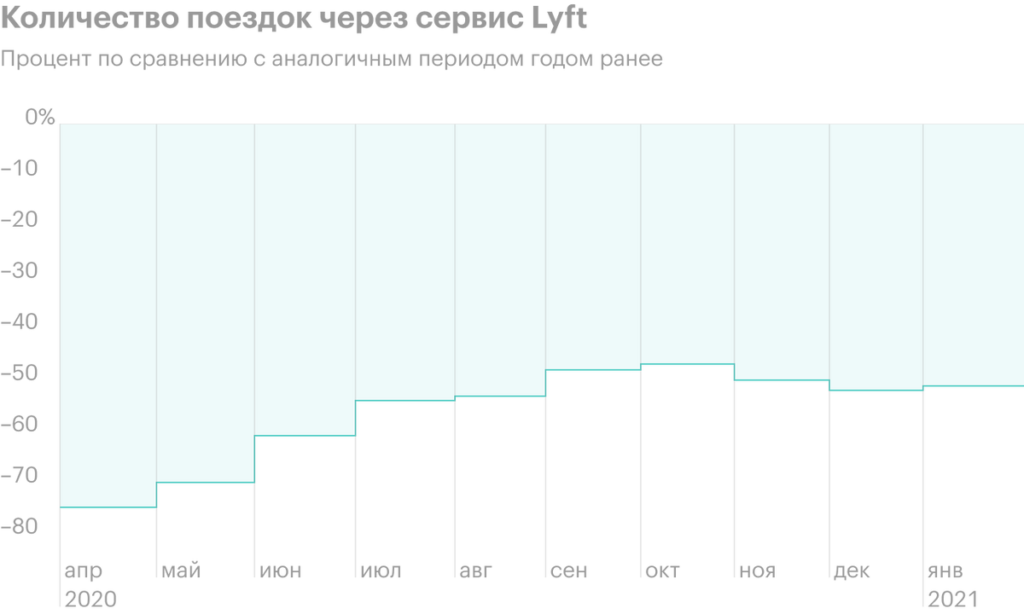

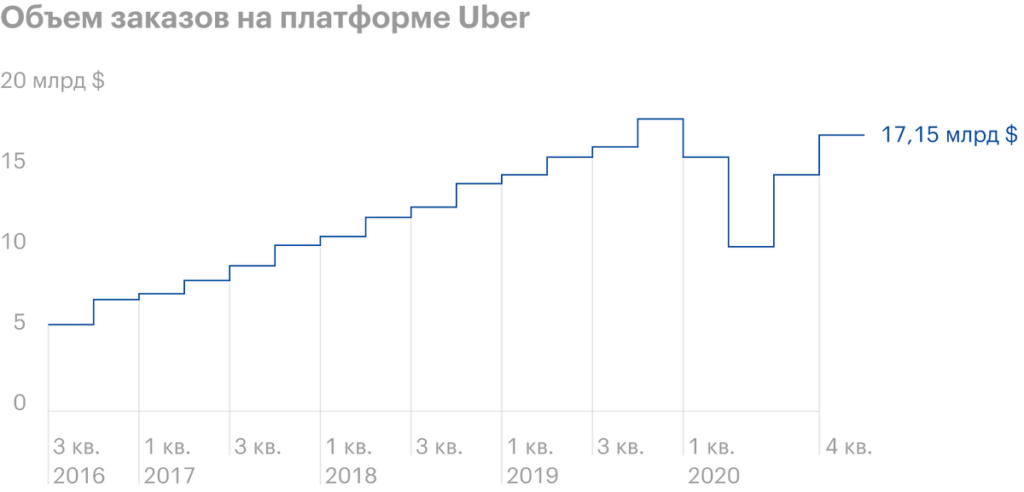

И Lyft, and Uber are money-losing ventures, That, in fact, don't make a profit. As a business, they seem untenable., especially now, in the era of a permanent pandemic, when the mobility of the population decreased and the demand for the services of both companies fell noticeably.

