Few people know, how mutual funds work. People hear this abbreviation for the first time, When do you start investing.

Banks and investment companies offer to invest in mutual funds, but no one explains, how investment funds are structured, who benefits and who manages them.

I work for a management company, which invests money for fund shareholders. I'll tell, what are mutual funds, what are their advantages and what are the risks. But I'm a person in some way interested, so take my words with skepticism. The conversation will be long and rather boring.

How mutual funds are arranged

A mutual fund is like a safe, in which investors' assets are stored: The money, real estate, securities, shares in OOO And so on.

A share is a conditional share of property in this fund. This is a registered security, which confirms, that you own such and such a share of such and such a fund.

The property from the safe is managed by the management company. Her task is to earn money for shareholders on behalf of the mutual fund. To do this, she manages the assets of the fund.: rents out property, issues loans, buys and sells securities, currency, shares in organizations. If the value of the fund's property increases, the share price is also growing.

Services OK paid. The management company benefits, so that the shares of its funds grow in value: this is the best advertisement for attracting new shareholders. The more shareholders, the more assets OKand the more money she gets for her work.

For shareholders' assets OK responsible before the law, so she can't just sell them, take the money and go into the sunset.

Before becoming a shareholder, investor studies the rules of trust management of the fund, Remote control, - document, where the conditions for the functioning of the mutual fund are prescribed, - and then transfers money or other property to management OK. It becomes the common share property of the shareholders, and you can no longer take it out of the fund.

There is a concept "anchor shareholder". This is a big investor., who is ready to invest assets immediately for a large amount, on average from 25 million rubles, but wants, for the mutual fund to work on its terms. Then OK creates a separate fund, all shares of which belong to this shareholder. The company manages the property, shareholder receives income.

