20 October, the first representative of the insurance industry plans to hold an IPO on the Moscow Exchange - the company "Renaissance Insurance". The group includes companies directly related to insurance, and those involved in related fields: asset management and medical business.

About company

Renaissance Insurance (MCX: KIDNEYS) — a large universal insurance company. Operates only in Russia. Company 82 office in 27 regions of the country. The number of clients exceeds 3.5 million. More recently, the group of companies included a non-state pension fund., but in July 2021 it was sold. Renaissance Insurance identifies three operating business segments.

Life insurance. This segment includes cumulative, investment, credit and risk life insurance. At the end of 2020, more than half of the insurance portfolio was occupied by investment insurance., but in the first half of 2021, its share fell to 36%, but the share of endowment insurance is stable — 17%. At the end of 2020, Renaissance Insurance occupied 10,7% market and was the largest private company, ranking fourth among all. An important feature of the segment: a significant part of insurance policies is sold through 46 partner banks in the process of issuing loans.

Other types of insurance. This includes property insurance, cargo, cars — casco and CTP, – additional medical insurance (DMS) and other types. The share of auto insurance and VHI is growing, according to the results of the first half of 2021, reaching 58 And 20% respectively. In this market, Renaissance Insurance is a little less successful.: at the end of 2020, the market share was 3,4% and the company took seventh place in the list of the largest insurance companies.

Asset Management. Here, the company manages assets to generate additional income from the placement of money. According to the results of the first half of 2021, assets under the management of the subsidiary Sputnik - Capital Management were estimated at 53 billion rubles, which is approximately 30% from the total assets of Renaissance Insurance.

If you take the entire insurance market, then the company at the end of 2020 takes the eighth place on it with a share 5,5%. At the same time, customers are satisfied with Renaissance Insurance: the company is included in the list of five companies with the highest client rating on the financial marketplace "Compare-ru". This is the only representative of the ten largest Russian insurance companies by market share out of these five., which are presented on "Compare-ru".

One of its main achievements "Renaissance Insurance" considers a high level of digitalization of business and even calls itself a digital innovator., revolutionizing the Russian insurance market.

Renaissance Insurance uses artificial intelligence and Big Data technologies to manage risks, real-time scoring. For example, the company has launched mobile telematics - in fact, it is a mobile application, evaluating the driver's driving style and offering, based on the collected data, discounts on casco policies. New software interfaces allow you to integrate the company's insurance products into partner ecosystems very quickly – within a few hours –.

Budu application developed — medical service, including telemedicine, own clinic and means of preventive diagnostics. In the second quarter of 2021, the average monthly audience of the service was estimated at 22 thousand users.. The company calls Budu the buzzword "ecosystem", but agreed to sell 51% the company - the owner of the service "Renaissance-health" one of its shareholders. As a result, Budu will receive 850 million rubles for its further development.

Market share and form of ownership of the ten largest insurance companies in Russia in the life insurance segment in 2020

| "Savings insurance" | 24,4% | Part of the banking group |

| "Alpha Insurance" | 19,6% | Part of the banking group |

| Sogaz | 17,6% | Among the shareholders are the largest state-owned companies |

| Renaissance Insurance | 10,7% | Private |

| Rosgosstrakh | 4,5% | Part of the banking group |

| Capital Life | 4,2% | Private |

| "RSHB-insurance" | 2,7% | Part of the banking group |

| "Rosbank-insurance" | 2,2% | Part of the banking group |

| "SiV-life" | 1,6% | Part of the international insurance group |

| Allianz | 1,3% | Part of the international insurance group |

Market share and form of ownership of the ten largest insurance companies in Russia in the segment of other types of insurance in 2020

| Sogaz | 27,1% | Among the shareholders are the largest state-owned companies |

| "Alpha Insurance" | 10,4% | Part of the banking group |

| "RESO-guarantee" | 10,1% | Private, a large minority stake in an international insurance group |

| Ingosstrakh | 9,8% | Private |

| Rosgosstrakh | 7,8% | Part of the banking group |

| "VSK" | 7,6% | Private |

| Renaissance Insurance | 3,4% | Private |

| "Agreement" | 3,1% | Private |

| "Savings insurance" | 2,0% | Part of the banking group |

| "Tinkoff Insurance" | 1,7% | Part of the banking group |

Market share and ownership of the ten largest insurance companies in Russia in 2020

