Ethical investments according to the principles of ESG (environmental, social, governance) become more and more popular. ESG funds raised $21 billion in Q1 2021. It's a lot, since for the whole of 2020 the funds raised 51 billion. In 2019 and 2018, the inflow of funds amounted to 21.4 and 5.4 billion.

In an interview with CNBC Armando Senra, one of the leaders of the investment company BlackRock (NYSE: BLK), Said, that by 2030, investment in ethical ETF reach $1 trillion. “We are at the very beginning of a ten-year history of growth”, Senra said.

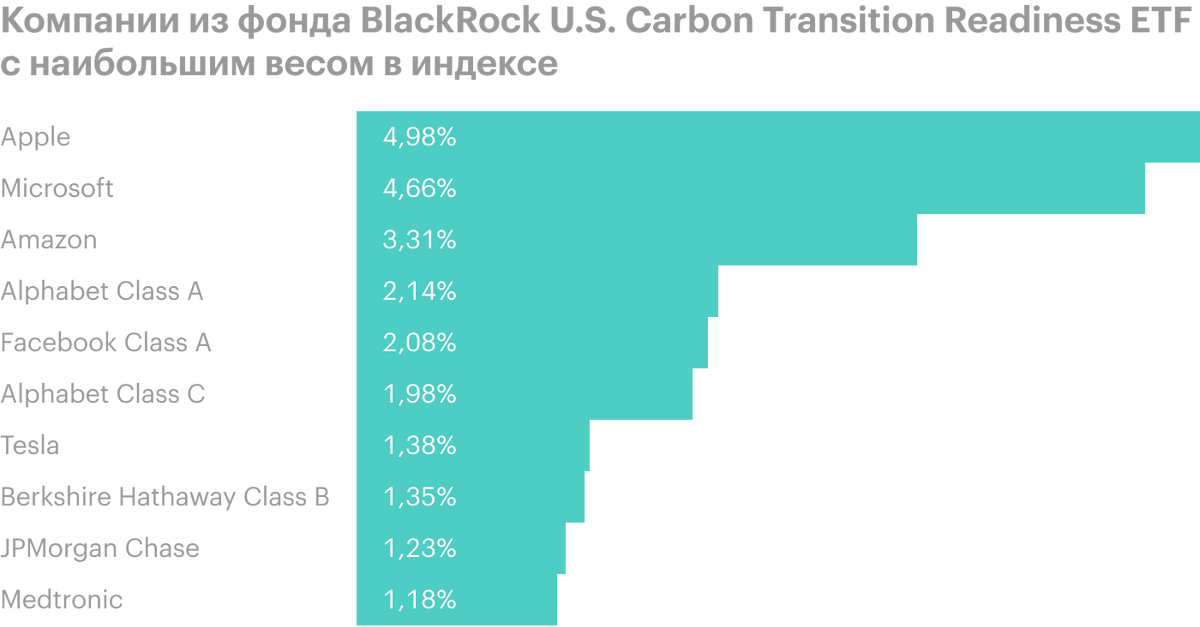

BlackRock recently launched the U.S Foundation. Carbon Transition Readiness ETF. It includes issuers, who can benefit from the transition to a low-carbon economy. The fund is based on large growth technology companies from the top ten S&P 500.

Recruitment of companies in the new BlackRock fund allows you to solve one problem in two ways. First: attract investors with popular and growing stocks. Second: attract investors with the trendy abbreviation ESG in the fund description. Not yet known, what the managers care about more: ESG or "attract investors".

As mentioned in the article about responsible investing, today there is no single system, which would help to unambiguously evaluate the company in accordance with the principles of ESG. Tesla received a low ESG rating compared to other automakers last year, but this does not prevent it from regularly entering different "responsible" indexes.