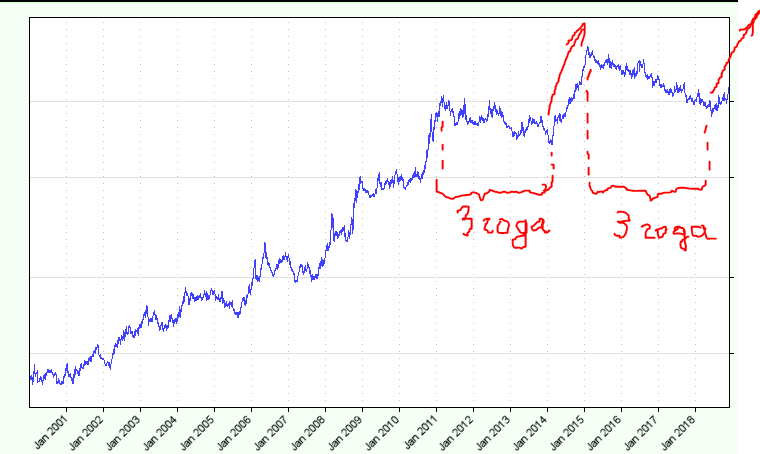

As known, due to zero rates, with 2011 years with a break for 2014 a year stopped earning a previously widespread method among trend-tracking funds, so-called trend tracking systems for a diversified futures portfolio. Almost all funds have been at a loss for seven or eight years..

And here it is., seem to be, with an increase in rates, there is some movement, which will possibly stir up commodity futures and the tradition of entering a trend three years from the previous peak, like last time, will repeat. So far, the movement is connected, mostly with oil, gasoline, natural gas and palladium, which are in trend now. But will the trend continue, it's a question.

The picture shows my benchmark of a long-term trend-following system for 17 major futures, diversified by sector.

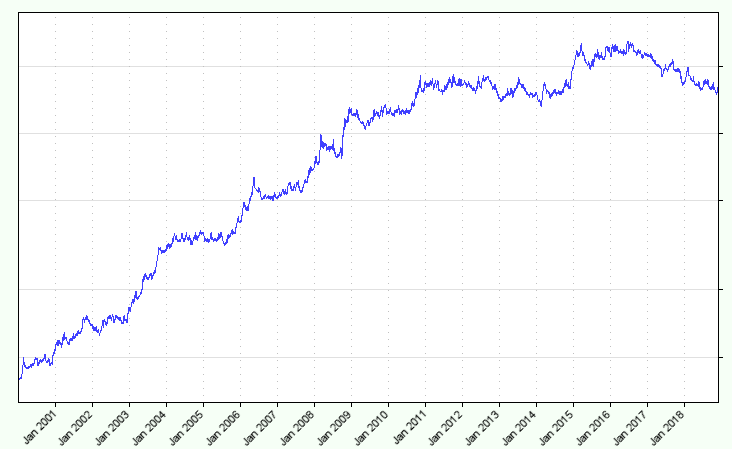

But, On the other hand, mid-term benchmark (in the picture below) while sleeping, which does not instill confidence that trend tracking will ever recover. The same is with the short-term.

Probably, there will be a question, what are these benchmarks? These are simplified, for universality, trend following systems. For a long term, it is wider so that the average position holding time is within 40-60 days, for the medium term 15-20 days.