| Sogaz | 24,4% | Among the shareholders are the largest state-owned companies |

| "Alpha Insurance" | 13,0% | Part of the banking group |

| "Savings insurance" | 8,3% | Part of the banking group |

| Ingosstrakh | 7,4% | Private |

| "RESO-guarantee" | 7,3% | Private, a large minority stake in an international insurance group |

| Rosgosstrakh | 6,8% | Part of the banking group |

| "VSK" | 5,8% | Private |

| Renaissance Insurance | 5,5% | Private |

| "Agreement" | 2,5% | Private |

| "RSHB-insurance" | 1,4% | Part of the banking group |

Structure of the company's insurance portfolio in the life insurance segment in 2020-2021

| 2020 | 1п2021 | |

|---|---|---|

| Investment | 54% | 36% |

| Cumulative | 17% | 17% |

| Credit and risk | 29% | 47% |

Structure of the company's insurance portfolio in the segment of other types of insurance in 2020-2021

| 2020 | 1п2021 | |

|---|---|---|

| Auto insurance | 57% | 58% |

| DMS | 17% | 20% |

| Other | 26% | 22% |

Detailed structure of the company's insurance portfolio in the segment of other types of insurance in 2020

| CASCO | 32,4% |

| OSAGO | 19,3% |

| DMS | 18,0% |

| Cargo insurance | 8,9% |

| Accident insurance | 5,5% |

| Property insurance | 5,0% |

| Other | 10,9% |

32,4%

Financial indicators

The company is steadily growing the volume of collected insurance premiums, and growing faster than the market. Net profit until 2020 also grew, but for the first half of 2021 decreased slightly. For that., among other things, influenced by exchange rate differences: in 2020, there was a profit on this item, and in 2021 — loss. Capital and debt are also growing..

In the announcement of the IPO parameters, the company provides a coefficient of administrative costs, net profit ratio and return on capital as key performance indicators. The first two indicators increased in 2019 compared to 2018, and in a difficult 2020 expectedly fell. But the return on material capital is constantly falling..

The life insurance segment brings about 56% volume of collected insurance premiums, other types of insurance — 44%.

Amount of collected insurance premiums, net profit, capital and debt of the company by year, billion rubles

| Amount of collected insurance premiums | Net profit | Capital | Duty | |

|---|---|---|---|---|

| 2017 | 42,2 | 1,4 | 20,0 | 2,7 |

| 2018 | 70,3 | 3,4 | 21,6 | 2,5 |

| 2019 | 71,7 | 4,1 | 25,6 | 4,0 |

| 2020 | 82,8 | 4,7 | 30,2 | 3,8 |

| 1п2021 | 47,7 | 1,3 | 31,6 | 6,7 |

Administrative Cost Ratio, net profit ratio and return on material capital of the company by year

| Administrative Cost Ratio | Net profit ratio | Return on tangible capital | |

|---|---|---|---|

| 2018 | 9,3% | 4,8% | 34,8% |

| 2019 | 9,4% | 5,8% | 31,5% |

| 2020 | 8,5% | 5,7% | 25,9% |

Dividends and dividend policy

The company has little history of paying dividends: in 2018, they were paid in the amount of about a billion rubles. After that, the company did not declare or pay dividends., since it was spent on its development.

According to dividend policy, dividends are planned to be paid once a year in the amount of 50% net income under IFRS, but with a caveat that, that when calculating dividends, the company's need for money for investments will be taken into account, deals M&A and the regulator's capital adequacy requirements.

History and share capital

The company was founded as a non-state pension fund in 1993, and in 1997 reorganized into an insurance company. Own medical subsidiary was established in 1998, and in 2004 a joint life insurance company with the EBRD was established. Renaissance Insurance entered the top ten Russian insurers in 2008. In 2017, the company merged the insurance business with NPF Blagosostoyanie with the participation of the Baring Vostok fund. In May 2021, it became known, that NPF Blagosostoyanie sold its stake in the company to the structures of Roman Abramovich and his long-term partners.

The controlling stake in Renaissance Insurance belongs to the structures, the main beneficiary of which is the president and chairman of the board of directors of the company Boris Jordan. Nearly 29% shares of Roman Abramovich and his partners, more 12% - Baring Vostok Foundation.