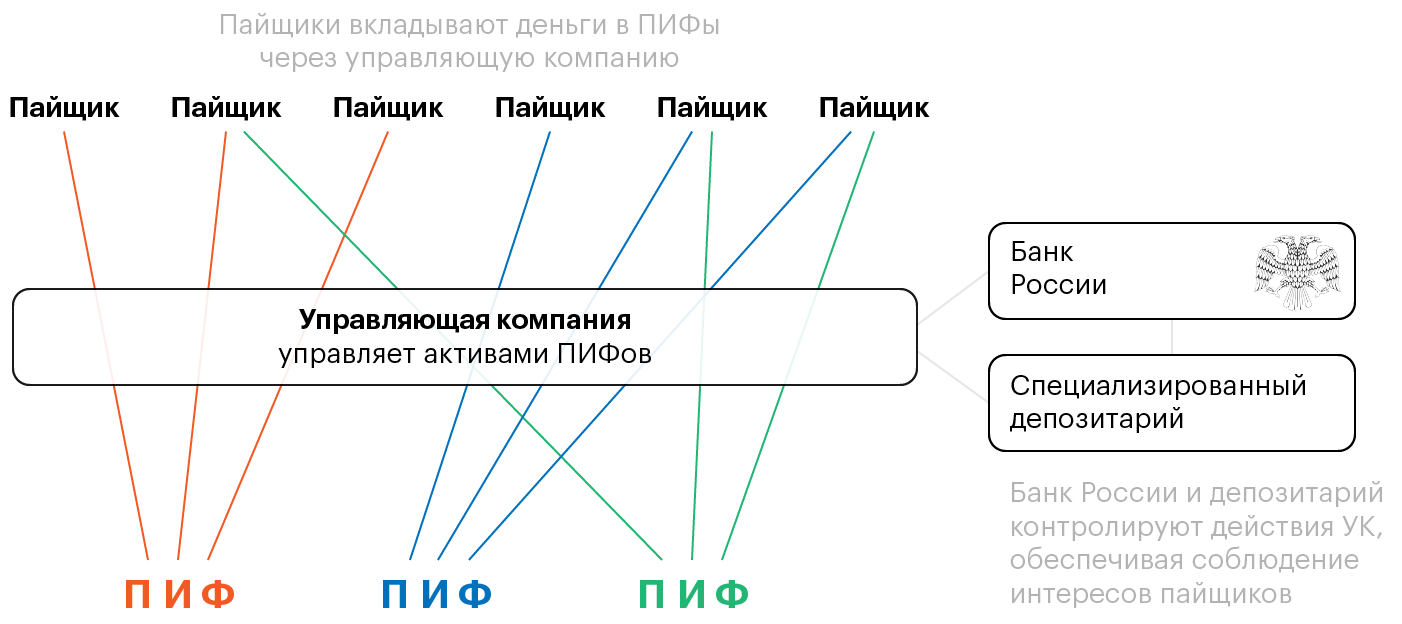

I'll explain a little, what is shown in the diagram.

Shareholders invest in different funds, and OK manages them, earning money for the shareholder. Different shareholders can invest in the same fund. Funds invest in different assets.

Same OK can manage different mutual funds. Every month she takes part of the funds from each fund as her remuneration..

OK closely interacts with a specialized depository (SD). SD renders OK services: maintains a parallel accounting of the property of funds, gives consent to transactions, controls the disposal of property of mutual funds in the interests of shareholders, agrees reporting OK. For these services, the special depositary also receives from OK monthly remuneration.

OK And SD controlled CB RF: hand over to him reports of funds, provide information upon request, comply with all regulatory legal acts of the Central Bank.

CB RF And SD for the management company - regulatory authorities. They follow the action OK in order to protect the interests of shareholders.

CB can send a request to the special depositary, to obtain information of interest to him about the management company, And SDis obliged to provide this information.

How to earn on shares

It is impossible to withdraw the property and money invested in the mutual fund. But the shareholder has two ways to exchange his shares for money: redeem shares or sell them to another investor.

Redemption of shares. In this case OK compensates the value of redeemed shares in cash.

Sale to another investor. The shareholder has to find a buyer and negotiate a price with him. Some shares are limited in circulation, so it's not easy to sell them.

Selling depends on, for which investors the shares are intended. If the mutual fund for qualified, experienced investors, then you can't. If for unskilled - you can.

Units for unqualified investors are called units, not limited in circulation. Shareholders can freely dispose of them: sell, pledge, present, leave a legacy. Anyone can freely buy such shares, receive income from them and sell them at the market price at any time.

On the shares, like any other securities, can earn speculative way: buy, when they get cheaper, and sell, when they went up.

A share has a current value and a market value.. The current value is recorded in the documents, this information can always be found on the website OK. The market value is slightly different from the current one and depends on many factors, including from the general information background. Here - how to bargain.

Let me explain with an example. Let's admit, you own shares of a closed-end mutual fund, its main assets are residential real estate. Real estate market statistics released, and it turns out, that the market went down. Means, housing cost, owned by the foundation, will decline. Consequently, the value of your shares will also decrease in the next couple of months. If at this point you decide to sell your shares, then their market value will be lower than the current.

Another example: PIF, shares of which you have purchased, invested in shares of oil companies. The cost of a barrel is growing and dragging the entire oil sector with it. If at this point you decide to sell shares, they will be bought above the current price.

Income and taxes

Mutual funds are not guaranteed returns.: shareholders may not earn anything or even lose money. Profitability depends on a huge number of factors: manager's experience, understanding the processes taking place in the economy, seasonality, crises, exchange rates, oil prices and more.

The results of investing the same fund from year to year vary greatly. Some mutual funds for 2017 have grown by more than 25%, and some lost money.

While the shareholder makes a profit, he has to pay tax: NDFL. The management company does it for him., acting as a tax agent. But if the shareholder sells shares, the tax on possible income, namely, the difference between the sum, proceeds from the sale of shares, and sum, spent on their purchase, will pay on its own. The income tax is: 13% for residents of Russia and 30% - for non-residents,

If you own shares at least 3 years from the date of purchase,

Qualified and unqualified investors

Mutual funds are different. Funds for qualified investors, or qualifying funds, different from mutual funds for beginners, unqualified investors. Supposed, that shareholders of qualified funds are willing to invest in riskier and more profitable instruments.

