When it comes to stock market and exchange trading, first, what comes to mind for many people is forex. Really, advertising this type of investment (although such operations in this market can hardly be called) penetrated into many areas of our life - successful traders, who earn thousands of dollars in parallel with their main job or lying on the beach, look at us and from posters in subway cars, and from banners on the web. Meanwhile, everything is not so simple here.

The nature of the FOREX market

FOREX is short for Foreign Exchange., what does Currency Exchange mean. The same word Exchange in English is called the exchange or any other trading platform where the exchange of some assets for others takes place., for example, trading in stocks or futures contracts: фьючерсами и опционами. Отсюда происходит first delusion относительно природы этого рынка.

Forex firms stubbornly call the game on exchange rates - or trading on the stock exchange, либо инвестициями. In reality, the lion's share of the market for the exchange of some currencies for others takes place on the OTC market between large international banks. This is a relatively "closed club", it's very difficult to get there. Trade is carried out for very large amounts. Минимальным лотомявляется сумма в 1 million dollars or euros, standard - 5 or 10 million dollars.

Currency trading primarily provides export-import operations of bank clients, а во вторую, but not the last, - interests of own trade and investment departments of international banks, conducting their investment activities around the world. Understandably, what for, to become a client of an international bank and start buying and selling currency in order to extract "income" from the movement of exchange rates, you need to deposit more than one million dollars.

In this case, trading will be carried out, probably, without leverage and according to the quotes of the bank itself, not the free market. And the bank's quotes will differ from the desired ones for the worse for the client.. well, it is natural: the bank must also earn! Its traders won't work for free. Отсюда следует second and foremost misconception of people, involved in forex. They think, that their deals are indeed brought to the market through a clever system of "inter-broker relations". but, this is not true.

Most transactions in the real interbank market are concluded through a limited number of private information and dealing networks (for example, such well-known companies as Thomson-Reuters or Bloomberg), where the entrance from the street is simply ordered. Many networks do not have gateways, which would allow connecting external dealing systems to them in order to route client orders to the market. And to "drive" each client order into such a system is expensive and therefore not advisable.

Every deal, which is done by currency dealers of banks through such systems, then it is processed by the back office of the bank and on the third banking day, it is used to settle the delivery or acceptance of the traded currency. Naive to believe, that the orders of clients of domestic forex brokers for 3-5-10 one thousand dollars (yes even on 100 thousand) go to the real market. No one will do on such a small amount, nor confirm, neither process the deal, nor make calculations on it. It's just not cost effective.

In this way, can be stated, and forex brokers know it well, that no deals, which they conclude with clients, are not listed on the exchange, ни на межбанковский over-the-counter market. And where, then, these deals are executed? And who is the opposite side of such transactions?

Where trades are executed?

Many forex broker managers explain the work scheme to clients something like this:

Risk management system, installed on the "firm" ( registered in the BVI or the Cayman Islands), considers risks very well and does not send all client orders to the real OTC market, but only their aggregated component, exceeding a certain size. And the rest of the orders are matched by the firm with opposite orders., received from other clients. Ie, if you have an order for 10 one thousand dollars, then it will be executed for you inside the forex broker itself, if on 100 one thousand dollars, then it will be executed - by her counterparty, large international bank, which will take this order to its position. But if you have an order for 1 million dollars, then it will certainly be sent "to the exchange" and executed only there.

This, certainly, не соответствует действительности. Not a single forex broker practically ever brings their clients' "deals" to the open market, whether it is a mythical exchange or a partner - counterparty - a large international bank or an over-the-counter market, because he knows, that the conditions of the game are, that the client will lose sooner or later. Consequently, there is no need to bring deals to the market.

And who, in this case, becomes the second party to the transactions? Where to look for a counterparty? You don't have to go far - the forex broker itself is the other side of the deal.

In this way, by concluding an agreement with a forex broker, bringing him money, the client will make transactions with the forex broker itself. In this case, any loss of the client is the gain of the forex broker., and any winnings of the client are the losses of the forex broker. And he loses, just interested least of all.

Next misconception, which Forex brokers are persistently trying to root in the minds of ordinary people, is, that you can make very good money on the movements of currency quotes. If you only correctly guess the direction of the course. But, Is it so?

Is it possible to make money on Forex?

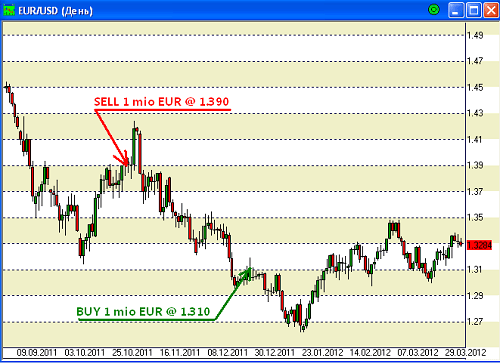

Standard example, forex broker, is as follows. Consider schedule, depicted in the picture below, where the movement of the euro-dollar rate is shown.

If the client sold 25 October 2011 of the year 1 million euros at a price 1.390 EUR/USD, and 22 December of the same year bought this million at a price 1.310 EUR/USD, так как это показано на рисунке, then the profit he received would be 80 one thousand dollars. Good money, isn't it true? These 80,000$ would be received for invested in the transaction 1 390 000 $, which in two incomplete months would give a profit in the amount of 36% per annum. Not bad?

Yes, Not bad. The trouble is, that the average Russian investor does not have that kind of money. "No problem, - the forex broker answers him: я дам вам свое плечо!