Share capital structure of the company before IPO

| Beneficiaries | share | |

|---|---|---|

| Renaissance Insurance Holding LLC | Boris Jordan, Mary Louise Ferrier, Dmitry Bakatin and Sergey Ryabtsov | 52,12% |

| Sputnik Management Services Limited | Boris Jordan, Mary Louise Ferrier, Dmitry Bakatin and Sergey Ryabtsov | 7,16% |

| Notivia Limied | Baring Vostok | 12,08% |

| Centimus Investments | Roman Abramovich | 9,99% |

| Laypine Limited | Alexander Abramov | 9,55% |

| Bladeglow | Alexander Frolov | 4,77% |

| Andrey Gorodilov | Andrey Gorodilov | 4,33% |

IPO scheme

"Renaissance Insurance" announced the indicative range of the share price as 120-135 P, which implies the size of the company's capitalization in the range of 67.2-73.3 billion rubles. Shares will be sold as existing shareholders, so is the company itself, which for these purposes will issue new shares. The volume of shareholders' supply is up to 7.2 billion rubles, companies — up to 18 billion rubles.

Besides, existing shareholders will provide option Stabilization Manager, who can fulfill it, selling additionally up to 10% from the volume of supply. Also, the company and the selling shareholders have assumed obligations to, that they will not sell shares for 180 days after the IPO.

The company plans to use the proceeds to invest in the business, including digitalization., and possible transactions M&A.

Why stocks may go up after an IPO

A growing company in a growing sector. In the information memorandum, Renaissance Insurance refers to the KPMG study, according to which the Russian insurance market from 2020 to 2024 will grow at a compound annual growth rate (CAGR) 11%. At the same time, the company itself for the period from 2017 to 2020 grew faster than competitors.: with CAGR 17 against 11% the market as a whole and 9% on average the other ten largest players in the market. Based on the results of 1 Half of 2021 Renaissance Insurance continues to grow faster than the market. Besides, the average return on capital over the past two years is 29%, while competitors have an average 19%. Well, the growth of business indicators is the main fundamental reason for the growth of the company's stock prices..

And if the business grows faster than the market, Renaissance Insurance will also be able to pay dividends., this will further increase its attractiveness among investors. Truth, dividend yield is unlikely to be as interesting: even if the company manages to repeat the net profit for 2020 and it will be estimated at the lower limit of the placement, then, subject to the dividend policy, it can turn out to be about 3,5%. Yield may be lower., but, On the other hand, "Renaissance Insurance" should not be considered as a purely dividend story: yet it's more of a growth story.

Also, a recent entry into the capital of the company by such a well-known and experienced businessman can be considered as some positive factor., like Roman Abramovich, and its partners: one can assume, that they also believe in the company's bright prospects., once invested in it.

Digitization. "Renaissance Insurance" in materials for investors positions itself as an innovative player, who managed to successfully introduce very fashionable information technologies into such a long-existing and conservative sphere of activity, as insurance. Furthermore, the company approves, that it's not just a tribute to fashion, and that digitalization really makes her business more efficient.. Maybe, such positioning will help the company attract investors, who love everything fashionable and modern.

Pioneer of the sector on the stock exchange. The company will be the first of the insurers to enter the Moscow Exchange, what can cause an influx of investors, who simply want to invest in this sector of the economy to diversify their portfolio.

Why stocks may fall after an IPO

The situation in the sector is mixed.. Yes, the company is among the ten largest players in the insurance market, but this share is small., at the same time, a significant part of competitors or is part of large banking groups - including state-owned, — or is listed as subdivisions of large international insurance companies.

Seems, that they have more financial and other resources for their development. In my opinion, hard to expect, that Renaissance Insurance will be included in the foreseeable future, for example, in the top three largest players in the insurance market.

Besides, the company plans to increase market share through M transactions&A, but it is worth noting, that the market is already sufficiently consolidated: to fate 10 the largest players have to 82,4% from him, basically, for the company, the life insurance segment is even more - as much as 88,8%.