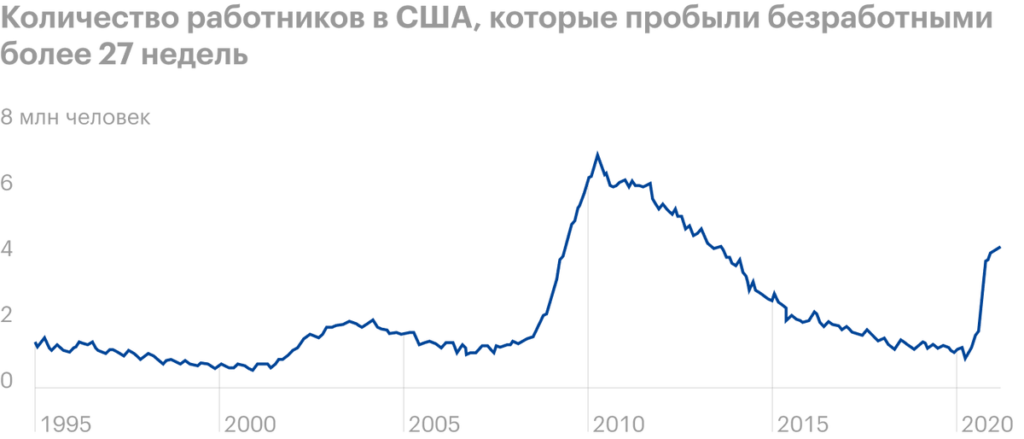

But if you look at these companies as a global economic experiment to destroy the profession of highly paid drivers, then yes, this experiment is successful. The average Uber driver in the US in the pre-corona crisis era was earning about $29,000 a year — well below the US average for regular taxi drivers of $44,000 a year.. They, who drives a lot for Uber, can earn up to 40 thousand a year. But it's hard work without these things., as medical insurance, social guarantees, minimum payment, and without everything else, what do ordinary taxi drivers have.

In large cities, entry into the profession of a taxi driver has always been very expensive and this work is well paid., until Uber and Lyft came along. Now it is enough to have a driver's license and a car - and you no longer have to pass difficult exams, as a London cabby, and buy expensive licenses, like in new york. But now you have to compete for a penny with an army of cheap performers, who are not on staff, and act as independent contractors. The last juices are being squeezed out of these drivers, and very cunning methods: the same Uber largely gamified the process of taking orders, adding game "tasks", "achievements", "medals" and other items in the application, to motivate drivers to work harder.

Should say, that Uber and Lyft have only slightly scratched the surface: The potential of the “part-time economy” goes far beyond ordinary driving and even delivery, because the share of part-time jobs is also large in many other industries, who are also waiting for their Uber. Services like Upwork are a step in that direction..

Shouldn't be ruled out, that Uber and Lyft will begin to expand beyond transportation and logistics and will begin to develop other areas: for example, hospitality industry or freelance jobs on the Internet. The situation on the US labor market is still positive for both companies: there are millions of unemployed. So,, the negotiating position of companies in relation to drivers will be quite strong: if there is a large pool of cheap labor, then already working drivers will not actively advocate for wage increases.

This is very important, because now in many regions of the world the authorities have taken a course towards, to force services like Uber to recognize their drivers as employees with the right to sick leave and minimum wage. So, for example, decided by the court in London. Such solutions can significantly increase the already high costs of these services..

However, when California passed a similar law earlier, Uber and Lyft ended up getting out of his reach, what, it seems to me, indicates that, that the “side labor industry” has high patrons, who will save her. This, By the way, can serve as an explanation, why the shares of these companies have risen so much this year, although their revenues have fallen sharply, there was no profit, so not expected, and activity levels have dropped significantly..

Well, it also helps, that many drivers of these companies themselves want to remain in the status of contract workers, instead of retraining as full-fledged employees. This, certainly, not because, that they like everything as it is, but just because, that for many of them, driving with the app is a part-time job, which they can lose if the law is passed: 100% very few drivers tax during working hours. Numerous contractors, part-time employees under the law to recognize drivers as employees, they will simply lose this job - after all, companies will not be able to cope with the costs of such a number of full-time employees. As the economist Joan Robinson said on a similar occasion,: “The suffering from capitalist exploitation is nothing compared to the suffering from, that no one is exploiting you".