You don't need to have a million in your account. Enough of everything 10 000$. Then with a shoulder 100 you will be able to buy and sell lots up to 1 million. Dollars. And with a shoulder 150 - up to one and a half million ". This is what the forex broker says. It means, that with a shoulder 100, you should consider income not on the invested 1 390 000 $, and in the amount of 100 times less!!! This, naturally, increases profitability in 100 times and gives fantastic 3 600% per annum!!! This is fantastic - any person working in the financial market will tell you.. And it will be right.

What does shoulder really mean??

See, what does shoulder really mean. The average daily fluctuation of prices for the euro-dollar currency pair is based on the results of trades in the last year (with 01 April 2011 year on 29 Martha 2012 Year.) 0.28%. It means, what is your investment in 1 390 000 dollars every day experiences average fluctuations in value of about 4 thousand dollars is a plus, then negative. This also means, that about two and a half days of average adverse one-way traffic is enough for you, so that from the account in 10 thousands of dollars there is absolutely nothing left. Your position will be closed, despite the fact, that in the future you, maybe, could make a profit. These are the rules.

[Upon reaching the critical level of losses on the client's open position, broker имеет право закрыть ее по текущей рыночной цене в принудительном порядке. ]

In the considered case, when the client has an account in 10 000 dollars and shoulder 100, the exchange rate needs only to change by 0.01 (0.01= 100 pips = 1 figure, 1% = 1 / shoulder), ie. with 1.390 to 1.400, so that your position is forcibly liquidated by a forex broker and you are left without money. At the shoulder 50 the situation is somewhat better. Prices should change unfavorably no longer by 1%, and at 2% = 1/50, what constitutes 200 pips or two figures, in the terminology of currency speculators. but, even in this case, your position would be closed after just two days. A price movement for a figure or two is not such a rare event in the forex market..

That fact, that in the forex market with a leverage of more 20 almost impossible to earn, even correctly predicting the direction of movement of the exchange rate in the medium and long term, Unfortunately, there is a statistical fact, following from simple mathematical modeling of course movement. It doesn't matter at all: Do you assume this movement of rates at the micro-level is fractal or purely Brownian.

The sadness of this fact stems from the randomness of the pricing process on the one hand and the limited resources of your resources when working with leverage on the other.. Whichever direction you open a position when trading with leverage - sooner or later you will lose all your money. And no risk management, no money management can save you from this disaster. The only question that can be posed is: with what probability and for how long does a complete loss of all funds occur?.

The larger the leverage, the greater the likelihood of loss and the less time, necessary for the realization of this adverse event.

Complete analogue of leveraged trading 2 in the foreign exchange market - playing roulette in the casino. If you don't stop, then sooner or later there will be a sequence of events, when you lose all the funds you brought with you, as well as all earned before that, не зависимо от того, what strategy do you use.

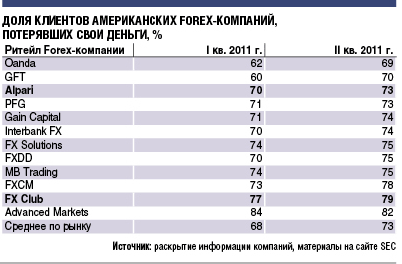

Согласно материалам, posted on the RBC-Daily website and referring to research by Philadelphia Financial, Forex broker clients part with their money at a speed 60-80% per quarter.

A source: www.rbcdaily.ru

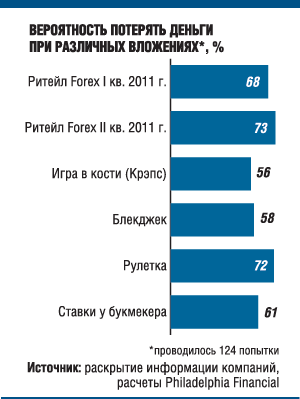

It means, what order 70% funds, brought by clients within 3 months migrate to the pockets of forex broker owners. This profitability is no worse than the profitability of a casino, where the likelihood of winning customers is even higher, as shown in the figure below:

A source: www.rbcdaily.ru

Is forex necessary at all??

Generally speaking, of course needed, no matter how casino it may seem. But only real forex is needed, where the real exchange of some currencies for others takes place. Why? To carry out export-import operations, for investment and trading activities on a global scale, such as carry trade, etc., to hedge risks, to invest in currencies. However, banks do an excellent job with these operations., providing services to their clients for performing conversion operations. They perform them as in the interbank OTC market, and on currency exchanges.

Furthermore, liberalization of foreign exchange legislation in Russia made it possible to 01 January 2012 participate in foreign exchange trading not only for authorized banks with a foreign exchange license, but also to others.

Moving in this direction, the country's leading stock exchange, Moscow Exchange, opened in February 2012 years two-level access for individuals to their foreign exchange market. Wherein:

- really, transactions are concluded for the purchase or sale of foreign currency or for rubles, or for US dollars,

- the place of transactions is known - the exchange,

- the counterparty for each completed transaction is known - this is the central counterparty, ie. the exchange itself, which stands between the buyer and the seller, and guarantees the execution of the concluded transaction to both parties,

- the rights and obligations of each of the parties to the transaction are known,

- the legal consequences for each concluded transaction are known,

- there is a clear procedure for the commission and execution of these transactions,

- and there are also quite specific rules for accounting for such transactions by exchange intermediaries and settlements on them.

It would seem that, many issues of regulation of this market and supervision of those participants, who want to do real business and do real (and not pretentious or aleatory) deals, - resolved.

So maybe, it's worth moving in this direction? For those forex brokers, who really want to legalize, should be licensed as real brokers and conduct business in a civilized manner, complying with applicable law. It's time to ask the others: "and you, граждане, actually, what are you doing here?»

author: Vladimir Tvardovsky, Chairman of the Board of ITinvest.