Business conditions may worsen. As we mentioned, the company earns most of the money on life insurance, but with this segment you can expect several problems at once:

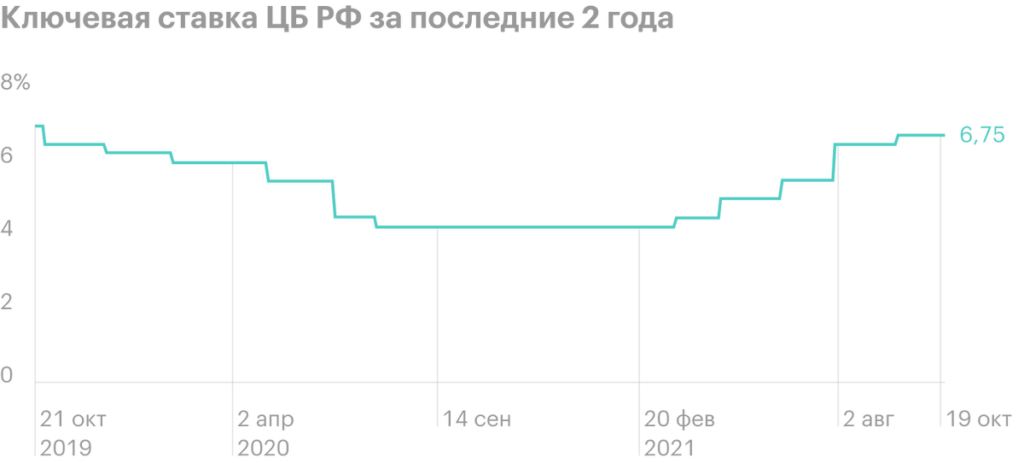

- The Central Bank of the Russian Federation began to actively raise the key rate, what makes loans more expensive and, respectively, less attractive. And this is one of the main sales channels for life insurance policies..

- Raising the key rate is the reason for the gradual increase in bank deposit rates, which will make them more attractive and may reduce the popularity of investment life insurance.

- In the review of the activities of insurance companies, the Central Bank of the Russian Federation mentions, that after 2018, the interest of the population in investment life insurance began to weaken. He attributes this to his regulatory actions to raise awareness of the essence of the product., so it is with that, that he brought his customers low profitability: ended in 2 In the quarter of 2021, three- and five-year policies on average brought only 4,6 And 4,4% annual respectively.

- The boom of recent years in the Russian stock market may also contribute to an increase in the percentage of people., who will invest on their own – not through insurance products – for potential higher returns, than bank deposits.

The ambiguity of the absence of public competitors. As we discussed above, the absence of public competitors in the sector can play positively on stock prices, but there may be negative effects. Since there is no one to directly compare the company with, harder to assess, is it expensive or cheap. For example, if you try to calculate the multipliers of "Renaissance Insurance" according to the data of 2020, then P / E taking into account the price range, the IPO will be in the region of 14-16, and ROE — around 16%. If you count from data 1 half of 2021, where the net profit is lower, and allow, that the same will be in the second half of the year, the values of the multipliers will turn out even worse.

Maybe, someone does not want to invest in the sector, because there are absolutely no alternatives.

Number of clients on brokerage services in Russia by year, million people

| 2018 | 2,2 |

| 2019 | 4,3 |

| 2020 | 9,9 |

| 1п2021 | 14,9 |

2,2

Forecasted multiples of the company

| P / E | ROE | |

|---|---|---|

| According to 2020 | 14,3—15,6 | 15,6% |

| According to 1p2021 | 25,8—28,2 | 8,2% |

Eventually

Renaissance Insurance has a fairly diversified insurance portfolio, the main emphasis is on the life insurance segment. The company has achieved great success in digitalization, which help it to increase the efficiency of the core business, expand it and provide medical services.

The company is growing faster than the market and plans to expand further due to organic growth and absorption of competitors. For this, among other things, will use a significant part of the money, attracted during the IPO.

At the same time, the insurance market in Russia is quite consolidated and its significant share is occupied by the company's competitors., members of large banking and insurance groups, which are not easy to fight. In its turn, life insurance market, according to the forecasts of the Central Bank of the Russian Federation, can wait for hard times.

Another controversial fact: Renaissance Insurance will be the first insurer on the Moscow Exchange. On the one side, this can cause an influx of investors into the company's shares, those wishing to invest in this sector. On the other hand, it makes it difficult to evaluate the company to understand., how expensive its shares are.