Qualified funds provide shareholders with more investment opportunities. For example, Qualified real estate funds can include property rights from reconstruction contracts, and in funds of financial instruments - derivative financial instruments, e.g. futures for the purchase of exchange-traded securities. For this, certain conditions must be met., listed It will not be possible to include such risky assets in nonquantal funds..

Qualified Fund Shareholders Can Control Big Deals, for this OK convenes a meeting of a special commission of shareholders - investment committee, IK. Before the deal OKexplains all the conditions to shareholders and asks them to vote. The deal will take place, if the majority votes in the affirmative.

IN IK not all shareholders participate, but only those who have a certain number of shares. Results and Protocol IKsent to a specialized depository, SD, registrar, and shareholders - so that they understand, deal accepted or not.

If the fund is not qualified, then the investment committee is not needed. OK she solves all issues and concludes all transactions, without asking the consent of the shareholders. Non-qualified funds are less risky and do not require the participation of shareholders.

real estate mutual fund

Mutual funds differ depending on the assets, which can be included in.

Mutual funds for investing in real estate are considered the most reliable funds., because the property is insured, and there is always some demand for real estate.

Investing in real estate is a big long-term investment.. The entry threshold for investors starts from a million rubles, because real estate is expensive, and OK it is much more convenient to work with several large shareholders, than with many small.

Here's how a real estate mutual fund works. Let's admit, the investor has 2,5 million rubles and he wants to receive a stable monthly income from them, but this amount is not enough, to buy and rent property. He turns to OK, which finds nine more of the same investors and agrees with them on the creation of a mutual fund. The money of all investors is added up and transferred to the fund, then OK starts to manage. On 25 million purchased commercial real estate with a stable rental flow. For example, office in a business center or warehouse.

If everything goes according to plan, the value of the fund's assets will grow along with the value of real estate, shareholders will receive a share of the rental income, and OK - your reward.

Mutual investment funds of market financial instruments

Mutual funds of market financial instruments for unqualified investors work with money, securities, shares in OOO, loans. In mutual funds of financial instruments, the risks are much higher, than in real estate mutual funds. You can be left without income and lose the invested money.

Securities, unlike real estate, not very expensive, not taxed VAT and they do not require a large staff to manage them. Therefore, the entry threshold for investors may also be lower., even from a thousand rubles. No exact amount: Each OK she decides, how much money should the shareholder invest, to make it profitable to work with him.

Here's how a market-based mutual fund works. Let's admit, the investor has 250 thousand rubles. He wants to get the maximum return with a reasonable level of risk and as quickly as possible.. The investor does not want to play on the stock exchange on his own, therefore turns to OK.

She finds other investors with a similar goal, pools funds and creates a fund of market financial instruments. With fund money OK buys securities: part of the funds is invested in shares of promising companies and shares in OOO, part - in bonds of the Ministry of Finance or large corporations, good coupon payments, part - in shares of open mutual funds. The rest of the money is put on deposits.

Specialists OK track changes daily, analyze financial information, sell declining assets and buy rising ones, promising.

Combined mutual fund

Combined mutual fund is a new tool, appeared on the Russian market at the end 2016 of the year. You can include anything in this PIF., other than cash. For example, aircraft, private roads, collection cognac, stamps and other collectibles, works of art, oil and wheat options, precious metals and stones, cryptocurrencies, foreign deposits. It all depends on, what OK prescribed in the rules of the fund.

But there is a nuance: property, except for real estate, must be kept in the depository. Therefore, it will not be possible to “pack” a factory for tailoring sneakers into the fund, but the sneakers themselves are quite. To do this, you need to pre-register sneakers in Remote controland agree with the depository on storage, and the UIF sneakers themselves will have to buy from the factory as a commodity.

