Today we have a speculative idea: take shares in US arms manufacturer Smith & Wesson Brands (NASDAQ: SWBI), to capitalize on speculative expectations of arms bans by investors.

Growth potential and validity: 30% behind 16 Months.

Why stocks can go up: the current situation in the United States will lead to a surge in violence, which will allow speculative pumping of these shares.

How do we act: we take shares now by 21,5 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

Last year, T-Zh published a detailed analysis of the company's business, so we will not repeat ourselves here..

Arguments in favor of the company

Most dangerous year. The first year of Biden's presidency is coming to an end, in this regard, it is already possible to sum up some results.

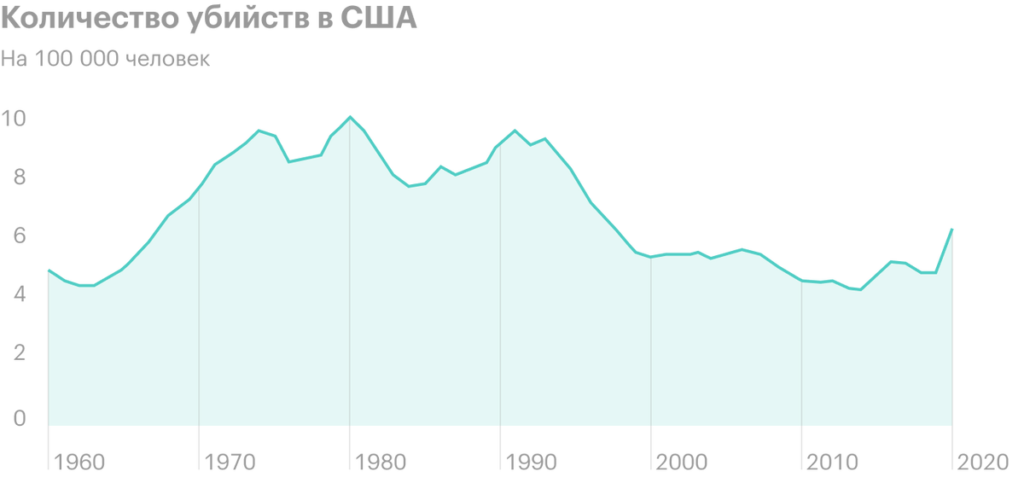

The first conclusion is the growth of crime. In the United States, the number of murders and the overall crime rate are growing. This has already led many cities to cancel cuts to police spending..

The level of interracial tension in the United States has not decreased, but just grew up. The example of the Buckhead neighborhood in Atlanta is extremely illustrating.: rich and predominantly white in population area wants to separate from the more ethnically diverse Atlanta, wherein 50% - African American, due to the increased crime rate.

Political situation in the United States favors the polarization of society. In fact, there are not two parties in the United States now., and one and a half: after Biden came to power, the Democratic Party staged a large-scale campaign of harassment of Republicans and affiliated conservatives. So right-wing conservatives will radicalize even more, which will lead to an increase in radical sentiment among the left. I would even expect in the U.S. in the coming years. 15 years of repetition of something like the Italian lead seventies, that is, a surge in political violence.

