25 May payment service Paymentus (NYSE: PAY) goes public. We decided to figure it out, how fascinating this company is.

What happens here

Readers have been asking us for a long time to start sorting out the financial statements and business foundations of foreign issuers.. Offer in the comments of the company, analysis of which you would like to read.

The overview contains many screenshots with tables from reports. To make it more convenient to use them, we transferred them to google-sheets and translated into Russian. Direct your attention: there are several sheets. And keep in mind, that companies round off certain numbers in documents, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

Paymentus is a cloudy platform for making transfers to accounts, used in North America 1,3 thousands of companies. Through Paymentus payments on your accounts in December 2020 held 16 million personal and organizations. Commission from payments - 98,58 % company revenue, other 1,42 % gives the cryptic "other".

The company is profitable, however, the final margin there is not extremely large - 4,54 % from proceeds.

In terms of the structure of payments at the site of the company, the situation is as follows:: fifty seven percent - housing and communal services,23 % - money institutions,16 % – insurance, the rest falls on other sectors.

eighty-eight percent of the company's revenue comes from the US, the rest - in the rest, unspecified states.

Evaluation

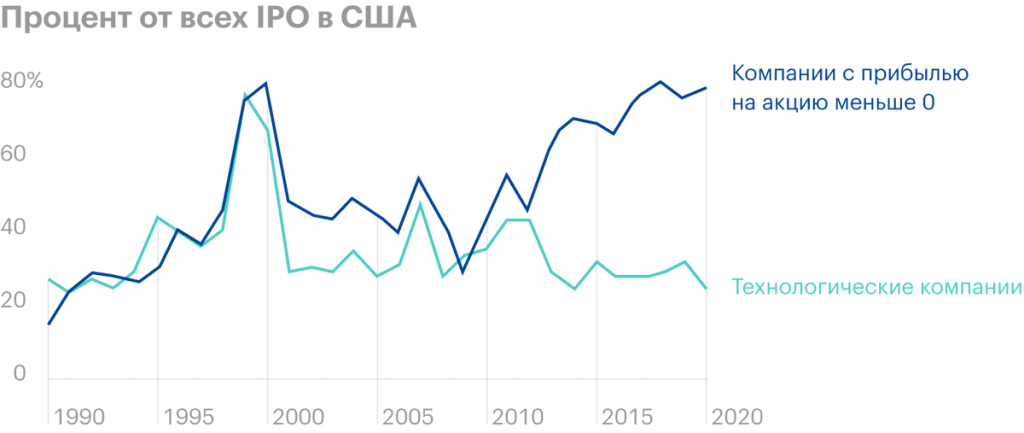

With an expected share price in the range of 19-21 $ the capitalization of the company will be in the area 2,43 billion dollars. In my opinion, this is a very conservative estimate, when looking at Paymentus in a broader context. IPOs of unprofitable companies are now popular in the US, for example Airbnb and DoorDash. The shares of such companies are growing, despite the complete lack of profit. Paymentus, on the other hand, looks very neat against this background..

With regard to the prospects for expansion, everything is good here too. On the Paymentus platform, only 2% of the total volume of payments on accounts - in the region 4,6 trillion dollars a year in the US. I think, that the company has a lot of room for further growth.

Certainly, she will have P / E in the area 272, which is actually very expensive.. But high P / E better, than none at all, like many IPO companies.

It makes sense to invest

The pandemic has accelerated business, related to non-cash payments. According to the company's prospectus, in 2020 year the volume of transactions, carried out through the Paymentus platform, grew up on 33,4% - to 195 million. But the main thing here, it seems to me, Not this.