OK while they are in no hurry to purchase everything in combined funds and stick to more traditional financial instruments.

Open, interval, closed mutual funds

Different types of funds have different terms for the purchase and redemption of units.

Shares of open funds do not have a finite number, and you can buy them at any time. In interval funds, terms, in which you can apply for the purchase of shares, fixed in the rules.

In closed-end funds, shares can be purchased only during the formation of the fund or at the time of additional issuance of shares. For the issuance to take place, OK must issue an order and carry out the appropriate procedure, and then pay the fee and make changes to Remote control. Usually, additional issuance is carried out, when OK and the investor has already agreed, what property will go to the fund.

In open funds, you can redeem shares on any working day., in interval and closed, everything is a little more complicated.

Buying and selling shares

You can buy shares from OK or its agents, for example brokers, investment and financial companies. To do this, you must submit an application and transfer money to the account of the fund.. It's not hard.

To become a shareholder, need to take a few steps.

Choose a mutual fund and find out, who is the registrar: look in Remote controlon the first page.

Ask the registrar about the documents, required to open a personal account. Usually, for an individual, a passport is sufficient and INN.

Submit an application for the purchase of shares, if you buy shares directly from OK or its agents, and send it to OK. A copy of the application is always in Remote control.

If you buy shares from another shareholder, it is enough to conclude a contract of sale, it does not need to be notarized. Only the registrar will need to show the contract, to be entered in the share register.

Pay for an application or contract, for example, in the personal account of your bank. Everything, now you are a shareholder.

Selling shares is harder. The shareholder can sell his shares himself or through intermediaries: brokers, agents, investment companies.

If you want to make the most money on the sale of shares, look for buyers and involve intermediaries. Looking for investment companies, who are engaged in the resale of shares, find a buyer through friends or on financial forums. To sell shares, it is enough to conclude a simple contract of sale and submit it to the registrar.

If you do not want to waste time searching, write an application for the redemption of shares in OK. Units will be redeemed at current value, documented, bargain and earn no more.

Advantages of mutual funds

There will be disadvantages, but first, the merits.

High yield possible. Mutual funds can show good returns compared to deposits and bonds. It all depends on the strategy, adheres to OK.

No need to mess around with money every day. The shareholder does not waste time studying and analyzing markets, does it OK. She keeps track of changes., tries to minimize risks and increase assets. She knows, What factors should be taken into account in the first place?, how to correctly assess and reduce risks.

Reporting. If the shares are not limited in circulation, then OK is obliged to publish monthly reports of the mutual fund on its website. Anyone can get the most detailed information about the composition and structure of the fund's assets.

Protection Mechanisms. The interests of the shareholders are well protected. OK it is unprofitable to bankrupt the fund, since its remuneration and business reputation depend on the volume of assets. A couple of dubious deals - and all shareholders will scatter.

Selling the fund's assets quickly for next to nothing is also impossible.. Specialized depository (SD) will not give consent to a suspicious transaction and will be obliged to report it to the Bank of Russia. And the Bank of Russia may require OK economic rationale for its actions and, if he deems it insufficient, involve the prosecutor's office.

No risk, related to the payment of penalties. penalties, fines and penalties OK pays out of his own pocket. For example, if the counterparty sued the fund and won, or if the fund did not pay the contractors on time. The interests of shareholders should not suffer in this case..

Fixed expenses. Amount of remuneration OK registered in Remote control, there are also limits on spending from the fund: remuneration SD, registrar, appraiser, auditor, other expenses. If at the end of the year OK spend more, than those recorded in Remote control percentage of the average annual value of the fund's net assets, she will have to pay back. This should guarantee the shareholder protection from unnecessary expenses. OK.

Possibility to change CC. If the shareholders do not like, how OKmanages their assets, they can make a change OK to the general meeting of shareholders. Shareholders can do it, owning a total of at least 10% of all issued fund units. In this case, the depository will hold the general meeting.

