Hello, friends!

To the article Forex investing in PAMM you need to add instructions, following which you can roughly calculate profitability of pamm accounts.

By the way,, I came across articles on this topic on the net, but I was amazed, how confused people can be there, where everything can be described in simple words. Make up some formulas, introduce variables, break down.

Why? It only confuses. The investor is interested in clarity and clear explanation. I believe, that in life you need to follow the principle of Occam's Razor and not multiply entities unnecessarily. If someone wants to get confused on the calculations, then let them decide at least one of 7 Millennium Challenges and get their well-deserved million dollars.

Now to the point.

Let's not philosophize slyly try to deal with the alleged profitability of pamm accounts on the example of one of the recommended for investment in the above article:

5. 7031 sven (expected annual return +244%, Maximum drawdown 38%, about 11 million dollars in management)

I'll tell you right away, that the expected annual return in 244% — this is not my guess, and the information, taken from the description of the pamm account. It is calculated as the average for the entire period of existence of the PAMM. Given the fact, that almost all traders seek to mitigate risks over time, which affects the decrease in profitability, should be understood, that the expected return will not match the specified.

I recommend doing your calculation, and without any complex tables and systems.

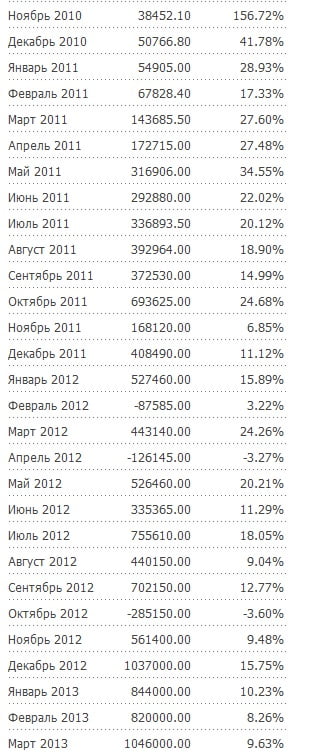

Below in the picture you can see the manager's profitability by month.

Immediately visible, that he started trading very aggressively. Some months showed a yield of about 30%. One month income even exceeded 100%. However, the further, the more funds a trader has in management and, so as not to lose your deposit and investor confidence, he reduced the risks. Last year, the average monthly income is about 7%.

But!

This is the total profitability of the account, but there is also a manager's offer, according to which the profit is divided between the manager and the investor in a certain ratio. In our case it is 50/50.

Let's put it this way. — not the most generous offer, but without fish and cancer — fish, right? =) In this way, profit, received in the investor's account, will be split exactly half between the trader and the investor at the end of each rollover (in our case — weekly).

So the real profitability, on which the investor should rely when choosing this account, the memory will be about 40% per annum from invested funds, excluding reinvestment, and around 60% taking into account the reinvestment of all profits.

Since there are other PAMM accounts with a different ratio of profit distribution, Let's see, how the investor's profitability will change depending on the manager's offer.

As an example, we will calculate two more theoretical pamm counts, where the average monthly profitability is the same 7%, but the offer is more profitable for the investor and the profit is distributed in the ratio 40/60 (40% Manager, 60% — Investor) And 30/70 (30% Manager, 70% — Investor).

And also let's look at the estimated profitability of PAMM with an average profit 15% per month.

I present the investment result in the form of a table for greater clarity., so you can compare the result:

Use a similar method to, to calculate profitability of pamm accounts other managers.

And God bless you, at least until the next blog update .