In the spring 2017 analysts at Credit Suisse bank published report About "the real role of HFT trading in the modern ecosystem of the financial market". The document states that, like high frequency Trading changed the state of affairs on the world's stock exchanges – we have selected the five main conclusions of the study.

Increased trading volumes

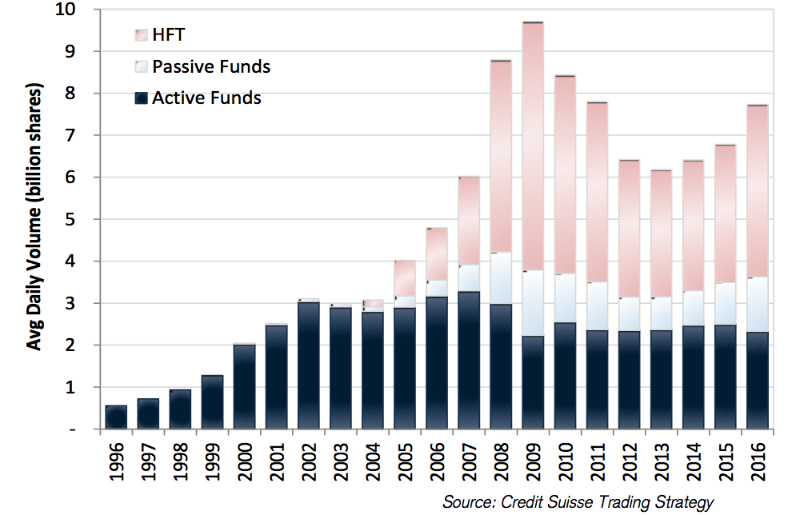

The development of high-frequency trading technologies has had “the greatest, the most noticeable and long-term "influence on trading volumes. Credit Suisse estimates, Trading volume, which accounts for the operations of trustees and investors, both active and passive, in the American stock market has remained almost unchanged over the past ten years (3-4 billion shares per day).

At the same time, the total trading volume on the US stock exchanges in the period after the crisis 2008 years more than doubled, and it was during these years that HFT was developing especially actively – trade.

This fact also has negative consequences - for example, the topic of "fake" activity of trading robots is widely discussed, which can submit many bids, and then immediately cancel them, hoping to influence the price. However, in general, Credit Suisse analysts believe, that "much of the HFT activity helps to connect people operating in the financial market, reducing the time spent waiting for the counterparty ".

The difference between the prices for buying and selling shares has changed

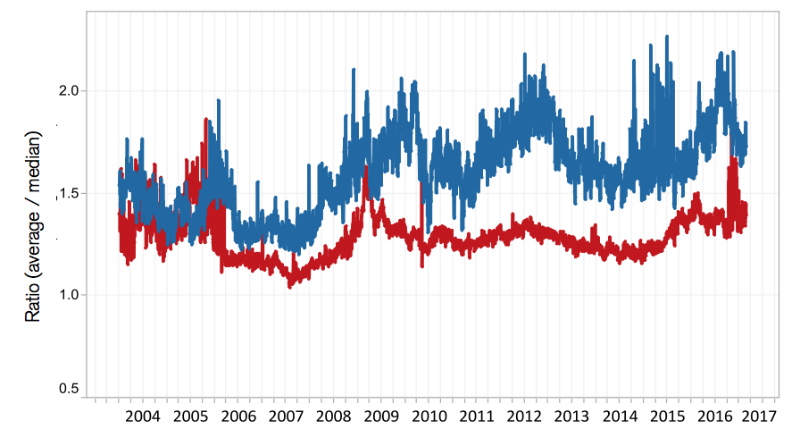

Price difference in purchase orders (we) and sale (ask) called bid-ask spread - this is an important concept for stock trading. In theory, the smaller the "gap" between them, the better for the market. The development of HFT had an impact here too - the size of the spreads of shares of large companies decreased, and smaller ones - vice versa, increased. This indicates, that high-frequency traders are more often interested in more liquid shares of well-known companies.

Credit Suisse report, stock spreads change according to volatility, and variance of spreads between the most and least liquid stocks with 2009 years increased significantly. That is, now the spreads of shares of large and small companies no longer move in the same direction..

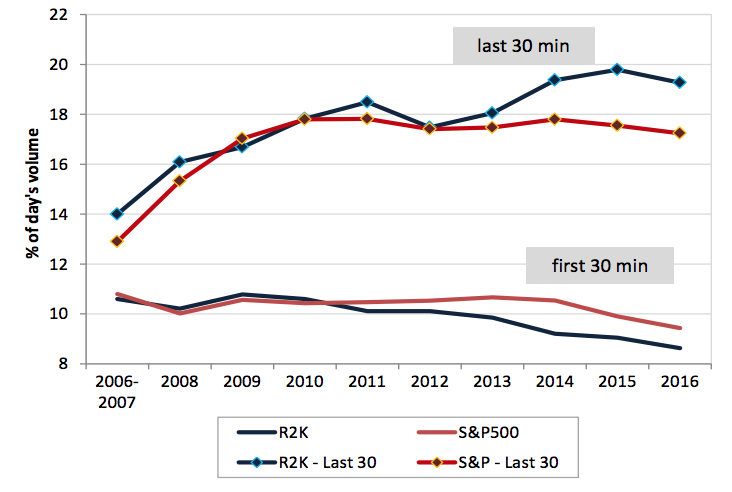

Shares of large and small companies are volatile at different times of the day

The volatility of stocks of large and small companies in recent years has been observed at various periods of the trading day.. For instance, at the beginning of trading, the price of shares of not the largest companies changes more actively - this is due to the fact, that it takes more time to determine the fair price of such shares at the moment. However, by the end of the trading session, against, such actions are calmer, than securities of large organizations.

Against, for shares of large companies, which are actively traded on the market, sometimes there are “flickering” price fluctuations, when they quickly change many times within the bid-ask spread at the end of the trading day. Both of these phenomena are also attributed by analysts to HFT..

The number of notable spikes in stock prices of large companies has decreased

Usually, HFT trading strategies aim to profit from market inefficiencies, rather than participating in large price movements. This results, among other things, in a decrease in large fluctuations in prices of well-known companies., with which high-frequency traders often make transactions.

A source : habrahabr.ru/company/itinvest/blog/343286/