But the threat of disruption to operations due to changes in labor laws in large cities should not be discounted.. Same Uber 22% orders fall on 5 large agglomerations: Chicago, Los Angeles, New York, London and Sao Paulo.

The percentage of part-time employees in different industries

| Recreation and entertainment | 38% |

| Construction | 33% |

| Business Services | 30% |

| Finance | 25% |

| Transportation or work in warehouses | 24% |

| Information services | 22% |

| Education | 20% |

| Professional or technical services | 19% |

| Hotels or catering | 19% |

| Retail | 16% |

| healthcare | 13% |

| Mining | 7% |

| Wholesale or housing and communal services | 7% |

| Production | 2% |

Recreation and entertainment

38%

Construction

33%

Business Services

30%

Finance

25%

Transportation or work in warehouses

24%

Information services

22%

Education

20%

Professional or technical services

19%

Hotels or catering

19%

Retail

16%

healthcare

13%

Mining

7%

Wholesale or housing and communal services

7%

Production

2%

Uber and Lyft drivers about their position in the company

| Before the pandemic | After the pandemic | |

|---|---|---|

| I want to be a full-time employee | 9,95% | 17,44% |

| I want to be an independent contractor | 81,47% | 71,39% |

| Do not know | 8,58% | 11,17% |

I want to be a full-time employee

Before the pandemic

9,95%

After the pandemic

17,44%

I want to be an independent contractor

Before the pandemic

81,47%

After the pandemic

71,39%

Do not know

Before the pandemic

8,58%

After the pandemic

11,17%

What about others?

In the comments on the same Upwork idea, our reader Konstantin Burkov also suggested comparing the results of other “auto-apps”.

Singapore App Grab, where Uber has a stake, until it becomes profitable.

Yandex taxi is not the main, but very large segment: 31,12% from the entire revenue of the company, it includes delivery. The segment's adjusted operating income is 3,52% from its proceeds. The word "adjusted" in 99,999999% cases means unprofitable by GAAP standards, so I wouldn't count, that the example of "Yandex-taxi" shows, that pickup apps have the potential to be profitable.

According to Citymobil, a joint venture between Sberbank and Mail.ru Group, I also did not find normal profit data.. “Normal” is when they are not “adjusted”.

Gett's pre-pandemic adjusted EBITDA turned positive, but it's not indicative of normal profitability.

According to some information, Chinese Didi is already profitable: it seems like the company earned as much as a billion dollars in 2020. But this is known only from the words of the owners of the company.. Basically, I'm ready to believe it: cars and people are cheaper in China, than in the USA, therefore, there is really a more likely option for a profit for such a company. Finally, the same Chinese Alibaba squeezes huge profits in the online commerce sector, in which the American Amazon brings in a measly penny after deducting all expenses. But, Again, about Didi's profit is known only from the words of the company's owners.

At all, after the story with Luckin Coffee, I perceive all the wonderful stories from China - with a great deal of skepticism. And the profit of a taxi service in terms of demand at the level of 60-70% from “before the pandemic” is a miracle..

As a result, taxi applications can be considered "conditionally profitable": there is at best a very low margin and often no final profit. The same can be said about food delivery services - which we already talked about in the DoorDash and Grubhub reviews.. By the way,, and transport applications, and for food delivery depend on the labor of an army of low-paid "independent contractors".

Resume

If Uber and Lyft are subsidized experiments to increase the degree of pauperization in the labor market, then, maybe, these companies are worth investing in. Think, they will continue to pump the same, how to pump unprofitable Tesla to popularize electric cars: so that more such applications appear and reduce the cost of labor of workers in many other industries. But as a business, both companies are completely bankrupt.. At the same time, this does not completely cancel the opportunity to earn on their shares..