Possibility to exchange shares of one mutual fund for shares of another mutual fund in the same management company. This is useful in cases, when the shareholder is satisfied, how OKmanages his property, but he wants to spread the risks. For example, in OK there are several funds in trust management. Each fund is designed for its own purposes and works with certain assets. Shareholder, owning shares of one mutual fund, can simply exchange some of them for shares of another mutual fund - instead of redeeming shares and buying new ones. To pay NDFL not required for exchange., since there is no income in the form of money, and the period of ownership of shares is not reset.

Disadvantages of mutual funds

Income not guaranteed. OK cannot guarantee, that the share will rise in price, because any investment is a risk. If OKinvested in stocks, and the issuer went bankrupt, shareholders will lose money. Investments in deposits and real estate also have risks: the bank's license may be revoked, and the building may simply collapse. Therefore, in each Remote control indicated, that the results of investing in the past do not determine future returns.

Constantly growing commissions. Every year the Bank of Russia tightens requirements for employees OK, that's why OK expand staff and raise salaries. Respectively, the cost of customer service is rising.

Six years ago OK of five financial specialists could run eight closed-end funds for a fee in 50 000 R per month from each fund. Now OK, which leads eight closed-end funds, takes from each mutual fund from 150 000 R per month, and the state has at least doubled. These are average calculations., they may change depending on the activity of funds.

High entry threshold in closed-end funds. The law does not specify a minimum contribution amount.. In practice, in closed-end funds, the amount starts from 250 thousand rubles. One OK, with whom I worked, issues shares upon contribution from 10 million rubles.

In open-ended funds, the minimum contribution is much lower, meet And The larger and more famous financial institution, the more funds she can attract and the less her services will cost per client.

SD, registrar, appraiser and auditor work for the management company. Despite, what SD monitors the observance of the interests of shareholders, pays him a reward OK. This means, what in situations, which do not directly contradict the law, SD better deal with OK, by asking to modify or rewrite the disputed terms of the transaction.

The largest holdings other than their own OK also create their own depository. It's not prohibited by law. For example, OK «VTB capital asset management" Group of companies "Region"

Appraiser and auditor OK chooses for the fund herself and pays for their services at the expense of the mutual fund. That's why OK may ask the appraiser to slightly inflate the appraised value of the assets, to increase your reward. The auditor can be asked not to issue minor violations in the audit report, not to spoil the reputation OKin the eyes of the shareholders. That is, all its own, pocket.

Licensing risks. If OK revoke the license, shareholders will have to look for another trustee.

If the license of the depositary is canceled, Job OK will stop for a while. OK need to find another one SD, register changes to Remote control, revise the amount of remuneration and work procedures. Cancellation of a license can lead to disruption of transactions and loss of income.

What's wrong with mutual funds

For six years I worked in different management companies. And only one of them really worked with a large number of shareholders. Majority OK were created artificially. They were built into financial and industrial holdings, to save the company money: Mutual funds do not pay income taxes.

This is not good for the average client., because such OK do not care about the quality of services and do not value their reputation. The main shareholder provides them with stability, and the rest of the investors they consider as a small additional income.

This is what this scheme looks like for a real estate business. All assets, which are intended for sale or rent, handheld OK and become the property of the mutual fund. And then the mutual fund independently rents and sells real estate - income tax is zero at the same time.

The trick is, that the shareholder cannot find out, who apart from him owns the shares of the fund. OK every month sends a report on the owners of shares to the Bank of Russia, but this is classified information, she is not disclosed. The only option is to ask a representative OK during a private conversation, but OK not required to disclose this information.

If the shareholder wants to make sure, that he is the sole or largest shareholder of the fund, he can informally show documents. But if the shareholder wants to know, how many people have invested in mutual funds, then he, probably, refuse.

I would not recommend mutual funds to those, who wants to invest money and forget about them for a couple of years. The shareholder should periodically check, how are things going OK, learn about strategy, plans and forecasts.

A source: https://journal.tinkoff.ru/pif/