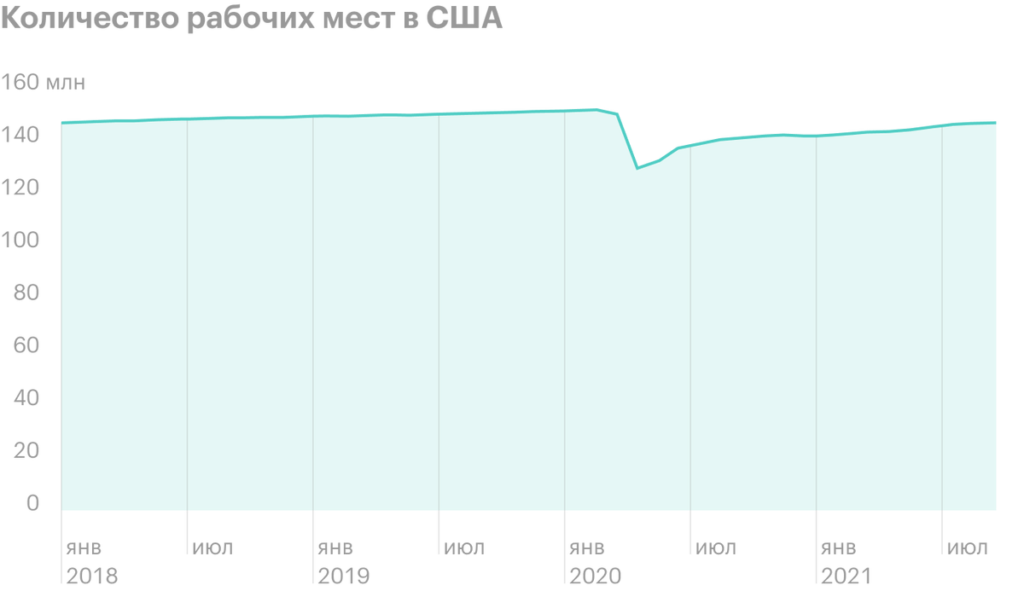

To all other, pandemic has strengthened inequality in the U.S.: the rich got richer, and the poor are even poorer. By the way,, US GDP has already exceeded pre-pandemic level, but millions of jobs in low-skilled areas have never returned.. The presence of such a mass of unemployed in one way or another will manifest itself in a criminal plan..

All this will favor swbi's business in the coming years. 4 more people will buy guns. And from all sides - as liberals, so do conservatives.

History of violence. Like last time, we do the calculation on that, that SWBI shares will repeat the standard history:

- Another massacre with the use of firearms will take place in the United States.

- In the US, talk will start again about, that you need to restrict the sale of firearms.

- Investors will start to wait, that arms sales will go up, – because consumers will be purchased for the future. And the shares of arms companies will go up..

I've seen it all more than once and, observing the current situation in the United States, I think, that such a massacre will not take long to wait.