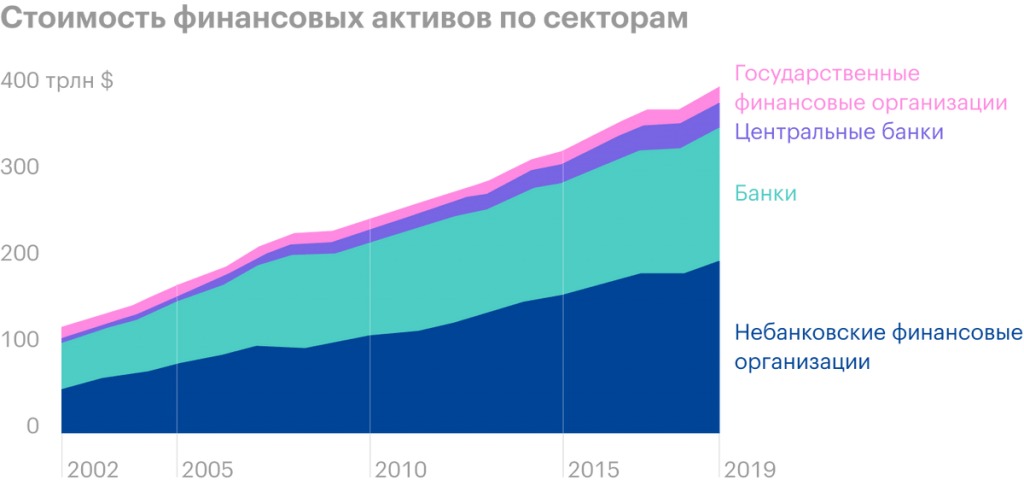

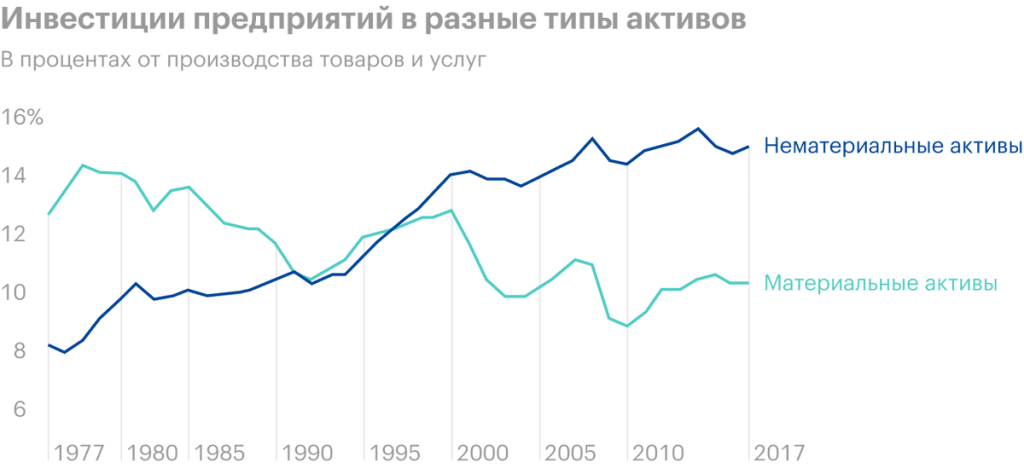

In terms of the scale of the fintech sphere, the capitalization of Paymentus is quite a bit. Even if the company's capitalization triples, it will still be small. Considering this, as well as the very fact of the profitability of the company, its purchase by someone larger in the foreseeable future will be more than likely. Especially now a lot of money is invested by American companies in intangible assets such as software..

Besides, the Paymentus platform collects and analyzes a huge amount of information on payments - this is an additional argument in favor of buying a company by someone bigger in the future. For example, the company can be bought by Visa or Mastercard.

Good roof

The company chose the traditional IPO path - as opposed to the now popular DPO. And that's a plus, since there are such large organizations among the underwriting banks for the company's IPO, as Goldman Sachs, J. P. Morgan, Citigroup. Underwriters have a strong interest in the success of an IPO, after all, in the era of low rates for banks, the importance of the exchange and investment business has increased. Therefore, they can advertise Paymentus as a cool investment among their client base., in order to create excitement around stocks, which will inflate capitalization.

Certainly, it does not guarantee that, that stocks will fly into the stratosphere, but still contributes to less volatility and can attract a bunch of investors into them.

In any case, there is a lot of demand for an IPO on the market today., yes and Paymentus, as a profitable company, can attract additional investor attention. Although, in my opinion, investing in these stocks, it is still worth focusing on the prospect in the area 5 years, to see, how this company can realize its full potential.

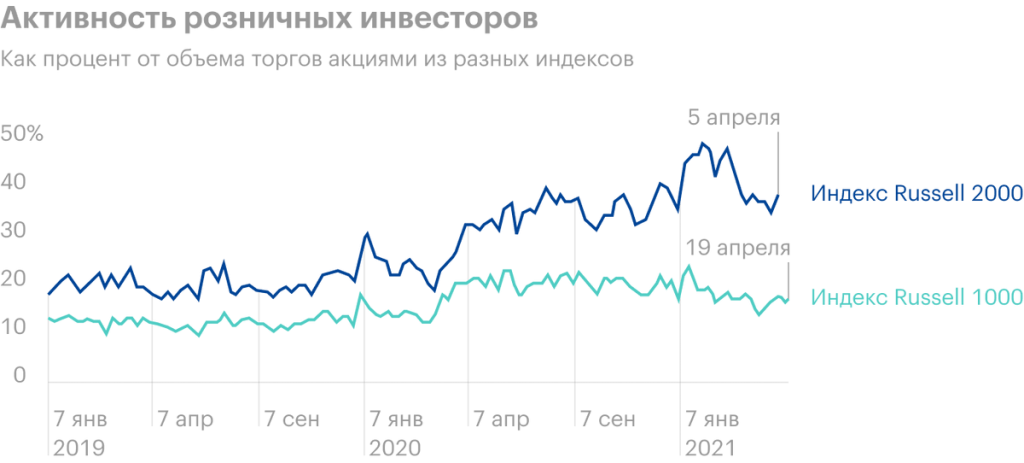

But even outside of the IPO, I think, that the company's shares, due to profitability and a halo of prospects, will be very popular among retail investors. Considering the weight of these investors in the total trading volume of small cap stocks, chances are high, that the inhabitants of Reddit will pump up Paymentus quotes without regard to the high price tag.

Things to Keep in Mind

Private Foundation Accel-KKR, invested in Paymentus back in 2011 year, after the IPO will keep 80% votes in the company, which in theory can lead to infringement of the rights of minority shareholders. I, however, I doubt it, because Accel is a private foundation, which aims to generate profit from Paymentus. Now, if most of the votes were controlled by some startup founders, then this should be feared. This category of owners is very fond of sacrificing profitability in pursuit of the “empire building” chimera..

Resume

Paymentus is a very nice business. Promising sector, as well as the very fact of profitability - a huge competitive advantage against the backdrop of unprofitable IPOs - make this company a good investment for the long term. But still keep a high P in mind / E.