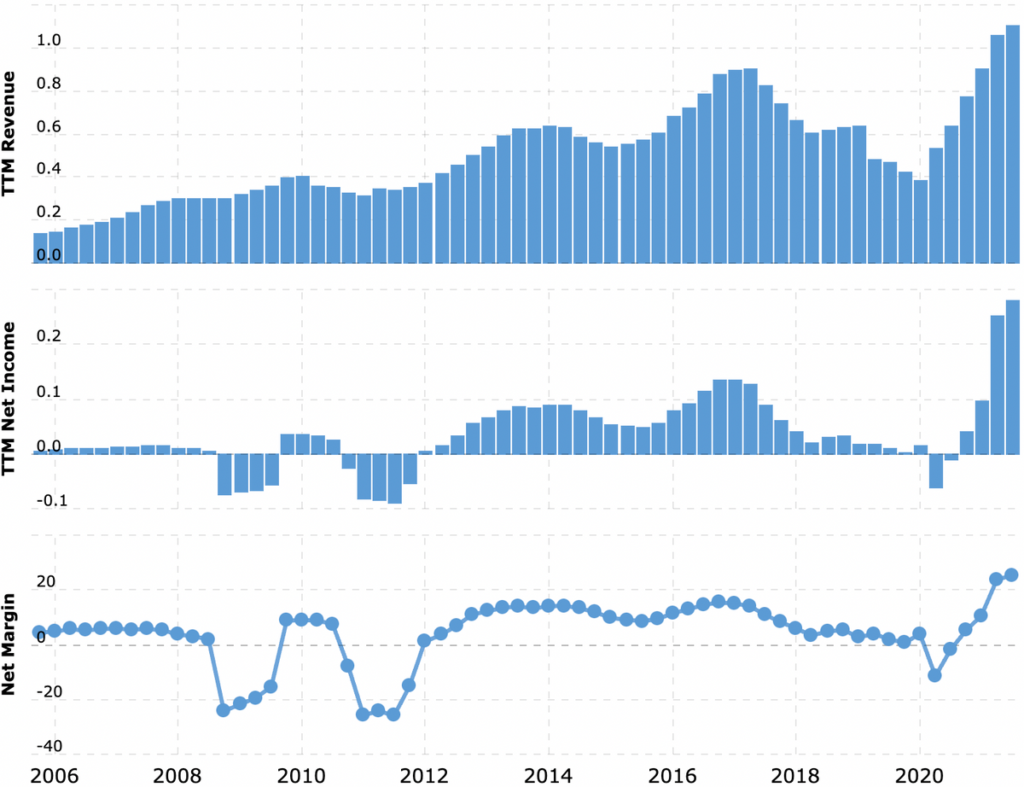

Clean accounting. According to the latest report, the company has $192.6 million in debt, of which 138.82 million must be repaid during the year. Money is more than enough to close term debts: on company accounts 171.4 million, and if we take into account 41.19 million debts of counterparties, then she can close all debts here and now.

What can get in the way

Don't wait for a good quarter. The company's sales correlate well with the number of checks on the status of citizens when they try to buy weapons.. And in the last three months, these indicators are less., than in 2020, when the polarization of the U.S. population led to the growth of weapons. This means, that the company's results will be worse this quarter, than a year ago. So here stocks will rise mainly from the speculative factor of "investor hype around possible restrictions on the sale of weapons in the United States.". On the other hand, stocks have already fallen sharply from their peak., so i think, that all negative expectations of investors in quotations are already, probably, laid down.

Expenses. Increase in the cost of logistics, raw materials and labor will negatively affect the company's reporting. Now this is a common problem in all manufacturing enterprises in the United States..

Bullying. P / S at the company 1,05, a P / E — 4. This seems to be on the list of arguments in favor of the company.. But in fact, the low cost of SWBI is an indicator of that., that the company's shares are being harassed by the ESG lobby, which is strongly opposed to the free sale of arms. So P / E the company can be equal to at least one, but its shares will not rise under the influence of that, that "she has a good business".

Business is good, only it's not so important here, as ideology. It's just that in the case of large-scale shootings, interest in the shares of arms companies becomes so strong., that he can't be stopped, - well, unless liberal funds will stubbornly short SWBI shares against the will of the market for ethical reasons.. But then that wave of interest subsides.. Also, the discrepancy with the progressive agenda will limit the company's access to loans.. And in principle, this situation does not allow us to count here on horizons longer than the next four years..

«You can’t be lucky like you are Luciano». Recently, the company was forced to decide to move its headquarters from Massachusetts to Tennessee.. Massachusetts is preparing to pass a law banning the production of a number of weapons there - and these types of weapons give SWBI 60% proceeds. The company will have to move almost 750 jobs out of the state, what, certainly, will negatively affect its accounting. Let it not happen tomorrow, and in 2023, but it will have to spend $ 125 million. The worst part is, that such a story could repeat itself in the future in other states., where the company has a business.

Wrecked. The company pays 32 a cent of dividends per share per year - as much as 1,48% per annum. This is unlikely to attract dividend investors. Fact, that the company spends $15.6 million a year on payments — 55,7% profits for the last 12 Months, — should worry us because of the large expenses, which she will have to. So the payoffs can chop, which can lead to a fall in shares.

What's the bottom line?

Take the shares now for 21,5 $ and then we wait, when the next massacre in the US will lead to a speculative increase in quotations to 28 $. Think, what will happen next 16 Months.

And if you've already held stocks since last year, in the old idea, we had the option of holding shares. 5 years, — then you can buy more now.